News

World Bank lowers 2016 forecasts for 37 of 46 commodity prices, including oil

Further economic slowdown in major emerging economies could push commodity markets lower

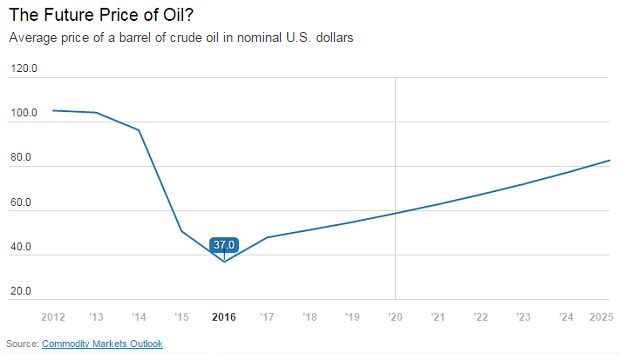

The World Bank is lowering its 2016 forecast for crude oil prices to $37 per barrel in its latest Commodity Markets Outlook report from $51 per barrel in its October projections.

The lower forecast reflects a number of supply and demand factors. These include sooner-than-anticipated resumption of exports by the Islamic Republic of Iran, greater resilience in U.S. production due to cost cuts and efficiency gains, a mild winter in the Northern Hemisphere, and weak growth prospects in major emerging market economies, according to the World Bank’s latest quarterly report.

Oil prices fell by 47 percent in 2015 and are expected to decline, on an annual average, by another 27 percent in 2016. However, from their current lows, a gradual recovery in oil prices is expected over the course of the year, for several reasons. First, the sharp oil price drop in early 2016 does not appear fully warranted by fundamental drivers of oil demand and supply, and is likely to partly reverse. Second, high-cost oil producers are expected to sustain persistent losses and increasingly make production cuts that are likely to outweigh any additional capacity coming to the market. Third, demand is expected to strengthen somewhat with a modest pickup in global growth.

The anticipated oil price recovery is forecast to be smaller than the rebounds that followed sharp drops in 2008, 1998, and 1986. The price outlook remains subject to considerable downside risks.

“Low prices for oil and commodities are likely to be with us for some time,” said John Baffes, Senior Economist and lead author of the Commodities Markets Outlook. “While we see some prospect for commodity prices to rise slightly over the next two years, significant downside risks remain.”

Beyond oil markets, all main commodity price indices are expected to fall in 2016 due to persistently large supplies, and in the case of industrial commodities, slowing demand in emerging market economies. In all, prices for 37 of the 46 commodities the World Bank monitors were revised lower for the year.

Emerging market economies have been the main sources of commodity demand growth since 2000. As a result, weakening growth prospects in these economies are weighing on commodity prices. A further slowdown in major emerging markets would reduce trading partner growth and global commodity demand.

“Low commodity prices are a double-edged sword, where consumers in importing countries stand to benefit while producers in net exporting countries suffer,” said Ayhan Kose, Director of the World Bank’s Development Prospects Group. “It takes time for the benefits of lower commodity prices to be transformed into stronger economic growth among importers, but commodity exporters are feeling the pain right away.”

Non-energy prices are expected to slip 3.7 percent in 2016, with metals dropping 10 percent after a 21 percent fall in 2015, due to softer demand in emerging market economies and gains in new capacity. Agriculture prices are projected to decline 1.4 percent, with decreases in almost all main commodities groups, reflecting adequate production prospects despite fears of El Niño disruptions, comfortable levels of stocks, lower energy costs, and plateauing demand for biofuel.

Weak growth in emerging market economies: What does it imply for commodity markets?

The World Bank has recently revised downwards its growth forecasts for emerging and developing economies to 4.0 percent in 2016. Amid amply-supplied markets, weak growth prospects for these economies are weighing on commodity prices. This Special Focus addresses the following questions:

(i) How are emerging and developing economies performing?

(ii) How important are these economies for commodity markets?

(iii) What are the implications of the slowdown in major emerging market economies for commodity markets?

The results indicate that major emerging markets – particularly China – have been among the largest sources of additional commodity demand during the 2000s. A faster-than-expected slowdown in major emerging economies – especially if combined with financial stress – could reduce commodity prices considerably and set back growth in commodity exporters.

Introduction

The sharp decline in commodity prices over the past five years has coincided with slowing growth in emerging and developing economies (EMDEs). Commodity prices slid by 40 percent since 2010 while growth in EMDEs slowed from 7.1 percent in 2010 to 3.3 percent in 2015. Although the decline in commodity prices has been mostly due to excess supply, weakening demand from commodity-importing EMDEs has also played a role. For example, recent developments in oil markets have been driven by both supply and demand factors.

A decomposition of oil price movements into demand and supply factors suggests that the decline in oil prices since mid-2014 has been predominantly (about 65 percent) driven by supply factors. However, pressures from softening demand have steadily increased as EMDE growth slowed, compounded in the last quarter of 2015 by mild winter temperatures in the northern hemisphere.

The weakness in oil prices has mirrored that in other commodity prices, especially those of other industrial commodities. Following a decade of large investments encouraged by high prices, capacity in most industrial commodities is now ample, while slowing growth in EMDEs has weighed on demand.

How are emerging and developing economies performing?

The global economy remained in a fragile state in 2015, as further deceleration in activity across major EMDEs more than offset a modest recovery in advanced economies. As a result, global growth slowed to an estimated 2.4 percent in 2015 from 2.6 percent in 2014. EMDEs grew by 3.3 percent in 2015, the weakest showing since 2010.

In about half of EMDEs, growth in 2015 fell short of expectations, with the largest disappointments among energy exporters (Angola, Colombia, Ecuador, Kazakhstan, Nigeria, Russian Federation, República Bolivariana de Venezuela) and countries experiencing conflicts (Ukraine) or heightened policy uncertainty (Brazil).

Of the five BRICS economies (Brazil, China, India, Russian Federation, and South Africa), four slowed or even contracted in 2015. China’s economy continued to slow, and its rebalancing away from commodity-intensive activities toward services has weighed on global trade and commodity prices. Brazil and Russia, two large commodity exporters, are in deep contractions accompanied by currency depreciation, above target inflation and deteriorating public finances. In South Africa, chronic power supply bottlenecks are a major factor behind weak growth. In contrast to the other four BRICS, growth in India remained robust, buoyed by strong investor sentiment and the positive effect on real incomes of falling oil prices. (India is the world’s fourth largest crude oil consumer after the United States, China, and Japan, and imports most of the oil it consumes).

Both external factors – including weak global trade, financial market volatility, and persistently low commodity prices – and domestic factors have contributed to the slowdown. Adverse external developments have hit commodity-exporting developing economies particularly hard. Growth in several of the largest countries (Brazil, Colombia, Nigeria, Peru, South Africa) weakened considerably in 2015, as the impact of deteriorating terms of trade on exports was compounded by tightening macroeconomic policy and softening investor confidence. Governments responded to falling fiscal revenues from the resource-intensive sectors with spending cuts. Central banks raised interest rates to help moderate pressures on exchange or inflation rates. Investor confidence weakened on deteriorating growth prospects and credit ratings, resulting in declining capital inflows and currency depreciations.