News

Foreign Direct Investment: An important source of external development financing for the poorest economies

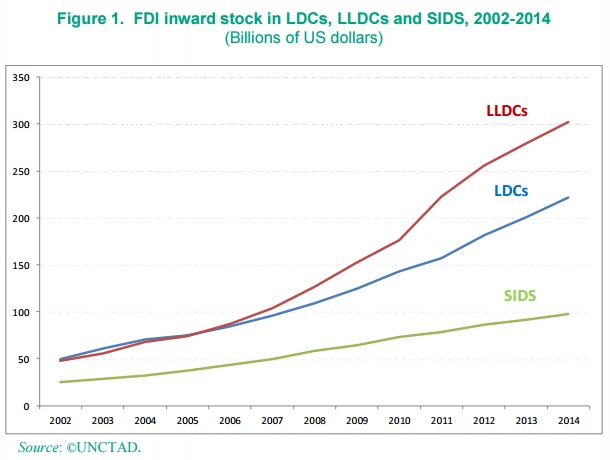

Over the past decade, foreign direct investment (FDI), in terms of stock, tripled in least developed countries (LDCs) and small island developing States (SIDS), and quadrupled in landlocked developing countries (LLDCs), the Special Financing for Development Issue of UNCTAD’s Global Investment Trends Monitor says.

Since the first Conference on Financing for Development, which produced the Monterrey Consensus of 2002, particular concern has focused on mobilizing financing and investment for LDCs, LLDCs and SIDS, in order to ensure robust, resilient growth and sustainable development. In the context of the post-2015 development agenda, financing for those economies is even more to the fore.

With a concerted effort by the international community, a quadrupling of FDI stock in these economies by 2030 from today’s level is achievable, and consistent with past and recent growth in FDI inflows. Beyond international initiatives per se, today a wider range of investors than ever before are potential sources of financing for investment. They include commercial banks, State-owned banks, pension funds, insurance companies, multinational enterprises (MNEs), sovereign wealth funds, foundations, endowments, family offices and venture capital funds.

The challenge is to mobilize and channel them into the sustainable development goals (SDGs) sectors and make positive contributions to sustainable development and inclusive growth.

FDI is a critical source of finance for developing countries, but policymakers need to pay due regard to minimizing risks. For host countries, FDI can contribute to employment generation, technology diffusion, economic growth and sustainable development. However, potential risks should be minimized through: good governance and capable institutions, high absorptive capacity and an effective regulatory framework.

The UNCTAD Investment Policy Framework for Sustainable Development and its Action Plan for Investing in the SDGs are designed to guide investment policy making and implementation focusing on productive capacity building, inclusive growth and sustainable development.