News

Sub-Saharan Africa’s economic downturn and its impact on financial development

Global GDP growth rate was 3.1% in 2015 and – before the Brexit shock – was forecast at 3.4% in 2016 and 3.6% in 2017. This is being driven by a weak and uneven growth in advanced economies and the continued rebalancing of the Chinese economy. Lower commodity prices and strained global financial markets are expected to continue.

These global shocks have affected sub-Saharan Africa where GDP growth fell in 2015 to a 15-year low of 3.5%. It is expected to fall further, to 3%, in 2016. This sharp decline in growth was due to the shocks from collapsed commodity prices, tighter financial conditions and severe drought in parts of southern and eastern Africa.

The current economic climate is causing a slowdown in financial development in sub-Saharan Africa. Credit is contracting, savings have declined, cross-border capital is less available and more costly, while indicators of financial soundness have deteriorated.

There have also been failures in governance of private and public institutions, including corruption and fraud that have deepened these problems. These have also undermined the public trust that is essential for long-term formal financial development.

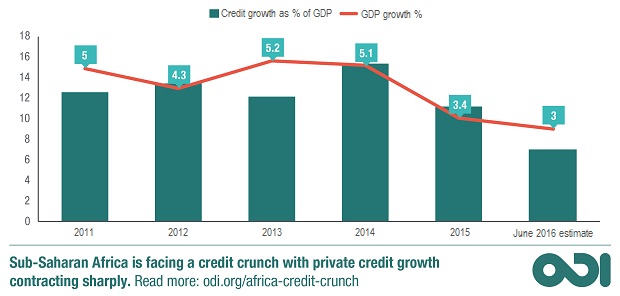

By early 2016, these economic problems were beginning to manifest in slowing financial development as well as rising financial fragility. Indicators of this include the following (Figure 1):

-

A ‘credit crunch’ in the banking sector resulting from the economic slowdown reducing the pace of growth in lending in some countries and stalling it in others;

-

Reduced availability and increased expense of nonbank sources of finance including cross-border capital;

-

Increased financial fragility with declines in banks asset quality, capital ratios and profitability.

These trends were strongest in oil-exporting countries and more moderate in oil-importing countries, highlighting the vulnerability of sub-Saharan Africa’s economies and financial systems to commodity price cycles.

While it seems unlikely that these conditions will develop into a financial crisis unless there are further significant economic shocks, they are negative for economic growth – and especially given the on-going ‘credit crunch’ – in an economic environment that is already difficult. In this context, policy needs to counterbalance the short-term negative effects. However, it also needs to address the long-term needs to maintain and balance financial sector development and stability.

In the short-term, as well as increasing the risks of financial instability, these trends are reinforcing the current recessionary forces in the region by reducing the availability of private finance for development – colloquially termed a ‘credit crunch’.

However, more important is the question of whether the current conditions will cause a deterioration in long-term private finance. This includes in relation to both its scale and cost and in relation to whether it is flowing into the ‘right’ sectors for structural economic transformation.

To date, although there has been strong growth in private finance prior to 2015, much of that finance has flowed into the ‘wrong’ sectors – that is those with relatively low impact on structural economic transformation. This includes sectors such as extractive industries, consumer finance and short-term working capital.

Other sectors such as manufacturing and agriculture, with much greater potential impact on structural economic transformation, have received little or no financing.

Policy needs to address these new and less favourable conditions for private financing for development. Whilst conventional policy approaches, particularly ‘getting the basics right’ and anti-cyclical development financing, remain relevant, new thinking is also needed. This includes:

-

Developing macro prudential policy that is tailored to the sub-Saharan African context;

-

Policy that more robustly directs credit into priority sectors; and

-

International cooperation to tackle corruption more effectively

Sub-Saharan Africa has made remarkable and unprecedented progress in terms of economic growth and poverty alleviation in the last decade. Tackling these issues in the financial system is needed if this progress is to be kept on track.

Key messages

-

Sub-Saharan Africa is experiencing a deterioration in financial markets including a ‘credit crunch’ in the banking sector, reduced availability and increased expense of international finance – which has been made worse by the ‘Brexit’ shock – and increased financial fragility. On-going governance problems are making these issues worse.

-

Importantly for the region’s long-term growth prospects, scarce banking finance is being used in sectors with little or no transformational effect such as extractives or middle class consumer finance.

-

This is starving sectors that would transform the economy – such as manufacturing, trade and agri-processing – of the financing they need to grow, reducing the prospects for structural changes that would diversify the economy and create employment.

-

Policy suggestions include tailored macro prudential policy for sub-Saharan Africa, more robustly directing credit into priority sectors and international cooperation to tackle corruption.