News

UNCTAD: Investing in Sustainable Development Goals

Action Plan for Promoting Private Sector Contributions

The United Nations’ Sustainable Development Goals need a step-change in investment

Faced with common global economic, social and environmental challenges, the international community is defining a set of Sustainable Development Goals (SDGs). The SDGs, which are being formulated by the United Nations together with the widest possible range of stakeholders, are intended to galvanize action worldwide through concrete targets for the 2015-2030 period for poverty reduction, food security, human health and education, climate change mitigation, and a range of other objectives across the economic, social and environmental pillars.

Private sector contributions can take two main forms; good governance in business practices and investment in sustainable development. This includes the private sector’s commitment to sustainable development; transparency and accountability in honouring sustainable development practices; responsibility to avoid harm, even if it is not prohibited; and partnership with government on maximizing co-benefits of investment.

The SDGs will have very significant resource implications across the developed and developing world. Estimates for total investment needs in developing countries alone range from $3.3 trillion to $4.5 trillion per year, for basic infrastructure (roads, rail and ports; power stations; water and sanitation), food security (agriculture and rural development), climate change mitigation and adaptation, health and education.

Reaching the SDGs will require a step-change in both public and private investment. Public sector funding capabilities alone may be insufficient to meet demands across all SDG-related sectors. However, today, the participation of the private sector in investment in these sectors is relatively low. Only a fraction of the worldwide invested assets of banks, pension funds, insurers, foundations and endowments, as well as transnational corporations, is in SDG sectors, and even less in developing countries, particularly the poorest ones (LDCs).

UNCTAD proposes a Strategic Framework for Private Investment in the SDGs

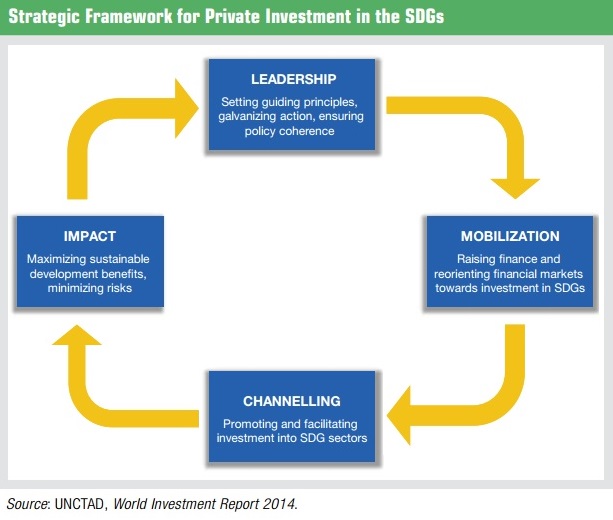

A Strategic Framework for Private Investment in the SDGs addresses key policy challenges and solutions, related to:

-

Providing Leadership to define guiding principles and targets, to ensure policy coherence, and to galvanize action.

-

Mobilizing funds for sustainable development – raising resources in financial markets or through financial intermediaries that can be invested in sustainable development.

-

Channelling funds to sustainable development projects – ensuring that available funds make their way to concrete sustainable-development oriented investment projects on the ground in developing countries, and especially LDCs.

-

Maximizing impact and mitigating drawbacks – creating an enabling environment and putting in place appropriate safeguards that need to accompany increased private sector engagement in often sensitive sectors.

A set of guiding principles can help overcome policy dilemmas associated with increased private sector engagement in SDG sectors

The many stakeholders involved in stimulating private investment in SDGs will have varying perspectives on how to resolve the policy dilemmas inherent in seeking greater private sector participation in SDG sectors. A common set of principles for investment in SDGs can help establish a collective sense of direction and purpose. The following broad principles could provide a framework.

-

Balancing liberalization and the right to regulate. Greater private sector involvement in SDG sectors may be necessary where public sector resources are insufficient (although selective, gradual or sequenced approaches are possible); at the same time, such increased involvement must be accompanied by appropriate regulations and government oversight.

-

Balancing the need for attractive risk-return rates with the need for accessible and affordable services. This requires governments to proactively address market failures in both respects. It means placing clear obligations on investors and extracting firm commitments, while providing incentives to improve the risk-return profile of investment. And it implies making incentives or subsidies conditional on social inclusiveness.

-

Balancing a push for private investment with the push for public investment. Public and private investment are complementary, not substitutes. Synergies and mutually supporting roles between public and private funds can be found both at the level of financial resources – e.g. raising private sector funds with public sector funds as seed capital – and at the policy level, where governments can seek to engage private investors to support economic or public service reform programmes. Nevertheless, it is important for policymakers not to translate a push for private investment into a policy bias against public investment.

-

Balancing the global scope of the SDGs with the need to make a special effort in LDCs. While overall financing for development needs may be defined globally, with respect to private sector financing contributions special efforts will need to be made for LDCs, because without targeted policy intervention these countries will not be able to attract the required resources from private investors. Dedicated private sector investment targets for the poorest countries, leveraging ODA for additional private funds, and targeted technical assistance and capacity building to help attract private investment in LDCs are desirable.

When implementing IIA reform and choosing the best possible options for designing treaty elements, policymakers have to consider the compound effect of these options. Some combinations of reform options may “overshoot” and result in a treaty that is largely deprived of its basic investment protection raison d’être. For each of the reform actions, as well as their combinations, policymakers need to determine the best possible way to safeguard the right to regulate while providing protection and facilitation of investment.

» Read more in Investing in Sustainable Development Goals, Part 1

Reforming the International Investment Regime: An Action Menu

The IIA regime is at a crossroads; there is a pressing need for reform

Growing unease with the current functioning of the global IIA regime, together with today’s sustainable development imperative, the greater role of governments in the economy and the evolution of the investment landscape, have triggered a move towards reforming international investment rule making to make it better suited to today’s policy challenges. As a result, the IIA regime is going through a period of reflection, review and revision.

As evident from UNCTAD’s October 2014 World Investment Forum (WIF), from the heated public debate taking place in many countries, and from various parliamentary hearing processes, including at the regional level, a shared view is emerging on the need for reform of the IIA regime to make it work for all stakeholders. The question is not about whether to reform or not, but about the what, how and extent of such reform.

World Investment Report 2015 offers an action menu for such reform

WIR15 responds to this call for reform by offering an action menu. Based on lessons learned, it identifies reform challenges, analyses policy options, and offers guidelines and suggestions for action at different levels of policymaking.

IIA reform can benefit from six decades of experience with IIA rule making. Key lessons learned include (i) IIAs “bite” and may have unforeseen risks, therefore safeguards need to be put in place; (ii) IIAs have limitations as an investment promotion and facilitation tool, but also underused potential; and (iii) IIAs have wider implications for policy and systemic coherence, as well as for capacity-building.

IIA reform should address five main challenges:

-

Safeguarding the right to regulate for pursuing sustainable development objectives. IIAs can limit contracting parties’ sovereignty in domestic policymaking. IIA reform therefore needs to ensure that such limits do not unduly constrain legitimate public policymaking and the pursuit of sustainable development objectives. IIA reform options include refining and circumscribing IIA standards of protection (e.g. FET, indirect expropriation, MFN treatment) and strengthening “safety valves” (e.g. exceptions for public policies, national security, balance-of-payments crises).

-

Reforming investment dispute settlement. Today’s system of investor-State arbitration suffers from a legitimacy crisis. Reform options include improving the existing system of investment arbitration (refining the arbitral process, circumscribing access to ISDS), adding new elements to the existing system (e.g. an appeals facility, dispute prevention mechanism) or replacing it (e.g. with a permanent international court, State-State dispute settlement, and/or domestic judicial proceedings).

-

Promoting and facilitating investment. The majority of IIAs lack effective investment promotion and facilitation provisions and promote investment only indirectly, through the protection they offer. IIA reform options include expanding the investment promotion and facilitation dimension of IIAs together with domestic policy tools, and targeting promotion measures towards sustainable development objectives. These options address home- and host-country measures, cooperation between them, and regional initiatives.

-

Ensuring responsible investment. Foreign investment can make a range of positive contributions to a host country’s development, but it can also negatively impact the environment, health, labour rights, human rights or other public interests. Typically, IIAs do not set out responsibilities on the part of investors in return for the protection that they receive. IIA reform options include adding clauses that prevent the lowering of environmental or social standards, that stipulate that investors must comply with domestic laws and that strengthen corporate social responsibility.

-

Enhancing systemic consistency. In the absence of multilateral rules for investment, the atomised, multifaceted and multilayered nature of the IIA regime gives rise to gaps, overlaps and inconsistencies between IIAs, between IIAs and other international law instruments, and between IIAs and domestic policies. IIA reform options aim at better managing interactions between IIAs and other bodies of law as well as interactions within the IIA regime, with a view to consolidating and streamlining it. They also aim at linking IIA reform to the domestic policy agenda and implementation.

WIR 2015 offers a number of policy options to address these challenges. These policy options relate to different areas of IIA reform (substantive IIA clauses, investment dispute settlement) and to different levels of reform-oriented policymaking (national, bilateral, regional and multilateral). By and large, these policy options for reform address the standard elements covered in an IIA and match the typical clauses found in an IIA.

A number of strategic choices precede any action on IIA reform. This includes whether to conclude new IIAs; whether to disengage from existing IIAs; or whether to engage in IIA reform. Strategic choices are also required for determining the nature of IIA reform, notably the substance of reform and the reform process. Regarding the substance of IIA reform, questions arise about the extent and depth of the reform agenda; the balance between investment protection and the need to safeguard the right to regulate; the reflection of home and host countries’ strategic interests; and how to synchronize IIA reform with domestic investment policy adjustments. Regarding the reform process, questions arise about whether to consolidate the IIA network instead of continuing its fragmentation and where to set priorities as regards the reform of individual IIAs.

When implementing IIA reform and choosing the best possible options for designing treaty elements, policymakers have to consider the compound effect of these options. Some combinations of reform options may “overshoot” and result in a treaty that is largely deprived of its basic investment protection raison d’être. For each of the reform actions, as well as their combinations, policymakers need to determine the best possible way to safeguard the right to regulate while providing protection and facilitation of investment.

» Read more in Investing in Sustainable Development Goals, Part 2

Downloads

- Investing in Sustainable Development Goals Part 1: Action Plan for Private Investments in SDGs [Special Edition for the Third International Conference on Financing for Development]

- Investing in Sustainable Development Goals Part 2: Reforming International Investment Governance [Special Edition for the Third International Conference on Financing for Development]