News

The sub-Saharan African services economy: Insights and trends

While sub-Saharan Africa (SSA) accounts for a small share (1.8%) of global commercial services trade volume, SSA services trade volume has grown rapidly in recent years, accounting for 18% of total SSA trade in 2014. U.S. services trade with the African continent has also grown rapidly in recent years.

This U.S. International Trade Commission (USITC) staff report provides insight into many aspects of the sub-Saharan African (SSA) services sector, describing some of its general characteristics and highlighting distinctive qualities of this segment of the region’s economy. This report is a compilation of recent work, and as such, does not attempt to present summary findings or a comprehensive overview of the region’s services sector.

Despite this, a few broad themes do emerge from the analyses contained in the report. For example, overall services output and trade in SSA, while small, are growing rapidly: in many individual SSA countries, services account for more than half of total GDP. Nonetheless, several factors – including poor infrastructure and a lack of skilled workers, among others – continue to inhibit services sector expansion in the region.

An Overview of the Sub-Saharan Africa Services Market

The services markets of sub-Saharan African (SSA) are small compared to those in developed markets, with SSA as a whole accounting for only 1.8 percent of global services value added in 2014. However, services sector output in the region has grown rapidly in recent years. SSA services value added increased at a compound annual growth rate (CAGR) of 6.3 percent during 2005-14, outstripping world services sector growth (2.6 percent) by a significant margin. This chapter gives a brief overview of output and employment in the SSA services sector; highlights key markets, industries, and growth trends in SSA services trade; and discusses the relative openness of services markets in the region. The chapter concludes by focusing on one of the many issues that affect the SSA region as a whole: China’s growing presence in the region.

GDP and Employment

Services account for a large and growing share of overall SSA economic output. In 2015, the services sector accounted for 58.0 percent of SSA gross domestic product (GDP), up from 47.6 percent in 2005. However, despite rapid growth, the services share of SSA’s GDP remained significantly lower than the 2014 global average (68.5 percent, latest available data). The extent to which individual SSA countries rely on services sector output varies widely. For example, in 2015 services accounted for more than 70 percent of GDP in Cabo Verde, Mauritius, and Sao Tome and Principe. Distribution services (including restaurants and hotels) and financial, business, and real estate services are large contributors to services output in each of these countries. By contrast, services accounted for a particularly small share of output in Chad (33.4 percent) and Sierra Leone (33.9 percent) in 2015. The agriculture sector accounted for over half of GDP in each of these countries in 2015 (52.4 percent for Chad and 61.3 percent for Sierra Leone).

South Africa and Nigeria, SSA’s two largest economies, dominate the SSA services economy, respectively accounting for 29.9 percent and 27.8 percent of SSA services value added in 2015. The next-largest services market for which data are available – Sudan – accounted for only 3.6 percent. The services markets of South Africa and Nigeria are discussed in greater detail in chapter 3, along with those of four other countries which contribute at least 2 percent of SSA services value added – Kenya, Ghana, Ethiopia, and Tanzania. A specific discussion on the Sudanese services market is not included due to the relative lack of recent data available for that economy.

Sub-Saharan African Trade with the World

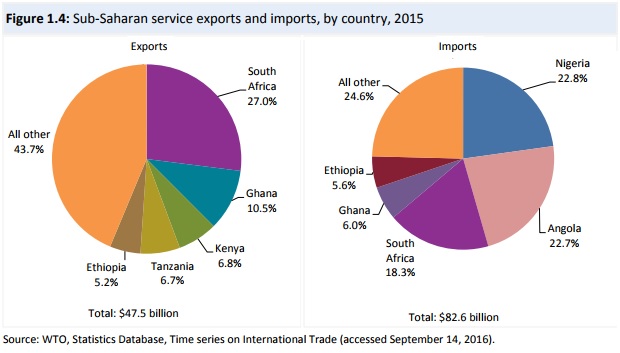

SSA accounted for a small share (about 2 percent) of global commercial services trade volume in 2015. However, SSA services trade volume has grown rapidly in recent years and accounted for 24.6 percent of total SSA trade in 2015. U.S. services trade with the African continent has also grown rapidly in recent years. Commercial services account for a small but growing share of total SSA trade. In 2015, commercial services accounted for 16.9 percent of total SSA goods and services exports and for 29.7 percent of imports. During 2005-15, SSA exports and imports of commercial services doubled, with exports increasing by 108.1 percent to $58.1 billion and imports increasing 120.5 percent to $156.9 billion.

South Africa is SSA’s largest commercial services exporter; however, it saw a 10.9 percent decrease in commercial services exports in 2015. Travel services accounted for the largest share of this decline (with exports in that industry falling by $1.1 billion during 2014-15), while exports in the maintenance and repair services industry decreased at the fastest rate (62.6 percent). By contrast, exports of personal, cultural, and recreational services grew by 17.2 percent to $170.1 million during 2014-15, the only increase among those South African service industries for which specific data are available.

Nigeria is the largest SSA importer of commercial services, although it, too, underwent a precipitous decline in this indicator during 2014-15; imports fell from $22.5 billion in 2014 to $18.8 billion in 2015. “Other business services” accounted for the largest share of this decline, as Nigerian imports of such services fell by 58.3 percent from $4.8 billion in 2014 to $2.0 billion in 2015.

By industry, travel services accounts for the largest share of total SSA commercial services exports, with 47.2 percent in both 2014 and 2015. In 2014, South Africa was the largest exporter of travel services by a wide margin, accounting for 35.6 percent of total SSA travel services exports, followed by Tanzania (7.7 percent), Angola (6.1 percent), and Mauritius (5.5 percent). Tourism is a key contributor to the South African economy, with one source reporting that the tourism industry supports 8 percent of jobs in that country. Industry-specific data on the SSA region’s commercial services imports are available only for transport services (which accounted for 13.5 percent of SSA commercial services imports in 2015) and travel services (which accounted for 12.9 percent).

Chinese Participation in the Sub-Saharan African Services Sector

In recent years, China has become an increasingly important economic partner of SSA, with rising trade and investment throughout the continent. While commodities and manufacturing account for large shares of this economic activity, Chinese participation in SSA services industries has also been significant. The following section presents analyses on two illustrative facets of China’s involvement in the SSA services sector: Chinese investment in the SSA financial services industry, and official Chinese assistance in SSA countries’ transport and storage industries.

Drivers of Chinese Investment in SSA Financial Services Markets

Several factors have led to increased Chinese investment in SSA financial services markets. First, increasing trade between China and SSA countries has encouraged some exporters and importers to accept settlement in renminbi (RMB) instead of U.S. dollars in payment for trade, resulting in a stronger presence of Chinese banks in SSA countries to conduct RMB-related business (although the recent depreciation of the RMB has mitigated this advantage). Traditionally, SSA countries and China have used the U.S. dollar as their primary settlement currency for bilateral trade. However, in 2009 the Chinese government began a campaign to reduce its exchange-rate risk, elevate its economic position globally, and lower firms’ transaction costs by internationalizing its currency, including expanding the use of RMB in settling international trade. This led to a rapid increase in the value of RMB cross-border trade settlements between Africa and China from just RMB 5.2 billion ($0.8 billion) in 2011 to RMB 35.8 billion ($5.7 billion) in 2012. From October 2010 to January 2013, South Africa accounted for 87.8 percent of cross-border RMB settlement between China and Africa, while Nigeria accounted for a further 6.0 percent. Standard Chartered Research predicts that, as trade settlement between China and SSA countries grows, the value of cross-border RMB settlement between Chinese firms and top importers of Chinese goods such as Nigeria, Ghana, and South Africa will likely increase. Second, the increasing presence of Chinese government-backed investment in SSA countries has prompted higher demand for Chinese banking services in the region. For instance, in June 2015, Power Construction Corporation of China, a Chinese state-owned enterprise which is mainly engaged in electricity investment and operations, signed a $1 billion contract with Amu Power Company to construct a coal-fired power plant in Lamu, Kenya. ICBC has pledged a loan of $0.9 billion to ensure the successful completion of the project. In June 2015, ICBC signed an agreement with the Angolan government to lend $840 million for the construction of the Soyo Power Plant. Further, in August 2015, Bank of China and ICBC announced that they would jointly provide $300 million to finance a 300 MW coal-fired power plant in Zambia.

Finally, the growing number of Chinese tourists in SSA has led to increasing demand for local merchants to accept the China UnionPay credit card – Chinese tourists’ preferred credit card – in several SSA countries. From 2009 to 2011, the number of Chinese tourists traveling directly to Africa nearly tripled, rising from 381,600 to 1,012,000. The UnionPay credit card is issued by China UnionPay – China’s only domestic bank card organization. China UnionPay started its African market expansion in 2007, and by 2013 UnionPay credit cards were accepted for use at ATMs in over 70 percent of SSA countries. In August 2013, UnionPay International and Mauritius Commercial Bank (MCB) jointly announced their cooperation in issuing UnionPay cards in Mauritius – the first UnionPay cards issued in an SSA country. These cards are now in circulation.

The views expressed in this working paper are those of the author and not those of the U.S. International Trade Commission or any of its Commissioners.