News

A study on the global governance architecture for combating illicit financial flows

Executive Summary

The most up-to-date estimates by the Economic Commission for Africa indicate that during the period 2000-2015, net illicit financial flows between Africa and the rest of the world averaged US$73 billion (at 2016 prices) per year from trade misinvoicing alone. Recent exposure of illicit financial flow scandals shows that those involved in such activities have used a range of practices to perpetrate the flows. Furthermore, there are a number of fundamental enablers of illicit financial flows that cut across institutions, sectors and stakeholders, such as: the benefits to the perpetuators, the facilitating infrastructure, the absorptive jurisdictions and the constraints of public authorities.

Since the release of the African Union-Economic Commission for Africa pdf High-Level Panel on Illicit Financial Flows report (2.16 MB) in 2015, some headway has been made at the global level, but this continues to be in silos of sectors, groups of nations or stakeholders. Moreover, evidence reviewed for this study suggests that illicit financial flows continue to present a serious challenge to development in Africa. Given that illicit financial flows from Africa involve actors from across the globe, and that the laws and policies of non-African jurisdictions have a serious impact on illicit flows from Africa, it has become a priority to review the adequacy of global frameworks in tackling illicit financial flows.

In the present study, the global framework or architecture for combating illicit financial flows and its effectiveness in tackling the illicit financial flow problem are examined. Another objective of the study is to identify the gaps in the existing architecture for preventing illicit financial flows, and how Africa should feed into this process to improve its efficiency, effectiveness and inclusiveness. The literature available on the issue was examined, while delving into the framework for tackling illicit financial flows, and analysing actions and their impacts on: (a) the world as a whole; (b) the subregions of Africa; and (c) individual African countries, with a focus on Cameroon, Côte d’Ivoire, Morocco and South Africa, from which primary data were collected to support the study.

The results of the study indicate that a range of different institutions and agreements exist with the aim of tackling the various aspects of illicit financial flows. However, the institutions have different mandates, which often overlap. In addition, there is currently no mechanism covering all relevant organizations and all aspects of illicit financial flow problems at the global level, indicating substantial gaps in the global fight against illicit financial flows from Africa.

Accordingly, as the perpetrators of illicit financial flows have the ability to exploit the different methods of transfer available, a weakness in any part of the global regulatory architecture on such flows could substantially compromise the overall efforts to tackle illicit financial flows. This is because the perpetrators may conduct “regulatory arbitrage” and divert the flows through channels with weak controls. In addition, aside from creating opportunities for regulatory arbitrage, the lack of a comprehensive coordination mechanism for anti-illicit financial flow efforts also risks duplication in the activities of the different organizations trying to tackle those flows. Consequently, in a context characterized by a complex web of actors and issues, the application of the principles of effective governance becomes critical to influence the commitment, coordination, and cooperation of all stakeholders involved in combating illicit financial flows. Accordingly, the study highlights, the urgent need for Africa to play a more active role in addressing the imbalance in global power structures. This requires a concerted continental approach, which includes actions at both the regional and domestic levels.

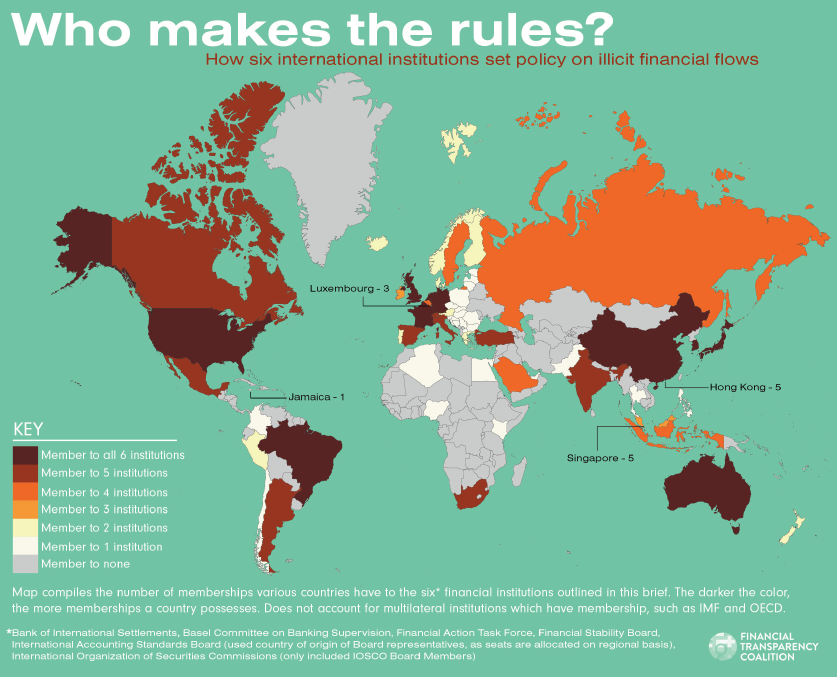

Source: Financial Transparency Coalition, 2017. Who Makes the Rules on Illicit Financial Flows? FTC Policy Brief.

Recommendations

Based on the analysis above and the gaps identified, some recommendations to improve the performance of the global governance architecture in combating illicit financial flows at the global, regional and national levels are provided in the study.

The main global recommendations include: (a) the development of a global governance framework to mitigate illicit financial flows; (b) publication by the Bank for International Settlements of the data it holds on international banking assets by country of origin and destination for all jurisdictions; (c) support be given for the setting up of and capacitating of transfer pricing units; (d) promotion of global minimum standards for the publication of ownership information; (e) consideration of countermeasures for noncompliant jurisdictions; (f) immediate reciprocity not be considered as to entry requirement to tax information exchange; (g) establishment of global standards in conducting reviews of accounts held by senior government officials, leaders of political parties, executives of State-owned enterprises and others with access to substantial State assets and power to direct them.

Recommendations at the continental level include: (a) piloting of “follow the money” partnerships to curtail trade mispricing globally; (b) setting up of a continental-level data standard for the exchange of tax information; (c) extending the provisions of the African Union Convention on Preventing and Combating Corruption, especially, with regard to the functions of the Advisory Board on Corruption; (d) amending the African Peer Review Mechanism questionnaire to include illicit financial flows; and (e) introducing systems for automatic exchange of tax information among African countries.

Recommendations at the national level include: (a) requiring multinational corporations to provide comprehensive reporting on their operations, indicating disaggregated financial reporting on by-country or by-subsidiary bases; (b) require companies to prepare cost-benefit analyses before allowing them to invest in a country; (c) African countries should join voluntary initiatives, such as the Extractive Industries Transparency Initiative; (d) African Governments should provide training to and empower investigators responsible for combating illicit financial flows; (e) greater coordination should be instituted between revenue authorities and ministries of finance in developing transfer pricing rules and build capacity in this area; (f) ensure transparent procurement procedures and government tenders and build capacity in this area; (g) introduce effective incentives for civil servants with clear documentation; and (h) place politicians’ companies into trusts for the duration of their political term and prohibit them from engaging in any government businesses.

The present paper was prepared under the overall guidance of Adam Elhiraika, Director of the Macroeconomic Policy Division, Economic Commission for Africa (ECA).