News

As volatile financial markets create rumblings in developing countries, UNCTAD report calls for fresh policy thinking

For most developing economies, integration into global financial markets has up to now had only weak linkages to their long-term development goals, the UNCTAD Trade and Development Report, 2015 says. Coupled with increasingly large and volatile capital flows that have expanded vulnerabilities to external shocks, the effectiveness of the policy tools designed to manage growth and development is also being limited.

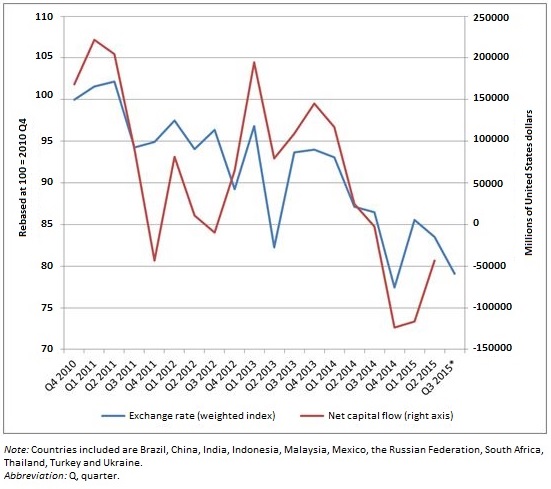

Since the early 2000s, private capital inflows to developing and transition economies have accelerated substantially. External inflows to these countries, as a proportion of gross national income, increased from 2.8 per cent in 2002 to 5 per cent in 2013, after reaching two historical records of 6.6 per cent in 2007 and 6.2 per cent in 2010. Worries of a sudden or substantial exit of inflows began with the economic slowdown and have become more pronounced with the increased volatility of recent months. The close ties between capital flows and key economic prices also increase the danger of a downward deflationary spiral (see figure).

Particularly after the crisis of 2008, those capital flows owed as much to policy decisions in advanced economies as to improved fundamentals in recipient countries. Prior to the crisis, borrowing and asset appreciation drove consumption booms and private investment bubbles in some major economies, and net exports in others. After the inevitable collapse that followed, developed country policies of quantitative easing, together with fiscal austerity, have largely continued this pattern of generating excess liquidity in the private sector.

In mid-2015, global financial markets were spooked by recessions in Brazil, the Russian Federation and South Africa and by signs of economic weakening in China. Global investors, already anticipating a hike in interest rates in the United States of America and a continuing fall in commodity prices, moved briskly to exit emerging economy equity and bond markets.

“Managing the persistent volatility of financial short-term flows requires an internationally coordinated policy response,” UNCTAD Secretary-General Mukhisa Kituyi said, not merely a financial correction with few serious consequences for the real economy. “With developing countries contributing over 60 per cent of global growth since 2011, the knock-on effects of recent emerging market difficulties could be widely felt.”

Overall, developing country growth is forecast to decline to around 4 per cent in 2015, continuing a slowdown that began in 2011 after what initially seemed to be a robust recovery from the crisis in 2008/09, when annual growth reached 7.8 per cent in 2010. That forecast, though, hangs on robust growth in the Asia region; downside risks could push the figures sharply lower in the final quarter of 2015.

For much of the last decade, many developing countries experienced strong growth and improving current accounts, accumulating considerable external reserve assets as a group. The promise of higher returns for investments in developing countries presented an attractive alternative to the low interest rates on offer in advanced economies for international investors.

These capital inflows, however, generated pressures for exchange rate appreciation. More open capital accounts also meant Governments had to conduct monetary and fiscal policy with an eye to the preferences of international finance. An estimated $2 trillion carry trade in emerging economy markets was “an accident waiting to happen”. A minor currency correction by Chinese authorities seems to have been the straw that broke the camel’s back.

Trade growth is also stalling, with the slowdown in most developing regions in 2014 expected to continue or accelerate this year. Commodity prices fell significantly during 2014 and the first half of 2015, extending their downward trend from peaks in 2011/12. The most dramatic fall was that of crude oil prices, but commodity groups whose demand is more closely linked to global economic activity experienced substantial decreases as well.

The resulting decline in the terms of trade for commodity exporters, coupled with increasing capital outflows, has severely weakened economic prospects for many developing countries, the report notes.

The associated depreciation in emerging market currencies does not, however, hold the promise of a recovery-inducing surge in exports. Instead, lower global prices are likely to result in more deflationary pressures than expanded trade given the ongoing weaknesses in global aggregate demand.

A monetary and fiscal policy mix aimed at better managing private capital flows, in particular those of an unstable or speculative nature, and their macroeconomic effects, would help developing countries to face the challenges and to enhance the gains made overall from integrating into global financial markets, the report argues. Measures at the national level, including the judicious use of capital controls and credit allocation policies, need to be supplemented by global measures that discourage the proliferation of speculative financial flows and provide more substantial mechanisms for credit support and shared reserve funds at the regional level. The recent financial turmoil has added urgency to adopting such measures.

Graph 1: Aggregate net capital flows and exchange rates

Highlights

The Trade and Development Report (TDR) 2015: Making the international financial architecture work for development reviews recent trends in the global economy and focuses on ways to reform the international financial architecture. It warns that with a tepid recovery in developed countries and headwinds in many developing and transition economies, the global crisis is not over, and the risk of a prolonged stagnation persists. The main constraint is insufficient global demand, combined with financial fragility and instability, and growing inequality.

These trends reveal the lack of a well-functioning international monetary and financial system, which should be able to properly regulate international liquidity, avoid large and lasting imbalances and allow for counter-cyclical policies; however, international liquidity and capital movements respond to economic conditions in developed countries rather than to actual needs in developing countries. Furthermore, much of the current regime is in fact driven by large international banks and financial intermediaries whose activities increased much more rapidly than the capacity of any public institution (either national or multilateral) to effectively regulate it. Recent initiatives aiming at better regulation remain too timid and narrow.

This dysfunctional regime can neither prevent boom-and-bust episodes nor recurrent debt crises; and when such crises occur, it leads to asymmetric adjustment that throws most of the burden on debtor countries and exacerbates a pro-cyclical bias. This calls for a mechanism for debt resolution, in particular for sovereign external debt, which minimizes the cost of crisis and shares it fairly among the different actors. Furthermore, inefficiencies and missing elements in the international financial architecture have had negative effects in the provision of long-term finance for development.

Against this background, TDR 2015 identifies some of the critical issues to be addressed in order to establish a more stable and inclusive international monetary and financial system which can support the development challenges over the coming years. It considers existing shortcomings, analyses emerging vulnerabilities and examines proposals and initiatives for reform.

In order to improve global growth and financial stability, and to realize the investment push required to fulfil the new development agenda, the systemic problems of the international financial architecture need to be addressed. Solutions are available, but they require dedicated action by the international community.

The main recommendations of the Report are:

-

To avoid secular stagnation, developed countries need to combine monetary expansion with fiscal expansion and wage growth, and be mindful of the international spillovers that their policies can produce;

-

To make the provision of official international liquidity more stable and predictable, multilateral reform remains the desirable target – in the meantime, developing countries may build on regional and interregional initiatives, set swap arrangements among Central Banks and reduce the need for reserve accumulation;

-

A bolder regulatory agenda is needed. This should include strict separation of retail and investment banking, strong regulation of shadow banking as well as public oversight of credit rating agencies and their progressive substitution by more appropriate mechanisms for risk assessment;

-

Developing countries should not be required to apply prudential rules which have been conceived for countries hosting internationally active banks as they result in credit rationing to sectors and agents that need support from a development perspective;

-

A sovereign debt restructuring mechanism is urgently needed. This could be in the form of contractual improvements or internationally accepted principles to guide sovereign debt restructuring. However, the Report sees the best option in a statutory approach based on a multilateral treaty defining a set of rules for a debt restructuring that restores growth and debt sustainability;

-

Specialized public institutions and mechanisms are crucial for the provision of long-term development finance, in particular development banks. The international community needs to meet its Official Development Assistance commitments and to tune it better to strengthening the productive economy.