News

Investor-State Dispute Settlement: Review of Developments in 2014

Statistical update (as of end 2014)

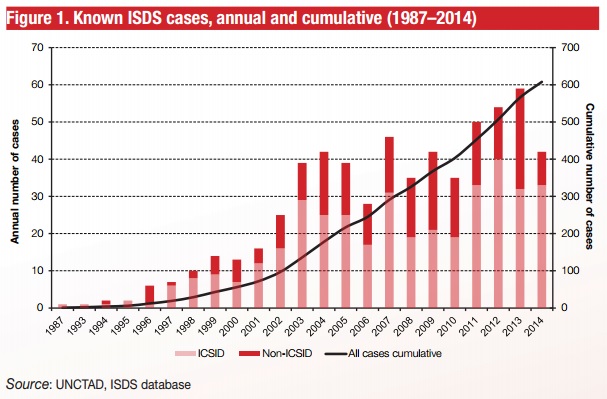

In 2014, investors initiated 42 known ISDS cases pursuant to international investment agreements (IIAs). This is lower than the record high numbers of new claims in 2013 (59 cases) and 2012 (54 cases) and closer to the annual averages observed in the period between 2003 and 2010. As most IIAs allow for fully confidential arbitration, the actual number of cases is likely to be higher.

Last year’s developments brought the overall number of known ISDS claims to 608. Ninety nine governments around the world have been respondents to one or more known ISDS claims.

Respondent States

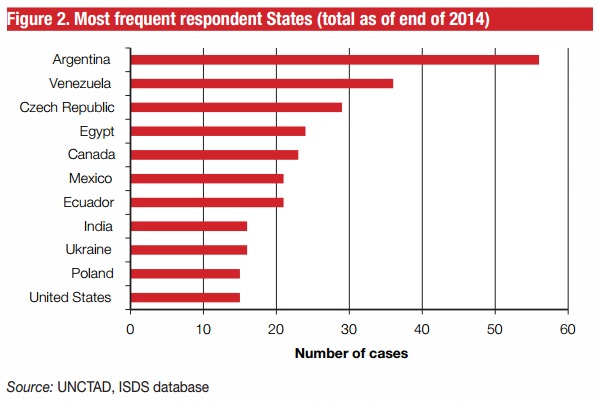

The relative share of cases against developed countries is on the rise. In 2014, 60 per cent of all cases were brought against developing and transition economies, and the remaining 40 per cent against developed countries. The share of cases against developed countries was 47 per cent in 2013, and 34 per cent in 2012, while the historical average is 28 per cent. In total, 32 countries faced new claims last year. The most frequent respondent in 2014 was Spain (five cases), followed by Costa Rica, the Czech Republic, India, Romania, Ukraine and the Bolivarian Republic of Venezuela (two cases each). Three countries – Italy, Mozambique and Sudan – faced their first (known) ISDS claims in history.

Home country of investor

Of the 42 known new cases, 35 were brought by investors from developed countries and five were brought by investors from developing countries. In two cases the nationality of the claimants is unknown. The most frequent home States in 2014 were the Netherlands (seven cases by Dutch investors), followed by the United Kingdom and the United States (five each), France (four), Canada (three) and Belgium, Cyprus and Spain (two each). This corresponds to the historical trend where developed-country investors – in particular, those from the United States, Canada and several European Union (EU) countries – have been the main users of the system responsible for over 80 per cent of all ISDS claims.

Applicable investment treaties

The majority of new cases (30) were brought under BITs. Ten cases were filed pursuant to the provisions of the ECT (twice in conjunction with a BIT), two cases under the Central America-Dominican Republic-United States Free Trade Agreement (CAFTA), one case under the NAFTA and one case under the CanadaPeru FTA. Looking at the full historical statistics, the ECT has now surpassed the NAFTA as the most frequently invoked IIA (60 and 53 cases respectively). Among BITs, the Argentina-United States BIT remains the most frequently used agreement (20 disputes).

Economic sectors involved

About 61 per cent of cases filed in 2014 relate to the services sector. Primary industries account for 28 per cent of new cases while the remaining eleven per cent arose out of investments in manufacturing. Looking at the industries in which investments were made, the most numerous was generation and supply of electric energy (at least eleven cases), followed by oil, gas and mining (ten), construction (five) and financial services (three).

Measures challenged

The two types of State conduct most frequently challenged by investors in 2014 were (i) cancellations or alleged violations of contracts or concessions (at least nine cases); and (ii) revocations or denial of licenses or permits (at least six cases). Other challenged measures include: legislative reforms in the renewable energy sector, alleged discrimination of foreign investors vis-à-vis domestic ones, alleged direct expropriations of investments, alleged failure on the part of the host State to enforce its own legislation, alleged failure to protect investments, as well as measures related to taxation, regulation of exports, bankruptcy proceedings and water tariff regulation. Information about a number of cases is lacking. Some of the new cases concern public policies, including environmental issues, anti-money laundering and taxation.

ISDS outcomes in 2014

In 2014, ISDS tribunals rendered at least 43 decisions in investor-State disputes, 34 of which are in the public domain (at the time of writing). Of the 34 public decisions, eleven principally addressed jurisdictional issues, with six decisions upholding the tribunal’s jurisdiction (at least in part) and five decisions rejecting jurisdiction. Fifteen decisions on the merits were rendered in 2014, with ten accepting – at least in part – the claims of the investors, and five dismissing all of the claims. The remaining eight public decisions were rendered on applications for annulment and on preliminary objections.

Of the ten decisions finding States liable, six found a violation of the FET provision and seven a violation of the expropriation provision. At least eight decisions rendered in 2014 awarded compensation to the investor, including a combined award of approximately USD 50 billion in three closely related cases, the highest known award by far in the history of investment arbitration.

Five decisions on application for annulment were issued in 2014 by ICSID ad hoc committees, all of them rejecting the application for annulment.

Ten cases were reportedly settled in 2014, and another five proceedings discontinued for unknown reasons.

By the end of 2014, the overall number of concluded cases reached 356.13 Out of these, approximately 37 per cent (132 cases) were decided in favour of the State (all claims dismissed either on jurisdictional grounds or on the merits), and 25 per cent (87 cases) ended in favour of the investor (monetary compensation awarded). Approximately 28 per cent of cases (101) were settled14 and eight per cent of claims (29) were discontinued for reasons other than settlement (or for unknown reasons). In the remaining two per cent (seven cases) a treaty breach was found but no monetary compensation was awarded to the investor.