News

Green bonds are changing investor expectations & making sustainable investing easier

A year ago in Davos, World Bank Group President Jim Kim encouraged investors at the World Economic Forum to take a closer look at green bonds, a relatively new but growing option for investing in a sustainable and responsible way: Green bonds act like other bonds, but they can help fill gaps in much-needed development finance for climate-friendly projects.

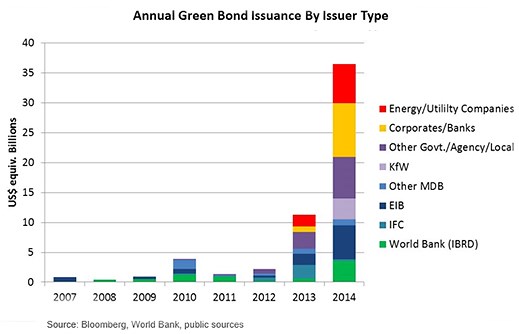

About $11 billion in green bonds had been issued the previous year. The president called for doubling the annual issuances by the September 2014 Climate Leadership Summit. With new types of issuers, new green bond indices being created, and more buyers investing, the year closed with more than $35 billion in new green bonds.

As the World Economic Forum returns to Davos this week, green bond investments are widely forecast to continue their strong growth in 2015.

At the World Bank Group, we see several trends emerging.

Investor expectations are changing

The growth of the green bonds market is helping change how money is invested and what investors expect their money to accomplish.

Since the start of the market in 2007, the majority of green bonds have been issued by development banks like the World Bank and IFC and used for climate- and environment-friendly projects such as expanding rural solar power in Peru and large-scale renewable energy in Mexico; increasing irrigation efficiency in Tunisia; and expanding clean urban transport in Colombia, among other work.

Investors are drawn to both the liquid, fixed-income investments that green bonds offer and the positive impact they can have.

Many institutional investors such as pension funds now have mandates for sustainable and responsible investments and are developing strategies that explicitly address climate risks and opportunities in different asset classes. Green bonds can provide the verification and impact measurement that investors need. In the case of World Bank green bonds and IFC green bonds, they also bring AAA/Aaa ratings.

“Environmental degradation, poverty and the effects of climate change all threaten the well-being and stability of countries, communities, resources and businesses. Investors increasingly recognize the threats these forces create for long-term financial value and are increasingly considering it in their investment choices,” said Laura Tlaiye, a sustainability advisor at the World Bank, one of the first and largest issuers of green bonds with more than US$7 billion issued in 18 currencies.

Green bonds also give smaller investors a way to vote with their money. The State of Massachusetts, for example, received more than 1,000 orders from investors for a green bond it issued last year – most of them individual investors interested in supporting their local government's investment in the environment.

“The fact that there are investors looking for these types of investments and asking for detailed metrics on environmental performance changes incentives. We reach investors we would not otherwise reach, diversify and expand the investor base and funding sources,” said Heike Reichelt, head of investor relations and new products at the World Bank.

Expanding the issuer and investor bases

As the market grows, the size of green bonds is growing and new types of issuers are coming in.

Cities and state agencies, which have used bonds in the past to raise money for infrastructure projects, have started issuing green bonds to help support and highlight environment- and climate-friendly projects, such as efficiency improvements and public transportation. Johannesburg, South Africa, issued Africa’s first municipal green bond last year to help finance emissions-reducing projects including bio gas energy, solar power, and sustainable transportation.

Corporations and utilities have also started issuing green bonds. The French utility GDF Suez issued the largest green bond to date, 2.5 billion euros, intended to finance renewable energy projects such as wind farms and energy efficiency work such as smart metering and integrated districting heating networks. The expansion of issuers has drawn attention to the importance of transparency and standards.

For issuers, the green label can help reach new investors. As the green bond market grows, green projects will be prioritized over others, and issuers with strong sustainability credentials will be rewarded with a broader investor base.

New types of green bonds are also coming in and bonds are being issued in more currencies. The World Bank closed its first green bond for European retail investors in early January, raising $91 million for climate-friendly projects with an innovative equity index-linked green bond. IFC, which has issued over $3.7 billion in green bonds so far, issued its first green bonds in Renminbi and Peruvian soles last year.

Transparency and indices

Investors will tell you that the key to a successful green bond market is transparency. Green bond indices are an important development in this area.

The World Bank set a high standard when it launched the first green bond in partnership with Swedish bank SEB in 2007. Others have followed and adapted the model. The model starts with defining eligibility criteria for green bond-financed projects and verifying the criteria with an expert organization, such as CICERO. The World Bank established a process for selecting projects that meet the criteria, then set up a separate account to ring-fence the proceeds so they can be allocated to eligible projects. Finally, it reports on the climate and environment impact of the projects and ensures compliance.

That structure and focus on transparency and disclosure was a foundation for developing the voluntary Green Bond Principles, endorsed by over 70 investors, banks, other issuers and other market participants and now coordinated by the International Capital Markets Association.

To help investors evaluate green bonds, MSCI/Barclays and others have also launched green bond indices that score issuers and check their project selection criteria and management of proceeds to ensure the promised use, and ongoing reporting.

The impact on development finance

Public finance alone will never be enough to rein in climate change – private investment in climate-smart projects is necessary to put economies on a cleaner growth path. Green bonds help mobilize private sector finance and further educate the private sector in the value of investing in clean development.

“We believe sustainable investing will become the standard way of managing a fixed-income portfolio, transforming how companies and the projects they support are managed,” Reichelt said. “The next generation of portfolio managers will wonder how short-term gains could have overshadowed sustainable growth for so long.”