News

Developing Asia now invests more abroad than any other region, UNCTAD report says

Countries in developing Asia have, for the first time, collectively invested more money abroad than countries in the North American and European regions, the latest UNCTAD Global Investment Trends Monitor says.

Hong Kong (China) and China were the second and the third largest investors in the world, after the United States which remains the largest single source of outward foreign direct investment (FDI). Among the 20 largest investors, nine were either from developing or transition economies.

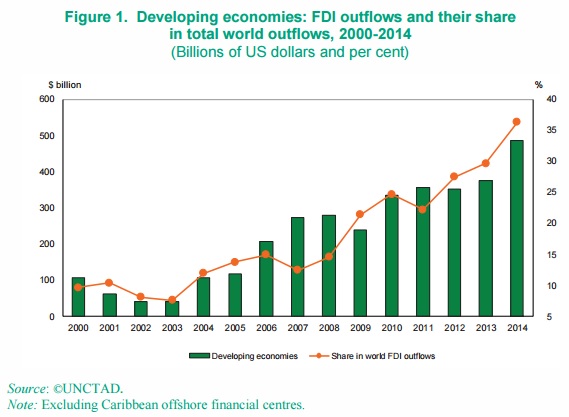

In addition, in 2014 transnational corporations (TNCs) from developing economies alone invested almost half a trillion US dollars abroad − a 30% increase from the previous year.

This UNCTAD trends monitor analyses the most recent trends in global outward investment and assesses its prospects for 2015. It covers outward FDI trends in developed, developing and transition economies.

An in-depth analysis of global, regional and sectorial trends will feature in the forthcoming World Investment Report 2015, to be published in June 2015.

Highlights

-

In 2014, transnational corporations’ (TNCs’) share in global foreign direct investment (FDI) reached a record of 36%, up from 12% in 2007, the year prior to the financial crisis (see figure 1).

-

Developing Asia has become, for the first time, the world’s largest investor region with US$440 billion invested, followed by North America (US$390 billion) and Europe (US$286 billion).

-

In 2014, Hong Kong (China) and China were the second and the third largest investors in the world, after the United States. Among 20 largest investors, nine were either from developing or transition economies.

-

Investments by developed country TNCs were largely flat at US$792 billion, with the modest rise in flows from North America and Europe more than offset by a 16% decline in Japanese investment abroad.

-

More than half of investments from TNCs based in developing economies were in equity, while as much as four-fifths of FDI outflows from developed country TNCs were in the form of reinvested earnings − the result of record amounts of cash reserves in their foreign affiliates.

-

The value of cross-border merger and acquisitions (M&As) surged to US$399 billion in 2014 − 28% above 2013 levels. Megadeals dominated the scene in 2014. TNCs from the South continued to acquire developed country foreign affiliates in developing world.

-

Announced greenfield investment projects rose by only 7% reaching US744 billion. The increase was driven mainly by investments from TNCs of the South. Greenfield investors from developed countries, however, account for a larger share (66%).

-

UNCTAD estimates that TNC investment appetite will improve, encouraged by better economic prospects, especially in the United States, proactive monetary policy in the Eurozone and the large cash holdings of companies. However, TNCs remain guarded due to the fragility in some emerging markets, exchange rate volatility and increased geopolitical tensions.