News

Africa remains world’s second-fastest growing region

In 2016, Africa as a whole maintained its position as the world’s second-fastest growing economies behind South Asia, according to data released during the Financial Presentation at the African Development Bank Group’s Annual Meetings, which entered its third day on Wednesday in Ahmedabad, India.

The report analyzed the continent’s economic outlook, Bank operations, financial profile and capital market activities, noting that the continent recorded an average of 2.2% GDP growth in 2016 compared to 7.1 posted by South Asia powered India against a 2% average for the developed economies.

The report said African economies would improve further to average 3.4% growth in 2017 and 4.3% in 2018, driven largely by growing domestic demand and good performing countries.

“Although natural resources and primary commodities are still major drivers, their importance has declined while domestic factors including consumption demand play an increasing role,” AfDB Senior Vice-President Charles Boamah said during the presentation.

Other factors include improved supply conditions and good business environment, prudent macroeconomic management, favorable external financial flows, and high public spending, he said.

The report notes that, while natural resources and primary commodities remain major growth drivers, their importance has declined, while domestic factors including consumption demand now play a greater role.

Vast differences in country, sub-regional performances

East Africa emerged the best sub-regional performer with a 5.3% real GDP growth average driven by strong performance in Ethiopia, Tanzania and Djibouti.

North Africa followed with an average 3.3% growth driven by recoveries in Egypt (4.3%) and Algeria (3.5%), amidst persistent political uncertainties.

Southern Africa recorded a 1.1% average due to the poor performance of South Africa and Angola, two major commodity exporters in the sub-region hit by drought, persistent power outages and adverse terms-of-trade shocks, while Madagascar and Mozambique were rare bright spots, posted growth rates above 4%.

Central Africa followed with a 0.8% average due to low commodity prices while some countries lime Cameroun proved resilient. Central African Republic and São Tomé and Príncipe improved their economic performances.

West Africa was at the bottom, averaging a 0.4% growth rate despite good performances by Côte d’Ivoire and Senegal, which were cancelled out by recession and socio-political factors that bogged down the economy to 1.5% growth.

Nigeria and South Africa account for the largest share of Africa’s GDP with 29% and 19%, respectively.

Overall, external flows slowed

The report said Foreign Direct Investment increased slightly reaching US $56.5 billion in tune with growing urbanization and cities growing with consumer markets increasingly targeted by foreign investors. Official development assistance (ODA), which remains the most important source of public finance, declined by 1.7%.

Remittances mainly by the African diaspora represent a key source of capital for African countries totaling US $64.6 billion in 2016, the report says.

However, the facts on the ground suggest that these resources are insufficient to fully meet the continent’s development challenges.

An improved outlook

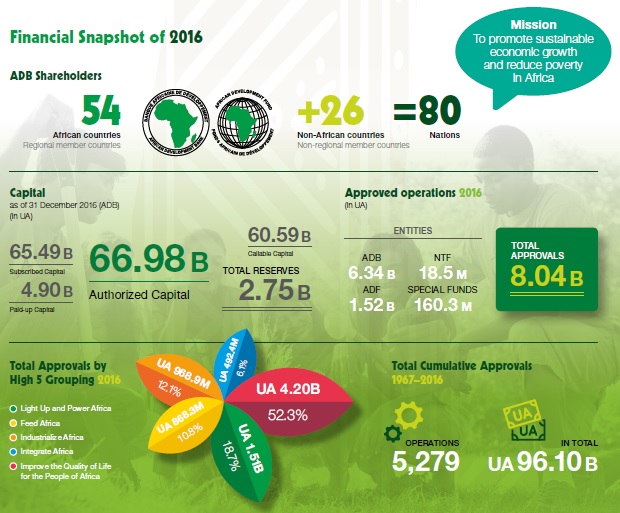

In this regard, the Bank estimates that its High 5 priorities – Light up and power Africa, Feed Africa, Industrialise Africa, Integrate Africa, and Improve the quality of life for the people of Africa – would spearhead Africa’s economic diversification and growth in broad-based economic opportunities that will shield the continent from future commodity shocks and enhance their resilience.

“Growth prospects would further be boosted by expected increases in commodity prices, strong domestic demand, better macroeconomic governance and an improved business environment,” co-presenter and Acting Vice-President for Finance, Hassatou N’Sele, said.

However, the report also cited rising debt, structural weaknesses, power outages, climate change, conflict, political instability and terrorism among some of the downside risks which should not be ignored.

African Development Bank Group Annual Report 2016

Repositioning the Bank Group

Africa has come a long way. Before the turn of the century, poverty was rampant, economies were faltering, infrastructure was in disrepair, and political and economic governance was weak. Africa as a continent was fragile. Things changed as Africa grew rapidly over the next two decades. Extreme poverty in Africa declined from 56 percent of the population in 1990 to 41.5 percent in 2015. Economic policies, political stability, and the business environment all improved, making the region a target for foreign direct investment, which reached USD 56.5 billion in 2016. Africa is on the rise.

Despite these achievements, poverty remains a challenge in Africa, with an estimated 400 million poor, in 2015, up from 350 million in 1990, largely because of rapid population growth. Income inequality remains high, youth unemployment is rising, and gender equality remains elusive. The benefits of growth in Africa have not reached the masses.

More important, Africa continues to be at the mercy of boom-bust cycles dictated by trends in the global economy. Global growth slowed to 3.1 percent in 2016 (from 3.2 percent the previous year). The loss of momentum in the economic recovery of the United States (where growth dipped to 1.6 percent in 2016 against 2.6 percent in 2015), the uncertainty following Brexit and the slowdown in China, where growth is converging to a “new normal” after declining continuously from its 2010 level, are the key factors weighing on Africa’s growth. The weak global environment has hit African economies mainly through low commodity prices and depressed export demand for African goods. Economic growth in Africa plunged to 2.2 percent in 2016, the lowest in over a decade.

The biggest commodity-exporting countries saw a sharp drop in growth, but several oil-importing countries continued to enjoy reasonably rapid growth. Nigeria’s economy, the largest in Africa, contracted in real terms by 1.5 percent. South Africa and Angola narrowly escaped recession. South Sudan suffered a deep economic contraction (of 13.1 percent), while growth in other oil-exporting countries remained negative (Chad and Equatorial Guinea). Only Egypt (4.3 percent) and Algeria (3.5 percent) were able to maintain reasonably good economic performance in the face of declining oil prices. In contrast, non-resource-intensive economies generally fared well, led by Côte d’Ivoire (8.4 percent) and Senegal (6.7 percent) in Western Africa, and by Tanzania (7.2 percent) and Kenya (6.0 percent) in Eastern Africa. Economic growth in Africa is expected to rebound to 3.4 percent in 2017 – but still below the average for the past 10 years.

The diversity of economic performances in the face of global headwinds underpins Africa’s heterogeneity as a region, as illustrated by the resilience of non-commodity-intensive economies. There is also evidence – from Africa’s response to the financial crisis – that the most regionally integrated countries are able to better weather external economic shocks. Together, this points to the need for African countries to diversify their economies in terms of both the basket of goods and services that they produce and the markets. Urgent and bold economic transformation is more than ever a priority for the continent. The opportunities to pursue it abound.

Africa’s enormous development potential – in almost all sectors – has yet to be tapped. In agriculture, African countries remain food insecure, spending billions of dollars on food imports every year to feed their people. Yet Africa has 65 percent of the world’s untilled arable land to meet the food needs of the planet’s 9 billion people by 2050. In energy, Africa has the lowest electrification rate across world regions, with more than 645 million people lacking access to electricity. Yet the continent’s potential in renewable energy is huge, and largely unexploited.

Moreover, many African countries are stuck at the low end of the agricultural value chain, exporting raw commodities that are subject to price and climatic fluctuations. Industrialization efforts have faltered, mainly because of poor policies and a lack of support services. Even so, agriculture can form the basis for industrialization in Africa, and African countries can position themselves to integrate into global value chains and move up along them through agro-processing. Harnessing the private sector – by facilitating access to finance for innovative enterprises, incentivizing entrepreneurship, and providing the right business environment – will be critical to maintaining industrial impetus.

Lastly, Africa’s intraregional trade is among the lowest in the world, held down by fragmented markets owing to poor policies, little economic diversification, and weak infrastructure. Regional integration remains an imperative for a continent where 16 countries, with one-third of Africa’s people, are landlocked, and 19 countries have populations of less than 5 million.

All these challenges have persisted for too long. Therefore, business as usual will not be enough to drive sustainable growth and alleviate poverty in Africa. A new development approach is in order. This is needed because the Bank, as Africa’s leading financial institution, continues to face challenges in meeting the development agenda of its Regional Member Countries (RMCs) – despite its track record of delivering development impacts across the continent for over half a century. While the Bank Group remains financially strong, as confirmed by its AAA/ Aaa and AA+/Aa1 ratings, there is an urgent need to augment its revenues, which have declined significantly in recent years. Moreover, to improve the development impact of its operations, the Bank must get closer to its clients and reform its processes to speed up disbursement and project implementation, all while cutting costs and enhancing productivity. In short, the Bank must transform itself to deliver more effectively. Piecemeal, incremental reforms have not worked.

In 2016, the Bank Group embraced a bold transformation agenda – a promise to transform Africa by transforming itself, by becoming a more efficient and effective institution, by rallying its people and partners behind this cause, and by leveraging and scaling up development finance to catalyze development.

Evolving with the New Business Development Landscape

At the center of the Bank’s transformation agenda are the High 5s – Light Up and Power Africa, Feed Africa, Industrialize Africa, Integrate Africa, and Improve the Quality of Life for the People of Africa – that the Bank Group adopted in late 2015. In 2016, the Bank Group sharpened its focus on the High 5s as it rolled out the strategies needed to implement them. It adopted in April 2016, a new Development and Business Delivery Model (DBDM) to realign its organizational structure with the strategic objectives of the Ten-Year Strategy 2013-2022 for achieving inclusive and green growth and the High 5s priorities to accelerate delivery and development impacts. The new structure also aims to bring the Bank closer to its clients and improve organizational effectiveness to meet the growing needs of RMCs and their private sector.

During the year, the Bank Group initiated several reforms as part of a transformative agenda to restructure the organization to build regional capabilities, change the Bank’s culture, and streamline its processes. It approved The Update of the Decentralization Action Plan with a view to adjusting the ongoing decentralization process with the new DBDM. The Update seeks to strengthen the presence of the Bank at the regional level; right-size offices at country and regional levels; reconfigure the role, functions, and relations of the sector departments at Headquarters; and establish the Regional Development, Integration, and Business Delivery hubs. The strategies to operationalize four of the five priorities were swiftly developed and approved by July 2016, along with initiatives to implement these strategies. For the Integrate Africa priority, the Bank Group has, for now, retained the existing Regional Integration Policy and Strategy 2014-2023 but is working on a new strategy that will reflect emerging priorities.

The new strategies entail major financial commitments and active engagement by the Bank over the next ten years. Their implementation will require investments of about USD 100 billion, and the Bank will leverage several times this amount through strategic partnerships, including those with the private sector.

In 2016 the Bank Group’s operations laid the foundation to unleash an agricultural transformation in Africa, create jobs for thousands of youth, empower young entrepreneurs including many women, and bring electricity to several million Africans – improving their quality of life.

» Download: AfDB Annual Report 2016 (PDF, 14.2 MB)