News

Infrastructure Financing Trends in Africa 2014

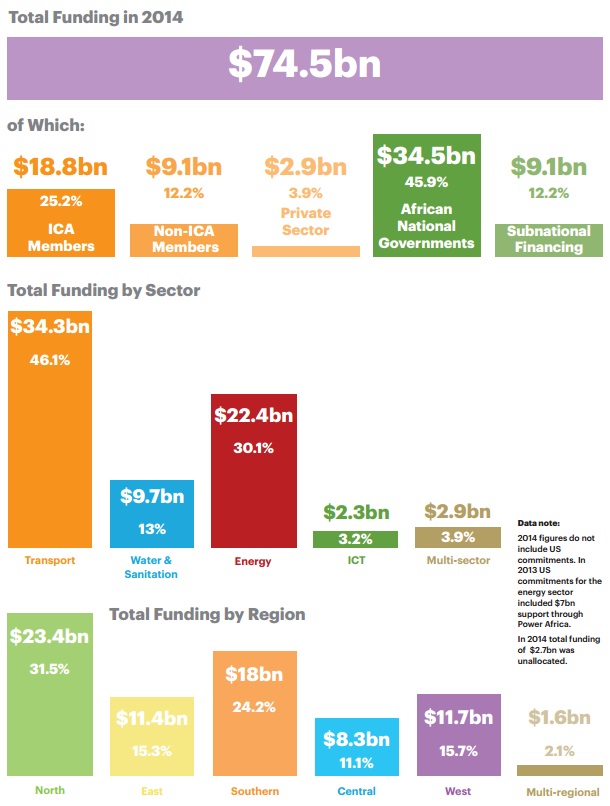

Infrastructure Financing Trends in Africa 2014 shows that over $74bn was committed in 2014 to the development of Africa’s infrastructure, and that disbursements by ICA members reached a record level of $13bn.

The 2014 commitments of $74bn is $25bn less than the $99.6bn reported in 2013. A sharp decline (of over $10bn) in Chinese commitments and the inclusion in 2013 of an exceptional £7bn commitment from the US towards the Power Africa initiative account for this decline.

African governments’ budget allocations to infrastructure of $34.5bn account for the largest share of reported commitments. ICA members* reported commitments totalling $18.8bn in 2014 – less than the $25.3bn committed in 2013 but, excluding the exceptional US contribution of $7bn in 2013, the figure is on a par with the volumes committed since 2012. The remaining commitments were made by non-ICA member external public sector funders and the private sector.

Key messages and findings from the report include:

-

Key trends observable from ICA members’ data for 2014 include a shift towards multi-sector projects, growing attention to Central Africa, the energy sector’s continued dominance in attracting commitments and a very sharp decline in commitments to regional projects, including PIDA/PAP.

-

Identified central government budget allocations provided 2014’s largest category of commitments to infrastructure development, totalling $34.5bn. Data was obtained from 42 countries (up from 20 in the 2013 report) yet the total value of commitments is lower in 2014 compared with the $46.7bn reported for 2013. This was due to a more rigorous analysis of budget spending and external funding. However, the potential for double counting remains.

-

Central government budget allocations for infrastructure grew between 2012 and 2014, according to analysis that uses a more rigorous methodology applied to the 2012 and 2013 budgets of a control group of 20 countries (who generally report data in a consistent manner). In 2014, this group’s allocations totalled $24.6bn, compared with $27.1bn in 2013 and $23.3bn in 2012.

-

Substantial commitments may also be made to infrastructure at a subnational level – by local governments, utility companies and other institutions. This recognises that national government allocations do not reflect a country’s total public sector spending.

-

Africa’s regional development banks committed nearly $1.6bn to infrastructure projects in 2014. This is a decrease on their $2.2bn commitments across the continent in 2013.

-

$16.5bn (88%) of the total $18.8bn ICA member commitments were directed to hard infrastructure in 2014.

-

$2.3bn (12%) of ICA member commitments went to soft infrastructure. Two-thirds ($1.4bn) of soft commitments went to capacity building, some 16% was directed at project preparation and around 5% at research and evaluation. Another 16% of commitments were aimed at other soft infrastructure projects and programmes.

-

ICA members used conventional financing instruments the most. Loans accounted for $14.3bn (75%) and grants for $2.7bn (14%) of financings in 2014.This marks a distinct shift in the emphasis of members that consistently report data to ICA. In 2013 they reported that loans and grants provided $10.8bn (37%) and $7.4bn (25%) of funding respectively.

-

Transport operations attracted the most financial commitments of any sector in 2014, taking all sources of finance into account. This was largely due to $17.6bn in national government budget allocations and the $8.4bn of investment certificates for Egypt’s Suez Canal expansion.

-

Chinese funding for transport infrastructure fell away significantly in 2014, having catalysed some very substantial road and rail projects in recent years.

-

Commitments from non-ICA member countries included Brazil ($503.4m), India ($423.9m) and South Korea ($206m). Non-member European bilaterals committed $876.8m, a substantial increase compared with $189m in 2013.

-

The private sector concentrated its investments mainly on energy in 2014, having showed substantial interest in port expansions in 2013.

-

There was a decline in the number of projects with private sector participation reaching financial close, as recorded in the Private Participation in Infrastructure (PPI) Project Database. This was down from $8.8bn in 2013 to $5.1bn in 2014. Of this, $2.9bn was financed by the private sector with the remainder from DFIs.

-

Energy once more dominated ICA members’ commitments with a 49% share (54% in 2013). It was followed by transport at 19% (22% in 2013) and water & sanitation at 18% (17%). ICT received just 2.7% of total commitments.

-

The trend towards ICA members backing multi-sector projects is gaining momentum. In 2013 they attracted twice the share reported in 2012, registering 5% of all commitments, and in 2014 this rose to more than 11% of the total.

-

North Africa has overtaken West Africa as the region that received the highest commitments from ICA members in 2014, with 27% of the total ($5bn).

-

ICA members’ commitments to Central Africa reached their highest point in 2014 for five years, with commitments of $3.7bn. This made the region the second highest recipient of 2014 commitments after North Africa.

-

More than 50% of private sector investors said they would invest more in the sectors where they already participate, while 88% of energy investors said they intend to increase their commitments, according to the 69 respondents to ICA’s African Infrastructure Investment Survey 2014. Respondents said Kenya and South Africa provided the most favourable investment locations followed by Nigeria.

-

Constraints such as bureaucratic delays, policy uncertainty, lack of transparency and insufficient institutional capacity remain a challenge, private sector respondents and ICA members agreed.

-

The shortage of adequately prepared or bankable projects was a much bigger challenge than finding project finance, members and operators agreed – although this registered as much less of an issue for private capital than in previous years.

-

Private sector investments focused on just a few large-scale projects in 2014, while participation in regional projects appears too challenging for most private sector investors and developers.

The report also found that, according to both ICA members and the private sector, constraints such as policy uncertainty, bureaucratic delays and a lack of transparency remain a challenge to increased investment in infrastructure, while a shortage of adequately prepared or bankable projects was a bigger obstacle than finding project finance, according to both ICA members and operators.

The report was discussed at the ICA 2015 Annual Meeting, which took place in Abidjan, Cote d’Ivoire, on 16 & 17 November 2015.

» Download: Infrastructure Financing Trends in Africa 2014 (PDF, 8.88 MB)

* ICA members are: G8 countries, South Africa, the African Development Bank, the Development Bank of Southern Africa, the European Commission, the European Investment Bank and the World Bank Group.