News

Financial sector must promote inclusive growth

Finance is a key ingredient of modern economies, but too much finance may hamper economic growth and worsen income inequality, according to new research from the OECD.

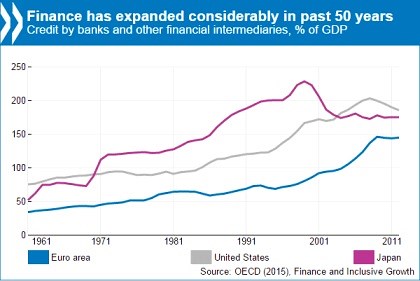

The OECD’s latest work on Finance and Inclusive Growth analyses 50 years of data to demonstrate the variable effects that further expansion of different types of finance can have on both economic activity and inequality.

“The global financial crisis has raised deep questions about the influence of finance on economic activity and the distribution of income,” OECD Chief Economist Catherine L. Mann said while launching the new research in London. “What our research has shown is that avoiding credit over-expansion and improving the structure of finance can lead to improvements in both economic and social well-being.”

The OECD identifies a number of risks to long-term growth posed by an over-reliance on bank lending, versus other types of market-based finance, such as bonds and equities. These include misallocation of capital, by funding investments with low profitability; magnifying the cost of implicit guarantees for too-big-to-fail banks; drawing highly talented workers away from sectors with greater productive potential; and generating boom-bust cycles.

At today’s level of financial development, further expansion of bank credit to the private sector is shown to slow growth in most OECD countries. A rise of bank credit by 10% of GDP translates into a GDP growth rate that is 0.3 percentage points less than would otherwise be the case, according to the OECD.

Greater levels of stock market financing, on the other hand, are still seen to boost growth. An increase in stock market capitalisation by 10% of GDP is, on average across OECD and G20 countries, associated with a 0.2% rise of GDP growth.

Bank loans slow economic growth more than market-based credit, while credit to households – which is primarily aimed at the real estate sector – is a stronger drag on growth than credit to businesses.

Whereas financial expansion can help low-income individuals fund their projects and home ownership, it tends more to drive inequality. People with higher incomes can and do borrow more than those on lower incomes, and the benefits from growth in stock markets accrue more to high-income households who tend to have more wealth in equity. Similarly, the financial sector pays high wages, which are above what employees with similar profiles earn in the rest of the economy, increasing income inequality. In Europe, financial sector employees make up 20% of the top 1% earners, but are only 4% of overall employment.

The OECD identifies reforms to make the financial sector more stable and enable it to contribute to strong and equitable growth. These include:

-

Greater use of macro-prudential instruments to prevent credit overexpansion, and the supervision of banks to maintain sufficient capital buffers.

-

Measures to reduce explicit and implicit subsidies to too-big-to-fail financial institutions, through break-ups, structural separation, capital surcharges or credible resolution plans.

-

Reforms to reduce the tax bias against equity financing and to make value added tax neutral between lending to households and businesses.

This paper on the link between finance and growth is part of the OECD’s New Approaches to Economic Challenges (NAEC), an Organisation-wide reflection on the roots and lessons to be learned from the global economic crisis, as well as an exercise to review and update its analytical frameworks.