News

IMF Executive Board 2017 Article IV Consultation with Somalia

On February 21, 2018, the Executive Board of the International Monetary Fund concluded the Article IV consultation with Somalia.

Despite a severe drought and sporadic terrorist attacks, Somalia avoided a significant economic slowdown in 2017 with support from the national and international community.

The authorities’ commitment to the staff-monitored program is strong and they are implementing difficult reform measures.

In 2017, Somalia faced a severe drought and sporadic terrorist attacks. These developments hurt economic activity, particularly in the north of the country and in rural areas, and temporarily impacted the tax collection efforts of the Federal Government of Somalia. However, the authorities have navigated through these challenges and, with sustained national and international community support, the country avoided a severe humanitarian crisis and a significant economic slowdown.

Despite the challenging environment, the Somali authorities remain committed to reform implementation under their program. On June 21, 2017, IMF management approved a second 12‑month SMP covering the period May 2017 – April 2018, following Somalia’s successful completion of its first SMP. The program is designed to help economic reconstruction efforts and assist the country in establishing a track record of policy and reform implementation. We are encouraged by the authorities’ commitment and the pace of reforms to restore key economic and financial institutions, and welcome their efforts to keep the program on track.

The IMF is helping Somalia reach debt relief under the Heavily Indebted Poor Countries (HIPC) Initiative as soon as feasible within established HIPC procedures. The HIPC process is designed to help countries avoid slipping back into arrears while putting them on a path to sustainable debt and reducing poverty. The authorities are normalizing relations with the international community and establishing track record of reform implementation, developing adequate policy instruments, tackling Somalia’s low institutional capacity and fragile security situation to help the country to achieve arrears clearance and debt relief. During this period, Somalia can continue to receive substantial grants from donors. The IMF is also assisting the authorities in addressing outstanding concerns by major creditors, such as weak governance and institutional capacity, and establishing a track record of implementing strong economic policies. Somalia is among the largest beneficiaries of the IMF’s technical assistance (TA) and training work, with 87 TA missions since late 2013.

The authorities are continuing to improve Somalia’s fiscal framework, including its revenue collection performance. They have taken steps to reform the national currency and developing the country’s financial sector. The authorities are also making progress on addressing significant shortcomings in economic data, and making efforts to develop coherent social programs and address corruption.

Staff Report

Economic developments

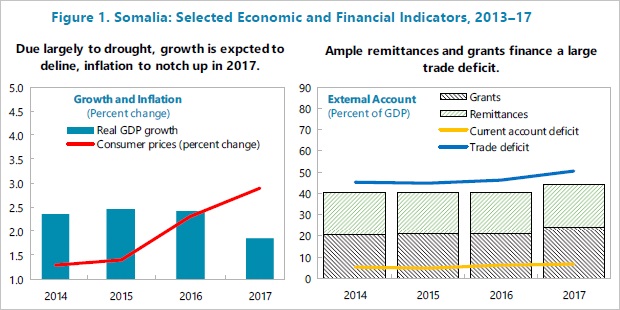

Economic activity in 2017 is expected to have slowed. The drought that hit the country since late 2016 has receded, but it took a large toll on economic activity, particularly in the remote areas. Reflecting continued slowdown in the agricultural sector, GDP growth is projected to remain subdued at 1.8 percent in 2017 (down from 2.4 percent in 2016). Driven by higher food prices, year-on-year inflation increased to 5.2 percent (4 percent annual average) at the end of December 2017. Reflecting increased food imports and lower exports of livestock, the trade deficit is expected to have widened by 4.3 percentage points of GDP.

At end-September, a small budget surplus was achieved. While domestic revenue fell short of the program target at end September 2017, fiscal operations showed a small surplus ($3.8 million), in part due to a slower-than-expected pace of budget execution. For end-December 2017, based on preliminary information, the implementation of critical tax measures since September together with the higher-than-programmed bilateral grants are expected to have resulted in a budget surplus of about $1.8 million and to have lifted domestic revenue to achieve the program target.

Somalia’s central bank’s balance sheet expanded in the second half of 2017, reflecting mainly a one-off revaluation effect of its property. The SOS/U.S. exchange rate was stable in 2017 at around an average of 23,100.

The financial sector is underdeveloped, but its activities have been increasing. At end-September 2017, the commercial banks’ total assets and credit to the private sector were about 4 percent and 1.3 percent of GDP, respectively. Nonetheless, banks’ assets have continued to improve since 2015, and their capitalization remains broadly adequate. The loan-to-deposit ratio reached 40.1 percent, up from 33.3 percent in September 2016, and credit to the private sector increased to 31.2 percent (as a share of total assets), from 24.8 percent in the previous year. Mobile money and money transfer businesses (MTBs) play a crucial role in providing financial services in Somalia. In 2017, MTBs provided trade finance amounting to about $2.1 billion.

Outlook and risks

Economic activity is expected to recover, and fiscal performance is projected to improve. The drought is receding, and with the support of the international community efforts to contain terrorist attacks have been stepped up. These developments, along with the improved momentum of reforms, are boosting the outlook for economic performance. Growth will recover gradually in 2018-2020 and stabilize at around 2.5-3.5 percent. Inflation will remain low, and the fiscal framework is expected to continue to improve over the near term.

Downside risks are significant. They include the fragile security situation; weak institutional capacity that could result in poor fiscal management and new domestic arrears accumulation; inadequate efforts to tackle serious governance problems; a lack of political consensus among the federal government and the federal member states, which could slow critical reform measures; slow progress in policy and reform implementation, particularly on tax reform and domestic revenue mobilization; and shortfalls in donor support to the FGS. The authorities' continued commitment to the program, and sustained and coordinated international support, would help mitigate these risks.

Policy Discussions

The discussions laid the groundwork for the second and final review under the SMP and were centered on near-term policies to (1) improve the fiscal framework; (2) finish the preparation for the launch of the new national currency; (3) develop the financial sector; and (4) establish the foundations for sustained economic recovery and poverty reduction while strengthening institutions and governance.

Developing Monetary and Financial Institutions

With the launch of the new national currency approaching, stronger resolve to establish proper financial and monetary institutions will be essential.

Currency Reform

The authorities have successfully completed all the measures in the currency reform roadmap, which pave the way for the launch of the new national currency. Among the critical reforms completed, the FGS and the heads of the FMS have agreed – through a signed agreement – to support the reform project, including an effort to combat counterfeiting of the Somali shilling in their regions. The authorities are also preparing an information campaign; a framework for an independent evaluation of the currency reform project; and the budget for the currency reform which will be submitted to donors for funding.

At this stage, currency reform will be limited to Phase I, which involves exchanging the counterfeit currencies in circulation with the new banknotes. The authorities confirmed that there will be no further injection of the new Somali Shillings beyond Phase I and that additional injection of the new currency will only occur during Phase II. They also stressed that: (1) they do not anticipate making any decision about the choice of the future exchange rate regime until Phase II of the currency reform; and (2) they will not intervene in the foreign exchange market which will continue to float freely.

Financial Sector

The financial sector is nascent but plays a critical role in economic activity. Notwithstanding its critical role in the economy, the sector severely suffers from structural problems, including, but not limited to (1) absence of centralized payment and inter-bank payment systems; (2) weak re-licensing, supervision, and regulation of commercial banks and MTBs; (3) shortcomings in the Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) framework and its weak compliance; and (4) a still-weak central bank capacity and widespread SOS counterfeiting.

The authorities are making strong efforts to develop the financial sector. As part of the SMP benchmarks set for end-2017, the authorities prepared a comprehensive financial sector roadmap that highlights the key bottlenecks for financial development and inclusion, and outlines reforms to improve the functioning of the sector, including issues related to the withdrawal of correspondent banking relationships. The Financial Reporting Center (FRC) is now operational and started reviewing suspicious transactions in December 2017. With continued TA from the IMF, progress has been made on developing regulations for financial sector development; building technical capacity in the areas of commercial bank licensing, regulation, and supervision; and improving transparency and sound commercial banking and financial intermediation in Somalia.

The authorities are taking steps to move forward with the needed financial sector reform. They have agreed to (1) fully implement new accounting and financial reporting systems in line with international financial reporting standards (IFRS) and audit functions; (2) make tangible progress on strengthening the governance and organizational structure of the CBS together with its oversight authority; (3) continue to develop the necessary financial regulations and strengthen the annual relicensing process of banks and MTBs; (4) expand on-site examinations of banks and MTBs; and (5) address gaps and overlaps in the AML/CFT framework (Box 2). On the latter, in line with Financial Task Force (FATF) standards, the CBS is planning to finalize the Targeted Financial Sanctions Regulation law. This measure will enable provisions to implement Somalia’s international obligations under UNSCRs 1267, and 1373, and enhance AML/CFT compliance by MTBs. In this context, they will improve the MTBs’ compliance with the AML/CFT regulations and the reporting of suspicious transactions to the Financial Reporting Center (FRC).

Box 2. AML/CFT Regulation and Supervision

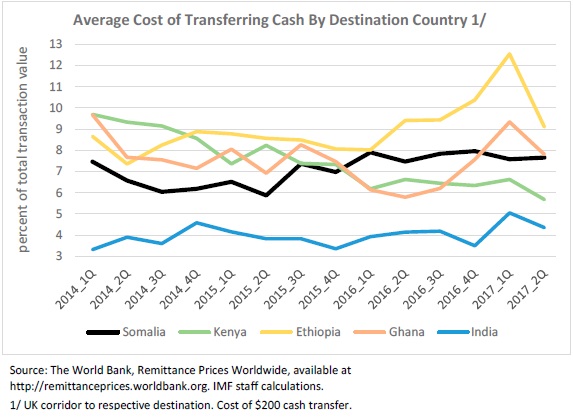

Addressing AML/CFT regulatory issues is critical to supporting remittance flows and external financial linkages for Somalia. Remittances make up nearly 40 percent of household income, and the closure of some corresponding accounts has increased costs of transactions over the past several years. Overall, however, costs remain contained and inflows averaged over $1.3 billion per year during 2015-2017.

The authorities have made progress on AML/CFT regulations and supervision over the past few years. The CBS has issued foundational regulations since 2014, including AntiMoney Laundering, Customer Registration, and Operations for MTBs. MTBs’ compliance with AML/CFT regulation is improving and accelerating, supported by regular financial data collection and examination. The CBS is also strengthening the annual MTB relicensing process and on-site examination. In 2017, on-site inspections of the three largest MTBs, representing over 80 percent of transactions, were conducted for the first time.

Despite progress that has been achieved, important gaps remain. Reporting of suspicious transactions needs to improve and the process regularized. Cooperation between the FRC and the CBS needs to be strengthened, and the lack of reliable national identification and business registration systems limits implementing Know Your Customer (KYC). On the legal side, overlaps in the counter terrorism and the AML/CFT Laws, such as the definition of “financial institution” and “property and funds,” need to be streamlined.

The authorities are committed to addressing these gaps. They are strengthening the renewal of MTBs’ annual licenses which will focus on improving MTBs compliance with AML/CFT regulations, including reporting requirements. The authorities are also seeking to improve cooperation between the CBS and FRC, including on effective risk-based AML/CFT supervision. A strategy for a national identification system is being considered with World Bank assistance, and a business registry is under construction.

Establishing the Foundations for Sustained Economic Recovery and Social Inclusion

Complementing the ongoing fiscal and financial sector reform efforts with stronger resolve to tackle bottlenecks to growth will pave the way to sustained economic recovery and social inclusion.

There are pressing needs for developing sustained economic recovery and social inclusion programs for Somalia. The country’s per capita GDP during 2014-2016 was only $515, far below regional peers as well as low-income countries. The following four pillars will remain essential for the country:

-

Business environment. The private sector could play a key role in supporting growth and creating jobs, in particular, youth employment which could lower insecurity. However, Somalia’s business environment remains structurally weak as evidenced by the country’s lowest ranking in almost all key pillars of the World Bank Doing Business survey results.

-

Governance and corruption. Governance and corruption problems complicate reform and development efforts. The FGS’s efforts to combat corruption are hindered by weak administration and capacity.

-

Social spending and safety net. The need for social spending is very large and the FGS’s resources to tackle social needs are very limited. Aside from a small budget to provide for orphans of military personnel and police officers, there is no explicit social safety net program at the FGS level, and budgetary social spending is very low.

-

The National Development Plan (NDP). The authorities recognize that the current NDP has several shortcomings, including weak prioritization of development needs and lack of coherent safety net programs; limited sectoral consistency; and poor mapping of costing and financing needs.

A broad-based reform agenda is underway. The authorities have also identified several reform measures, which are listed below, for accelerating economic recovery.

-

Business environment. The authorities have stepped up efforts to increase the participation of the private sector role in economic activity. In particular, the recent passage of a foreign direct investment law and adoption of a procurement bill will further accelerate the role of the private sector. While the authorities welcome the inclusion of Somalia in the Global Doing Business Survey in 2017, they recommended that some indicators be treated with caution, given that it is the first time the country is in the survey.

-

Governance and corruption. While the authorities took important measures on these fronts, the challenges ahead remain significant. They include weak: (1) tax revenue collection; (2) transparency on fiscal reporting; (3) law enforcement; and (4) compliance with the AML/CFT framework.

-

Social spending and social programs. The authorities and staff agreed that the inclusion of social safety net programs in the budget and the development of a medium-term fiscal framework would be essential. This would contribute to poverty alleviation, development of resilience framework against shocks, and contribute to creating jobs.

-

The NDP. The update of the NDP will address the weaknesses identified in the current NDP as well as challenges the country faced during the recent drought. It will also include social safety net and job creation programs; and programs on strengthening resilience to natural disasters.

Box 3. Tackling Governance and Corruption

Governance is weak and corruption remains high. Both the corruption perception index of the Worldwide Governance Indicator Control of Corruption Index (WGI CCI) by Daniel Kaufman (Natural Resource Governance Institute and Brookings Institution) and Aart Kray (World Bank) and the Maplecroft Corruption Risk Index (CRI) point to the lowest ranking of Somalia in terms of corruption.

The severity of corruption contributes to the weak economic performance. Somalia’s President was elected, in February 2017, on an anti-corruption platform. While there is a lack of data to adequately assess the scale and the impact of corruption on the Somali economy, the authorities have acknowledged how critical governance and corruption issues are to the country’s economic performance and social cohesion. Greater efforts to address these issues will improve the effectiveness of economic policies, the efficiency of institutions, and the country’s overall economic performance.

The authorities have stepped up efforts to tackle corruption and governance issues. Their efforts include the establishment of a “Delivery Unit “at the Prime Minister’s office to (1) monitor performance of the government’s programs, (2) ensure proper public service delivery, and (3) improve governance at ministers’ levels. Also, the Minister of Finance has initiated several programs to strengthen internal audit functions at the ministry in 2018. An anti-corruption bill has been approved by the Parliament, cash payments have diminished, and electronic payment system has expanded across all FGS agencies. To improve procurement system and government effectiveness, all key government contracts with private enterprises are either under review, canceled, or being renegotiated.