News

South Africa strives to revive growth, cut exposure to risks

South Africa can celebrate significant progress in its first 20 years of democracy, but faces the challenge of reviving a weak economy and addressing elevated vulnerabilities the IMF said in its 2014 review of the country’s economy.

As the government’s Twenty Year Review notes, South Africa “has emerged from its deeply divided and violent past into a peaceful, robust, and vibrant democracy that has made major strides in improving the lives of its citizens.” Income levels have increased, access to education and health care has improved, and strong institutions and policy frameworks have delivered macroeconomic stability.

Yet the country faces difficult challenges. Real GDP growth is projected to fall to 1.4 percent this year, the lowest since 2010, and recover to only 2.1 percent in 2015, assuming some normalization in industrial relations. About a quarter of South Africans and half of its youth remain unemployed.

The current account and fiscal deficits are elevated relative to other emerging markets. Going forward, the consumption-driven growth model of the past few years is unlikely to be sustainable and headwinds stem from tighter global financial conditions, the uneven global recovery, reduced policy space, and softer commodity prices.

Structural constraints

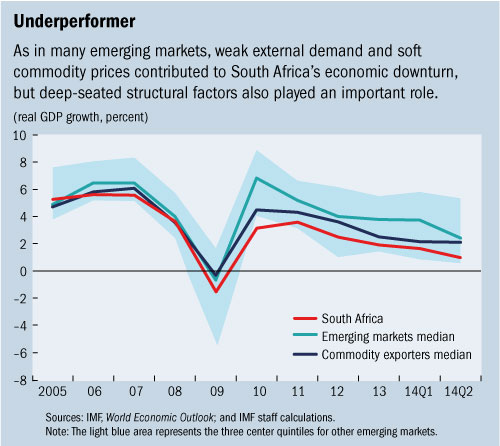

As in many emerging markets, weak external demand and soft commodity prices contributed to South Africa’s economic downturn, but deep-seated structural factors also played an important role. An increase in workdays lost to strikes and increasingly binding supply bottlenecks, especially in electricity provision, were important factors behind South Africa’s growth underperformance, in addition to long-standing rigidities in product and labor markets, poor education outcomes, and apartheid legacies (see chart).

Unless these structural constraints are relieved, South Africa is likely to struggle to grow above 2-2½ percent per year, well below what is required to create sufficient jobs to lower unemployment.

Sources of resilience

Poor export performance and robust imports despite a large currency depreciation have kept the current account deficit above 5 percent of GDP. This, combined with low foreign direct investment, makes South Africa vulnerable to a pullback by foreign investors.

After years of accommodation, government debt has risen sharply. These vulnerabilities, however, are mitigated by the floating exchange rate, a favorable currency and maturity composition of debt, and the large domestic institutional investor base.

In an accompanying assessment of the South African financial sector, IMF staff found that risks are elevated given the challenging operating environment but are also manageable thanks to high capital adequacy buffers and strong supervision.

Nevertheless, downside risks dominate. More strikes and further delays in relieving electricity shortages are the key domestic risks. Also, South Africa, like other emerging markets reliant on external financing, remains vulnerable to tighter global financing conditions, lower world economic growth, and weaker commodity prices.

More fiscal measures

Notwithstanding the weak economy, the government’s 2014 Medium-Term Budget Policy Statement concluded that “fiscal consolidation can no longer be postponed.” The envisaged consolidation is significant, but additional measures may be needed to stabilize debt at the 50 percent of GDP level projected by the government.

Inflation remains close to the upper end of the South African Reserve Bank’s target range, but inflation momentum is slowing and the recent fall in oil prices may allow monetary policy to remain accommodative for longer. Nevertheless, over the medium term, real interest rates will have to rise to encourage domestic savings and address vulnerabilities.

Infrastructure projects

Constrained policy space means structural reforms are the only way for South Africa to boost job-rich growth. Ongoing infrastructure projects are key, but should be complemented by increased private participation to ease pressure on public sector balance sheets.

Steps to normalize labor relations are vital and could be accomplished in a social bargain to raise product market competition and increase labor market inclusiveness. These reforms are not only critical to raise growth and job creation, but also to rebalance the economy toward exports and investment and to increase scope for countercyclical macro policies.

As Finance Minister Nhlanhla Nene recently noted, “…the biggest constraints to a faster rate of growth are domestic factors, in other words things that are within our powers to fix.”