News

Global Economic Prospects: Sub-Saharan Africa regional outlook

Sub-Saharan Africa’s growth improved, for the second consecutive year, to 4.5 percent in 2014. Despite headwinds, growth is projected to pick up to 5.1 percent by 2017, lifted by infrastructure investment, increased agriculture production, and buoyant services.

The outlook is subject to downside risks arising from a renewed spread of the Ebola epidemic, violent insurgencies, lower commodity prices, and volatile global financial conditions. Policy priorities include a need for budget restraint for some countries in the region and a shift of spending to increasingly productive ends, as infrastructure constraints are acute. Project selection and management could be improved with greater transparency and accountability in the use of public resources.

Recent developments

Growth picked up moderately in Sub-Saharan Africa in 2014, to 4.5 percent, compared with 4.2 percent in 2013. In South Africa, growth slowed markedly, constrained by strikes in the mining sector, electricity shortages, and low investor confidence. Angola was set back by a decline in oil production and the Ebola outbreak severely disrupted economic activity in Guinea, Liberia, and Sierra Leone. In contrast, in Nigeria, the region’s largest economy, activity expanded at a robust pace, supported by a buoyant non-oil sector. Growth was also strong in many of the region’s low-income countries. Excluding South Africa, the average growth for the rest of the region was 5.6 percent. However, extreme poverty remains high across the region.

Investment in public infrastructure, increased agriculture production, and buoyant services were key drivers of growth. FDI flows, an important source of financing of fixed capital formation in the region, declined in 2014, reflecting slower growth in emerging markets and soft commodity prices. However, several frontier market countries including Cote d’Ivoire, Kenya and Senegal, were able to tap international bond markets to finance infrastructure projects.

The fiscal deficit for the region narrowed as several countries took measures in 2014 to control expenditures. At the same time, however, the fiscal position deteriorated in many countries. In some, it was due to increases in the wage bill (e.g. Kenya and Mozambique). In other countries (e.g. Mali, Niger, and Uganda), it was due to higher spending associated with the frontloading and scaling up of public investment. Elsewhere, the higher deficits reflected declining revenues, notably among oil-exporting countries because of declining production and lower oil prices (e.g. Angola). The region’s debt ratio remained moderate thanks to robust growth and concessional interest rates. However, in a few countries, debt increased significantly in 2014, especially in Ghana, Niger, Mozambique and Senegal.

Falling prices for oil, metals, and agricultural commodities weighed on the region’s exports. In contrast, spurred by infrastructure projects, import demand remained strong. As a result, several frontier market countries as well as South Africa continued to have substantial twin fiscal and current account deficits. Inflation edged up in the first half of 2014, due in part to higher food prices, but remained low in most countries. Reflecting concerns about low oil prices, the sovereign spreads for oil exporters rose strongly. The Nigerian naira weakened sharply against the U.S. dollar, prompting the central bank to raise interest rates and devalue the naira. The South African rand continued to fall on concerns about the country’s large current account deficit.

Outlook

Regional GDP growth is projected to remain broadly unchanged at 4.6 percent in 2015, rising gradually to 5.1 percent in 2017, supported by sustained infrastructure investment, increased agricultural production, and expanding service sectors. Commodity prices and capital inflows are expected to provide less support, with demand and economic activity in emerging markets remaining subdued.

Growth will remain robust in most low-income countries, owing to infrastructure investment and agriculture expansion, although soft commodity prices will dampen activity in commodity exporters. South Africa is expected to experience slow but steady growth, helped in part by gradually increasing net exports, and reforms to alleviate bottlenecks in the energy sector. Growth is expected to pick up moderately in Angola, as oil production rebounds. In Nigeria, the devaluation of the naira will push up inflation and slow growth in 2015, but with continued expansion of non-oil sectors, particularly the services sector, growth is expected to pick up again in 2016 and beyond. Among frontier market countries, growth is expected to increase in Kenya, boosted by higher public investment and the recovery of tourism. High interest rates and inflation would weigh on consumer and investor sentiment in Ghana, slowing economic activity.

Risks

The risks to the region’s outlook are mostly on the downside, stemming from both domestic and external factors. On the domestic front, the Ebola outbreak could spread more widely than assumed in the baseline, dent confidence and cause severe disruptions to cross-border trade and supply chains in the region. In various countries, government budgets are at risk from demands for increased spending. Conflicts in South Sudan and Central Africa Republic, and security concerns in northern Nigeria could deteriorate further with harmful regional spillovers. On the external front, a sudden increase in volatility in international financial markets, and lower commodity prices are among the major risks to the region’s outlook. A sharper or sustained decline in the price of oil would adversely affect the region, even though net oil importers would gain.

Lower growth in emerging economies, to which Sub- Saharan Africa exports, is the main external risk to the regional outlook. A worse-than-expected slowdown in China especially would reduce demand for commodities, putting further downward pressure on prices, especially where supply is abundant. A further decline in the already depressed price of metals, in particular iron ore, gold, and copper, would severely affect a large number of countries in the region. In countries such as Mauritania, Mozambique, Niger, Tanzania, and Zambia, metals account for a large share of exports; and their exploitation involves large FDI flows. A protracted decline in metal prices would lead to a significant drop in export revenues. A scaling down of operations and new investments in these countries would reduce output in the short run, and reduce growth momentum over an extended period of years.

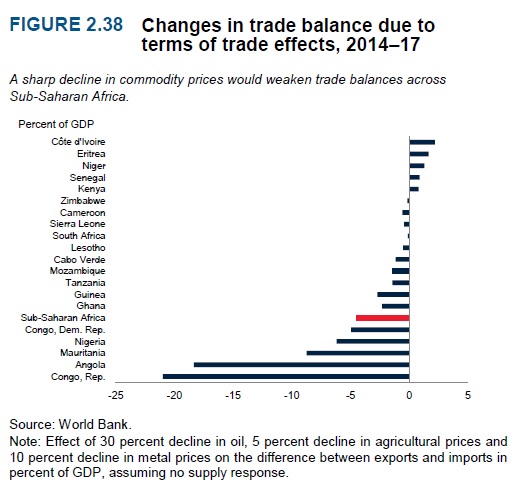

Simulation results suggest that the income effects of a sharp decline of commodity prices on Sub-Saharan African economies could be large. The scenario considered has a price decline from the baseline of 10 percent for metals (aluminum, copper, gold, iron ore, and silver), 5 percent for agricultural commodities (cocoa, coffee, tea, cotton, and tobacco), and 30 percent for crude oil. In the simulation, Sub-Saharan Africa is affected more than other parts of the developing world. Countries where metals, agricultural products, or oil represent a large share of total exports see their terms of trade deteriorate sharply. A sharper-than-expected and sustained decline in the price of oil from the baseline would, on the whole, adversely affect the Sub-Saharan Africa region, even though non-oil importers would gain. Oil exporters with a narrow economic base such as Angola and the Republic of Congo would be affected the most. The positive effect on oil importers is reflected in large trade balance improvements for Côte d’Ivoire, Eritrea, Kenya, Niger, and Senegal and moderate trade balance deterioration in South Africa.