News

Overview of developments in the international trading environment: Annual Report by the WTO Director-General

This trade-monitoring report reviews trade-related developments during the period from 16 October 2014 to 15 October 2015. It is submitted by the Director-General to assist the Trade Policy Review Body (TPRB) in undertaking its annual overview of developments in the international trading environment that are having an impact on the multilateral trading system.

The report confirms that WTO Members continue to show some restraint in taking new trade-restrictive measures with the introduction of such measures remaining relatively stable since 2012. During the period under review, 178 new trade-restrictive measures were put in place – an average of just under 15 new measures per month.

More encouragingly, WTO Members continued to adopt measures aimed at facilitating trade, both temporary and permanent in nature. Members implemented 222 new trade-facilitating measures during the period under review – an average of almost 19 measures per month, the second highest number since the beginning of the monitoring exercise.

Nevertheless, the slow pace of removal of previous restrictions means that the overall stock of restrictive measures is continuing to increase. Of the 2,557 restrictions (including trade remedies) recorded by the monitoring exercise since October 2008, only 642 have been removed. In other words, the total number of those restrictive measures still in place currently stands at 1,915 – up by almost 17% compared to the last annual overview. The addition of new restrictive measures, combined with a slow removal rate, remains a persistent concern with 75% of all restrictions measures implemented since 2008 still in place. The longer-term trend in the number of trade-restrictive measures is an area where continued vigilance remains imperative.

The downturn in world trade observed in the last monitoring report continued in the second quarter of 2015. Global economic growth was modest during the review period and continues to be unevenly distributed across countries and regions. Prices for primary commodities including oil are down sharply from last year, squeezing a number of important exporters. Exchange rates have undergone important shifts since the last report and speculation surrounding monetary policy alongside recurring bouts of volatility in financial markets has stoked uncertainty. In light of these developments, the Secretariat recently (30 September 2015) lowered its forecast for world merchandise trade volume growth in 2015 to 2.8%, and reduced its estimate for 2016 to 3.9%.

In the area of trade remedies, the decelerating trend observed in the previous report continued. This owes particularly to the decline in the number of initiations of anti-dumping investigations. Concerning anti-dumping and countervailing measures applied on the basis of investigations initiated in 2008 and 2009 (coinciding with the onset of the financial crisis), the data on extensions of measures pursuant to sunset reviews versus expired measures show no discernible change from the pattern observed in prior periods.

During the review period, the WTO’s TBT and SPS Committees saw significant developments. The SPS Committee has witnessed a persistent growth in notifications from developing countries leading to the highest number of notifications to date. An increase in the number of notifications does not, however, automatically imply greater use of measures taken for protectionist purposes. Another noteworthy development was the significant increase in the number of specific trade concerns (STCs) raised in the TBT Committee.

This report shows that WTO Members introduced 128 new general economic support measures – an average of almost 11 new measures per month, and a significant increase from the previous report. The main beneficiaries were selected industries in the agricultural sector, oil and gas industries, the automotive sector and assistance schemes for exports and for SMEs.

In the area of services the period under review witnessed several important policy developments in such diverse sectors as financial services, telecommunications and ICT, audio-visual services, construction services, energy and transport services, services supplied through the movement of natural persons and a number of other sectors. The large majority of the policies adopted during the period under review reflect trade-liberalizing measures.

Several other important trade-related developments also took place during 2015. These include the adoption of the Trade Facilitation Agreement, the expansion of the Information Technology Agreement, the Global Review of Aid for Trade and new initiatives in the area of Regional Trade Agreements.

The overall assessment of this monitoring report is that the uncertain global economic outlook continues to weigh on international trade flows. It shows that the continuing increase in the stock of trade-restrictive measures recorded since 2008 remains of concern. Looking towards the 10th Ministerial Conference in Nairobi in December, WTO Members should reflect on the central role of the multilateral trading system as a predictable and transparent framework helping Members resist protectionist pressures and as a stable and inclusive platform for pursuing further multilateral trade liberalization.

Recent Economic and Trade Developments

Overview

The WTO downgraded, on 30 September, its forecast for world trade after declines in the first two quarters of 2015 reduced the potential expansion for the year and clouded the outlook for 2016. The Secretariat now expects merchandise trade to grow 2.8% in volume terms in 2015 (down from 3.3% in April) and 3.9% in 2016 (down from 4.0% previously).

These downward revisions reflect a number of factors that have weighed on world trade and output recently, including the rebalancing of the Chinese economy away from investment and towards consumption, declines in primary commodity prices that have hit export revenues and imports of resource-based economies, as well as strong exchange rate fluctuations and volatility in financial markets. Uncertainty over the timing and pace of expected interest rate rises in the United States has also raised the prospect of capital flow reversals in developing countries and clouded the outlook for the global economy going forward.

Economic Developments

If the September forecast holds, 2015 will be the fourth consecutive year with merchandise trade growth of less than 3%, and the fourth year where world trade has grown at approximately the same rate as world GDP, rather than twice as fast, as in the 1990s and early 2000s. The current forecast indicates faster trade growth of 3.9% in 2016, but this rate of increase is still well below the average of 5% since 1990.

Large exchange rate fluctuations since the middle of 2014 reflect changes in economic prospects and policy expectations in major economies, and have exerted a strong influence on nominal dollar denominated trade statistics.

Primary commodity prices, including oil prices, have not recovered since the last monitoring report and have in fact continued to decline. Lower prices for fuels (down 50% year-on-year in the latest month) are partly explained by new sources of supply. Investment in oil production from unconventional sources has fallen in North America as prices have declined, but output from existing capacity remains strong. Another contributor to falling prices is the appreciation of the dollar, which now commands more goods and services than it did a year ago. There has traditionally been an inverse relationship between dollar denominated commodity prices and the exchange value of the U.S. currency, with appreciations causing commodity prices in dollars to fall.

The IMF released its latest World Economic Outlook (WEO) on 6 October with projections for world GDP and trade in 2015 and 2016. GDP estimates received modest downward revisions but the organization's trade numbers were reduced sharply, bringing them more in line with WTO forecasts. The IMF expects world GDP at purchasing power parity to grow 3.1% in 2015 and 3.6% in 2016. Risks are tilted to the downside and include financial shocks stemming from exchange rate movements and commodity price declines.

Merchandise Trade

The dollar value of world trade was down sharply in the first and second quarters of 2015, around 13% in both periods compared to 2014. These drops were entirely attributable to changes in export and import prices since quarterly trade volume indices jointly prepared by the WTO and the United Nations Conference on Trade and Development (UNCTAD) show positive year-on-year growth over the same period (+3.1% in Q1 and +1.4% in Q2 on the export side). Very little useful information can be discerned from the contributions of developed and developing countries to trade growth in dollar terms in the current circumstance of strong dollar appreciation. However, the fact that these contributions are of similar magnitude suggests that both groups of countries are equally affected by the appreciation of the dollar.

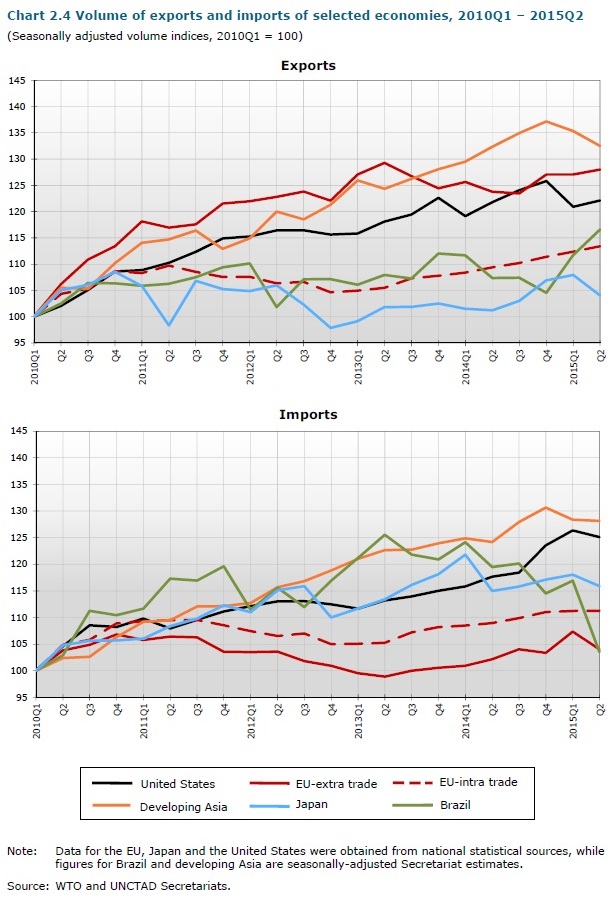

Trade statistics in volume terms frequently provide a more accurate picture of trade developments since they are adjusted to account for fluctuations in prices and exchange rates. These data are illustrated by Chart 2.4, which shows seasonally-adjusted quarterly merchandise trade volume indices for Brazil, developing Asia (including China and India), the EU, Japan and the United States from 2010Q1 to 2015Q2. These data present a rather negative trend of trade in the first half of 2015, especially with regards to exports of developing Asia and imports of South America.

This report is submitted by the Director-General to the Trade Policy Review Body (TPRB) pursuant to Paragraph G of the trade policy review mandate in Annex 3 to the WTO Agreement. It builds on the Director-General’s report to the TPRB on trade-related developments circulated to Members on 3 July 2015.