News

Development billions channelled through tax havens

Public institutions providing finance to businesses in developing countries are channelling billions of euros through secretive tax havens, a report published today (4 November) has found.

Development Finance Institutions (DFIs) in Europe and the World Bank’s lending arm, the International Finance Corporation (IFC), are playing an increasingly dominant role in funding development.

DFIs support private companies in developing countries directly by providing loans or buying shares, or indirectly by supporting financial intermediaries such as commercial banks and private equity funds, which then on-lend or invest in enterprises.

But many of the intermediaries are based in the world’s most secretive tax jurisdictions, according to the report Going Offshore, published on 4 November by the European Network on Debt and Development (Eurodad).

Report author Mathieu Vervynckt said it was strange that DFIs route so much financial support through tax havens when developing countries lose hundreds of billions of euros every year through company tax evasion and avoidance.

“DFIs are essentially providing income and legitimacy to the offshore industry,” he said.

Supporters of the use of havens argue that they have a stable legal and regulatory framework designed for financial services and that their use prevents double taxation, when income is taxed twice by two jurisdictions.

Offshore financial centres are sometimes the only feasible way for pooling much needed capital for investment in risky regions such as Africa where there are weak legal and regulatory systems, they claim.

Tax evasion by multinationals has risen up the political agenda since the financial crisis. Cash-strapped EU countries are not willing to overlook much-needed revenue lost through tax dodging.

“The current political momentum towards tax justice presents DFIs with a great opportunity to set an example of best practice in establishing the highest standards of responsible finance,” the report said.

Report findings

The report examined 14 national DFIs and three international DFIs, the European Investment Bank, the European Bank for Reconstruction and Development and the IFC.

It also compared investments to countries on the Tax Justice Network’s Financial Secrecy Index, which ranks countries according to their tax secrecy and activities.

It found that:

-

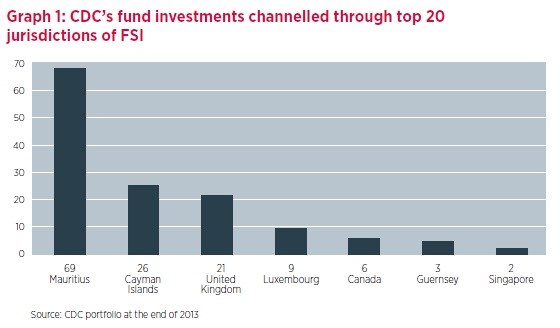

By the end of 2013, two thirds of the fund investments, 118 out of 157, made by the UK’s DFI, the Commonwealth Development Corporation (CDC), were through jurisdictions in the top 20 of the index

-

Between 2000 and 2013, these funds received a total of $3.8 billion (€3.04 billion) in original CDC commitments, including $553 million (€442.56 million) in 2013 alone

-

Of the 46 investment projects involving German DFI Deutsche Investitions- und Entwicklungsgesellschaft, as of 31 December 2012, at least seven were structured through major tax havens such as the Cayman Islands and Mauritius

-

30 of the 42 investment funds used by the Belgian Investment Company for Developing Countries were domiciled in tax havens. As of 4 June this year, the investments were worth €163 million

-

By the end of 2013, Norway’s Norfund invested $339 million (€267 million) through jurisdictions on the FSI’s top 20

-

Between 2009 and 2013, the IFC supported financial intermediaries registered in tax havens listed in the top 20 FSI jurisdictions listed under the FSI, to the tune of €1.7 billion.

Eurodad criticised the European Investment Bank for not disclosing the countries where the companies it invests in are domiciled. That made it very difficult to judge the extent of its use of tax havens. The EIB was asked to comment yesterday and the story will be updated once a response is received.

A spokesman for the UK’s CDC said, "Businesses we support employ over one million people in developing countries and last year paid over €2.94 billion in local taxes.

“CDC requires the businesses we invest in to pay all taxes that are due of them and avoids making investments in jurisdictions that are not compliant with the OECD’s internationally agreed standards on tax transparency.”

Call for transparency and intergovernmental tax body

The report conceded that most DFIs have standards to govern the use of tax havens but said they were not easily accessible to the public

The standards are based on the OECD Global Forum on Transparency and Exchange of Information for Tax Purposes. Many developing countries were excluded from the forum, Eurodad said, and it mostly focused on bank secrecy rather than corporate tax dodging.

The NGO called for the creation of a United Nations intergovernmental tax body to ensure developing countries can participate equally in the global reform of tax rules. This should take over from the OECD as the main forum for international tax cooperation.

Eurodad wants DFIs to ensure the funds they invest in are registered in the county of operation. They should also only back companies and funds that are willing to publicly disclose information about their owners and report back to the DFI their financial accounts on a country by country basis.

Vervynckt said, “We are urging these institutions to stop supporting companies that use tax havens and make sure that details of all operations are open to the public. It’s only right to demand that [DFIs] should be accountable to the taxpayers that pay for them and the people in the developing countries that they are supposed to help.”