Resources

African Continental Free Trade Area (AfCFTA) Legal Texts and Policy Documents

The African Continental Free Trade Area (AfCFTA) is flagship project of the African Union’s Agenda 2063, a blueprint for attaining inclusive and sustainable development across the continent over the next 50 years. It aims to boost intra-African trade by providing a comprehensive and mutually beneficial trade agreement among the State Parties covering trade in goods and services, investment, intellectual property rights, competition policy, digital trade, and women and youth in trade.

The main objective of the AfCFTA is to create a single market for goods and services, facilitated by movement of persons, in order to deepen the economic integration of the African continent. More specifically, the State Parties shall progressively eliminate tariffs and non-tariff barriers, progressively liberalise trade in services, cooperate on investment, intellectual property rights and competition policy, cooperate on all trade-related areas, cooperate on customs matters and the implementation of trade facilitation measures, establish a mechanism for the settlement of disputes concerning their rights and obligations, and establish and maintain an institutional framework for the implementation and administration of the AfCFTA.

On this page

The Agreement

The legally scrubbed documents, signed on 16 May 2018 in Kigali, Rwanda, are available below:

pdf Agreement Establishing the AfCFTA: consolidated text (4.67 MB)

pdf Compiled Annexes to the AfCFTA Agreement (985 KB)

The AfCFTA Agreement establishes a Free Trade Area (FTA) which will bring together all 55 member states of the African Union, covering a market of more than 1.3 billion people, including a growing middle class and youth population, and a combined gross domestic product (GDP) of more than US$3.4 trillion. In terms of numbers of participating countries, the AfCFTA will be the world’s largest free trade area since the formation of the World Trade Organisation. Eight regional economic communities (RECs) form the building blocks of the AfCFTA.

Estimates from the Economic Commission for Africa (UNECA) suggest that the AfCFTA has the potential both to boost intra-African trade by 52.3 percent by eliminating import duties, and to double this trade if non-tariff barriers are also reduced. Through the gradual elimination of tariffs and the reduction of barriers to trade in services, Africa’s income is expected to grow by $450 billion by 2035. According to the World Bank, the agreement has the potential to lift 30 million people out of extreme poverty, although achieving this potential will depend on putting in place significant policy reforms and trade facilitation measures.

The AfCFTA negotiations take place in phases. In Phase I, protocols on Trade in Goods, Trade in Services, and Dispute Settlement have been concluded. The AfCFTA will see the progressive liberalisation of 97% of intra-Africa tariffs on trade in goods. However, schedules of tariff concessions and rules of origin, which form an integral part of the Protocol on Trade in Goods, are you to be completed.

Phase II of the AfCFTA negotiations covers Investment, Competition and Intellectual Property Rights. These Draft protocols have been adopted by the AU Assembly. These Protocols will, however, have Annexes, which are still to be negotiated. A third phase has been added, which will cover digital trade and women and youth in trade. These negotiations have recently started.

Phase II Draft Protocols

pdf AfCFTA Protocol on Competition Policy (415 KB)

pdf AfCFTA Protocol on Investment (1.08 MB)

pdf AfCFTA Protocol on Intellectual Property Rights (978 KB)

Phase III Draft Protocols

pdf AfCFTA Protocol on Women and Youth in Trade (377 KB) (January 2024)

pdf AfCFTA Protocol on Digital Trade (9.63 MB) (February 2024)

Download the full set of legal texts and negotiations timeline here.

Background

The 18th Ordinary Session of the Assembly of Heads of State and Government of the African Union, held in Addis Ababa, Ethiopia in January 2012, adopted a decision to establish a Continental Free Trade Area by an indicative date of 2017. This deadline was, however, not met. The Summit also endorsed the Action Plan on Boosting Intra-Africa Trade (BIAT) which identifies seven priority action clusters: trade policy, trade facilitation, productive capacity, trade related infrastructure, trade finance, trade information, and factor market integration.

African leaders held an Extraordinary Summit on the African Continental Free Trade Area (AfCFTA) from 17-21 March 2018 in Kigali, Rwanda, during which the Agreement establishing the AfCFTA was presented for signature. On that occasion, 44 out of the 55 AU member states signed the consolidated text of the AfCFTA Agreement. To date, only Eritrea has yet to sign the consolidated text.

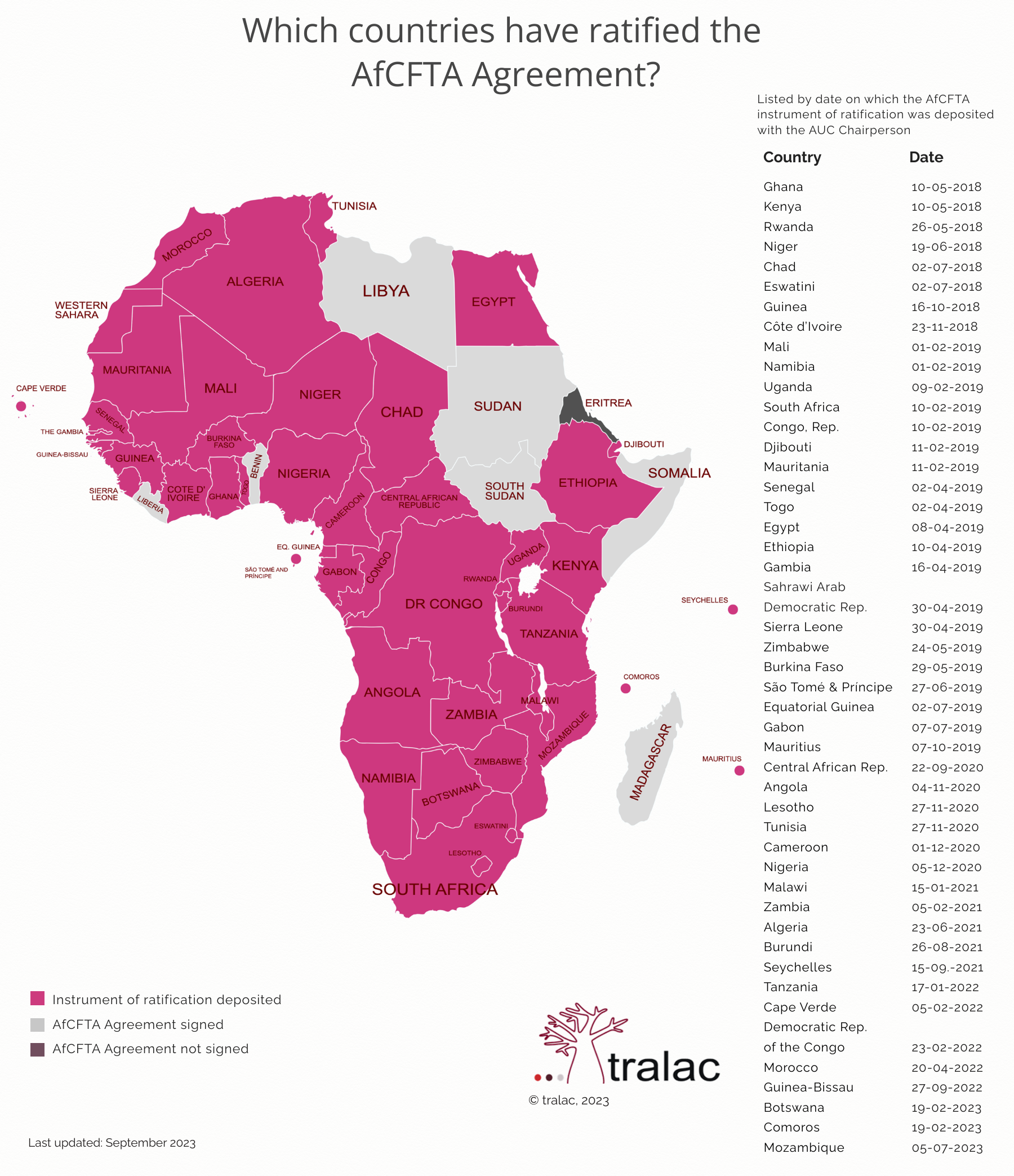

The Agreement entered into force on 30 May 2019 for the 24 countries that had deposited their instruments of ratification with the African Union Commission (AUC) Chairperson – the designated depositary for this purpose. As at August 2023, 47 countries have both signed and deposited their instruments of AfCFTA ratification with the AUC Chairperson. The State Parties are the AU Member States that have ratified the AfCFTA Agreement or have acceded to it, and for whom this Agreement is in force.

The operational phase of the AfCFTA was launched during the 12th Extraordinary Session of the Assembly of the African Union in Niamey, Niger on 7 July 2019. The AfCFTA will be governed by five operational instruments – the Rules of Origin, tariff concessions, online mechanism for monitoring, reporting and elimination of non-tariff barriers, the Pan-African Payments and Settlements System (PAPSS), and the African Trade Observatory. The AfCFTA Secretariat will facilitate the efficient conduct of business of the AfCFTA and is charged with various responsibility related to the implementation of the AfCFTA, including the annual budget and work programme. The AfCFTA Secretariat was officially handed over in Accra, Ghana on 17 August 2020.

In addition to the AfCFTA Secretariat, the Agreement provides for an institutional framework for the implementation, administration, facilitation, monitoring and evaluation of the AfCFTA. It consists of the Assembly of Heads of State and Government of the AU, Council of Ministers (CoM), Committee of Senior Trade Officials, the AfCFTA Secretariat, and the Dispute Settlement Mechanism. Various technical committees have also been established to assist with the implementation of the Agreement and will comprise of designated representatives from State Parties.

An Extraordinary Summit of the AU Assembly on the AfCFTA took place virtually on 5 December 2020. The Assembly approved the start of trading under the AfCFTA Agreement as 1 January 2021, although this did not materialise. On 7 October 2022, the AfCFTA Secretariat launched the AfCFTA Guided Trade Initiative (GTI) in Accra, marking the commencement of trade under the Agreement for eight (8) participating countries: Cameroon, Egypt, Ghana, Kenya, Mauritius, Rwanda, Tanzania and Tunisia, representing the five regions of Africa. The GTI is a pilot initiative to test the operational, institutional, legal and trade policy environment under the AfCFTA.

tralac Resources

pdf AfCFTA Update, August 2023 (558 KB)

pdf The African Continental Free Trade Area: a tralac guide (10th edition, May 2023) (2.15 MB)

pdf tralac AfCFTA Frequently Asked Questions (FAQs, updated May 2023) (530 KB)

Ratification status

According to Article 23 of the AfCFTA Agreement, entry into force occurs 30 days after the 22nd instrument of ratification is deposited with the Chairperson of the African Union Commission (AUC) – the designated depositary for this purpose – an essential step for the AfCFTA to enter into force. The Agreement entered into force on 30 May 2019 for the 24 countries that had deposited their instruments of ratification before this date.

As at September 2023, 47 of the 54 signatories (85%) have deposited their instruments of AfCFTA ratification with the AUC Chairperson.

pdf Official list of signatures and ratifications as at 19 September 2023 (12 KB)

pdf Status of AfCFTA ratification infographic (tralac) (1.09 MB)

Rules of Origin

The basic requirements for implementing an FTA are rules of origin (Protocol on Trade in Goods Annex 2, Article 9) and a tariff phase-down schedule. Rules of origin – the legal provisions that are used to determine the economic nationality of a product in the context of international trade – should only be used to reduce trade deflection while, at the same time, creating a conducive environment for trade in originating goods to take place between FTA members.

Negotiations on tariffs and rules of origin under the AfCFTA are yet to be completed. Agreed RoO currently cover 92.3% of tariff lines. Trade in goods, for which RoO are finalised, can take place under the tabled tariff offers. These offers must comply with the agreed modalities for tariff negotiations.

pdf Appendix IV to Annex 2, AfCFTA Agreement: Rules of Origin (approved) (522 KB)

pdf AfCFTA Rules of Origin Manual, Vol. 1, July 2022 (12.32 MB)

Also available in French, Portuguese and Arabic

Factsheets

pdf Interpreting the rules | Key sector outcomes (671 KB)

Tariff offers

The AfCFTA will see the progressive liberalisation of 97% of intra-Africa tariffs on trade in goods (non-sensitive products, Category A), 7% of which are categorised as covering ‘sensitive products’ (Category B). These will be liberalised over a longer timeframe. The remaining 3% of tariffs may be excluded from liberalisation for reasons relating to food security, national security, fiscal revenue, livelihood, and industrialisation (Category C). Non-Least Developed Countries will liberalise tariffs on non-sensitive goods over a period of 5 years and LDCs over 10 years.

As at August 2023, 43 tariff offers on trade in goods have been submitted by individual State Parties (Egypt, Mauritius, and São Tomé and Príncipe) and collectively as part of Customs Unions – CEMAC, EAC, ECOWAS and SACU, 29 of which had been technically verified.

spreadsheet Egypt - Category A (580 KB)

spreadsheet Mauritius - Category A (861 KB)

spreadsheet São Tomé and Príncipe - Category A (1 MB)

spreadsheet EAC - Category A (1.56 MB)

pdf Provisional Schedule for Tariff Concessions, 2022 (206 KB)

spreadsheet ECOWAS - Categories A, B and C (7.16 MB)

spreadsheet CEMAC - Categories A, B and C (617 KB)

spreadsheet SACU - Category A (375 KB)

pdf South Africa (SACU) AfCFTA tariff offer and phase down, 2020 (10.72 MB)

pdf Customs duty: AfCFTA Schedule, 2021 (2.57 MB)

Guided Trade Initiative (GTI)

While preferential trade under the AfCFTA can only truly begin once negotiations on issues such as tariff concessions and rules of origins are finalised, a ‘pilot phase’ of the AfCFTA was launched in October 2022 in the form of the Guided Trade Initiative (GTI). The primary aim of the GTI is to test the operational, institutional, legal and trade policy environment under the AfCFTA.

The Council of Ministers responsible for trade adopted the Ministerial Directive on the Application of Provisional Schedules of Tariffs Concessions in October 2021 which provided a legal basis for the AfCFTA State Parties that had submitted their tariff schedules in accordance with the agreed tariff modalities to trade preferentially amongst themselves. The GTI takes practical steps towards the facilitation of trade under the AfCFTA through direct engagement with key stakeholders both in the public and private sectors of State Parties.

The AfCFTA Guided Trade Initiative will serve as a gateway to encourage continued trade under the AfCFTA, resulting in a multiplier effect and increased opportunities for SMEs, Youth and Women in trade and ultimately establishing sustainable and inclusive economic development. The ultimate objective is to ensure that AfCFTA is truly operational and the gains from the initiative are improved implementation in order to achieve increased inter-regional and intra-Africa trade that would yield economic development for the betterment of the continent at large.

Eight (8) State Parties representing the five regions of the continent – Cameroon, Egypt, Ghana, Kenya, Mauritius, Rwanda, Tanzania and Tunisia – are currently participating in the initiative. In accordance with the 2023 AU Theme of the year “Acceleration of Implementation of the AfCFTA”, the scope of the GTI has been expanded in both product and country coverage across the five African regions and Islands States, with a total of thirty-one (31) State Parties having expressed interest in joining the initiative.

As at January 2024, 12 State Parties have finalised their legal modalities to enable trade under the GTI to commence, including South Africa, the first member of the Southern African Customs Union (SACU) to do so.

A number of products for trade under the Initiative in 2023 were identified covering thousands of tariff lines, including meat and meat products, poultry and poultry products, beverages, textiles and clothing, processed food products, powdered milk, mineral and chemical fertilizers, honey, nut butters, fruit jams, tea, coffee, and milling (flour and maize meal).

The next phase of the GTI will be to include trade in services in the priority sectors (Business, Communication, Financial, Transport, and Tourism Services) in order to fast-track the implementation of commitments in the adopted schedules of specific commitments and facilitate the start of trading in services under the AfCFTA Regime.

tralac Publications

pdf What have we learned from the AfCFTA Guided Trade Initiative? (1.02 MB)

pdf How will it work and where does trade under AfCFTA rules now stand? (489 KB)

Resources

tralac has been monitoring the AfCFTA negotiations with keen interest. Several factsheets, blogs, and publications have been published to encourage debate and inform government officials, policymakers, and interested stakeholders on key issues involved in the negotiation of Africa’s own mega-regional trade agreement.

Factsheets

pdf Trade in Services in the AfCFTA (530 KB)

pdf Trade Facilitation Agenda in the AfCFTA (452 KB)

pdf Gender Provisions in the AfCFTA Legal Instruments (172 KB)

pdf AfCFTA Protocol on Investment (3.14 MB)

pdf AfCFTA Protocol on Competition Policy (357 KB)

pdf AfCFTA Protocol on Intellectual Property Rights (739 KB)

pdf How are AfCFTA legal instruments adopted and how do they enter into force? (309 KB)

pdf Potential Cross Border Value Chain Involvement infographic (3.10 MB)

pdf The Agribusiness Value Chain in Africa infographic (484 KB)

pdf AfCFTA Institutions infographic (409 KB)

pdf Simplified Trade Regimes and Women Traders in Africa (698 KB)

pdf Making the AfCFTA NTB mechanism work for women traders (1.02 MB)

pdf Investment and Gender in the AfCFTA (334 KB)

pdf Gender and Digital Trade in the AfCFTA (1.00 MB)

pdf Architecture of the AfCFTA Protocol on Women and Youth in Trade (1.07 MB)

pdf AfCFTA Tariff Negotiations: Who negotiates with whom? (340 KB)

pdf How flexible and effective will the AfCFTA be (331 KB)

pdf What to expect from the AfCFTA Dispute Settlement Mechanism (331 KB)

pdf The Framework for the Implementation of the AfCFTA (310 KB)

pdf How will the AfCFTA protect the Rights of Private Parties (319 KB)

pdf The Obligations to be implemented by the AfCFTA State Parties (310 KB)

pdf The AfCFTA Agreement’s Annexes that deal with Customs and border management (386 KB)

pdf AfCFTA: Comparative analysis of tariff offers (772 KB)

Blogs

Promoting the Implementation of the AfCFTA Agreement: The Role of Regional Business Councils by Lilian Wairimu – 17 Dec 2023

Regional Electricity Market under the AfCFTA: Prospects and Challenges for Ethiopia by Bethelhem Abraham – 16 Dec 2023

How ready is Ghana for the AfCFTA? by Daisy Codjoe – 16 Dec 2023

What is the DNA of the AfCFTA? by Gerhard Erasmus – 30 Nov 2023

The AfCFTA Protocol on Women and Youth as part of a new trade and integration discourse by Gerhard Erasmus – 30 Nov 2023

Will investment flows increase under the AfCFTA Investment Protocol? by Gerhard Erasmus – 18 Oct 2023

How is the AfCFTA’s industrial development agenda shaping up? by Gerhard Erasmus – 18 Oct 2023

What the AfCFTA Agreement establishes and what the State Parties should do by Gerhard Erasmus – 13 Aug 2023

Wars in Africa are bad for the AfCFTA by Gerhard Erasmus – 13 Aug 2023

What is the Mandate of the AfCFTA? Is it changing? by Gerhard Erasmus – 13 Aug 2023

tralac Annual Conference participants visit Masaka Dry Port in Kigali, Rwanda – lessons for implementation of the AfCFTA by Elizabeth Mulae – 12 Jul 2023

Can reducing Non-Tariff Trade Costs in Africa be the gamechanger for the African Continental Free Trade Area? by Taku Fundira – 28 Mar 2023

Publications

tralac has prepared several Trade Briefs, Working Papers and Trade Reports on legal and practical issues related to the negotiation and signing of the Agreement Establishing the AfCFTA. Recent Publications are listed below.

Value chains and industrialisation: what is the status of the AfCFTA RoO? - 11 Oct 2023

Can Africa speak with one voice on trade matters through the AfCFTA? - 22 Aug 2023

Trade, Climate and Sustainability in the AfCFTA - 05 Jul 2023

Is the AfCFTA changing the gameplan for African integration? - 27 Jun 2023

The Potential of the Agribusiness Regional Value Chain under the AfCFTA - 22 Dec 2022

The AfCFTA design will determine how it will function and evolve - 29 Nov 2022

Does Africa Need a Continental Common Currency? - 31 May 2022

The Digital Economy Opportunity for the AfCFTA - 28 Apr 2022

Will Trade Remedies be used as part of Trade Governance under the AfCFTA? - 21 Feb 2022

Other useful resources

Partnering with governments by business is essential to ensure and facilitate investment in the accompanying measures necessary to complement the AfCFTA. This includes intra-African trade infrastructure as well as supplying trade finance, trade information, and logistics services. Such provisions will help businesses recognize and realize the trading opportunities available through AfCFTA. Additionally, more active involvement of the private sector in terms of advocacy is required in order to ensure direct input into the AfCFTA negotiating institutions to ensure that the AfCFTA is shaped to assist the business community to trade in Africa.

Although an advocacy and communication strategy has been developed to ensure that there is a buy in from all stakeholders in the AfCFTA – the AUC, RECs, member states, civil society, parliamentarians, and the private sector – African civil society organisations have made several calls for citizens, workers, farmers, traders, producers, enterprises, and the private sector to participate more effectively in negotiations towards the AfCFTA to ensure their concerns and views are adequately reflected.

pdf An Action Plan to Accelerate Global Business and Investment in Africa (3.61 MB) (WEF and AfCFTA Secretariat, 2023)

pdf A Guide to the African Continental Free Trade Agreement (855 KB) (the dtic, 2023)

pdf The AfCFTA Magazine (44.13 MB) (AfCFTA Secretariat, 2023)

pdf The AfCFTA: A new era of trade Factsheet (5.94 MB) (AfCFTA Secretariat, 2023)

pdf Economic Report on Africa 2023 (7.19 MB) (UNECA, 2023)

pdf Powering trade through AfCFTA: a People driven wholesome Development Agenda (175 KB) (African Union, 2022)

pdf 10 things Africa must do to accelerate industrialization and economic diversification in Africa: Press Release (297 KB) (African Union, 2022)

pdf Making the most of the AfCFTA (8.36 MB) (World Bank, 2022)

pdf LRS Briefing on the AfCFTA Agreement: Trade Unions and Trade – First edition, 2023 (861 KB)

pdf Trade Unions and Trade: A Guide to the AfCFTA Protocol on Trade in Goods (4.59 MB) (LRS, 2022)

pdf ITUC Africa Continental Forum on the AfCFTA: Tunis Statement (89 KB) (27 September 2022)

pdf AfCFTA Country Business Index Report: Executive Summary (363 KB) (UNECA, 2022)

pdf Primer for the AfCFTA Country Business Index (ACBI) (1.51 MB) (UNECA, 2022)

pdf The Futures Report: Making the AfCFTA Work for Women and Youth (6.45 MB) (AU-UNDP, 2022)

Policy Brief on the African Continental Free Trade Area (UN Office of the Special Adviser on Africa (OSAA), 2022)

pdf Implications of the African Continental Free Trade Area for Demand of Transport Infrastructure and Services (32.68 MB) (UNECA, 2022)

pdf Improving the framework conditions to unlock the potentials of AfCFTA for SMEs in Ghana (2.26 MB) (CUTS International, 2022)

pdf Policy Brief: Statements and recommendation on the AfCFTA regulations on Special Economic Zones (229 KB) (AEZO, 2023)

pdf African Economic Zones Outlook 2021 (12.27 MB) (AEZO)

pdf The Futures Report 2021: Which Value Chains for a Made in Africa Revolution (12.88 MB) (AfCFTA Secretariat and UNDP, 2021)

pdf The African Continental Free Trade Area: Economic and Distributional Effects (5.37 MB) (World Bank, 2020)

Key Note Address: H.E. Albert Muchanga African Union Commissioner for Trade and Industry (tralac Annual Conference 2020)

pdf AfCFTA Year Zero Report, Part One (1.79 MB) (AfroChampions, 2020)

AfCTFA Critical Success Factors - Private Sector Perspective (Valentina Mintah, tralac Annual Conference 2020)

Conditions for success in the implementation of the AfCFTA (Work commissioned by the AUDA-NEPAD, 2020)

Conditions for success in the implementation of the AfCFTA (French)

African Continental Free Trade Area: Questions and Answers, updated (ATPC and AUC, 2020)

2019 African Regional Integration Report: Voices of the RECs (AUC, 2019)

The AfCFTA: Opportunities and Challenges (CUTS International Study by Théophile Albert, 2019)

The AfCFTA Secretariat: Presentation by Beatrice Chaytor Senior Trade Expert, AfCFTA Support Unit (tralac Annual Conference 2019)

Assessing Regional Integration in Africa IX: Next steps for the African Continental Free Trade Area (UNECA-AUC-AfDB-UNCTAD, 2019)

Key Note Address by AUC Commissioner for Trade and Industry Ambassador Albert Muchanga (tralac Annual Conference 2018)

pdf AfCFTA: Towards the finalization of modalities on goods – Toolkit (914 KB) (UNECA, 2018)

Update on the Continental Free Trade Area negotiations: Presentation by Mr. Prudence Sebahizi, Chief Technical advisor on the CFTA and Head of CFTA Negotiations Support Unit, AUC (2017 African Prosperity Conference)