News

Understanding global remittances corridors in the Democratic Republic of Congo (DRC)

Is there any hope of reducing informal cross border remittances – or are informal channels really that bad?

The current global remittance market is estimated to be in the region of USD 500 billion annually and is expected to grow in future due to increasing international migration population, decreasing remittance costs, increasing disposable income, improving economic growth, growing refugees population and growing urbanization.

Over the last five to six years there has been an explosion of interest and focus on this market by financial service providers, donors, regulators and fintechs, and much has changed with many new formal products and innovations entering the market. What has not changed however, is the size of the informal market, which remains large. FinMark Trust estimates that 70% of all cross border remittances between SA to SADC remittance market are informal.

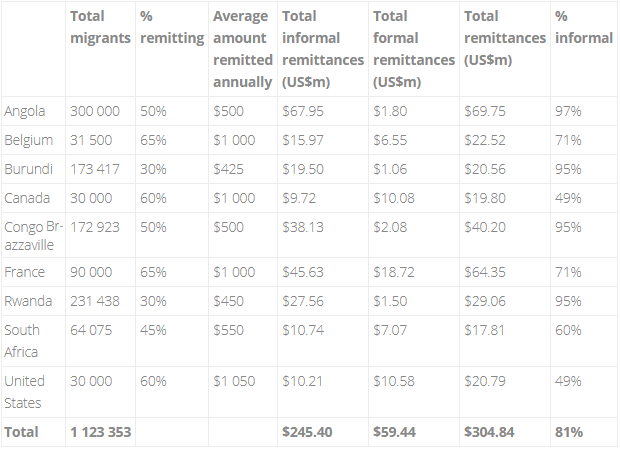

The current study of remittances in and out of the DRC estimates that 81% of the remittances sent and received are informal. These informal channels include – physical delivery of cash known as at the envelope system, Informal hawala-type remittance business models, and goods remittances.

Much has been written about these informal remittances, what causes them and the potential there is for new innovative formal products that are cheaper and more convenient. And of course the need to reduce the regulatory burden on financial service providers and consumers.

The current study reveals that DRC’s informal remittance market is well established and is currently much cheaper than its formal counterpart particularly for smaller remittances. The formal remittance cost from Belgium is in the region of 8,5% on a transaction of USD 175 and 16.17% from South Africa. By contrast this research found that the standard fee for the informal remittance market is in the region of 5%.

There are many other reasons why remitters use informal channels but on price alone, it is clear that formal products still have a very long way go to particularly in the corridors from African countries into the DRC. Ensuring customer value needs to be at the centre of formal product development if it is to compete with the informal market.

The total remittances into DRC from these nine destination countries are found to be in the region of US$305 million per annum, of which 81% is estimated to flow via informal channels. The largest of these remittance markets is Angola, followed by France and Congo-Brazzaville. 58% of remittances come from other African countries, and 92% of African remittances travel informally.

Table 1: Remittances to DRC from nine migrant destinations

Understanding global remittances corridors in the Democratic Republic of Congo (DRC)

The Democratic Republic of Congo (DRC) has a long standing history of migrant flows, and historically flows to and from Europe have been of particular importance. However, substantial political and economic upheavals from the 1990s onwards have been associated with major changes to the pattern of Congolese migration. Congolese emigrants increased in numbers, were increasingly undocumented, became less likely to return to DRC, and began to move to a greater variety of international destinations. In Europe and Africa respectively, France and South Africa became increasingly popular destination countries. While educated, wealthier Congolese are still more likely to migrate, since the 1990s political pressure has meant that emigrants have increasingly come from all social classes.

In light of these diverse migrant flows, this report has sought to obtain an understanding of the major global remittance corridors of the DRC, including the split between formal and informal channels, the value of funds sent and received, the regulatory environment, and the remittance product market. Information and data was obtained through a review of existing research on DRC migration and remitting patterns, as well as primary research interviews with senders and receivers of remittances domestically, the Congolese diaspora (in Belgium, France, USA, Canada, China, India, South Africa and Angola), and foreigners living in the DRC.

The regulatory environment

While some aspects of the regulatory environment for remittances in the DRC were found to be fairly permissive (with, for example, microfinance institutions allowed to offer remittance services, which is fairly rare in the region), other aspects of the regulatory framework are likely to increase the barriers to formalisation of the industry. In order to obtain a Category B licence to conduct foreign remittances, operators must offer remittance services as their main activity, which limits their ability to cross-subsidise their overhead costs by offering other financial services.

In addition, DRC has implemented fairly strict interpretations of money laundering requirements in the remittance market. Restrictions on large value transactions are often stricter in terms of transaction size limits than FATF recommendations.

Remittance market dynamics

High levels of economic and political stability in the DRC, including a period of hyperinflation and subsequent dollarization of the economy, led to the collapse of the retail banking system in the 1980’s. While the banking system did begin to revive in the mid-2000’s, much of the Congolese economy, including remittance markets, still operates informally.

Informal remittance channels include:

-

Physical delivery of cash: referred to by some commentators as the envelope system, the physical transmission of cash either by oneself or by an intermediary is a major remittance channel to and from DRC. The primary research we conducted found widespread use of the envelope system, and found that individuals may make substantial efforts to hide the money transported in their luggage, to avoid airport and border controls.

-

Informal remittance businesses with hawala-type business models are fairly prevalent. Typically, they occur where a legitimate business owner has operations in both the origin and destination country for the remittance. The remitter usually has a relationship of trust with the business owner. On this basis, they deposit money with the business in the sending country, and the recipient can then pick up funds from the branch in the receiving country.

-

Goods remittances are not only common, but are sometimes used as a means of dealing with restrictions on cash remittances, particularly when the sender is in Asian countries (China, India, etc.)

The formal remittances channels identified in the study included:

-

Commercial banks: All the 15 banks operating in the DRC offer international bank transfer services to their clients. Overall though the use of formal banking channels has been limited and instead banks have been used largely to complete the back end of a transaction.

-

NGOs: A specific channel used between France and DRC is via NGOs. These are businesses which are registered as NGOs in France, which means they are not liable for tax, but in DRC are “private businesses involved in many activities (travel, telephone booths, etc.).” This type of remittance is formal to the extent that it involves use of a registered NGO, which is regulated as regards the manner in which it undertakes a transaction

-

Money transfer agencies play a crucial role in DRC remittance markets. The primary research revealed that among the various money transfer agencies, Western Union, MoneyGram and Banques were among the most popular remittance agencies with 54%, 29% and 18% of respondents interviewed being aware of these agencies respectively.

Conclusions

Substantial migration from DRC has been driven by severe economic and political upheaval. As a result, the remittances sent by Congolese migrants are disproportionately important to the households that receive them, and play a crucial role in stabilising household income for many recipients. However, political and economic instability have also destabilised the formal payments system, and driven a high proportion of payments into the cash economy, and informal transacting methods.

Download the report in English or French on the Finmark Trust website.