Blog

Is Sub-Saharan Africa Deindustrialising? Interrogating Value-Chain and Trade Data

While most economists agree on the need for accelerated industrialisation in Sub-Saharan Africa (SSA), there is less consensus on whether the region has experienced a long term decline in the contribution of manufacturing to gross output – ‘deindustrialisation’. The SSA region is a physically large region and comprises a lot of countries – 46 – with significant heterogeneity, however there are certainly common developmental challenges faced by the grouping and a common outlook in many respects relating to development. This blog attempts to summarise some of the perspectives on deindustrialisation in the region, presents some data drawn from value chain and manufacturing trade databases and offers some policy recommendations.

Two recent studies that do not support the deindustrialisation thesis are a World Bank regional flagship study[1] and an International Food Policy Research Institute (IFPRI) article[2]. The World Bank study points out that the region has seen substantial growth in manufacturing jobs, albeit without a significant improvement in the contribution of manufacturing value-added to GDP. This growth in jobs has been attributed to SSA’s integration into global value chains (GVCs), particularly through exports of primary products and low-skill tasks. However, this integration has indeed led to job creation, especially in backward integration which is associated with more employment opportunities.

The IFPRI article challenges the deindustrialisation narrative, labelling it as a myth for the broader SSA region, excluding outliers like Mauritius and South Africa. This perspective highlights the importance of considering the informal manufacturing sector, which is substantial in SSA and often overlooked in formal employment statistics. For example, in Kenya, while formal manufacturing employment remained stagnant, informal sector employment in manufacturing saw significant growth. This pattern is indicative of an expanding share of manufacturing employment, contradicting the deindustrialisation thesis. Moreover, the manufacturing sector’s share of exports in goods and services has notably increased, driven by a diverse range of manufacturing activities. The IFPRI analysis also points to the rising Chinese investment in African manufacturing, which could further support the sector’s growth and job creation, emphasizing the potential for integrating informal and formal sector businesses to boost productivity and employment.

These views would appear to reflect a minority outlook. In general, the case for industrialisation in SSA is strong and is based on several observations:

-

Declining Share of Manufacturing in GDP: One of the most cited indicators of deindustrialisation is the declining share of manufacturing in the overall GDP of SSA countries. This trend suggests that, instead of progressing towards more complex and higher value-added sectors, economies in SSA are either stagnating in the agricultural sector or leapfrogging into the services sector without fully developing their manufacturing capabilities. This pattern diverges from the historical industrialization pathways followed by today’s developed economies and many emerging markets in Asia.

-

Employment Shifts Without Productivity Gains: While employment may be rising in certain sectors, such as informal manufacturing or services, these jobs often do not come with corresponding productivity gains. The movement of labour from agriculture into low-productivity service sectors, rather than into manufacturing, indicates a misalignment with the structural transformation that typically underpins sustainable economic development. This scenario is often referred to as ‘premature deindustrialisation’, where the peak of manufacturing employment comes at a lower level of income compared to earlier industrialisers, and the decline starts before a significant economic transformation has been achieved.

-

Investment and Industrial Policy Challenges: SSA faces significant challenges in attracting and sustaining the kind of investment needed for industrial deepening. Issues such as inadequate infrastructure, limited access to finance, and governance challenges have hindered the development of a robust manufacturing sector. Furthermore, the effectiveness of industrial policies in promoting sustained industrial growth has been variable across the region, with some countries struggling to implement policies that successfully stimulate industrial development.

-

Competition and Technological Change: The global economic environment, characterised by intense competition and rapid technological change, poses additional hurdles for SSA’s industrialisation. The automation of manufacturing and the shift towards more knowledge-intensive industries may limit the opportunities for labour-intensive manufacturing growth in SSA, a traditional path to industrialisation for developing economies.

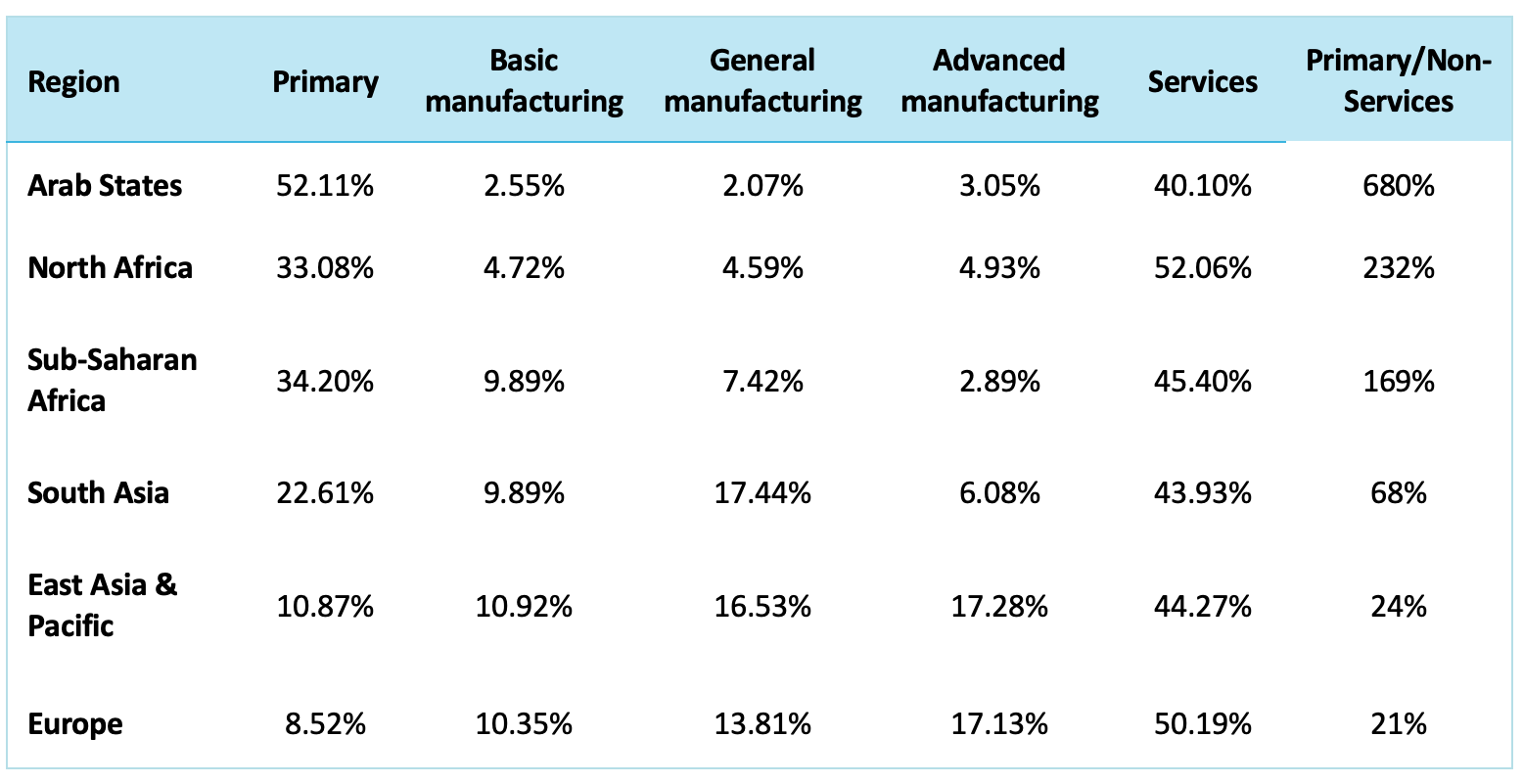

What insights can we derive from data? Table 1 contains value chain traded data originating (but not finally exported) by the indicated regions.

Table 1: Origination of value in global value chains: sectoral composition by selected regions

Source: Author’s classification and calculations using UNCTAD-Eora data

This MRIO-derived value chain data for 2017 tells us that SSA has a larger share of manufactured exported intermediate value than the oil exporting Arab States and North Africa, but dominated by basic manufactures. SSA’s pattern does not compare well with South Asia, which has the largest proportion of general manufactures, or East Asia & the Pacific, which has the largest proportion of advanced manufacturing. The extent of dependence on primary exported value is also seen in SSA, and although the extent is greater in the oil exporting Arab States and North Africa, very importantly – crude oil is not capable of being deeply beneficiated in the same way as metals, minerals, textiles and agricultural output, for example, is. This pattern does therefore appear to represent a lost opportunity for SSA and does support the thesis of deindustrialisation.

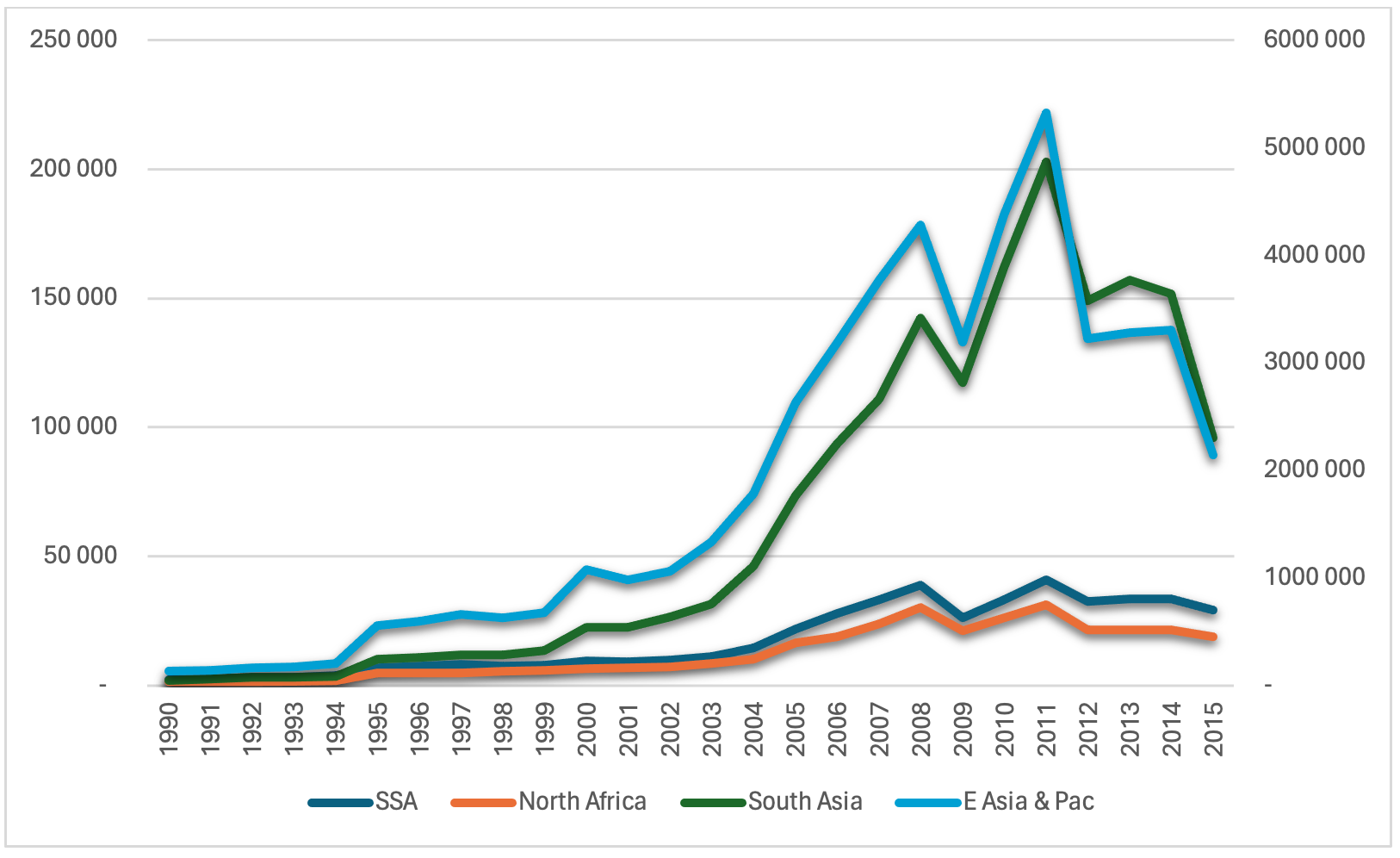

However, since ‘deindustrialisation’ is a dynamic concept, time series data is required in order to establish or identify patterns. Figure 1 presents 25 years of data on backward value-chain involvement for total manufacturing for four regions – SSA, North Africa, East Asia & the Pacific (RHS axis) and South Asia[3]. ‘Backward value chain involvement’ is the total of imported primary and intermediate value that is beneficiated for final export by the nominated country. This definition also has a meaning in regard to value chain ‘upgrading’, which refers to a country advancing up the value chain. For example, copper ore producer Zambia could graduate to producing copper wire and could become backwardly involved with neighbouring copper ore producers Namibia and the Democratic Republic of Congo.

This data is derived from the same original data source as the previous table.

Figure 1: Total manufacturing – backward value chain involvement (dual axes) for four regions (1990-2015)

Source: Author’s construction using the World Development Report (2020) database

What is striking in this data is the rapid growth of backward manufacturing involvement in the two Asian regions. Despite the volatility seen in the 2010s[4], due to financial crises and trade wars, the level of backward manufacturing involvement in the Asian regions remains high relative to the African regions. Of concern is the lack of growth in backward manufacturing involvement in SSA and North Africa since 2008. A previously-cited study that argues against the deindustrialisation thesis[5] notes that backward manufacturing value chain involvement is an important driver of job creation. This refers not necessarily to only the number of jobs but also the quality of the job. Jobs in agriculture are low skill, low paid and often seasonal. On the other hand, jobs in agro-processing are likely to require greater skill, be better paid and more productive, and offer more job stability.

How should policy makers respond to the challenges and headwinds faced by SSA countries in increasing their manufacturing industrialisation? The World Bank study emphasises the need for SSA to adopt a strategic policy mix that leverages current comparative advantages while developing capabilities for higher value addition and competition in high-skill tasks. Such policies should focus on boosting productivity growth, maintaining competitive market environments, developing industry-specific skills, and investing in enabling sectors like infrastructure and finance.

All of these approaches focus on creating an enabling business environment for GVCs, while being cognisant of actual comparative advantages[6], in other words they are business environment based. However there is also an important role for trade and industrial policy. The most successful manufacturing export industry on the African continent is the South African motor vehicle industry, which owes much of its success to a sustained and significant supporting policy package. Subsidies, high effective rates of protection, rebates and trade barriers have all been used (and are still used) to support the industry, which exports both fully assembled vehicles as well as components.

The development of value chains in Africa, within the context of free trade on the continent under the African Continental Free Trade Area (AfCFTA), has also been put forward as a potential path to industrialisation[7]. Free trade between African countries would certainly assist in continental value chain development, but attention would also be needed on the set of recommendations relating to the business and investment environment. In addition, given the experience of South Africa’s motor vehicle manufacturing industry, policy space with regard to trade and industrial policy may be needed especially in the early stages of industrialisation. Importantly however, these protections should not become a ‘crutch’ that is required to support the industries in perpetuity, preventing the development of true competitiveness.

The challenge of industrialisation in SSA remains, whether or not one accepts the thesis that the region has experienced premature deindustrialisation. Data presented above establishes that the quantum of manufacturing value chain origination in SSA is worryingly small, especially for non-basic manufactures. So too is the rate of growth of backward manufacturing value chain involvement, an indicator of manufacturing value chain upgrading. These tendencies should galvanise policy makers into action, not least in order to not miss the opportunity for value chain industrialisation presented by the AfCFTA.

[1] World Bank, 2021. Industrialization in sub-Saharan Africa seizing opportunities in global value chains. Washington: World Bank. https://www.worldbank.org/en/region/afr/publication/industrialization-in-subsaharan-africa-seizing-opportunities-in-global-value-chains

[2] McMillan, M. 2014. The Myth of de-industrialisation in sub-Saharan Africa. Washington: International Food Policy Research Institute (IFPRI). https://www.ifpri.org/blog/myth-de-industrialisation-sub-saharan-africa

[3] The regional aggregate for South Asia includes only India, Pakistan, Sri Lanka and Bangladesh in order to avoid biasing an unweighted aggregate of a highly heterogenous group.

[4] The reversal of value chain involvement is sometimes referred to as ‘re-shoring’ since the original transnational corporation (TNC) that initiated the value chain extension removes the outsourced production component back to the original country.

[5] See World Bank, 2021.

[6] A related tralac blog by this author – ‘Export Competitiveness, Export Diversification and Deindustrialisation in Sub-Saharan Africa’ – argues that attaining and maintaining global competitiveness as well as diversifying competitive product sectors should also be an area of focus for policy that aims to promote industrialisation.

[7] See, for example, the following tralac research: Stuart, J. 2023. The potential of the agribusiness regional value chain under the AfCFTA. Trade Report. Stellenbosch: tralac. https://www.tralac.org/publications/article/15872-the-potential-of-the-agribusiness-regional-value-chain-under-the-afcfta.html

Downloads

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...