News

South Africa’s exports performance: Any role for structural factors?

Despite substantive depreciation of the rand after the global financial crisis, South Africa’s export performance has been very weak. In a group of 20 emerging market peers, South Africa’s real effective exchange rate (REER) witnessed one of the longest and largest exchange rate depreciation spells in recent years, with its real effective exchange rate (REER) weakening by around 25 percent during January 2011-July 2014.

Notwithstanding the fall in relative prices, South African exports have grown at a very slow pace (about 4 percent) over this period. In relative terms, South Africa’s exports growth has averaged about 82 percent of its trading partners’ imports growth during 2011-14 – one of the lowest proportions among peers, with its share of global exports falling by nearly 15 percent. Sluggish exports combined with relatively inelastic imports – partly related to large infrastructure projects – have resulted in the widening of the current account deficit to levels close to 6 percent of GDP (from about 2 percent of GDP in the beginning of the aforementioned period).

Several explanations have been put forward to explain the insensitivity of South African exports to real exchange rate depreciation. Edwards and Garlick (2008) find that South African exports are constrained by infrastructure deficiencies. The South African Reserve Bank (SARB) argues that weaker external demand, softer commodity prices, prolonged industrial action, and logistical and energy constraints have played a major role on this issue. Other plausible explanations include the “survival of the cheapest” – large capital inflows and the concomitant real exchange rate appreciation in until 2010 may have eroded the competitiveness of South African exporting firms, forcing some of them out of business. High margins in product markets and wages in labor markets have resulted in uncompetitive domestic costs of production, eroding external competitiveness (Saint-Paul, 1997; Cuñat and Melitz, 2012).

In this paper we explore an alternative route – the supply-side story. Over the past few years, constraints to the production function of South African exporting companies, such as lower energy availability and strikes, have seriously hurt output. These binding structural constraints may be one of the reasons behind South Africa’s poor exports performance.

The innovation of the paper resides on the use of firm-level data to gauge the impact of structural factors on external sector performance. Traditional attempts to estimate the sensitivity of exports to exchange rate movements do not control for characteristics of individual firms or specific industries. We examine the responsiveness of export transactions to REER movements and external demand growth across companies operating in key sub-sectors of the South African economy. We assess how a set of proxies for structural constraints – more specifically, electricity gaps, labor-market regulation, and product-market rigidities – has affected firms’ export performance since 2010. Using a panel regression framework with firm-level data permits us to isolate the impact of structural constraints at the most “micro” level, while controlling for macroeconomic conditions common to all firms at each point in time.

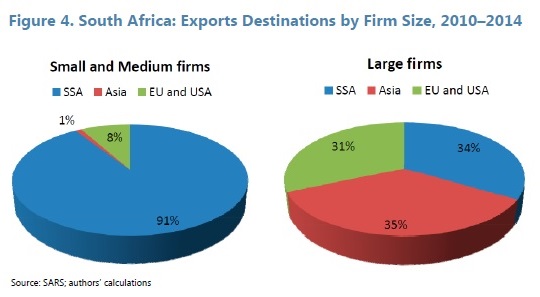

Our results suggest that electricity bottlenecks, limited competition in product markets, and binding rigidities in labor markets have reduced the responsiveness of South African exporting firms to exchange rate depreciation during the post-global financial crisis years. We also find that small and medium enterprises (SMEs), which export mostly manufacturing goods to Sub-Saharan Africa (SSA), are more responsive to exchange rate changes. Our findings suggest that structural reforms are macro-critical and have hindered external adjustment in South Africa.