News

Mozambique Economic Update: November 2014

Selected Highlights

Economy continues to register strong growth

The Mozambican economy grew by 6.9 percent in the second quarter of 2014, bringing average growth in the first half of 2014 to 7.2 percent, somewhat lower than projected growth in 2014 at 7.4 percent. Quarterly growth figures indicate an acceleration of economic activity after a dip in the second half of 2013. Slowdown in economic activity in the second half of 2013 was related to challenges in the mining sector (infrastructure, international commodity prices) affecting investment as well as the persisting political violence and conflict, which have now eased after the peace deal.

Despite this pick-up in activity, growth remains well below the strong levels of early 2013. Expansion has decelerated in some sectors that have been major drivers of growth in the recent past, such as construction and transport and communications. These sectors would be affected by a slowdown in mining but also suffer from the effects of recent political tensions. Growth in the agricultural sector has also slowed down while the manufacturing sector has accelerated. Financial services and extractive industries remain among the fastest growing sectors in the second quarter, although the latter has decelerated when compared to previous years. Despite moderate and below average growth, agriculture remains the single largest contributor, accounting to almost one third of the total growth in the economy, followed by financial services and manufacturing, each explaining about one fifth of the total growth. On the other hand, due to the small size of the sector, the extractive industries explained only about 4 percent of the total growth despite rapid year on year growth.

International Reserves remain stable

International reserves stood at US$ 2.9 billion at the end of October 2014, a slight decline in the quarter, to some extent caused by the strength in the US dollar. Other contributors to the decline in reserves were payments by the Government, US$ sales by the Central Bank and debt servicing. Positive contributions came from payments to the state (including from extractive industries) and budget support. Despite this slight decline, reserves are still the equivalent to 4.2 months of imports excluding the mega-projects.

Budget Execution Rates are higher than in the first half of 2013

State revenue by the end of the second quarter reached MT 74.6 billion, representing 50.7 percent of the target for the entire year. This execution rate is 4.6 percentage points higher than during the same time in 2013. This improvement in tax collections was partially the result of large capital gains taxes collected in the first quarter of the year. However, grants have flown in slower than expected, with only 36 percent of all grants projected for the year disbursed in the first half of the year. Total expenditures during the first two quarters reached MT 100.2 billion, a nominal increase of 44 percent compared to the period in 2013, with higher execution rates of both current and capital expenditures. Execution rates at the sectoral level shows significant differences, with very low execution rates in the agriculture sector.

The Revised Budget increases public spending to almost 47 percent of GDP

In August 2014 parliament approved a revised budget that brings expenditures to a projected 46.6 percent of GDP (although execution may be somewhat lower, given the large increase in investment spending), a further increase from the original budget. This revision would also mean an increase in the budget deficit (after grants) from 9.2 percent of GDP to 10.0 percent of GDP. This expansionary fiscal stance is explained by one-off expenditures related to the election year as well as other factors like the inclusion of the non-commercial part of the EMATUM operation in the budget. A fiscal deficit of 10 percent does not seem sustainable over a longer period of time, which suggests that fiscal policy will need to tighten in the near term.

Inflation continues to be low

Inflation in October 2014 fell to 1.3 percent. Inflation has been on the decline since April 2014. The low rate can be attributed to factors like favorable import prices due to appreciation of the Metical against the South African Rand, decline in the prices of food helped by a good harvest as well as marginal reductions in fuel prices. This trend in inflation is expected to continue until the end of the year and the Central Bank expects this low inflation to continue into next year.

While growth remains strong in Mozambique, downwards risks persist

A modest rise in global growth in the second half of the year is expected to bring annual average growth to 2.6 percent. While growth is recovering in the developed countries, developing countries are expected to post growth rates below long run levels. Average growth in Sub-Saharan Africa is expected to be above average for the developing world.

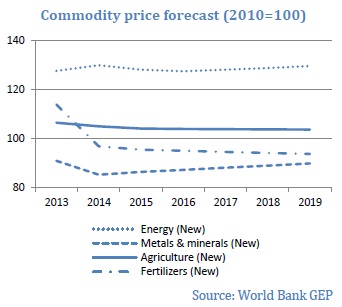

Commodity prices remain a major external risk to growth in Mozambique. A further decline in already depressed coal prices would result in lower exports and could affect investment and operations in the mining sector negatively, putting downward pressure on growth and the current account deficit as well as government revenues, with regular (non-capital gains) revenues from mega projects already accounting for 6-7 percent of total revenues.

Commodity prices remain a major external risk to growth in Mozambique. A further decline in already depressed coal prices would result in lower exports and could affect investment and operations in the mining sector negatively, putting downward pressure on growth and the current account deficit as well as government revenues, with regular (non-capital gains) revenues from mega projects already accounting for 6-7 percent of total revenues.

Commodity prices are expected to remain weak for the remainder of 2014 and much of 2015, a combination of both weak global demand and ample supply of key commodities; a rebound in prices is expected only by 2016. Metal prices remain low but stable, while prices for both agricultural and energy commodities have declined sharply in the past quarter. LNG prices in Asian markets have remained strong but are expected to slowly decline and converge with low energy prices in other markets.