News

Transcript of Sub-Saharan Africa Regional Economic Outlook Press Briefing, April 2020

Extracts from the press briefing held on 15 April 2020 at the IMF-World Bank Virtual Spring 2020 Meetings, with Mr. Abebe Aemro Selassie, Director of the IMF’s African Department, and Mr. Gediminas Vilkas, Communications Officer at the IMF

MR. SELASSIE: Good morning. Before taking your questions, I would like to briefly summarize some of our, some aspects of the outlook that as we see them today.

First, thank you for joining us remotely for the launch of our regional economic outlook for Sub-Saharan Africa. Unsurprisingly, the outlook this spring is tightly focused on the impact of the COVID-19 pandemic on the region, an unprecedented crisis which is threatening to reverse the region’s recent development and policy gains.

To summarize briefly, the impact that this crisis is having on the region and the policies that are needed to protect lives, and allow a swift recovery, I would like to make a few points. First, outlook in Sub-Saharan Africa is expected to contract by 1.6 percent in 2020, and highest, you know, in per capita terms, this would be higher still at close to 4 percent. This is the lowest growth number that we can find for the region going back at least to 1970.

The possibility that growth could be contracted more still is quite high, and even if the contraction is limited to this level, it is worth nothing that it represents a 5 percentage points downward revision since last October. And it is, as I noted, the worst performance that we’ve seen going back at least to 1970.

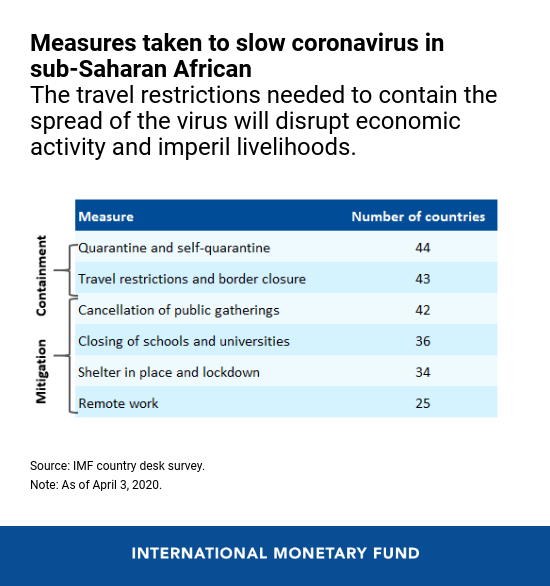

The hit to growth reflects a poisonous cocktail of shocks that is affecting livelihoods and economic activity. Swift and decisive measures, closing borders, shattering businesses, requiring people to stay at home have had to be adopted to halt the advance of the virus before it overwhelms already stretched health services, but will also disrupt production and reduce demand sharply.

Of course, worth bearing in mind is that these measures will have the greatest impact on the region’s most vulnerable. People, who in many cases, have to go out every day to earn income to put food on the table are now being required to stay at home now.

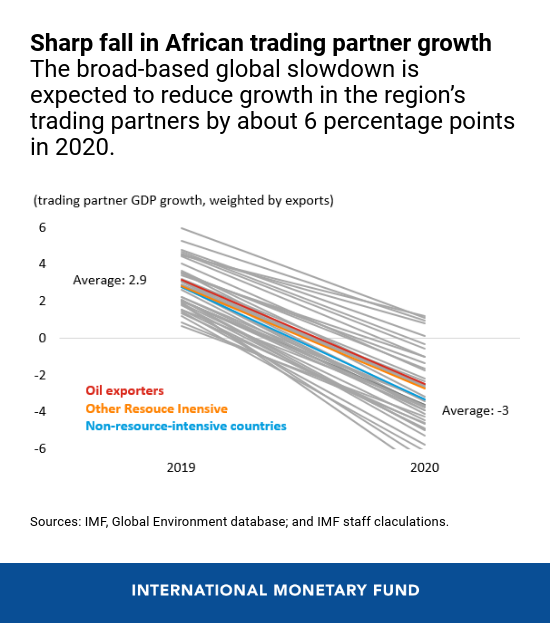

Coupled to this plummeting global demand will exacerbate the economic impact greatly by reducing demand for the region’s goods and services, tourism, remittance flows, tighter global financial conditions have already triggered significant capital outflows from the region, and will also adversely impact the prospect for investment going forward. And commodity exporters, will suffer from an additional sharp decline in key commodity prices adding significantly to the region’s difficulties.

As a result, no country will be spared. As elsewhere, the region faces a synchronized and deep economic downturn with less diversified economies. All exporters’ tourism dependent economies set to be very hard. Against this difficult backdrop, several urgent and decisive measured are needed to limit the humanitarian and economic cost of this crisis. The immediate priority is to do whatever it takes to protect people’s health, boosting health spending as needed regardless of fiscal space concerns.

We also see a significant role for fiscal policy in this crisis to mitigate the impact of the crisis. Targeted cash transfers and similar measures to support people whose livelihoods are being upended by the containment and mitigation measures government’s adopted are needed. Where feasible, consideration also needs to be given to temporary and targeted support for hard-hit small and medium scale enterprises.

It is only when the health and acute part of the economic crisis have subsided that fiscal policy can revert to medium-term past consistent with debt sustainability considerations.

Critically, the ability of the countries to mount an adequate response will depend on assistance from the international community. With domestic savings and financing options severely limited, as countries have been shut out of capital markets, excellent financing on concessional and grant terms has an inordinate important role to play.

Looser monetary policy can complement these fiscal efforts and financial measures can help minimize credit or liquidity disruptions for businesses. Countries with flexible exchange rates can consider a combination of currency movement and the drawdown on reserves, while countries facing sizeable and disorderly outflows might consider temporary capital flow measures as part of a wider policy package. This crisis is unprecedented and equally calls for bold and decisive support from the international community.

MR. VILKAS: Thank you. Now I go to a different set of questions. What policy advise IMF is offering for the countries. Question from Kemi Osukoya from Africa Bazaar Magazine – within the current latest decades alone African countries, particular those in Sub-Saharan Africa Region have experienced multiple strikes to their economies: climate-related disasters, Ebola outbreak, now we have COVID-19 pandemic – also, slowdown in commodity prices, which affect all exporting countries like Congo and Nigeria, and all the different things that relates to that.

Based on this uncertainty, what top long-term monetary and fiscal policy measures would cushion against unexpected return on external shocks, and what short-term actions can we take now during this current crisis that can be leveraged later on? Thank you.

MR. SELASSIE: Thank you. I think it’s important to note, I mean, what differentiates this particular crisis from the previous ones that were cited, commodity price declines, or the Ebola outbreak in Western Africa which impacted Guinea, Liberia, and Sierra Leone and the like, is the fact that no country is going to be left untouched by this crisis. Every country in the region will be impacted.

In previous cases we’ve often seen countries that have commodity exporters, or you know, Ebola, those being impacted by the outbreak of Ebola, or natural disasters like Mozambique last year, it’s been country-specific, or impacting a handful of countries.

Even the global financial crisis really largely impacted those countries that were much more integrated into the global capital markets, into global supply chains, and there were still quite a lot of countries that continued to sustain reasonable growth.

This time, however, because the shock is so widespread – because beyond the external impact on the region, we are also seeing domestic supply and demand being disrupted – the shock will be, really, quite widespread.

That’s why to deal with this shock, I think extraordinary type of policy interventions are needed, including the ones I laid out earlier: very supportive fiscal stance, resources being put on the health aspect of the crisis – this is really, really, very important.

Then, once the crisis is behind us is when policies can be recalibrated to more medium-term considerations.

I think, going forward, these are going to have to include deep thinking about how to have more resilient economies to the more medium-term threats that our economies face also, like climate change.

So, how do we build an economy that’s going to be resilient to more detail events, I think, is going to be one of the policy issues that are going to have to be discussed and thought through in the coming days.

Read the full transcript here.

Six Charts Show How COVID-19 Is an Unprecedented Threat to Development in Sub-Saharan Africa

Sub-Saharan Africa is facing an unprecedented health and economic crisis. One that threatens to reverse the development progress of recent years. Furthermore, by exacting a heavy human toll, upending livelihoods, and damaging business and government balance sheets, the crisis threatens to slow the region’s growth prospects for years to come.

Overall, GDP is expected to contract by -1.6 percent in 2020, a downward revision of 5.2 percentage points compared to six months ago, the IMF says in its latest Regional Economic Outlook: Sub-Saharan Africa.

Comprehensive measures are needed to limit humanitarian and economic losses. Despite the limited space going into the crisis, timely fiscal support is crucial to protect vulnerable groups and ensure a quick recovery when the pandemic fades.

“The ability of sub-Saharan African countries to mount the necessary fiscal response will require ample external financing on grant and concessional terms from the international community,” says Abebe Aemro Selassie, Director of the IMF’s African Department.

Here are six charts that tell the story:

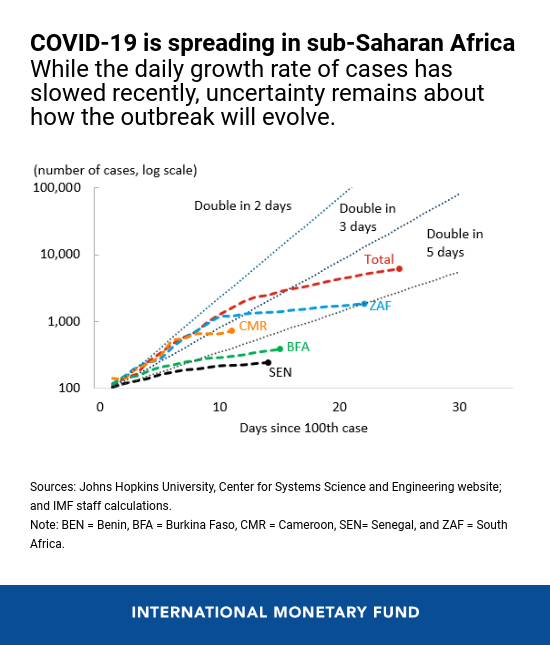

1. COVID-19 threatens to unleash an unprecedented health crisis in sub-Saharan Africa. As of April 13, over 7,800 cases of COVID-19 have been confirmed across 43 countries in the region. South Africa, Cameroon, and Burkina Faso are the most affected. The rapid spread of the virus, if left unchecked, threatens to overwhelm weak healthcare systems and exact a large humanitarian toll.

2. The health shock is precipitating an economic crisis and upending the livelihoods of already vulnerable groups. Containment and mitigation measures needed to slow the spread of the virus will severely impact economic activity. Furthermore, a lockdown can have devastating effects – for example, on food insecurity – on households who live hand-to-mouth and have limited access to social safety nets.

3. Spillovers from a rapidly deteriorating external environment are compounding the economic challenges facing sub-Saharan Africa. A sharp growth slowdown among key trading partners is reducing external demand. In addition, tightening global financial conditions are reducing investment flows and adding to external pressures. Finally, a sharp decline in commodity prices, especially oil, is exacerbating challenges in some of the region’s largest, resource-intensive economies.

4. GDP in sub-Saharan Africa is projected to contract by -1.6 percent this year – the worst reading on record. While the effect across countries is expected to differ depending on factors like extent of diversification and dependence on tourism, no country will be spared. Compared to projections made six months ago, growth for 2020 has been revised down for all countries in the region.

5. Timely fiscal support is crucial to limit humanitarian and economic losses. Stepping up health spending is essential, irrespective of fiscal space and debt levels. Given the large but temporary nature of the shock, some discretionary fiscal support is warranted, even in countries with limited space. The focus should be on targeted measures that alleviate liquidity constraints on vulnerable firms and households.

For countries facing financing constraints, especially oil exporters where the shock is likely to be more long-lasting, the aim should be to undertake well-paced, growth-friendly spending adjustments that seek to generate resources for social spending, while mobilizing additional financing from the donor community.

A comprehensive and coordinated effort by all development partners is essential to respond effectively to this crisis. The ability of countries to mount the required fiscal response is highly contingent on ample external financing and grant on concessional terms being made available by the international financial community. Without adequate financing, temporary liquidity issues could turn into solvency problems, resulting in the COVID-19 crisis having long-term effects on economic activity.