News

Could Europe’s historical trade links offset China slump?

Fears that a slowing China will cause world trade to stagnate could be overstated, given European nations’ long-standing trade links with emerging markets (EMs) across Latin America, Asia and Africa, experts have told CNBC.

“It sometimes slips under the radar quite how important Europe is for EMs (emerging markets),” William Jackson, senior EM economist at Capital Economics, told CNBC.

The European Union (EU) group of 28 countries is the world’s largest trading bloc, the largest trader of manufactured goods and services and the top trading partner for 80 countries, according to the bloc’s official website, which says that the U.S. is the top trading partner for only around 20 countries.

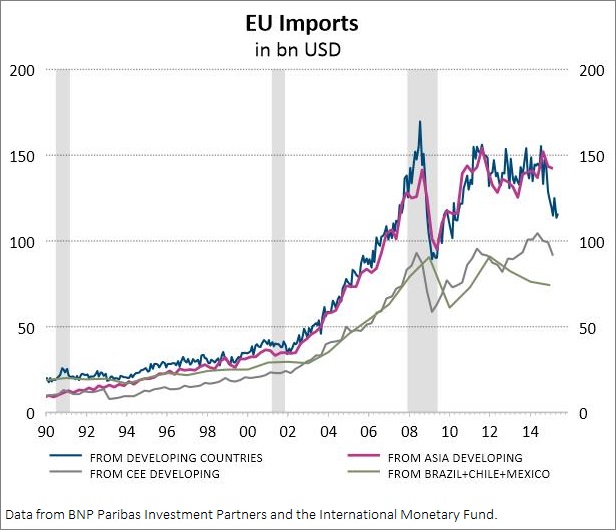

“Fuels excluded, the EU imports more from developing countries than the USA, Canada, Japan and China put together,” the website says.

Jackson and other economists highlight that the EU remains the largest export market for both Sub-Saharan Africa and eastern Europe and is also among the largest trading partners for Latin America.

“While much attention has focused on the role of China in slowing world trade growth, the trajectory of world trade growth from here depends more on the ‘old world’ markets of the U.S. and Europe than standard trade data would suggest,” said Adam Slater, lead economist at Oxford Economics, in a report out last week.

The slowdown in China cut around 0.5 percentage points from year-on-year world trade growth in the first half of this year, Slater said. However, in his opinion, this importance of China is overstated by standard trade data, in part because the trade growth figures cannot account for all the goods flowing into and out of the country.

“We should arguably be a bit less concerned about the import slowdown in China, which has already happened, and more so about what happens next in the U.S. and Europe,” he added.

Colonial era ties

Many of the strong trade links between emerging markets and Europe date back to colonial times, when Britain and France led the way in a race to paint the world in their home colors.

In Africa, for instance, many former colonies maintain trade links with their ex-colonial power that are as strong or stronger than those with either neighboring countries or with the relatively newcomer of China – despite the decades that have passed since Britain and France relinquished their empires.

“Colonial links are very strong; it is incredibly how strong they still are given the years that have passed,” Ravi Bhatia, a director at Standard & Poor’s who specializes in Africa, told CNBC on Monday.

“If you compare the intra-Africa trade with the trade between former colonial powers and ex-colonies, it is very much at the same sort of level. Intra-Africa trade is picking up a lot now, but it has been pretty low in the past.”

France, for example, remains a major trading partner for many of its ex-colonies, such as Cote d’Ivoire, Gabon and Cameroon in sub-Saharan Africa and Morocco in North Africa.

Similarly, the British are “very comfortable” trading with former colonies like Kenya, Bhatia said, citing “common language, common culture, established trading links and knowledge of the market from both sides” when explaining why the ties between colonizers and colonized remained strong.

Trade between the EU and sub-Saharan Africa reached $205 billion in 2014, up from $66 billion in 2000, according to Standard Chartered Bank. It remains relatively concentrated in both directions, with the former colonial powers of Germany, France and the U.K. accounting for a little less than 45 percent of EU-sub-Saharan Africa trade.

By comparison, trade between China and sub-Saharan Africa topped $170 billion in 2013, up from negligible levels in 2000, according to the World Bank.

Trade leads to… investment

These trade ties also provide indirect benefits in the form of foreign direct investment (FDI) links, Jackson told CNBC.

“This is perhaps most notable in central and eastern Europe where, following the end of communism, manufacturers became integrated into German supply chains (supported by FDI flows from west to east). But the EU is also the single largest source of investment into Sub-Saharan Africa and a major investor into Latin America,” he said on Monday.

“The key point here is that this investment then supports transfers of technology (as well as intangible benefits such as transfers of knowledge, know-how, management techniques, et cetera), which raises productivity and allows for a sustainable rise in incomes and living standards.”