Blog

Export Competitiveness, Export Diversification and Deindustrialisation in Sub-Saharan Africa

Sub-Saharan Africa (SSA) is a large, resource-rich region but one which lags the global aggregate in terms of industrialisation. This is of concern not least because of the developmental priorities in the region, but also due to the changing environment regarding the technical paths to industrialisation. This refers to the evolution of technology, which has always played an important role in industrialisation and enterprise management. Being able to wield technology is critically important to both maintain and advance competitiveness, and the saying ‘if you are not moving forward you are standing still’ is very true of manufacturing in particular and production in general.

One way that a country may benchmark its ability to maintain manufacturing competitiveness is through its export performance. Profit-maximising behaviour will tend to ensure that production methods are continually innovated. Export competitiveness refers to the ability of a country to sell its goods and services internationally at a scale and price point that is sustainable and profitable. For many developing countries, becoming competitive in export markets is challenging due to limited industrial capacity, infrastructural deficits, and a reliance on a narrow range of export commodities, primarily raw materials and agricultural products[1]. Enhancing export competitiveness in developing countries requires a multifaceted approach, including investment in value-added manufacturing, improvements in product quality, and the expansion of trade facilitation measures.

Export diversification, on the other hand, involves broadening the range of products and services a country sells internationally. For developing countries, diversification is not just a matter of economic policy but a necessity for reducing vulnerability to commodity price shocks and enhancing economic stability[2]. However, achieving meaningful diversification requires addressing structural constraints, enhancing human capital, and fostering a conducive business environment.

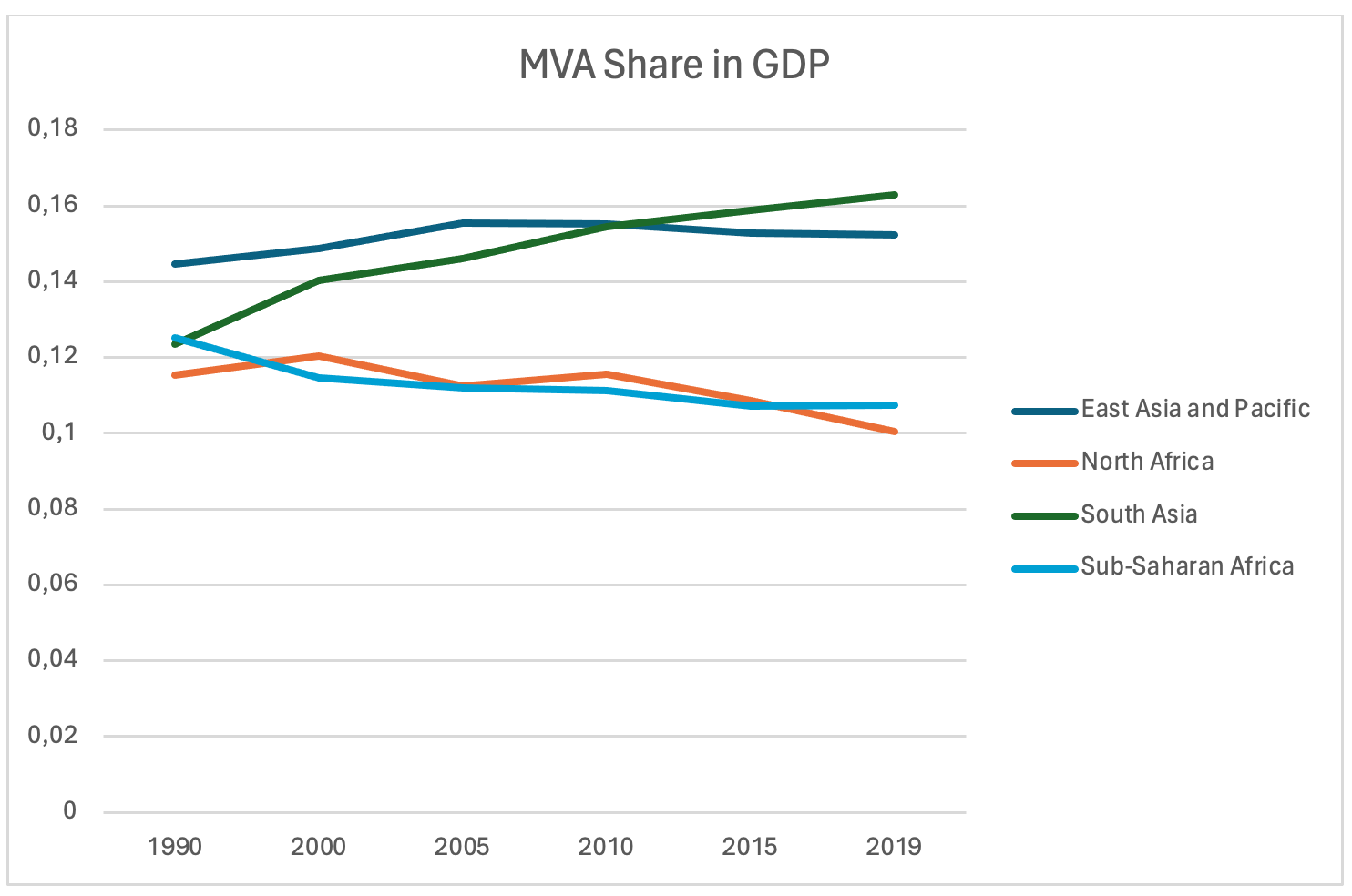

Deindustrialisation is commonly understood as a decline in industrial capacity, evidenced in data by a declining share of manufacturing value-added in GDP (MVAsh). This can further be defined as ‘premature’ deindustrialisation when the country of concern starts to experience declining MVAsh some time before the economy has developed a mature industrial base, and the share of services in total output starts to replace manufacturing[3]. One important driver of this pattern is the inability of developing countries to compete in export and in their domestic markets with more industrialised countries, highlighting the importance of competitiveness.

Figure 1 illustrates this situation well. The MVA share in GDP for the years 1990 to 2019[4] for four developing regions is plotted, allowing observation of the industrialisation paths followed by the regional aggregates. The plots for East Asia & the Pacific and South Asia[5] show an upward trend over the period, whereas those for North Africa and Sub-Saharan Africa show the opposite. Obviously, within each region there could be countries that have individual trends that are the opposite of the regional trend. For example, in SSA, Gabon and Tanzania have rising MVAsh trends, albeit off a low base. Likewise, for the East Asia & Pacific aggregate, Hong Kong and Macao have decreasing MVAsh trends while Vietnam and Cambodia have strongly increasing trends. In addition, the indicator MVAsh is a relative measure, meaning that absolute MVA may have increased over the period simply due to economic growth, without significant structural change in the economy.

Figure 1: Industrialisation trends in four developing regions: long term changes in MVA share in GDP (1990-2019)

Source: Author’s aggregation based on UNIDO 2024 data

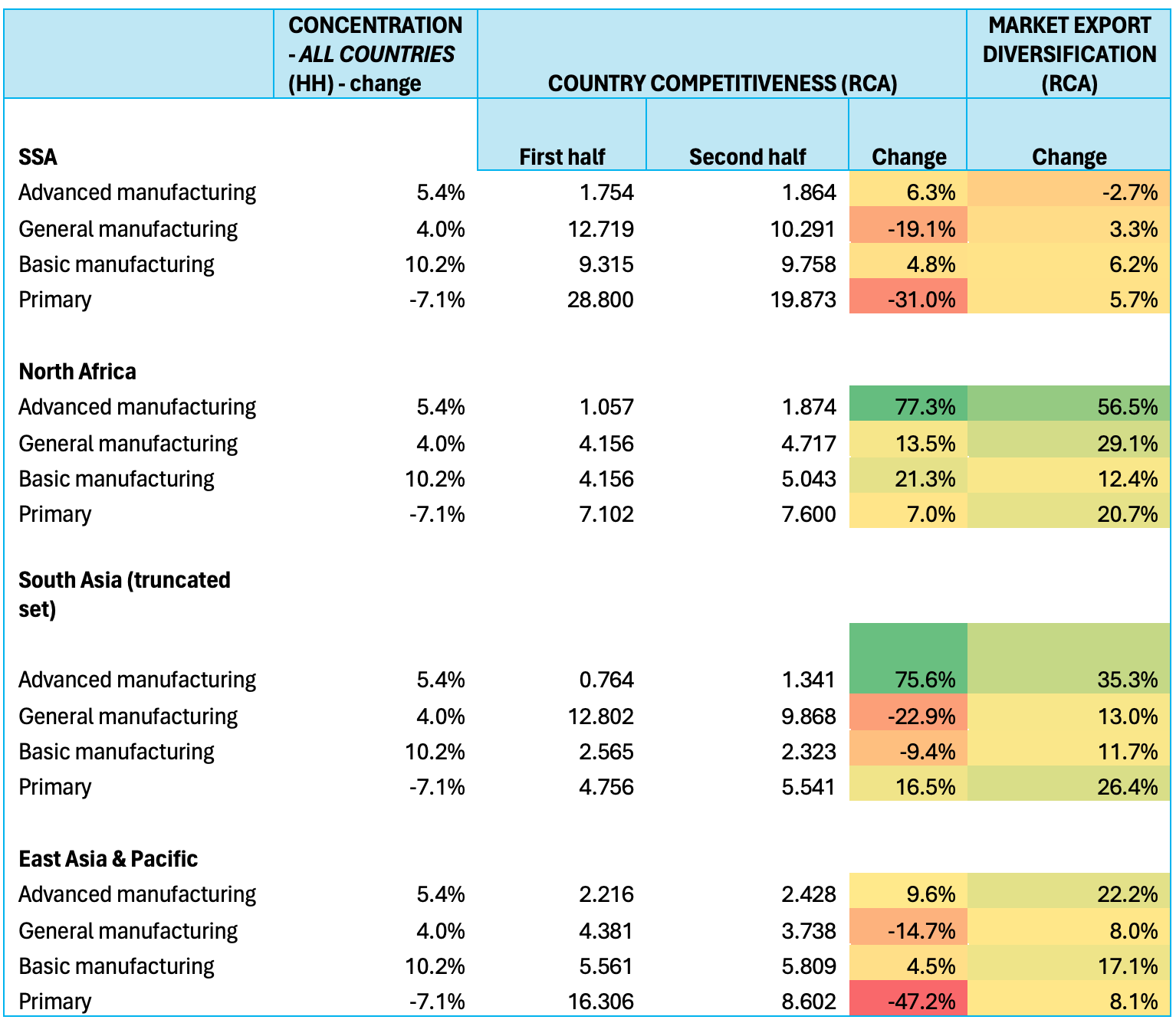

The point is often made in discussions about deindustrialisation based on MVAsh calculations, that they do not show a full picture of a country or region’s industrialisation potential. In order to understand the situation better, additional trade-based data is helpful. Table 1 presents some calculated data[6] derived from the UNCTAD revealed comparative advantage (RCA) dataset and the UNCTAD Herfindahl-Hirschmann (HH) index data on market concentration. The table is based on 25 years of data from 1995 to 2019, with two distinct periods considered. By using 15 year endpoint periods[7], the data is smoothed and more representative and all ‘changes’ indicators are calculated using this smoothed method. The export diversification calculation is based on the count of years with RCA greater than or equal to 1, meaning that a product/country/year RCA was competitive in global markets.

The aggregate competitiveness calculated indices are shown in the table because their absolute level is important (not just the change). RCA indices above 1 mean that the country was able to export the products at a greater level that the global aggregate, implying a competitive advantage. However in the case of resource products such as fuels, metals and minerals, a large RCA value does not mean the same thing as the same RCA value for manufactured goods, since resource endowments are ‘fortuitous’ whereas manufacturing advantages are created.

Although much can be said about this data, within the space constraints of a blog let us zoom in on a few insights that stand out. Firstly, we notice the levels of SSA’s RCA in all three manufacturing categories exceeds (or equals) that of the other groups save the advanced manufacturing category for East Asia & the Pacific. According to the HH index of concentration, this competitive edge is also made into markets that became more concentrated (i.e. less contested) over the period and this is encouraging. However, regarding the shifts over the 24 year period and looking at the same manufacturing categories and the indicators of export diversification, SSA countries diversified less than the other regions in every category, and in one category – advanced manufacturing – experienced a decline in diversity.

Table 1: Long term changes in export market concentration, export competitiveness and export diversification: regions (1995-2019)

Source: Author’s calculations based on UNCTAD Stat data (UNCTAD Stat 2024)

Secondly, regarding shifts in competitiveness over the 24 year period, one needs to consider these against the changes in market diversification. When a region’s exports become more diversified in product markets (both in terms of the number of countries and the number of products), there will be a corresponding decline in aggregate RCA indices, simply because an individual country’s exports are becoming less ‘exceptional’ relative to the global pattern. If a country’s competitiveness can improve at the same time as market diversification increases, this indicates progressive improvements in industrialisation.

Unfortunately, while SSA’s RCA levels compare favourably to other developed regions, the direction of changes is not progressive. This suggests the path of SSA industrialisation is problematic and would require policy intervention to address. ‘Industrial policy’ is a term used to describe deliberate policy action to benefit domestic industry. Developed countries tend to use subsidies more than tariff methods, and developing countries tend to do the opposite – making more use of tariff methods than subsidies. This is simply a consequence of the greater fiscal constraints faced by developing countries and the administrative simplicity of tariffs relative to potentially-abusable subsidies. One possible industrialisation path suggested for the countries of Africa in the context of the AfCFTA is that of regional value chains (RVCs). This topic is addressed extensively elsewhere in tralac research and the reader is encouraged to make use of the relevant publications available on the tralac website[8].

[1] UNIDO. (2021). Industrial development report 2022: the future of industrialization in a post-pandemic world. United Nations Industrial Development Organization.

[2] World Bank. (2020). World development report 2020: trading for development in the age of global value chains. World Bank.

[3] Rodrik, D. (2016). Premature Deindustrialization. Journal of Economic Growth, 21(1), 1-33.

[4] Data for the year 2020, while available, is not used as it incorporates a structural break due to the Covid-19 pandemic.

[5] The regional aggregate for South Asia includes only India, Pakistan, Sri Lanka and Bangladesh in order to avoid biasing an unweighted aggregate of a highly heterogenous group.

[6] The calculated indices are based on the author’s formulae and are not standard definitions of changes in competitiveness or export diversification.

[7] That is, six datapoints are used for the years dimension – 1995, 2000, 2005, 2010, 2015 and 2019 (2020, while available, is not used as it incorporates a structural break due to the Covid-19 pandemic). The ‘first period’ averages over the first three year points, the ‘second period’ averages over the second three year points. In this way, the data is smoothed somewhat, which is important with oftentimes volatile RCA data.

[8] See, for example, the following tralac research: Stuart, J. 2023. The potential of the agribusiness regional value chain under the AfCFTA. Trade Report. Stellenbosch: tralac. https://www.tralac.org/publications/article/15872-the-potential-of-the-agribusiness-regional-value-chain-under-the-afcfta.html

Stuart, J. 2023. The potential of the clothing and textile regional value chain under the AfCFTA. Trade Report. Stellenbosch: tralac. https://www.tralac.org/publications/article/15873-the-potential-of-the-clothing-textile-regional-value-chain-under-the-afcfta.html

Stuart, J., 2022. Benefitting from the AfCFTA – The Case of Mauritius. tralac Trade Report. Stellenbosch: tralac. https://www.tralac.org/publications/article/15846-benefitting-from-the-afcfta-the-case-of-mauritius.html

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...