Blog

African CT&L Value Chain Performance, Potential and Gender

This Blog is intended to give an idea of the potential of integrated and cross-dimensional value chain, trade performance and gender analysis using tralac’s current databases

The AfCFTA Secretariat has designated potential value chains for development to promote intra-African trade and industrialisation under the AfCFTA. One of these value chain categories is the broader clothing, textiles and leather (CT&L) sector, within which sub-categories of textiles, cotton, leather and footwear have been designated. The AfCFTA has also indicated which region and/or country would be best suited to develop the particular value chain, although this does not preclude other countries progressing in value chain development in future.

To enable data-driven analysis of potential intra-African value chain development, tralac has developed a series of databases that integrate directed value chain data, revealed comparative advantage data, gender data and a set of dimensions such as African sub-region, REC membership, LDC category and main export specialisation. This database is unique to tralac and earlier evolutions have already enabled analysis of value chain development in the CT&L and agri-foods sectors. [1]

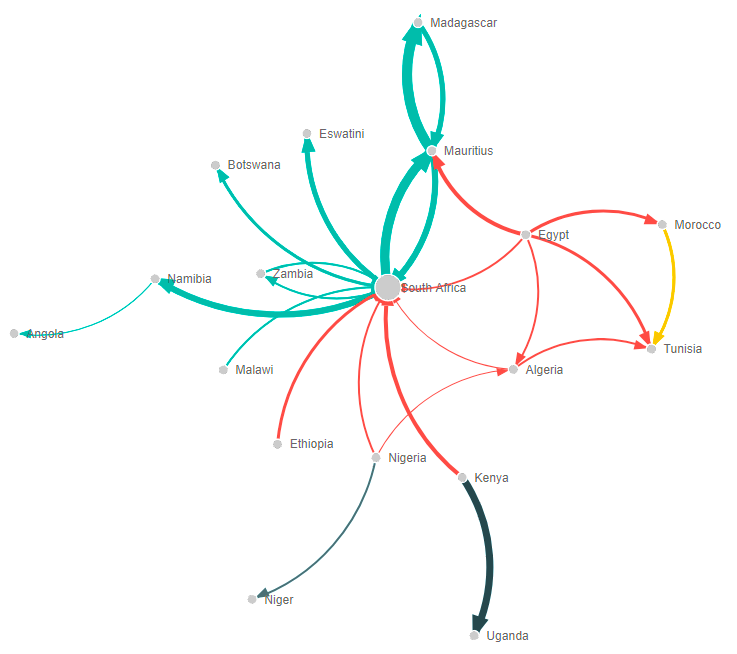

A small example of the potential of the current evolution of the database is presented overleaf in a chart and a table. The chart is a flow diagram showing the main intra-African value chain flows from originator to exporter, in the CT&L sector[2]. The chart is configured as follows:

-

The weight of the arrow reflects the average RCA of originator and exporter, not the export value. The chart is already ‘top sliced’ on the main value chain flows in this sector.

-

The colour of the arrow reflects current REC membership or not. Green arrows indicate SADC, Black arrows the EAC, grey arrows ECOWAS, yellow arrows CEN-SAD and red arrows indicate no common REC memberships between the two trade partners.

The chart shows how a significant portion of intra-African CT&L value chain trade does not take place at preferences (this would include CEN-SAD trade between Morocco and Tunisia). This implies that scope exists to extend value chain development in this sector under AfCFTA preferences. It also shows which current value chain ‘pairs’ have the strongest current trade advantage compared globally. It is clear that Mauritius and Madagascar are competitive in this sector, but in West Africa so is the Nigeria-Niger value chain, in East Africa the Kenya-Uganda value chain and in North Africa the Tunisia-Morocco value chain. Finally, it should be remembered that the weight of the arrow does not indicate trade value but trade competitiveness.

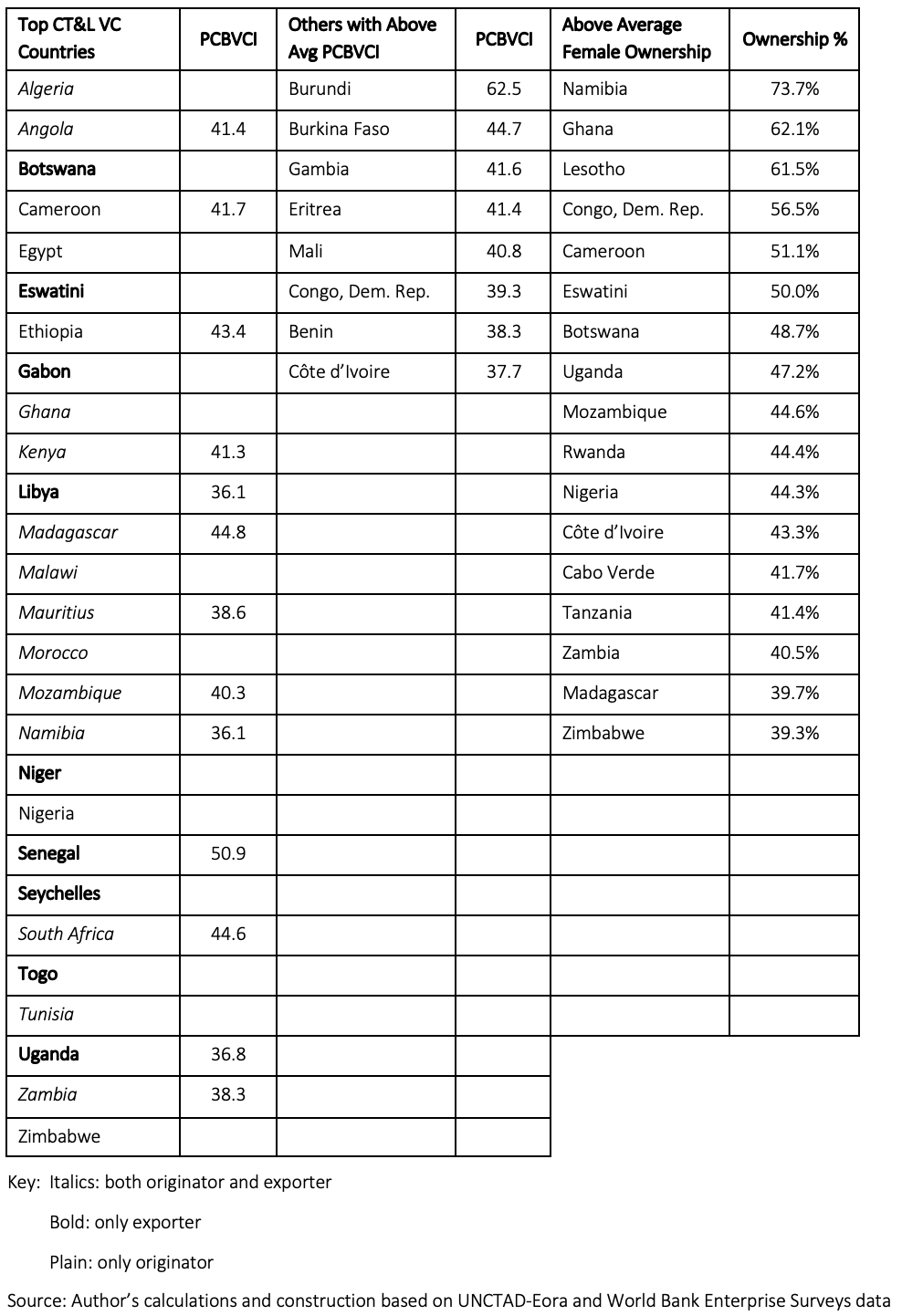

The accompanying table presents related data. The potential cross-border value chain involvement metric (PCBVCI) is derived from enterprise level World Bank data and is intended to show whether a country could potentially enter value chains in a sector, based on its export and supply chain involvement in that sector. The data indicates that the existing top countries are generally above average, but also lists some smaller countries that have the potential to enter the value chain, in the second column.

To assess the potential to advance gender parity in the sector and promote female owned businesses, the table contains female enterprise ownership data in the final columns. The data indicates that many of the top countries are above the continental average for female enterprise ownership in this sector, but certain smaller countries such as Lesotho and Rwanda, which don’t make the cut for the more important value chain flows, are well above the average for female ownership in this sector. This indicates that promoting the existing CT&L value chains and developing them to increase their intra-African extent, as well as a focus on developing currently smaller value chains but those with higher mutual trade competitiveness and gender parity could be part of the policy prerogatives for the immediate future for the AfCFTA.

[1] The support of IDRC to develop this database is gratefully acknowledged.

[2] Note that the exporter may export to other countries and continents beyond Africa. However, the value chain flow – the flow of intermediate value – originates in Africa and is exported finally by an African country.

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...