News

Economic Partnership Agreements: What has Africa gained and what can it lose?

ACP countries were required for the first time to negotiate reciprocal, though asymmetric trade agreements, with a major – and developed – trading partner, the EU, giving birth to the Economic Partnership Agreements (EPAs). What have ACP countries gained more than what they already had and how fit are these EPAs in an evolving trading regime?

After twelve years of long and protracted negotiations, 1 October 2014 put an end to a fifty years long non-reciprocal trade regime between Europe and its African, Caribbean and Pacific (ACP) partners. The non-preferential trade regime, guided by successive Yaoundé, Lomé and Cotonou Agreements in fact terminated in 2007, when the second waiver granted by the World Trade Organization, which had allowed the EU to discriminate between its ACP partners and the rest of the developing world, expired.

In anticipation, ACP countries were required for the first time to negotiate reciprocal, though asymmetric trade agreements, with a major – and developed – trading partner despite the fact that their own regional integration agendas were still largely in the making. Thus Economic Partnership Agreements (EPAs) were born.

A long and winding road….

The objectives of EPAs were ambitious. First, EPAs were expected to be development tools: negotiated at a regional level, they were supposed to contribute to building strong regional markets, boosting trade and investment, facilitating the integration of ACP economies in the global economy and stimulating deeper economic reforms. Secondly, they were meant to ensure indefinite, immediate and fully liberalized market access to the EU market for ACP goods and open the services market. They also aimed at giving European goods and service providers’ significant market access to African markets over time. Finally, all this was expected to create a new momentum in the ACP-EU relationship with a departure away from an aid paradigm towards one based on a business model. But the process proved to be much more difficult than expected and as time went by, the levels of ambition melted away.

Initially, most ACP partners, in particular least developed countries, turned their backs on the offer, because they did not see what they would gain more than what they already had: Europe had already provided them full access to its market since 2001. They resented the significant efforts that were required to open their markets to Europe, fearing the risk of losing fiscal revenues from import duties, unfair competition from subsidized European agriculture and crowding out of small businesses from an already weak manufacturing sector due to competition from European products. Despite this, however, ACP developing countries feared that no deal with the EU would make them worse off, as they would lose their Cotonou preferences and compete with all other developing countries. But the results were disappointing. By the end of 2007, of the 76 negotiating ACP countries only 36 had concluded EPAs with the EU. By end of 2014, the number of ACP EPA parties had risen to 49. A total of 27 countries opted out, 15 in Africa, 12 in the Pacific. The scope of the agreement was reduced to trade in goods (with the exception of the Caribbean EPA), although there were commitments to continue to negotiate services in the future. The development chapter largely fell short of expectations, with the exception of West Africa, that negotiated a development package to finance needs of implementation.

Decrypting EPAs

EPAs broadened the trade coverage for ACP products compared to the previous unilateral trade preferences. Under the unilateral regime, 97 percent of ACP products entered the EU market on a preferential basis. Under EPAs, the European market was completely liberalised and accessible from 1st January 2008. While the rules of origin (RoOs) improved quite substantially from the previous regime, cummulation provisions – that is, provisions that allow countries to source products from neighbouring countries to transform locally and still qualify for exports to the EU - varied significantly across regions, with some regions having more possibilities than others. Administrative customs cooperation has still not been addressed, which means that over the past 12 years, ACP countries have not been able to source regional inputs or use EPAs to foster the development of regional value chains for exporting to the EU.

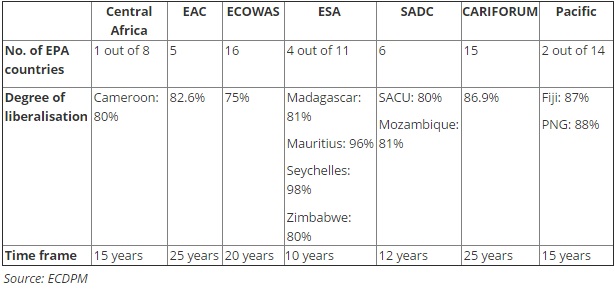

Further, liberalisation was not immediate, and tariffs will be phased down over at most 25 years for at last 75 percent of products, depending on the regions. In most cases, agricultural products remained sensitive, and were therefore not subject to liberalisation. The table below summarises liberalisation commitments in all EPA regions.

The agreements contain some degree of flexibility that allows countries to pursue their economic transformation reforms, including the use of industrial policies to diversify their economic base. For example, while the agreements regulate export restrictions, countries can still use them under specific circumstances. EPAs do not have stricter rules on other trade-related issues than the WTO, which means that most LDCs have the same degree of flexibility than under the WTO. Besides, European products will be able to access EPA signatories’ markets once those agreements enter into force.

On the development side, the only region that negotiated a comprehensive development package is ECOWAS, with at least €6.5 billion available for the programming period 2015-2019. The West African EPA Development Programme (PAPED) is expected to accompany and address potential challenges linked to the implementation of EPAs. Support will focus on trade, agriculture, infrastructure, energy and capacity building for civil society development.

How fit are EPAs for the evolving trading regime?

Despite the initial stated ambition, most EPAs, with the exception of the Cariforum EPA, remain partial agreements that focus narrowly on trade in goods. Trade in services is not covered and countries did not take any audacious steps to frame rules on other trade-related issue such as investment, competition or data protection.

To be sure, many developing countries, and in particular LDCs, may not be ready institutionally or capacity-wise to adopt far-reaching rules that go deeper than what the WTO covers or even to venture into areas that are not covered by the WTO. However, as international markets become more and more integrated and interconnected, and given that hopes for meaningful progress at the WTO are desperately low, large trading nations are going bilateral and plurilateral to improve their regulatory frameworks and adapt them to the needs of the evolving trading environment. This is the case for the EU, the US, Japan, India and China. Three large mega-regional trade agreements are currently being negotiated. These are the Trans-pacific partnership (TTP), involving 12 countries, namely the U.S., Japan, Canada, Australia, Singapore, Mexico, Chile, New Zealand, Brunei, Peru, Vietnam and Malaysia; the Transatlantic Trade and Investment Partnership (TTIP) between the European Union (EU) and the U.S; and the Regional Comprehensive Economic Partnership (RCEP) with 16 countries, among which the 10 member states of the Association of South East Asian Nations (ASEAN) – Brunei, Myanmar, Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand and Vietnam – and the 6 states with which ASEAN has existing FTAs, namely Australia, China, India, Japan, South Korea and New Zealand. If these deals are successfully concluded, they are expected to have significant implications for the regulatory environment.

An agreement such as the TTIP, if concluded, will necessarily entail some erosion of preferences for ACP countries, but this is not the key challenge. Applied tariffs between ACP countries and these two large economies are already low and ACP economies are neither direct competitors of the US on the EU market, nor direct competitors of the EU on the US market. But on the rules side, TTIP is expected to adapt current international trade and investment rules to the exigencies of the new business environment. In a nutshell, we expect new and higher rules and standards to be developed. While rules may be multilateralised at a later stage, standards are sometimes adopted in domestic policies that apply to all countries once developed.

We therefore expect competition over markets to play through the convergence of standards to reduce the cost of production. This is where the EPAs, in their current state, look disappointingly pale. While it is true that EU and US trade baskets are highly sophisticated, in that regard, EPAs fail to meet its stated objective of helping ACP economies to integrate into the global economy, by remaining a traditional FTA that is focused on tariff elimination, rather than market sophistication.

Conclusions

If successfully concluded, the TTIP (and other mega-regionals) will set new benchmarks for the global trading system. The timing and the outcomes are, for the moment unknown, but there is no time for complacency. It is clear that the ‘do nothing’ or ‘wait and see’ responses on the part of the ACP are not a strategy. Similarly, the ‘reject’ strategy is not helpful either, because mega-trade deals such a TTIP will happen anyway, and there will be very little third countries can do about it. Finally, retreating into protectionism may accentuate the marginalisation of the ACP countries because isolation weakens further the capacity of states to transform themselves.

It is therefore timely for ACP policymakers to forge strategic responses, by taking bold steps within their own intra-regional trade agenda, as a way to mitigate the ‘tsunami effect’ of mega trade deals. It may also be appropriate to build strategic alliances with other non-participating countries, in order to take the lead at the WTO to address some of the issues that might affect the global trading system once those mega-trade deals are agreed.

Isabelle Ramdoo is the Deputy Head of the Economic Transformation and Trade Programme at the European Centre for Development Policy Management in Maastricht.

This article is published under Bridges Africa, Volume 4 - Number 7, by the ICTSD.