News

Botswana: Budget Speech 2015

The 2015/2016 Budget Speech for Botswana was delivered by Honourable O.K. Matambo, Minister of Finance and Development Planning, on 2 February 2015

The 2015/16 Budget Speech focuses on interventions aimed at promoting economic growth and diversification in the country as they are critical in addressing the persistent challenges of unemployment, income inequality and poverty. Therefore, in this financial year’s budget, Government will continue to allocate significant budgetary resources to human capital and physical infrastructure development. This is in recognition of their importance in improving factor productivity and competitiveness, and ultimately increasing economic growth and diversification.

INTRODUCTION

To achieve the goals of promoting economic growth and diversification, Government will continue to adopt appropriate policies and strategies and make substantial budgetary allocations to human capital and physical infrastructure development in recognition of their importance in improving factor productivity and competitiveness. However, it should be noted that the role of Government in promoting growth in the country is a facilitatory one through the provision of a conducive environment for efficient operations of the private sector; which should be the engine of growth. To this end, domestic enterprises would also need to play their part by: improving their operational efficiency; enhancing productivity; and adopting appropriate technologies, in order to enhance their access to global supply chains and networks, which is necessary for global competitiveness.

Despite the positive domestic economic outlook for the financial year 2015/2016, there is a need to continue with prudent management of our resources, given the continued uncertainty over the recovery of the global economy. To this end, expenditure management and control should remain a priority, if fiscal policy is to continue to be supportive of a stable macroeconomic environment, which is necessary for growth and economic diversification. This means that the implementation of the programmes and projects should be guided by the principles of efficiency, effectiveness and financial discipline. Hence, the need to continuously strive for a balance between economic and social investment decisions, to ensure that, emphasis on one does not jeopardise progress in the other. Above all, there is need to ensure value-for-money throughout the implementation of our projects and programmes.

KEY THEMATIC AREAS FOR 2015/2016 FINANCIAL YEAR

With economic growth and diversification remaining the country’s economic priorities, the Government has identified four key thematic areas which are: Growing the economy; Promoting inclusive growth; Enhancing business environment to promote investment and foster diversification; and strengthening the judicial system and combating crime and corruption. These thematic areas are critical in promoting growth and ensuring economic diversification, and therefore assisting in efforts to create employment and improve on the general infrastructure, health and social development and the fight against corruption and crime.

GROWING THE ECONOMY

To address the development challenges of poverty, unemployment, and income inequality, we need economic growth. Without enlarging the size of the economy, it would be impossible to create jobs that the country desperately needs to address youth unemployment, and generate revenues to support Government’s social welfare programmes. It is for this reason that growth and economic diversification should remain our economic priorities.

Economic growth can also be generated through improving total factor productivity and increasing the productive human and capital inputs. Whereas, the country has performed reasonably well in increasing factor inputs, growth in factor productivity has been a challenge in the recent years. In this regard, improving productivity must remain a priority for driving economic growth and ensuring that the economy performs at its potential capacity.

Improving Productivity to Drive Economic Growth

A recent challenge to the promotion of growth and economic diversification has been the declining total factor productivity in the domestic economy, especially labour productivity. In this regard, Government will continue to put in place measures to promote productivity that include: reforming the country’s education and training system; improving work ethic through training the workforce; as well as reviewing labour legislation; with a view to promoting efficiency in the labour market. Such labour market reforms will assist the economy to transit from mineral-led to a knowledge economy. To further improve on total factor productivity, Government is implementing public sector reforms, enhancing research and development, and developing appropriate human skills.

Public Sector Reforms

Madam Speaker, public sector reforms are critical in improving productivity and achieving efficient public service delivery. Hence, a comprehensive Public Sector Reform Coordination Programme is being developed and will be implemented during NDP 11. The Programme is expected to generate five key results, which are: improved relevance and convergence of public sector reforms and their alignment with national priorities; enhanced coordination; increased capacity of implementing agencies; improved monitoring and evaluation; and informed decision making on prioritization and funding. These results are expected to improve service delivery within the public sector and thus, have a positive bearing on labour productivity and economic growth.

Furthermore, a Public Finance Management Reform Programme was adopted in July 2010 as part of on-going fiscal reforms. In this connection, the last few years have seen Government gradually strengthening its macro-fiscal management and budget formulation capabilities. In the process, my Ministry has been able to develop and implement a Medium-Term Fiscal Framework which generates medium-term fiscal forecasts. In addition, Government will implement a Medium Term Expenditure Framework in 2015/2016 financial year to strengthen management of public finance spending.

Enhancing Research and Development

Research and development are essential ingredients in driving economic growth and keeping the country abreast of emerging global competition. To this end, Government has undertaken to regularly generate indicators of Research, Science, Technology and Innovation to inform on the current status of Botswana’s capability in supporting and maintaining research and innovation. The indicators generated from the 2012/2013 data show that Botswana’s capability in research and development in terms of investment, private sector involvement and human resource dedicated to research, is still too low. Hence, the need for a coordinated, aggressive and concerted implementation of the Research, Science, Technology and Innovation Policy of 2011.

PROMOTING INCLUSIVE GROWTH

Despite the positive economic growth registered in the past years, the country continues to face development challenges of unemployment and poverty. To address this, Government will be promoting inclusive growth by creating a conducive environment for productive economic opportunities while ensuring that the benefits of economic growth are equitably shared among various sections of the society. While the focus will be on productive employment, Government will continue with its efforts to eradicate abject poverty by providing social welfare programmes to the poor and most vulnerable groups in the society.

Employment Creation

An inclusive growth approach is premised on gainful employment of factors of production, especially labour. The current unemployment rate of 19.8 percent therefore represents underutilisation of one of the country’s important resource, namely our human capital. This is a challenge for the country, especially that it affects the youth. It is for this reason that Government will continue to implement various programmes, projects and strategies geared towards assisting the youth and women to improve their livelihood. This year’s development budget of P12.93 billion which will mainly be spent on infrastructure projects such as construction of new schools, new power transmission lines and water pipelines, is expected to go a long way in creating new employment opportunities. In addition, complementary laws, labour laws such as the Employment Act, Trade Disputes Act, Workers’ Compensation Act and Trade Unions and Employers’ Organisations Act will be reviewed to facilitate harmonious industrial relations and also to make the labour relations environment conducive for investment.

Poverty Eradication

To address one dimension of inclusive growth, which is, the protection of the disadvantaged and marginalised groups of the society, Government will continue to put in place measures to improve the efficacy of our social welfare programmes. These measures will ensure food security, availability of social safety nets to reduce poverty, and the promotion of opportunities for special groups such as women, the elderly and people living with disabilities.

It is therefore pleasing to note that the poverty eradication efforts by the Government continue to yield results, as indicated by the decline in the population living in poverty from 30.6 percent in 2002/2003 to 19.3 percent in 2009/2010. Since November 2014, 9,588 projects funded by the Poverty Eradication Programme have been fully operational, covering all districts. Beneficiaries of such projects are now earning sufficient income to graduate from extreme poverty. Government will therefore continue to fund the programme, with a view to assisting more deserving citizens.

Meanwhile, Government is in the process of formulating a Botswana Poverty Eradication Strategy, which is expected to be finalized by end of September 2015. This strategy will serve to guide all efforts of Government towards poverty eradication across sectors to ensure consistency of action and results as well as fostering inclusive growth in our economic development agenda.

Financial Inclusion

Achieving inclusive growth as a policy objective will depend on, among others, the extent to which the financial system provides basic financial services to the people. In this regard, the financial sector has intensified its efforts to promote financial inclusion, broadly defined as the delivery of financial services at affordable costs to disadvantaged and low-income segments of the society. Mobile financial services is one of those initiatives that are being used to promote financial inclusion. It includes mobile money transfer and mobile banking such as e-wallet and others which are easily accessible and convenient medium for the delivery of financial services. In addition, the Ministry of Finance and Development Planning has adopted the Making Access to Financial Services Possible Approach to Financial Inclusion. During the year 2015/2016, a Making Access to Financial Services Possible diagnostic analysis will be carried out in Botswana with the view to developing a comprehensive financial inclusion road map, which should lead to a more accessible, inclusive and robust financial system.

Citizen Economic Empowerment

Inclusive growth cannot be achieved without empowering citizens to take an active role in economic activities. It is for this reason that Government continues to make concerted efforts to empower citizens in order to benefit from economic growth. To this end, the amended Citizen Economic Empowerment Policy makes it mandatory for sub-contracting of Government funded projects to 100 percent citizen owned companies. It further stipulates that 30 percent of each Ministry’s projects budget should be reserved for 100 percent citizen owned companies to promote citizen empowerment.

To further advance citizen economic empowerment, the implementation of Local Procurement Scheme has been progressing at different levels across the country. All the District Administration Tender Committees have been trained on the Scheme. Effective implementation of the Scheme should translate into more empowerment of citizens in rural areas, especially through businesses owned by women, youth and People Living with Disabilities.

The Government is committed to creating a favourable environment for the development of the small, medium and micro enterprises (SMMEs), as part of citizen empowerment in the country. However, the success of the SMMEs will depend on various factors such as their ability to deliver quality products to clients, delivery of goods and services on time, and reasonable pricing of such goods and services. This, in turn, requires that SMME’s also invest in innovation and skills development to ensure their long term sustainability.

ENHANCING THE BUSINESS ENVIRONMENT TO PROMOTE AND FOSTER DIVERSIFICATION

Economic diversification is a long-term process that, despite some achievements, is still a challenge. To address this challenge, Government continues to embark on several strategies that, of late, include cluster and value chain development, financial sector support, as well as fostering an environment that allows for complementarity between macro and micro economic policies and deregulation of domestic markets to promote competition.

Development of Cluster and Value Chain in Selected Sectors

The cluster and value-chain approach to development has yielded positive results in some countries. The concept of clusters refers to a group of inter-connected firms, suppliers and related industries, while a value chain is a sequence of activities that firms operating in a specific industry perform in order to deliver a valuable product or service. In this regard, Government has adopted the Cluster Development Approach as a practical strategy to achieve economic growth and diversification. The four identified clusters are Diamond, Tourism, Cattle, and Mining, comprising of coal, copper and other minerals excluding diamonds. Some work has already started on the development of the Diamond cluster. Regarding the Cattle cluster development, three districts of; Central, Kgatleng and Gantsi have been identified for the first phase of implementing the concept. The concept will include, among others, ensuring that within each district, there is development of industries such as livestock feed processing plants, abattoirs, and refrigerated transportation to support the beef industry.

Another sector where the cluster approach will be introduced is the tourism sector, which continues to be one of the key sectors that contribute to the diversification of the economy. During 2013, tourist arrivals were estimated at 2.4 million while receipts amounted to P6.24 billion. Government is reviewing the Tourism Policy to address local, regional, and international challenges experienced within the tourism industry. Such a review process is in its final stages and the revised Policy is expected to create a more supportive and enabling environment for local investors. Furthermore, Government is reviewing the Wildlife Conservation and National Parks Act No. 28 of 1992 and the revised Act is expected to be considered by Parliament during 2015/2016 financial year.

Financial Sector Support

In view of the critical role of the financial services sector in creating a conducive business environment for diversification, Government remains committed to the implementation of the Financial Sector Development Strategy of 2012, whose aim is to promote a smooth development of the financial services sector, including the development of the domestic capital market. Some of the measures pursued in this regard include development of financial regulatory framework and policies, as well as adequate resourcing of relevant regulatory institutions. Among the measures to further improve financial and business services, is a project on the electronic cheque imaging and truncation, whose objective is to reduce the cheque clearing cycle from the current four to two days. A successful implementation of the project will allow bank customers paid by cheque to have quicker access to their funds.

In order to improve on the level of protection of users of financial services, my Ministry has been working with the Non-Bank Financial Institutions Regulatory Authority in drafting several pieces of legislation. To this end, the Securities Act and the Retirement Funds Act were passed during the July 2014 sitting of Parliament. Furthermore, the Insurance Industry Bill is scheduled to be presented at this sitting of Parliament and we intend to present several new Bills to Parliament during the 2015/2016 financial period. The new Bills include: a revised Non-Bank Financial Institutions Regulatory Authority Bill; and a new Collective Investment Undertakings Bill.

Complementary Macro and Microeconomic Policies

In order to achieve the goals of economic growth and diversification, a number of policy reforms are necessary and should continue to be implemented at both the macro and the micro level. These include the implementation of macroeconomic policies such as fiscal: monetary and exchange rate, as well as micro policies such as privatization; promotion of efficient labour market; deregulation of domestic market to encourage competition; and promoting trade through participation in regional and international trade agreements such as SADC Trade Protocol, and SADC/EU Economic Partnership Agreement.

In terms of the macroeconomic policies, Government has maintained a stable macroeconomic environment by ensuring coordination between fiscal, monetary and exchange rate policies. The results of this coordination include: the return to positive budget balances following the 2008/2009 global recession; a monetary policy stance that balances between price stability and economic growth; and an exchange rate policy mechanism that aims for a stable real effective exchange rate to promote domestic competitiveness. In turn, it is expected that the private sector will take advantage of the conducive macroeconomic environment to grow and create employment opportunities.

STRENGTHENING THE JUDICIAL SYSTEM AND COMBATING CRIME AND CORRUPTION

A secure environment is a pre-requisite for both domestic and foreign investments, which are essential ingredients for growth and economic diversification. Botswana, like other developing countries, is increasingly becoming susceptible to complex security challenges such as cybercrime, terrorism, human trafficking and drug smuggling, to mention but a few. As a result, there is need to maintain a high state of readiness to protect people and property against any form of threat. It is for this reason that Government continues to invest in security services, as part of an effort to create a conducive environment for growth and economic diversification.

Despite accolades received by the country on good governance by reputable institutions such as Transparency International, corruption remains a challenge in Botswana. Achieving economic and social development will therefore require continued efforts to address this scourge. In this regard, Government will be: reviewing legislation, where necessary; increasing anti-corruption education; and promoting partnerships in the fight against corruption.

Furthermore, the Directorate on Corruption and Economic Crime has completed drafting of the National Anti-Corruption Policy, which aims at promoting accountability and providing a framework against which anti-corruption legislation and other interventions may be undertaken. A draft policy has been circulated to various ministries and stakeholders for their input and advice, after which it will be presented to Cabinet and Parliament. It is worth noting that a successful fight against corruption is necessary for attracting investors into the country to grow the economy, and create more employment opportunities.

Select infographics

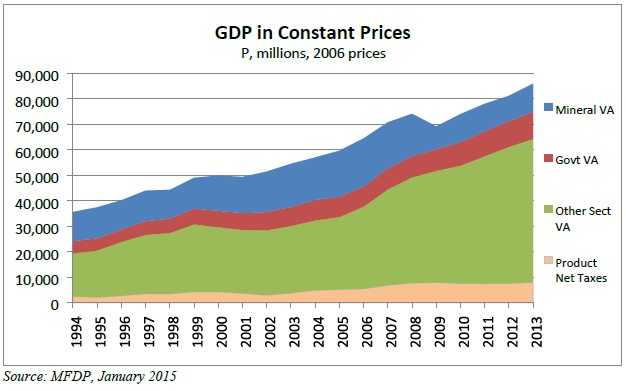

Gross Domestic Product

Real economic growth registered 5.8% in 2013; estimated at 5.2% in 2014 and forecast at 4.9% in 2015. Estimated GDP in current prices for FY 2014/15 = P143.7 billion, and projected for FY 2015/16 = P155.7 billion.

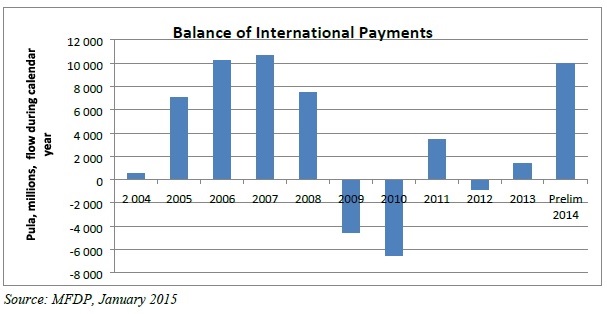

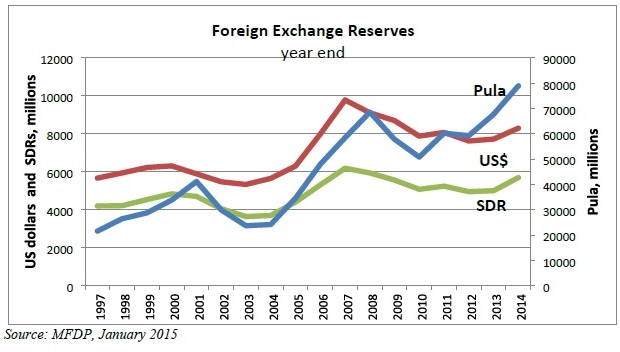

Balance of Payments and Foreign Exchange Reserves

Balance of international payments surplus of P10.0 billion in 2014 compared P1.3 billion in 2013.

As at the end of December 2014, Foreign exchange reserves stood at P79.0 billion, enough to finance 18 months of goods and services imports. Foreign exchange reserves in terms of SDRs and USD were 5.7 billion and 8.3 billion, respectively as at end December 2014.

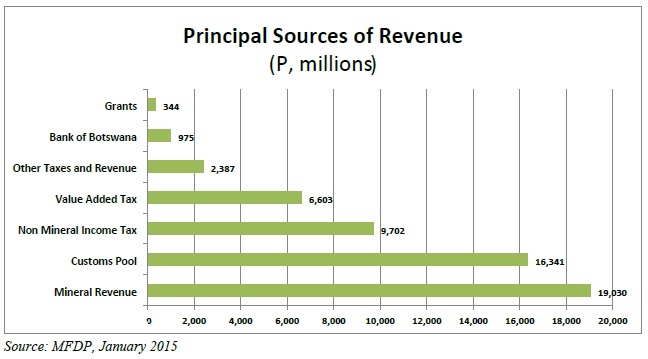

Revenues and Grants

The projected total revenues and grants for 2015/2016 amount to P55.38 billion, of which Mineral Revenue accounts for 34.4 percent, Customs and Excise for 29.5 percent, while Non-Mineral Income Tax accounts for 17.5 percent of total revenue.