Blog

South Africa’s trade for March 2020 – significant trade surplus shows the initial impact of COVID-19 on imports

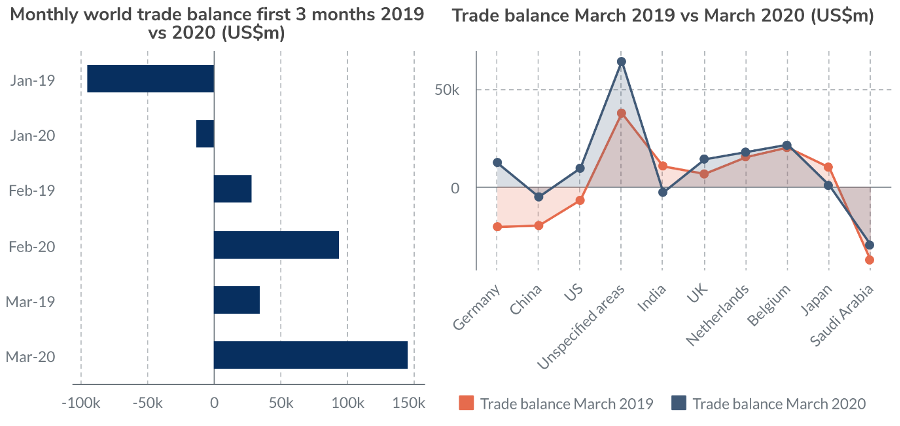

On 30 April 2020, the South African Revenue Services (SARS) released South Africa’s latest official trade data – trade for March 2020. The data shows some of the initial impact of the Covid-19 pandemic, mainly driven by shutdowns in some of the major economies and South Africa’s main trading partners which led to a decline in imports and a consequent trade surplus three times the trade surplus for March 2019.

Source: ITC TradeMap (2020); tralac calculations

For March 2020 the value of South Africa’s imports declined to US$5.7 billion, down from US$7.2 billion in January and US$6.4 billion in February. South Africa’s world exports for March 2020 were only 3 percent lower than exports for March 2019. Consequently, South Africa had a trade surplus of US$1.5 billion for March 2020, compared to a trade surplus of only US$348 million for March 2019.

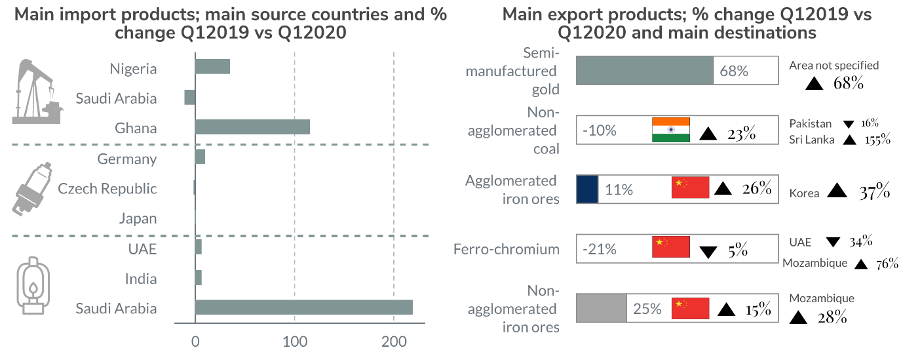

Comparing quarterly data for 2019 and 2020 reveals a similar pattern: imports for the first quarter of 2020 are 9 percent lower than imports for the same quarter in 2019, while exports in quarter one in 2020 are 3 percent higher than exports in quarter one of 2019. The increase in exports is mainly due to an increase in exports of semi-manufactured gold. The destination markets for these exports are, however, unknown – classified as unspecified areas in the official trade data. China, Germany and the US remained the main source countries for South Africa’s imports for the first quarter of 2020; and imports from all three declined (technology products from China, vehicles and original motor vehicle component parts from Germany and machinery and vehicle parts from the US) while imports from Nigeria, Ghana and Saudi Arabia increased.

Source: ITC TradeMap (2020); tralac calculations

The data is also starting to show some changes in the trade in medicines and medical equipment with a slight increase in imports of laboratory reagents and medical equipment from the US, in comparison with imports for March 2019.

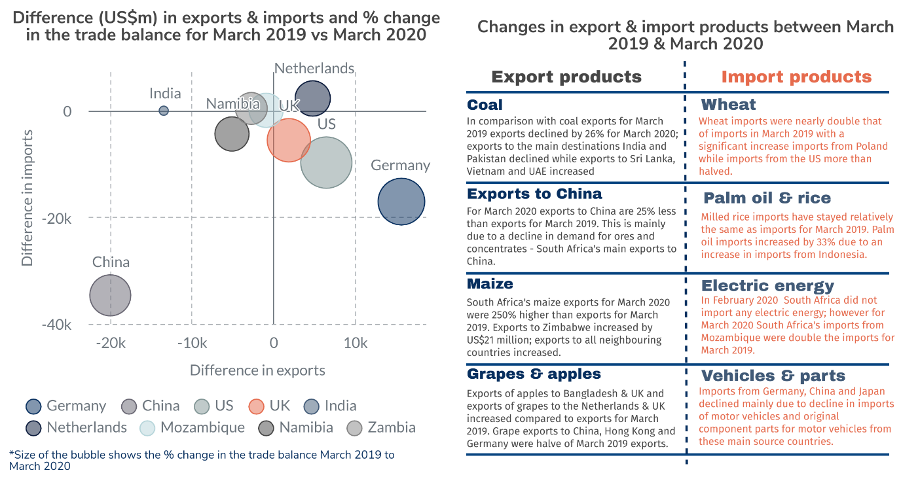

Comparing monthly data for March 2019 and March 2020 shows that the biggest change has been in imports; exports have stayed relatively the same. World imports declined by 19 percent with imports from most source countries declining. Some of the only exceptions are increased imports from Poland (wheat), Netherlands (light oils) and Ghana (crude petroleum oils). Some of the products which show a significant decline in imports include mobile telephones (China) and vehicles, parts and original component parts for the assembly industry (Germany, US and Japan).

Source: ITC TradeMap (2020); tralac calculations

There has been an increase in imports of light oils and preparations (distillate fuels and aviation kerosene), diagnostic laboratory reagents, antibiotics and agricultural products (wheat, rice, palm oil, soybeans, sugar and cattle). Imports of electric energy also doubled in comparison with March 2019; all from Mozambique. Energy imports increased from zero in February 2020 to imports valued at US$45 million for March 2020.

In comparison with March 2019 exports to many destination markets increased for March 2020; but exports to some of South Africa’s most strategic trade partners declined – China, India, Japan and numerous neighbouring African countries.

-

The decline in exports to China is mainly due to the decline in the demand for ores and concentrates (iron, chromium and lead)

-

The decline in exports to India is accounted for by the decrease in exports of coal and manganese ores, while South Africa exported fewer precious metals to Japan (platinum, palladium and rhodium)

-

The decline in exports to neighbouring countries was mainly due to the decrease in exports of vehicles and parts (Namibia and Zambia), and also fewer exports of cigarettes to Namibia, chromium ores and coal to Mozambique and distillate fuel to Lesotho. However, exports of maize to most of these countries increased for March 2020.

While coal used to be South Africa’s main export product it was surpassed by exports of semi-manufactured gold in 2020; which was responsible for almost doubling the value of exports of 2019. However, if one looks at the export data in terms of quantities the quantity of gold exported for March 2020 was only 2.3 tons more than exports for March 2019 and 1.7 tons more than exports for February 2020. Accordingly, the increase in exports can mainly be attributed to the increase in the price of gold, rather than the increase in the tonnage of gold exported.

The impact of the Covid-19 pandemic is starting to seep through South Africa’s trade data with the start of a new trade pattern emerging which will likely be similar for April and May – a significant decline in both imports and exports (due to lockdowns and transportation delays) and trade-centred less around automotive components and petroleum oil imports and ores, coal and vehicle exports. South Africa’s lockdown regulations have meant that most manufacturing and mining operations ceased, and similar lockdowns in trading partners lead to a decline in supply and demand, especially for agricultural and processed food products (essential goods in all countries) and medical equipment and laboratory reagents.

The question, however, is what will the long-term impact of Covid-19 (and possible recurring measures to slow the spread) on countries’ trade patterns be?

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...