Blog

South Africa’s April 2020 trade statistics – reduced exports lead to a significant trade deficit

South Africa’s March 2020 trade data[1] showed that measures adopted by its global trade partners to curb the spread of COVID-19 mainly impacted South Africa’s imports. Main source markets were already, or were going into lockdown leading to an overall decline in imports, while exports remain largely unchanged. The import data started to show changes in the trade in medicines and medical equipment (see an earlier tralac Blog here). The April 2020 trade data released by the South African Revenue Service (SARS) shows how South Africa’s lockdown and the demand for medical equipment are shaping South Africa’s pattern of trade with the rest of the world. As the pandemic spreads throughout the African continent, and more specifically, as countries adopted restrictive measures, the April 2020 data[2] also shows a change in South Africa’s trade with other African countries, especially with regards to exports.

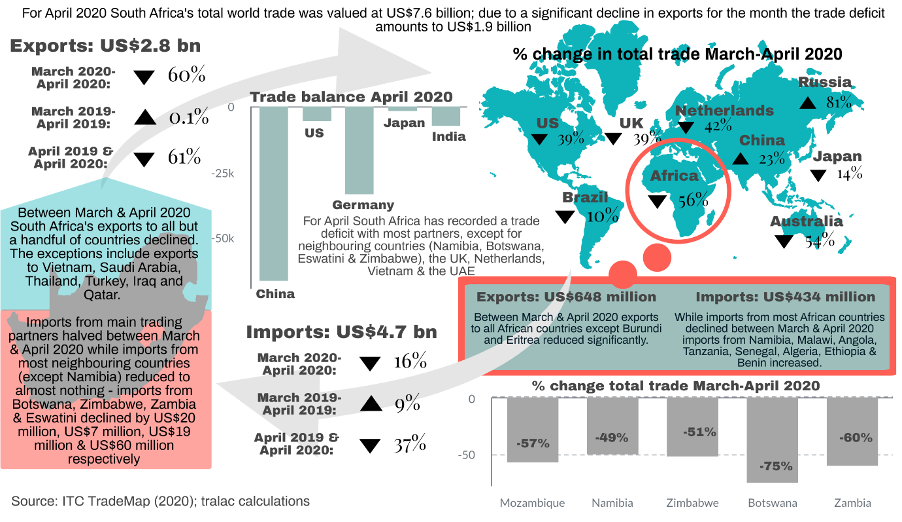

Figure 1: April 2020 – South Africa’s world trade

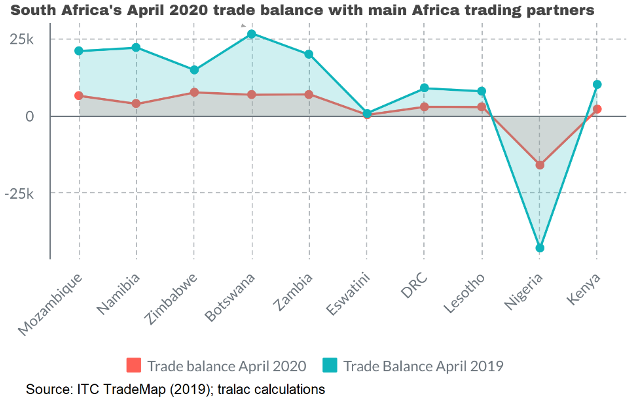

For March 2020 South Africa had a trade surplus of US$1.5 billion; for April this changed to a deficit of US$1.9 billion, a deficit of US$1.6 billion more than the US$242 million trade deficit recorded for April 2019. South Africa recorded a trade deficit with most trade partners, except some African countries, the UK, Netherlands, Vietnam and the UAE.

The trade deficit can be attributed mainly to a significant decline in total exports – in comparison with March 2020 and April 2019 exports more than halved. Exports to all but a handful of countries declined; the exceptions are some countries in Asia and the Middle East – Vietnam (coal and iron ores), Saudi Arabia (lemons, hydrocarbons and phosphoric acid), Thailand (hydrocarbons and chemical wood pulp), Turkey (aluminium and non-alloy pig iron), Iraq (lemons) and Qatar (lemons, lamb, beef, pears, apples and vegetables). Comparing April 2019 and March 2020 world exports with the April 2020 data shows traditional exports (coal, iron ores, platinum and ferro-chromium) decreased by between 25% and 50%. Exports of rhodium (to UK, Japan and Korea), lemons, hydrocarbons and sugar in solid form (to Malaysia and China) increased significantly.

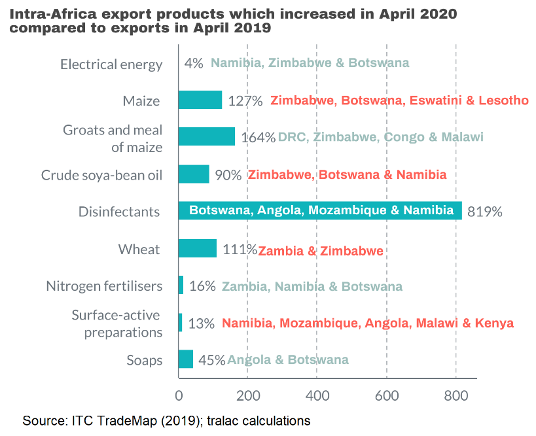

South Africa’s overall intra-Africa exports more than halved between March and April 2020, but intra-Africa exports of crude soya bean oil and sugar in solid form each doubled and exports of disinfectants increased by US$4.4 million. South Africa’s intra-Africa exports of staples (maize, wheat, oilcake, animal feed and fertilisers) and cleaning materials (disinfectants, soaps and surface-active preparations) in April 2020 were significantly higher than exports in April 2019, while exports of medicines declined due to export control measures put in place by South Africa. Furthermore, South Africa also increased exports to some east and west African countries – Ethiopia (maize seed and herbicides), Djibouti (coal), Togo (polyethylene), Burundi (printed books and brochures) and Libya (adhesive dressings).

Not only did South Africa’s world imports decline by US$1 billion between March and April 2020; intra-Africa imports more than halved. As more African countries locked down their economies imports from some African countries, including neighbouring Botswana, Zimbabwe and Lesotho and Zambia, Mauritius, Ivory Coast, Kenya reduced to almost zero. However, imports from other African countries did improve from March including semi-manufactured gold imported from Namibia; crude petroleum from Angola; cashews (from Tanzania and Benin); black tea (Malawi and Tanzania); coffee (from Tanzania and Ethiopia) and dried kidney beans from Ethiopia.

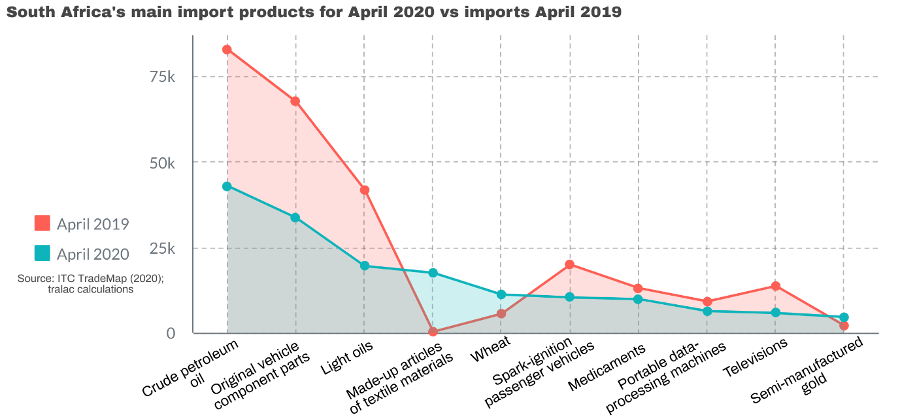

While traditional imports (crude petroleum oils, motor vehicles and original vehicle component parts, televisions and mobile telephones) declined, the data reflected South Africa’s increased demand for products with medical applications (rare gases (Algeria), medicaments (Uganda), masks (China and Hong Kong), portable data-processing machines (China) and laboratory reagents (US, Korea, Germany, China and Sweden)) and staple food items (wheat from Poland, Russia and Lithuania; rice from Thailand, Brazil and Pakistan; and oilcake from Argentina).

[1] pdf Merchandise Trade Statistics for March 2020 including BELN (SARS) (261 KB)

[2] pdf Merchandise Trade Statistics for April 2020 including BELN (SARS) (262 KB)

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...