News

Budget 2015 Fiscal Framework and Revenue Proposals – Preliminary Comment

Initial commentary by PricewaterhouseCoopers on the Tax Proposals included in the 2015 Budget Review

There is little doubt that the 2015 Budget was the toughest since the advent of democracy. The Minister faced difficult choices and fiscal consolidation was essential in order to reduce the risk of further credit rating downgrades. Given the slow economic growth and the need to reduce the budget deficit, he could either have increased taxes or trimmed government expenditure. Ultimately, he has done both.

Areas of Concern

Level of taxation

The level of taxation in South Africa has been steadily growing since 2004 when the main budget tax revenues stood at 22.3% of GDP. It reached a peak of 26.4% in 2008 before falling substantially in the wake of the global financial crisis. However, it has since recovered to similar levels with the level of taxation estimated to be 25.8% of GDP for 2015/16, increasing further to 26.2% by 2017/18. The below graph illustrates the level of taxation from 1996/97 to 2015/16.

Of concern is that, according to World Bank Group data, South Africa had the ninth highest tax:GDP ratio of all countries (excluding social security contributions) for 2012 (in fact South Africa would rank eighth if Botswana, whose tax revenues consists substantially of SACU revenues derived from South Africa, was excluded and even higher if other exceptional jurisdictions such as Macao are excluded). South Africa’s tax:GDP ratio is significantly higher than the world and Africa averages as well as most middle income countries. The below graph illustrates the nine countries with the highest tax:GDP ratios, world and regional averages and a selection of other middle income and BRIC countries.

It is clear that South Africa has a high tax burden by international standards. While some of this tax burden is explained by a large social security system funded out of general tax revenues rather than social security taxes, if the tax burden was reduced by social security expenditure, South Africa would still have a relatively high tax burden.

It is acknowledged that South Africa’s high income and wealth inequality necessitates its fiscal policy to play a crucial role in reducing inequality and South Africa does extremely well in this regard with the largest reduction in inequality achieved by any of the countries studied at this stage. In this regard, the World Bank notes that South Africa has probably reached the limit that can be achieved by fiscal policy and that further reductions in inequality require inclusive economic growth.

However, if South Africa is to rely on the private sector to be the primary driver of economic growth and employment, it is going to have to reduce the tax burden over time in order to free up resources for investment by the private sector. This is not, however, as critical as ensuring that our tax mix is conducive to economic growth.

SACU

In terms of the SACU agreement, a combined revenue pool is created for purposes of sharing customs and excise duties while trade between the SACU member countries is duty-free. The combined revenue is shared between the member countries in terms of three formulas:

-

Customs duties are shared based on relative intra-SACU imports;

-

Excise duties are shared based on relative GDPs; and

-

A development component derived from excise duties is shared based on relative GDP per capita.

Unfortunately, the revenue sharing formula is weighted heavily against South Africa. Of particular concern is the formula for sharing customs duties. South Africa has significant trade surpluses with all other member countries. In 2014, SACU exports from South Africa amounted to R132 billion, while imports amounted to only R28 billion. The result of these significant trade surpluses is that the bulk of customs duties in the combined revenue pool accrue to the other members, notwithstanding that the vast majority of customs duties collected relate to goods that are consumed in South Africa. To illustrate the point, the total value of imports by South Africa in 2014 amounted to R1.083 trillion. South Africa’s SACU exports amount to approximately 83% of all intra-SACU trade. The result is that South Africa’s share of the SACU customs pool amounted to only 17% for 2013/14.

To put the above into perspective, a more equitable sharing of the customs revenue pool would see South Africa entitled to at least 80% of the pool. The cost to South Africa is therefore at least R30 billion. This cost far exceeds the benefit for South Africa of being able to export goods to SACU members on a duty-free basis.

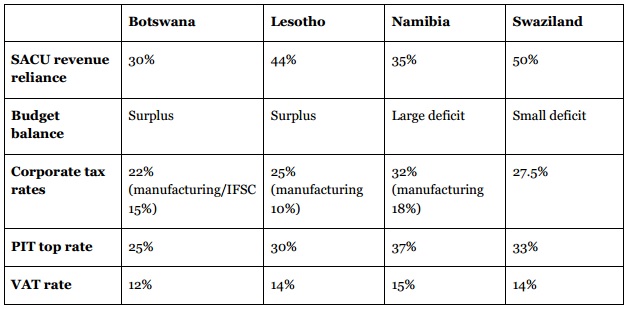

More importantly, the tax increases being sought in the 2015 Budget would not be necessary were the SACU revenue sharing formula to provide for a more equitable sharing of the revenues. The BLNS countries have now become heavily dependent on the SACU revenues. The result is that South African taxpayers are funding SACU member countries to a significant extent. The below table illustrates how dependent the BLNS countries have become on SACU revenues, the strength of their fiscal positions are and how they compete favourably with South Africa on tax rates (Namibia is the exception).

The South African taxpayer is no longer in a position to be able to afford to subsidise the BLNS countries to the extent that it is currently doing. While the fiscal stability of these countries must obviously be taken into consideration in order not to destabilise the region, the agreement should be renegotiated over the medium term in order to provide for a more equitable sharing of revenues, failing which South Africa should withdraw from the agreement.

Download the full document below.