News

Services, development and trade: The regulatory and institutional dimension

The fourth session of the Multi-year Expert Meeting on Trade, Services and Development is taking place from 18-20 May 2016 in Geneva.

The Doha Mandate, adopted at UNCTAD XIII, stresses that development of services and access to them, supported by adequate regulatory and institutional frameworks, is important for sound socioeconomic development.

The objective of the expert meeting is to identify best-fit practices at the levels of policymaking, regulations, institutions and trade negotiations that link services, development and trade in a balanced manner, including strengthening national services regulation.

The fourth session of the expert meeting will examine practices and experiences in building coordination and coherence between trade negotiators, policymakers and regulators, and making regulatory and trade agendas mutually supportive in services sectors.

Services sectors are essential to the efficient functioning of all economies and strengthened productive capabilities and competitiveness. The quality of policies, regulations and institutional frameworks is the key determinant of services performance.

At the same time, increased trade in services negotiations have also raised concerns over the relationship between the liberalization and regulation of services, as certain trade rules could affect the degree of national regulatory autonomy and policy space to pursue development objectives.

Within this context, coherence between regulatory and trade agendas, and effective coordination between regulatory authorities, sectoral ministries and trade ministries, are crucial for trade liberalization to become pro-developmental.

The session will examine lessons that can be learned from various country and regional practices and experiences, including UNCTAD Services Policy Reviews, in building mutually supportive regulatory and trade strategies.

Services, development and trade: The regulatory and institutional dimension

Introduction

Services sectors are essential to the efficient functioning of all economies and to strengthened productive capacity. Services are key to achieving structural transformation in line with developing countries’ aspirations towards economic upgrading and diversification, and greater competitiveness. The quality of policies, regulations and institutional frameworks is a main determinant of services performance and is decisive in harnessing the pro-development benefits of services sector development. A dynamic service economy can contribute significantly towards the Sustainable Development Goals, as their achievement presumes efficient and equitable functioning of the services sector and universal access to infrastructure and essential services, whether they be telecommunications, energy, financial services, health care, sanitation or education.

Regulations are important in harnessing the development benefits of the services economy and trade, particularly infrastructure services, as the latter are subject to network externalities and information asymmetry, and prone to market failure. Adequate policy interventions are instrumental for sectoral and economy-wide development. Services are increasingly subject to trade liberalization initiatives under multilateral, plurilateral and regional processes, in which developing countries increasingly take part. Most significantly, the new generation of regional trade agreements (RTAs), particularly the emerging “mega RTAs”, have extended the frontiers of liberalization and international rule-making to services, essentially addressing national regulatory measures as they apply to foreign services and services providers. These agreements not only define market access and entry conditions but also provide disciplines on qualification, technical and licensing requirements. This has raised a thorny policy question: How to balance commercial benefits that could arise from effective market opening with the prerogatives of national governments to implement necessary regulatory measures in support of public policy objectives? This issue underscores the importance of coherent approaches to trade liberalization and regulation of services.

The strong regulatory focus of recent RTA that seeks to achieve regulatory coherence and convergence in order to address what exporters see as trade-restrictive effects of domestic regulatory measures, including those arising from regulatory divergence across jurisdictions, has pointed to the importance of working towards “smart” regulations that are best fit to national circumstances and development needs. This is necessary to minimize the inadvertent trade-restrictive effect of regulations and introduce effective, efficient and equitable regulatory practices. While the elements of such best-fit regulations would differ across countries, some useful lessons could be learned from national experiences and international initiatives. Establishing policy coherence between domestic regulation and liberalization approaches should be seen in this broader context of striving towards a best-fit regulatory and institutional framework in an increasingly open trade environment. At the same time, it would be important to attend to risks, costs and trade-offs that such a reform agenda may entail with respect to national regulatory autonomy and policy space.

Trends in the services economy and trade

Services sector growth

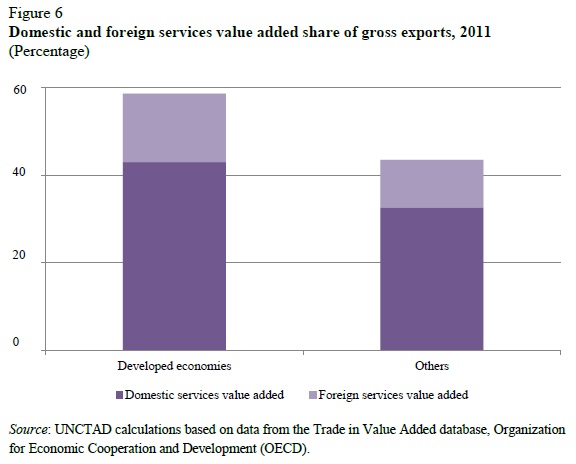

The “servicification” of economies characterizes the long-term trends in many countries. Between 1980 and 2013, the share of services in gross domestic product (GDP) increased for all income categories, from 61 per cent to 75 per cent in developed economies and from 42 per cent to 52 per cent in developing economies (figure 1). Among developing regions in 2013, services have the highest contribution to output in Latin America and the Caribbean – 63 per cent – but they are also predominant in Africa and developing Asia, with 50 per cent shares. Although with the lowest and more stable contribution at 42 per cent, services also have the largest share of the output of least developed countries (LDCs).

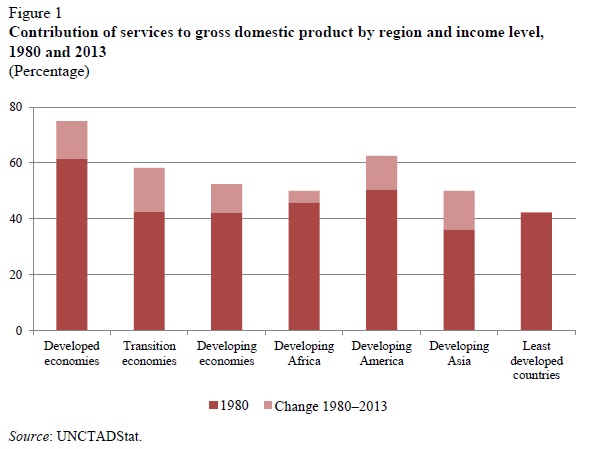

While the increased share of services between 1980 and 2013 is generally associated with a declining industrial share in developed economies – minus 23 per cent – it mainly corresponds to a decrease of minus 7 per cent in the agricultural contribution to GDP in developing countries (figure 2). The predominance and growth of services implies the need for countries to devise best-fit and coherent regulatory and institutional frameworks, which are determinants of services performance and therefore central to harnessing their potential for development goals.

Exports, migration and the services sector

In 2014, the world’s five largest exporters of commercial services were the United States of America (14 per cent of the global exports of commercial services), the United Kingdom of Great Britain and Northern Ireland (6.9 per cent), France (5.5 per cent), Germany (5.4 per cent) and China (4.7 per cent). These countries were also the leading services importers in the same year. Although underrepresented in the leading positions, developing economies expanded services exports faster than developed economies between 2005 and 2014, and their share in global services exports increased from 24 per cent to 29 per cent.

The sectoral composition of commercial services exports in 2014 reveals a contrast between developed and developing economies. While transport, travel and other business services are the largest categories for both types of economies, the relative importance of transport and travel is more pronounced for developing economies: 57 per cent of their total commercial services exports. Conversely, the share of financial and insurance services and charges for the use of intellectual property in total commercial services exports is higher in developed economies. This suggests that developed economies are more specialized in such high value added services, while developing economies, particularly Africa and LDCs, are more reliant on traditional services activities, such as transport and travel services.

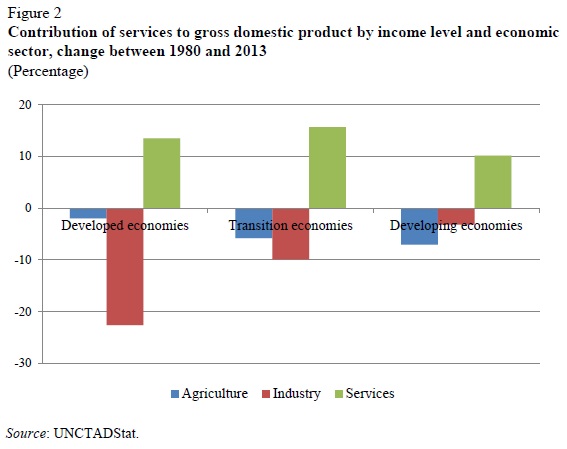

The evolution of exports of commercial services in developing economies between 2008 and 2014 is indicative of the dynamism of financial and insurance services, telecommunications, computer and information services, some of which are heavily regulated services sectors (figure 4). This trend confirms that some high value added services categories are the most dynamic in developing economies and contribute to their economic upgrading. Charges for the use of intellectual property represent the most dynamic commercial services exports in developing economies in the same period, which is largely a result of increased foreign direct investment (FDI), yet it still contributed to less than 1 per cent of these exports in 2014.

Between 2005 and 2015, the share of services in total exports of goods and services hovered around 25 per cent in developed economies and 15 per cent in developing economies. However, cross-border services trade data captures only a part of services trade, as services trade increasingly occurs with commercial presence through FDI and the temporary movement of natural persons – mode 4. Commercial presence is the major mode of supply in services. UNCTAD estimated the value of all sales by affiliates at $36 trillion in 2014. If half of this is assumed to be in services, trade through foreign affiliates could be of the order of $18 trillion, nearly four times the global cross-border services exports. In 2014, services accounted for 49 per cent of the global value of announced greenfield FDI projects, $341 billion. Of these, 47 per cent were for infrastructure services. Between 2005 and 2014, services FDI increased most in electricity, gas and water, construction, and health and social services.

The temporary movement of people supplying services is particularly important in professional and business services, as well as in services related to agriculture, manufacturing and mining. Given the continued growth of remittances, it would appear that trade through mode 4 is on an upward trend. In 2015, worldwide remittance flows are estimated to have exceeded $601 billion, with about $441 billion going to developing countries. The relevance of migration for the services sector is also underscored by the proportion of migrant workers in services – 71 per cent. Migrant workers accounted for 150 million of the 232 million migrants in 2013.

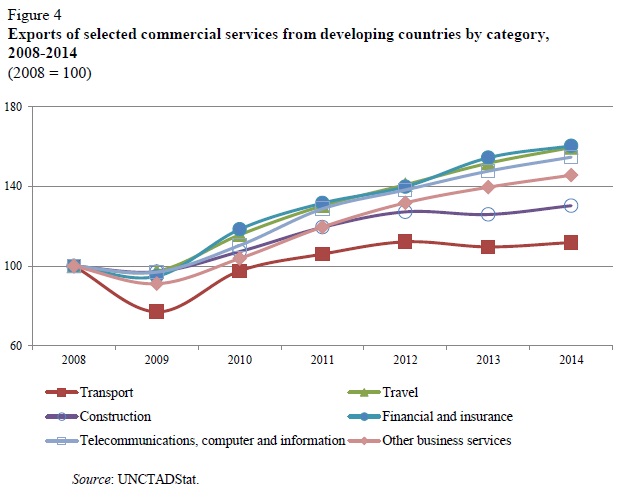

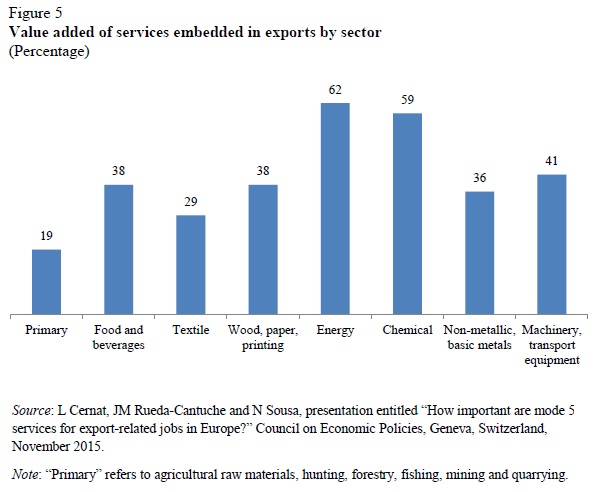

Furthermore, services are intrinsically embedded in goods exports. In 2011, services value added accounted for 59 per cent of the gross value of merchandise exports in developed economies and 43 per cent in others, much above the shares of services in the total exports of goods and services for both developed and developing economies. The value of services embedded in goods tends to be higher in sectors such as energy, chemicals, machinery and transport equipment (figure 5).

The sizeable shares of foreign services value added in gross exports – 16 per cent in developed economies and 11 per cent in others – confirm the increased tradability of services and their enabling role for participation in global value chains (figure 6). The international fragmentation of production requires efficient professional, business and infrastructure services, as well as research and development, product design and marketing services. The services sector, including infrastructure services, is therefore an important option for export diversification.