News

Zambia: IMF Executive Board 2015 Article IV Consultation

On May 20, 2015, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Zambia.

Executive Directors noted that, after a period of strong macroeconomic performance, the Zambian economy is facing significant challenges arising from large fiscal deficits, lower copper prices, and policy uncertainties. Directors emphasized that steadfast and strong efforts are needed to ensure macroeconomic stability and foster inclusive growth.

Directors underscored the need for significant fiscal consolidation in 2015 and over the medium term, to reduce the deficit, stabilize debt, and create conditions for lower interest rates. They welcomed the authorities’ decision to implement the policy of full cost recovery in the pricing of petroleum products. Directors called for sustained expenditure and revenue efforts, including efforts to contain the wage bill, target social spending through cash transfers, broaden the tax base, and put the pension system on a sustainable footing. They also welcomed the authorities’ decision to rescind the royalty-based mining fiscal regime, and called for swift action to resolve the issue of outstanding VAT refund claims to exporters.

Directors welcomed recent progress in the implementation of public financial management reforms, including the Integrated Financial Management Information System and the pilot phase of Treasury Single Account. They encouraged the authorities to utilize these tools to strengthen budget controls to avoid the accumulation of arrears, and to enhance the transparency of the budget process by improving fiscal reporting.

Directors noted that Zambia’s moderate risk of external debt distress calls for prudence in borrowing on commercial terms. Recognizing the need to address infrastructure gaps, they advised the authorities to strengthen the project selection process and prioritize capital spending. They also called for the development of a comprehensive debt management strategy to help address public debt vulnerabilities.

Directors supported the commitment of the Bank of Zambia to maintain a tight monetary policy stance to contain inflationary pressures. They stressed the importance of continued exchange rate flexibility and rebuilding reserves to provide adequate buffers for the economy.

Directors noted that the financial sector remains well capitalized and stable, and commended the strengthened banking supervision. They recommended continued efforts to enhance financial inclusion, including improving access to financial services in rural areas. Directors also called for the elimination of interest rate ceilings as they restrict access to credit.

Directors noted that poverty remains high, particularly in rural areas. To foster job creation, inclusive growth, and economic diversification, Directors encouraged the authorities to improve the business climate by restraining labor costs and ensuring a stable regulatory environment. They also recommended action to address infrastructure and electricity supply constraints; develop skills; and rationalize farm subsidies with a reallocation of resources to the social cash transfer program.

Key issues

Context

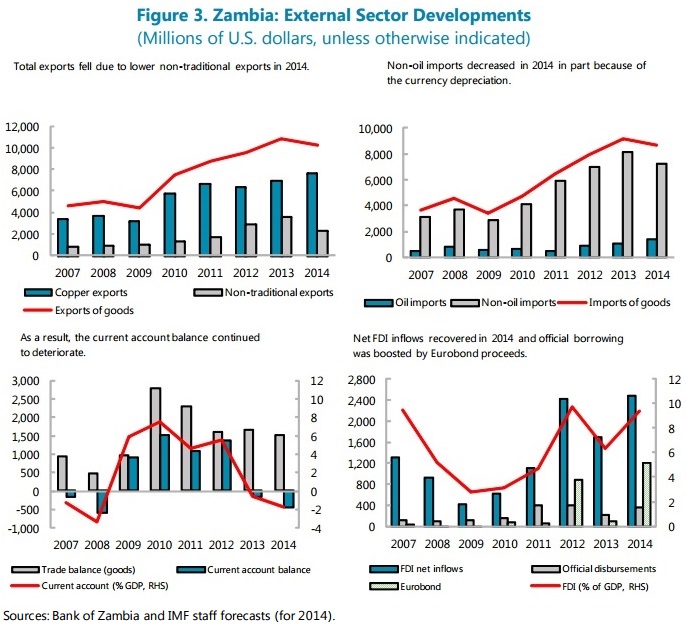

Zambia achieved strong growth and macroeconomic stability over most of the last decade. However, in the last two years, the Zambian economy has been facing strong headwinds from large fiscal imbalances, lower copper prices, and policy uncertainties. The current account has deteriorated, international reserves have fallen, and the exchange rate has been under downward pressure.

Outlook and risks

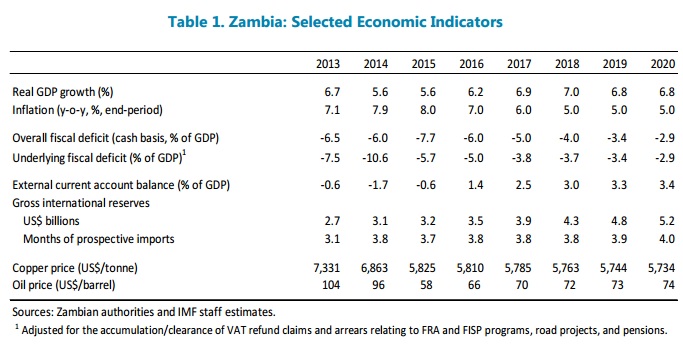

Provided the authorities implement strong adjustment measures, growth is projected to remain at annual rates of 5½-7 percent over the medium term, as investments in mining and electricity bear fruit. Annual inflation is projected to stay in single digits and decline gradually to 5 percent. Key risks to the outlook are persistent low copper prices, delayed fiscal adjustment in the lead-up to general elections in 2016, and policy uncertainties that could undermine mining operations and overall investment in the economy.

Resolving mining sector tax issues

A large build up of VAT refund claims of exporters and a change in the mining fiscal regime that came into effect at the beginning of 2015 adversely impacted the outlook for the mining sector which accounts for three quarters of Zambia’s export earnings. The authorities have partially addressed the VAT refund problem and have announced that the mining fiscal regime will revert to a system similar to what was in effect in 2014.

Ensuring macroeconomic stability and reducing external vulnerability

Growing fiscal deficits and depleting government deposits are threatening macroeconomic stability. Fiscal adjustment and continued tight monetary policy will help stabilize the exchange rate and contain inflation pressures. Given Zambia’s susceptibility to external shocks, the Bank of Zambia should aim to rebuild reserves over the medium term. Also, the export base needs to be diversified to reduce the high dependence on copper.

Enhancing competitiveness and inclusive growth

The government needs to address impediments to doing business and labor market policies in order to enhance competitiveness and promote job creation. To maintain Zambia as an attractive investment destination, frequent regulatory changes and uncertainty about policy direction should be avoided.

Selected Issues

Analysis of change in Zambia’s mining fiscal regime

Foreign investment has revived Zambia’s mining sector. Copper mines were privatized in the late 1990s and early 2000s after three decades under government control. Since then, foreign companies have invested around US$10 billion in the sector, revitalizing Zambia’s production to historical high levels. Copper production has trippled from about 250,000 tons in 2000 to over 750,000 tons in 2013.

The mining sector’s direct contribution to government revenues (royalties, corporate income tax) has been low. During 2000-07, on average, the sector contributed less than 0.1 percent of GDP to government revenue while accounting for about 6.2 percent of GDP. This low contribution reflected a combination of low international copper prices, depressed production, low profitability (due in part to large capital investments made to restore production resulting in significant tax credits), and the concession agreements granted to mining companies. Revenues have increased with increasing copper production, higher sector value-added, rising prices, and changes to the fiscal regime.

Enhancing financial inclusion in Zambia

The authorities are concerned about high lending rates and limited access to credit, particularly by small- and medium-scale enterprises (SMEs). Despite various measures taken, the authorities believe that lending interest rates in Zambia remain very high, which has limited access to credit by SMEs in particular. Credit to the private sector remains low at 14 percent of GDP in 2014, below the sub-Saharan regional average.

Toward more inclusive growth in Zambia

In the last decade, Zambia has sustained high growth in line with fast-growing peer countries in sub-Saharan Africa. Supported by market-liberalizing reforms in the 1990s and strong copper prices since 2004, real GDP growth has averaged about 7 percent since 2003, above the average of about 5½ percent for sub-Saharan Africa (SSA). Over the same period, improved policies for macroeconomic stability helped bring inflation down from about 20 percent to single digit. Strong growth resulted in sustained increases in GDP per capita, which more than tripled from about US$500 in 2000 to about US$1,800 in 2013, albeit still below the peak level of US$2,000 reached in the 1970s.

However, Zambia’s strong growth has not been sufficiently inclusive to benefit all Zambians. The overall growth effect in reducing poverty in Zambia is on par with those experienced in other developing countries. For each percentage point increase of growth in 1998-2010, Zambia’s extreme poverty rate declined by about 1.1 percentage points, and the overall poverty rate declined by about 0.7 percentage points, in line with the SSA average. But the rural-urban divide is significant. While the urban poverty rate has fallen to about 30 percent in 2010, the poverty rate in the rural areas – where 2/3 of the population lives – remains above 70 percent, much higher than the SSA average poverty rate of 48 percent. Growth incidences for 2006-10 also exhibit a sharp rural-urban divide on the consumption impact. In urban areas, consumption growth has been positive for all households and higher among poorer ones. In contrast, the impact has been regressive in rural areas, where the consumption of poorer households even declined. Similar urban-rural disparity exists in social indicators. From 2007 to 2010, the prevalence of underweighted children in urban areas dropped from 12.8 percent to 10.8 percent, while the indicator in rural areas declined from 15.3 percent to 14.2. As a result, inequality has worsened, with the Gini coefficient increasing from 0.47 to 0.52 over the last decade.