News

IMF Executive Board 2017 Article IV Consultation with South Africa

On June 26, 2017, the Executive Board of the International Monetary Fund concluded the Article IV consultation with South Africa.

Living conditions have ameliorated substantially for the bulk of South Africa’s population during the past two decades, but the pace of improvement has gradually slowed. Following last year’s near-standstill in economic activity, growth is projected to increase to 1.0 percent in 2017 and 1.2 percent in 2018, still insufficient to keep pace with the rising population. The current account deficit is projected to decline to 3 percent of GDP in 2017, boosted by mining and agricultural exports, and to widen to just below 4 percent of GDP in the medium term. Consumer price inflation recently returned below 6 percent, owing in part to the easing of the drought, and is projected to remain marginally below the upper threshold of the 3-6 percent target band for the remainder of 2017 and in 2018.

South Africa’s vulnerabilities have become more pronounced and are set to increase further unless economic growth revives. Low growth has taken a toll on the state of the public finances, increasing government debt. The public sector’s balance sheet is also exposed to sizable contingent liabilities from state-owned enterprises (SOEs). Perceptions of weakening governance and uncertainties regarding the direction of future economic policies, partly related to the electoral calendar, have also adversely affected consumer and investor confidence. In the external sector, large gross external financing needs, financed mainly by portfolio flows, expose South Africa to significant financing risks. Vulnerabilities from exchange rate fluctuations are attenuated by South Africa’s track record of a freely floating exchange rate, corporate resilience to sizable exchange rate depreciation during the past few years, and high share of domestic currency-denominated government debt. Even so, external and domestic contexts could result in significant shocks, whose implications could in turn be amplified by linkages among the real, financial, and fiscal sectors, especially if accompanied by further downgrades of local currency sovereign credit ratings to below investment grade.

Monetary and fiscal policies have been focused on keeping inflation in check and maintaining medium-term debt sustainability. The South African Reserve Bank (SARB) tightened the repo rate in stages by 75 bps in early-2016 to 7.0 percent and has kept it at that level since then. The headline fiscal deficit was reduced to 3.9 percent of GDP in FY2016/17 from 4.5 percent the previous fiscal year, and the budget for FY2017/18 envisages a further moderate tightening. The pace of reform in the labor market and in product/service markets has been insufficient to make a noticeable contribution to reviving economic growth.

Staff Report

Background: Slowdown in economic growth

Living conditions have ameliorated substantially for the bulk of South Africa’s population during the past two decades, but the pace of improvement has gradually slowed. Robust economic growth and sound macroeconomic policies were mutually reinforcing in the decade that followed the advent of democracy, fostering economic transformation and reducing poverty. However, potential growth has abated in more recent years and poverty reduction has stalled. Following the global economic and financial crisis that erupted in 2008 and the decline in commodity prices that began in 2011-12, economic activity dwindled to a near-standstill in 2016.

Weak economic growth impedes the economy’s ability to curb unemployment and inequality, and creates new vulnerabilities. South Africa remains one of the world’s most unequal societies, largely owing to the legacies of apartheid. A 2016 survey by the national statistical office found that average incomes for blacks are still one-fifth of those for whites. The rate of unemployment, at 27.7 percent (54.4 percent for ages 15-24) in the first quarter of 2017, is high by international standards and has risen by five percentage points since 2008. Projected output growth, at 1 percent in 2017, is insufficient to keep pace with the increase in population. In view of lackluster job creation and the rapid rise in the working-age population, the unemployment rate is set to rise further and inequality is unlikely to decline. Slow growth and persistent inequalities have contributed to increased questioning in the public discourse of whether the prevailing economic policy paradigm can deliver results for all citizens.

The electoral calendar has heightened perceived uncertainty regarding future economic policies. Public discourse in the run-up to the 2019 presidential elections is increasingly focusing on “radical economic transformation,” including more rapid transfer of economic resources to the black majority and other disadvantaged groups. A government reshuffle in late March 2017 led the rand to depreciate by 8 percent within a few days although the currency has largely recovered since then. The remainder of this year may bring increased competition among candidates for election in December to the presidency of the African National Congress – the party with an absolute parliamentary majority since 1994. Low investment and consumer confidence have been associated with rising uncertainty regarding the direction of policies as well as perceptions of weakening governance (including control of corruption), as illustrated for example by a gradual worsening during the past few years of the Doing Business index (text table) and the Control of Corruption index assembled by the World Bank.

Growth weakened further to 0.3 percent in 2016 from 1.3 percent in 2015. Domestic demand ground to a halt, as private investment declined consistent with weakening business confidence, and private consumption was constrained by tighter credit conditions and higher unemployment. The ensuing decline in imports more than offset the weakening in export demand, resulting in a positive contribution of net exports to growth. On the supply side, these developments were mirrored by a decline in agricultural and mining production, owing to drought conditions and low commodity prices, combined with weak growth in financial services and other business-cycle sensitive sectors. Employment growth fell to 0.3 percent in 2016 from 3.9 percent in 2015 as employment shrank in agriculture, mining, and manufacturing, and hiring slowed in the construction, financial, real estate, and business services sectors, as well as in the general government.

The current account deficit narrowed markedly to 3.3 percent of GDP in 2016, and was financed by portfolio flows. The trade balance turned to a surplus in 2016: beyond the positive net export contribution to growth, the terms of trade improved modestly. Unit labor cost growth has been broadly stable since 2011 and has been marginally above consumer price inflation. Overall, the current account deficit narrowed by more than 1 percentage point of GDP compared with 2015, despite a deteriorating income balance. Financing of the current account deficit relied fully on portfolio investment flows, in part as a review of equity portfolio investment flows led to a reallocation from unrecorded transactions toward portfolio flows. 2 Net direct investment outflows fell to 0.4 percent of GDP in 2016 from net outflows of 1.3 percent of GDP the previous year. Overall, the 2016 external position is assessed as moderately weaker than implied by fundamentals and medium-term desirable policy settings (Annex I. External Sector Assessment).

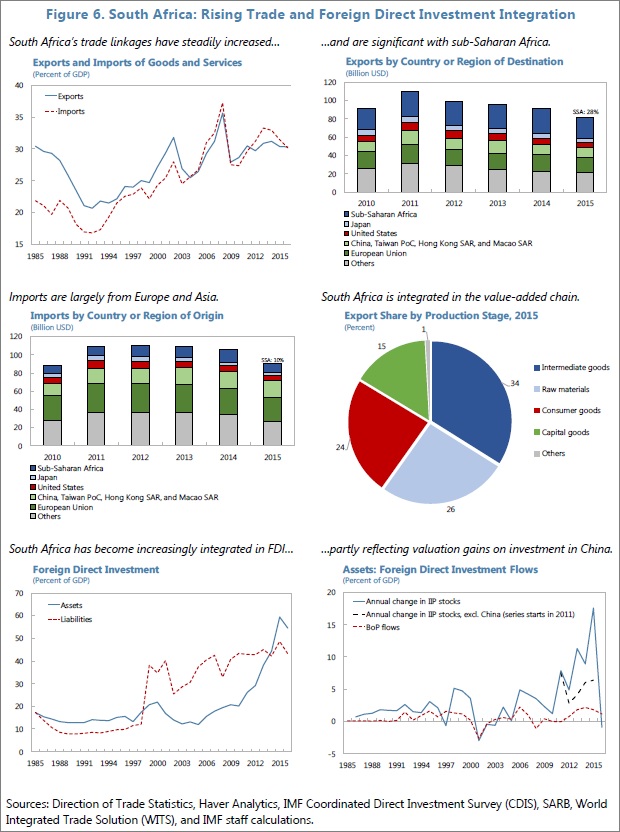

Rising integration between South Africa and its partners has been mutually beneficial but has also increased their interdependence. In 2016, South Africa’s imports and exports of goods and services were each equivalent to about 30 percent of GDP (11 and 9 percentage points of GDP higher than in 1994, respectively), with sub-Saharan Africa its largest regional recipient (28 percent of total goods exports). During the same period, FDI integration almost quadrupled as a share of GDP. Greater linkages have contributed to more significant inward and outward transmission of shocks. The decline in commodity prices has had not only a direct impact on South Africa, but also indirect effects through a slowdown in other commodity-exporting trading partners in sub-Saharan Africa. Similarly, a growth slowdown in South Africa would have adverse repercussions for its regional partners.

The financial sector has been resilient to slowing economic activity, but many less affluent individuals and SMEs have limited access to credit. The banking sector has traditionally been well capitalized and highly profitable, partly owing to high concentration and pricing power, including sizable fees for financial services. Major performance indicators broadly improved in 2017, largely because of higher interest income. Capital ratios (both risk weighted and unweighted) increased, with the Tier 1 capital ratio at 14.6 percent in April 2017, well above regulatory requirements. The non-performing loan ratio (NPL) declined to 2.4 percent in April 2017 from 3.1 percent in 2015 and 2.9 percent in 2016. Banks’ profitability improved as the rise in interest rates was transmitted more rapidly to their lending rates (often linked to the SARB’s repo rate) than to their deposit rates. Return on assets (1.7 percent) and return on equity (22 percent) are one of the highest since the global financial crisis and compare favorably with international peers. Wholesale funding has been an important but generally stable source of funding for banks (customer deposits accounted for 49 percent of total non-inter bank loans in April 2017). The Johannesburg Stock Exchange bank index rose by 27 percent in 2016. The banking sector’s resilience to the sluggish macro-economy stems from the sector’s conservative management, which focuses lending on less risky/higher net worth firms and individuals. However, compared to other emerging markets, less affluent individuals and smaller or riskier firms have more limited access to formal credit channels, with adverse implications for entrepreneurship and economic growth. For example, only 9 percent of SMEs have credit facilities with banks and only 4 percent of the poorest 40 percent of households have borrowed from a bank in the past year (Annex II. Financial Inclusion).

Outlook: Modest recovery in challenging external and domestic contexts

A modest improvement in real growth is expected in 2017 and the following few years. Growth is projected to rise to 1.0 percent in 2017 with better rainfall, an increase in mining output prompted by a moderate rebound in commodity prices, and prospects for a continued low number of days lost to strikes. 6 Private consumption growth is projected to be broadly unchanged, at about 1 percent, with relatively weak credit growth to households. Private investment is expected to decline – consistent with high uncertainty and low business confidence – but at a slower pace than last year. Net exports are expected to remain supportive of growth, as the rebound in commodity prices fosters export growth sufficiently to offset the rise in imports from the slight pickup in domestic demand. Economic growth is projected to recover gradually in subsequent years, as consumption and investment recover and the output gap closes, to 2.2 percent, slightly above population growth.

The current account deficit is expected to narrow further in 2017 before gradually widening over the medium term. The current account deficit is projected to decline to 3 percent of GDP this year as the surplus on the goods balance is boosted by mining and agricultural exports. Meanwhile, the deficit on the transfer balance is expected to widen moderately to its 2010–16 average. Over the medium term, the current account is projected to return to just below 4 percent of GDP as the surplus on the trade balance dissipates. External debt is seen rising to almost 50 percent of GDP over the medium term.

South Africa’s vulnerabilities have risen and are set to increase further unless economic growth revives. Low growth has taken a toll on the state of the public finances, with government debt projected at 52.6 percent of GDP by the end of fiscal year 2017 and the public sector’s balance sheet exposed to significant contingent liabilities from SOEs (10 percent of GDP). Weak growth and rising interest rates would pose risks also for some corporates: interest coverage ratios (cash flow profits divided by interest payments) were relatively low in personal services, energy, and business services. In the external sector, gross external debt equivalent to 48½ percent of GDP at end-2016, as well as significant gross external financing needs (projected at above 17 percent of GDP in 2017) expose South Africa to significant financing risks. Gross external liabilities are large at 128 percent of GDP at end-2016, though the net international investment position is marginally positive (3½ percent of GDP on the back of valuation effects). Vulnerabilities from exchange rate fluctuations are attenuated by South Africa’s track record of a freely floating exchange rate, corporate resilience to sizable exchange rate depreciation during the past few years, and high share of domestic-currency denominated government debt. Gross international reserves as of end-2016 covered 104 percent of short-term debt (residual maturity). However, at 77 percent of the IMF’s Assessing Reserve Adequacy metric (without considering capital flow management measures; 84 percent after considering them), they were below the recommended range of 100 to 150 percent.

Risks to the outlook are tilted to the downside given challenging external and domestic contexts

-

External Risks. South Africa’s highly liquid financial markets are vulnerable to tightening global financial conditions as investors may reassess policy fundamentals, in the event of international policy uncertainty and/or a faster-than-expected normalization of U.S. interest rates. Risks from unstable wholesale funding from European banks and exposure to sub-Saharan African borrowers would increase in such scenarios, especially if accompanied by additional local currency sovereign credit rating downgrades to below-investment level. A fall in the prices of South Africa’s main commodity exports would reduce investment and worsen the current account. A slowdown in partner growth (e.g., China, destination for about 10 percent of South Africa’s exports, or other large emerging markets) or structurally weak growth in key advanced and emerging economies would have both direct and indirect spillovers to South Africa through financial markets and trade channels.

-

Domestic Risks. These include protracted domestic policy uncertainty and continued deterioration in perceptions of the quality of governance; renewed spending pressures (such as resurfacing demands for free university tuition, a new costly public wage settlement in 2018, or the materialization of contingent liabilities from SOEs); reversal of the recent improvement in labor relations; or a deterioration in banks’ balance sheets stemming from protracted low growth.

Feedback loops between the real, financial, and fiscal sectors could amplify the impact of these shocks. A continued low growth outlook with rising unemployment would worsen the financial situation of households and firms, resulting in higher NPLs in banks’ loan portfolios as well as portfolio rebalancing by foreign investors and domestic non-bank institutions, which would reduce liquidity and increase funding costs for banks. Under these circumstances, banks would likely curtail credit, further exacerbating the growth downturn. Staff estimates suggest that, for instance, following a one percentage point decline in GDP growth, the NPL ratio would increase by 0.5 percentage point. This would in turn dampen credit growth by 2 percentage points (Annex VI. Macro-financial Linkages in South Africa). Lower growth and weaker bank profitability would also have sizeable implications for tax revenues. To maintain debt sustainability, further fiscal adjustment would be required, thus imparting an additional negative impulse to growth.

Policies to lift growth, permit more gradual fiscal adjustment, and increase resilience

With fiscal and monetary policy space constrained by rising government debt and the need to maintain inflation within the target band, the priority to stimulate economic growth and job creation rests with structural reforms, especially in labor and product/service markets. To the extent the authorities succeed in doing so, there will be an opportunity to reduce the pace of fiscal adjustment. An early start in undertaking such reforms would also reduce the likelihood of extreme downside risks materializing.

Monetary and Financial Sector Policies

Bringing to fruition ongoing reforms of prudential regulation and the resolution framework is expected further to buttress financial sector resilience. The authorities have made progress in implementing the 2014 IMF FSAP recommendations (Annex IX), particularly on modernizing the macro-prudential framework, including the introduction of “Twin Peaks” and resolution regimes. These reforms will likely increase financial stability by removing regulatory gaps and reducing implicit contingent liabilities from the banking sector. The Financial Sector Regulation bill to execute the Twin Peaks reform is likely to be approved and implemented in 2017, and the Designated Institutions Resolution bill to introduce the new resolution regime is expected to be submitted to parliament in late 2017. In this context, National Treasury and the SARB published for public comment a policy document on an explicit, privately-funded deposit insurance scheme. The SARB is also working toward an enhanced macro-prudential framework, including the addition of new tools such as countercyclical capital buffers, sectoral capital requirements, dynamic provisioning, as well as leverage and liquidity ratios. Moreover, the tightening of credit standards that began in 2015 has helped to correct past frothiness in the market for credit to households; slow consumption growth reflects not only these measures, but also an appropriate, continued reduction in the indebtedness of many overstretched households. A third draft on the OTC derivative regulatory framework will be reviewed by National Treasury and the SARB in 2017. However, limited progress has been made on the reform of collective investment schemes, promotion of fair competition and financial inclusion, and better consumer protection.

Access to financial services for low-income households and SMEs needs to be enhanced. Greater access of firms and households to banking services or the lifting of their financial constraints may be expected to foster economic growth and to reduce income inequality. At the same time, access to credit should be expanded with proper supervision to prevent an increase in financial stability risks, as illustrated by the recent bankruptcy of African Bank arising from its unsecured lending to low income customers. The authorities are taking steps to increase financial inclusion. For the first time in 11 years, the SARB granted three provisional banking licenses in 2016 (to Post Bank, Discovery Bank, and TYME (Take Your Money Elsewhere), a local mobile payments start-up acquired by Commonwealth Bank of Australia). The market conduct authority under twin peaks is also expected to introduce more transparency to financial products sold to consumers and SMEs. Even so, more could be done to expand financial inclusion while keeping financial risks in check. International experience suggests several options, such as encouraging community-based credit unions, institutions relying on emerging technologies (“FinTech”), and microcredit insurance; promoting financial literacy; better protection of low-income borrowers from predatory lending and abusive loan-recovery; streamlined disclosure standards for small-scale lending; expansion of eligible collateral and improved and centralized credit registry systems. Hurdles faced by potential entrants, such as non-transparent rules for access to clearing and payment systems operated by incumbents, should also be reduced.

Full and swift implementation of the Financial Intelligence Center Amendment (FICA) Act is needed to bring South Africa closer to international standards against money laundering, financing of terrorism, and other illegal financial transactions. The FICA Bill was signed by President Zuma in April 2017 and the next step is to issue and enact regulations to fully implement the FICA Act. Lack of comprehensive implementation might lead to a statement by the Financial Action Task Force about the risk of doing business with South Africa and could increase international transaction costs for South African businesses.