News

Africa: The billions that got away

Special report examining the Illicit outflows of money from the continent and the need for a global response to stem it.

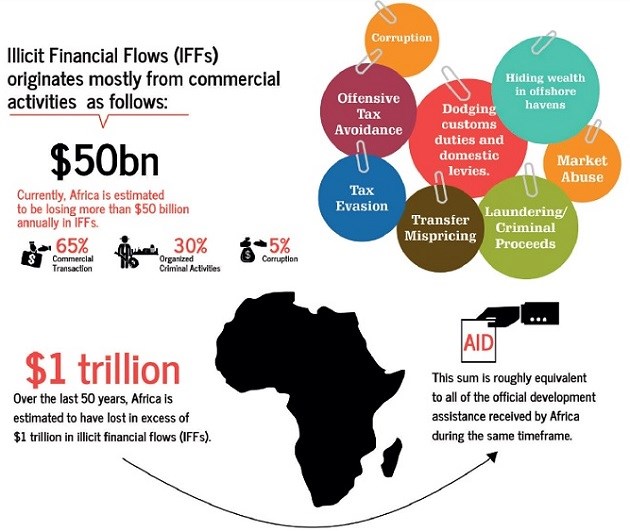

Africa loses approximately US$50 billion annually through Illicit Financial Flows (IFFs). The AU/ECA’s High Level Panel on Illicit Financial Flows report and other studies argue that Africa lost over US$1 trillion through IFFs in the last 50 years – an amount similar to Official Development Assistance in the same period.

Many, including ourselves at TrustAfrica, have always been cautious about the over dramatised narrative of “Africa Rising” especially as it mostly uses Gross Domestic Product (GDP) as a measure of growth. Other Human Development indicators such as Gross National Income (GNI), access to affordable health care, education, and decent jobs are rarely considered in the ongoing optimism surrounding Africa.

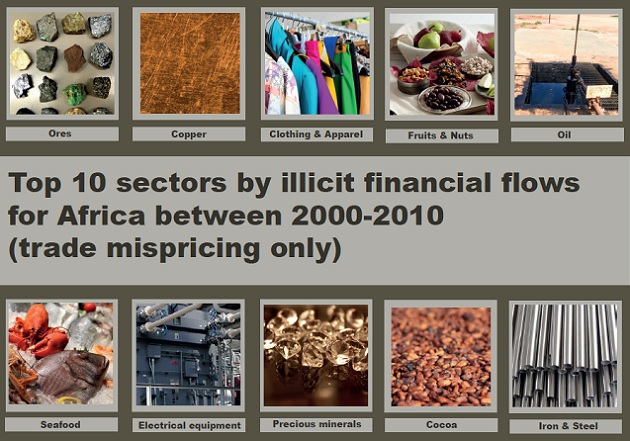

Whilst GDP growth has indeed been above an average of 5% for most of Africa, we rarely get insights into how African economies are structured and also a discussion on who benefits from this growth. One salient fact about the growth is that it comes largely from the global commodity super cycle and to some extent the boom in the telecommunications industry. Enterprises that produce and trade in the commodities are mostly large multinationals domiciled outside of Africa. They enjoy tax holidays, revenue repatriation arrangements and relaxed labour laws. Revenue repatriation agreements allow companies to remit their revenues to the head office, but this practice is NOT part of IFF.

Beyond the benefits cited above, these large companies are the drivers of illicit financial flows. According to the AU/ECA report, the most common practices include trade mispricing, under-invoicing of exports, exaggeration of import values, and general tax avoidance schemes. IFF processes are very complex in nature and some of the reports in this handbook attempt to expand upon them – except to restate that they are costing Africa about US$50 billion per year – approximately 68% of Kenya’s GDP.

Human development, inclusive of access to quality health provision, education, jobs and decent standards of living remains unattainable for many Africans. The benefits of the current growth cycle have been highly unequal and limited mostly to higher income earners.

More and more Africans perish in the Mediterranean every year trying to enter Europe in search of greener pastures. We also know about US$50 billion is needed annually to fund infrastructural projects amid the steady decline in Official Development Assistance (ODA).

The AU’s Agenda 2063 underlines improved domestic resource mobilisation as a key pillar for Africa’s sustainable and inclusive development. It is in this light that we at TrustAfrica, alongside our friends and partners within civil society, are calling for a new development compact underpinned by transparency, accountability and equity.

We aim at collecting a million signatures against an opaque global economic system that accommodates IFFs. It is morally reprehensible for economic actors to continue engaging in these harmful practices at the expense of Africa’s future. We need sufficient public energy and an outcry for an immediate end to these practices. Our governments and regional processes should play their part in fast tracking mechanisms and laws for compliance with the new thinking.