Blog

Strict lockdown regulations – medical and electronic equipment flown in and cross-border road traffic reduced by two-thirds

South Africa’s main trading partners are China (imports of electronic components, machinery and parts and motor vehicle components; exports of ores and concentrates), Germany (imports of motor vehicle components; exports of motor vehicles and silver ores and concentrates), US (imports of motor vehicle components and helicopters/airplanes and their parts; exports of unwrought palladium and rhodium) and India (imports of distillate fuel, medicine and vehicles; exports of coal and ores and concentrates). Consequently, the main mode of transportation for South Africa’s goods trade is maritime transportation.

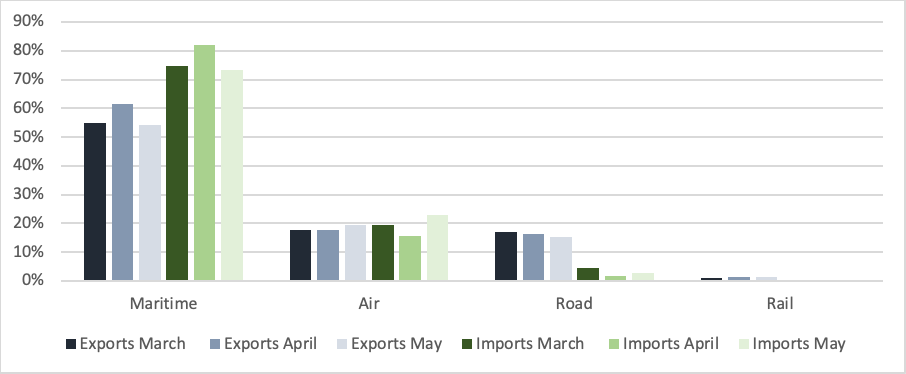

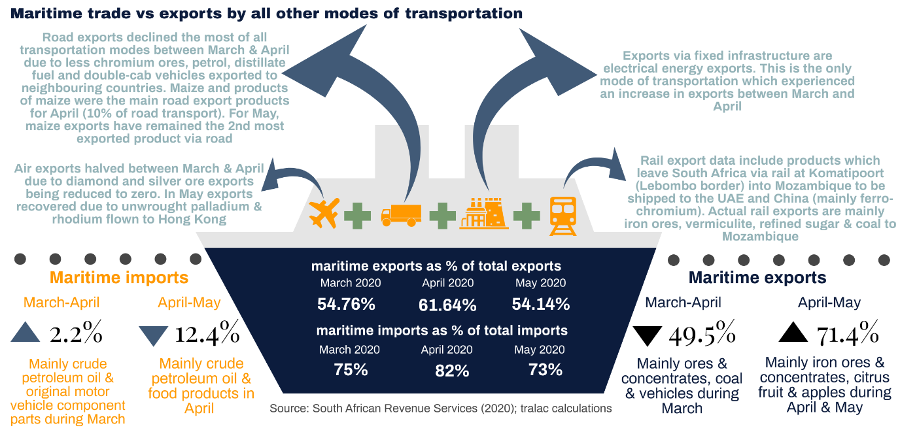

Even with logistic difficulties and delays in harbours due to strict lockdown requirements, maritime transport remained the main mode of transportation between March and May this year. Although South Africa’s goods exports declined significantly between March and April, the ratio of maritime exports to exports by all other modes of transportation (air, road, fixed installation and rail) increased – in March 54.76 per cent of exports were by maritime transportation; in April, this increased to 61.64 per cent. The same holds true for imports – in March maritime imports accounted for 73.36 per cent of total imports, while in April, this increased to 81.86 per cent. For May, maritime imports declined by 2.2 per cent back to March levels while imports via air transportation increased by 44 per cent. Imports by road also doubled in May (in comparison with a significant decline for April) although it is still far below road imports for March.

Figure 1: Exports and imports by mode of transportation (% of total exports and total imports); March–May 2020

Source: SARS (2020); tralac calculations

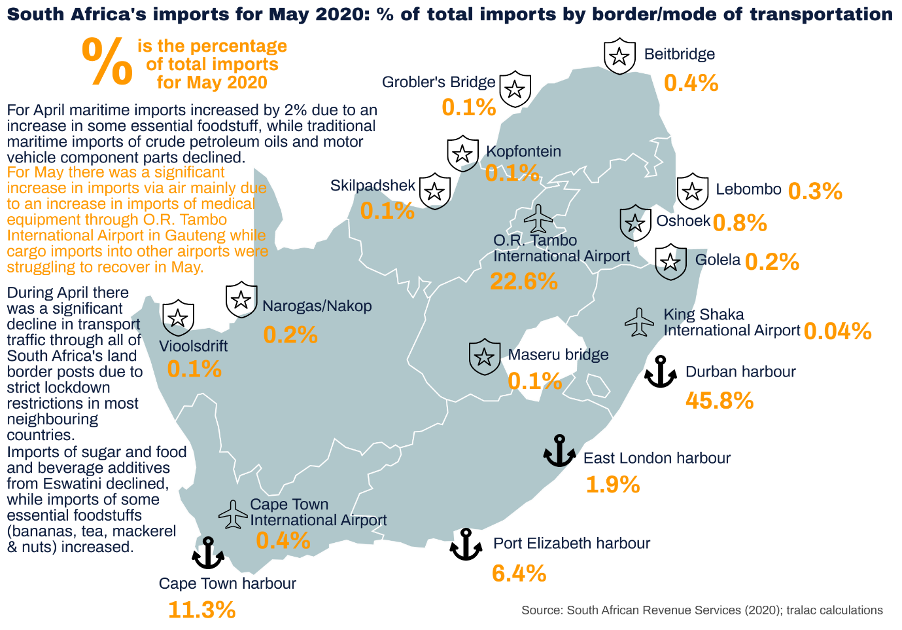

Due to strict lockdown regulations not only in South Africa but also neighbouring African countries, trade via road transportation declined the most compared to trade via any other mode of transportation – for April exports of chromium ores, petrol, distillate fuel and double-cab vehicles significantly decreased. Maize and maize products were the main products exported via road for April (10 per cent of exports via road transportation). For May maize remained as one of the main export products although exports of other products like ferro-chromium (to Mozambique) also recovered. There was a significant reduction in road traffic crossing into Botswana via three border posts – Grobler’s Bridge, Kopfontein and Skilpadshek – while exports via Beitbridge into Zimbabwe declined the least (31 per cent decline). Although imports of bananas (from Mozambique), mackerel (Namibia) and tea and nuts (Malawi via Beitbridge) increased, imports via Golela (Eswatini), Narogas (Namibia), Beitbridge (Zimbabwe), Oshoek (Eswatini) and Lebombo (Mozambique) declined by 83 per cent, 65 per cent, 64 per cent, 45 per cent and 44 per cent respectively.

The main products exported via maritime transportation are ores and concentrates (to China, South Korea, Netherlands, India and Japan), coal (to India, Vietnam, Pakistan and UAE) and vehicles (to Germany, US, Belgium, Australia, Spain and Japan). In March vehicle exports accounted for a significant portion of maritime exports, however, these exports reduced to almost zero during April and were still struggling to recover according to the May trade data. For April and May maritime exports of citrus fruits were three times vehicle exports. The decline in vehicle exports account for most of the significant decline in maritime trade with Germany. In March the goods transported by air were mostly precious stones and metals; for April exports via air transportation halved due to a decline in exports of diamonds and silver ores and concentrates exported to Botswana and Belgium. For April goods transported via air transportation were back to March levels mainly due to unwrought palladium and rhodium flown to Hong Kong and aviation kerosene recorded as exports as ship stores and bunkers.

Between March and April, maritime imports increased by 2 per cent while air imports increased by 44 per cent between April and May. Maritime imports are mainly crude petroleum oils and motor vehicle component parts. However, these imports reduced significantly during April while maritime imports of food staples increased – wheat, rice and oilcake. Although there were delays at South Africa’s harbours due to strict lockdown regulations, imports via the ports of Durban and Cape Town increased in April because of the increased demand for basic foodstuffs. In May imports into Durban harbour declined by 15 per cent while imports of crude petroleum oil, distillate fuel, wind-power generator sets, helicopters, oats, sausage casings and refined palm oil into Cape Town harbour increased.

Significant consignments of medical and electronic equipment (for wireless Internet) from China were flown into South Africa (mainly via O.R. Tambo International Airport) since April. Cargo into the other major South African airports – Cape Town International and King Shaka declined during April and were still struggling to recover during May – imports via Cape Town International Airport were only a third of March imports and May’s imports via King Shaka were only 13 per cent of imports for March.

See a related blog: South Africa’s trade data update – the May 2020 data reveals the effect of eased lockdown restrictions

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...