News

Air Freight Monthly Analysis – February 2018: Africa tops the international growth chart once again

Strong start to 2018 for FTK growth, but upward trend has eased

Demand for air freight has benefited in recent years from a stronger global trade backdrop, as well as an inventory restocking cycle. The latter factor helped air freight growth to outperform global goods trade in 2017 by the widest margin since 2010. That said, while year-on-year freight tonne kilometres (FTK) growth rates remain robust, there are increasing signs that the best of the upturn for air freight is now behind us.

But the upward trend has slowed since mid-2017

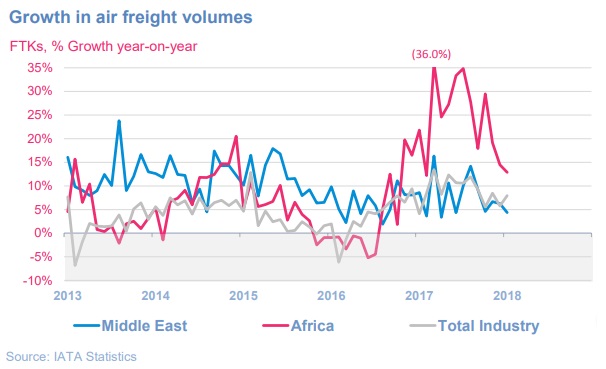

This is perhaps most apparent in the change in trend in SA FTKs since the middle of last year. Having risen at a double-digit annualized rate between late-2016 and mid-2017, industry-wide FTKs have now trended upwards at an annualized pace of just 3% since September. Unless the trend accelerates over the coming months, the year-on-year FTK growth rate is set to fall back below its five-year average (5.0%) in May.

More generally, the moderation in the SA FTK trend ties in with a softer picture from leading indicators, particularly the new export orders component of the global manufacturing Purchasing Managers’ Index (PMI). This measure remains consistent with positive year-on-year FTK growth in H1 2018, albeit at less stellar rates than we saw during the middle of 2017 (broadly in the region of 4.5-5%).

Demand drivers are shifting away from their highly supportive levels

It is worth noting that the new export orders component of the manufacturing PMI has softened in a number of key exporting countries in recent months, perhaps partly reflecting heightened concerns of a trade war. While the series generally remain above the notional 50-mark that is consistent with increasing demand for manufactured goods exports, order books in some countries – notably Germany, China, and the US – are no longer growing as quickly as they were a year ago.

Given that demand for air freight tends to be the strongest at the start of economic and trade upturns, this further illustrates the gradual shift in the demand drivers away from the highly supportive levels that were in place throughout 2017.

Solid FTK growth expected in 2018 as a whole

Despite the moderation, we continue to expect industry-wide FTKs to grow in the region of 4.5% in 2018 as a whole. Following the very strong growth performance seen in 2017 this would still be a robust outcome. (Note that carry-over effects from last year mean that even if FTKs were to just trend sideways in SA terms from their current level over the rest of 2018, this would still be consistent with 3% FTK growth over the year as a whole relative to 2017.)

Nonetheless, the recent pick-up in protectionist measures and the prospects of a global trade war arguably mean that the risks to the broader trade outlook are on the downside. This is an issue that we will continue to monitor closely in the months ahead.

Demand trend has fallen below that of capacity

Available freight tonne kilometres (AFTKs) grew by 5.6% year-on-year in February 2018, and by 4.9% in Jan-Feb combined. As a result, the industry-wide load factor rose by 0.5 and 1.1 percentage points respectively in annual terms over each period.

That said, the slowdown in the upward trend in SA FTKs means that demand is now currently trending upwards at a slower pace than capacity.

A mixed picture for international FTK growth

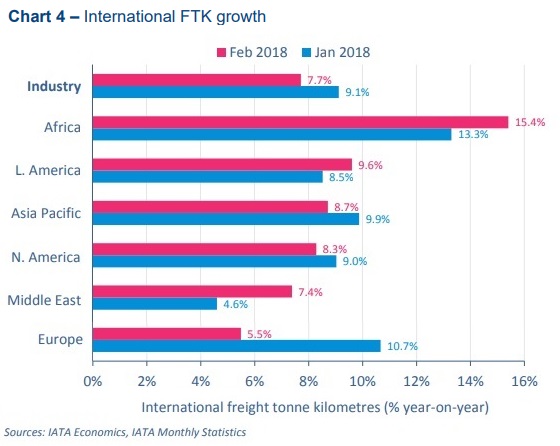

International FTKs grew by 7.7% year-on-year in February, down from 9.1% in January.

Africa tops the int’l growth chart once again

African airlines fly less than 2% of global FTKs but topped the international FTK growth chart in February for the 17th time in 18 months. As we have noted before, the strong growth seen in African airlines’ freight volumes has partly reflected higher volumes between Africa and Asia, on the back of ongoing foreign investment flows into Africa from the latter. While the surge in traffic looks to have stabilized, FTKs on the market segment were still nearly 24% higher in January 2018 than they were a year ago.

© International Air Transport Association, 2018. Air Freight Monthly Analysis – February 2018. Available on IATA Economics page.