News

A rebalancing act for China and Africa: the effects of China’s rebalancing on Sub-Saharan Africa’s trade and growth

China and Africa have developed close economic ties over the past 20 years. China’s rapid growth has boosted its demand for raw materials, many of which come from Africa, and trade has risen more than 40-fold over the period.

More recently, the growing strength of Chinese enterprises has also led to rapid expansion of Chinese direct investment in Africa. At the same time, China’s competitive manufacturing has provided consumer goods that were previously out of reach to low-income households across the continent.

But now China’s growth is slowing and the drivers of its growth are shifting from investment and exports to domestic consumption. This shift is affecting the global economy (see the IMF’s October 2016 World Economic Outlook) but is having a particularly large impact on commodity exporters, many of which are in Africa. Overall, Africa’s commodities exports have fallen as a result of the decline in Chinese demand and the precipitous fall in world commodity prices, putting pressure on the fiscal and external accounts of many African countries. After expanding by 5-6 percent over the past two decades, economic growth in sub-Saharan Africa is expected to reach barely 1.5 percent in 2016.

How does China’s new growth model affect sub-Saharan Africa? To address this question, this paper is structured as follows: It first looks at the growing ties between China and Africa; it then attempts to estimate more precisely the impact on growth through the trade channel, since trade dominates the economic ties between China and Africa. Finally, it draws some policy implications and the discussion reflects on whether this means an end of the Africa Rising narrative or merely the beginning of a new chapter.

Growing Integration between China and Africa

China Has Become Sub-Saharan Africa’s Single Largest Trading Partner

China’s rapid growth over the past 40 years has turned it into a major trading hub for most countries in the world, whether directly or indirectly through other trading partners.

Sub-Saharan Africa, where a remarkable shift in trade patterns has taken place in the past 20 years, is no exception. Advanced economies accounted for close to 90 percent of sub-Saharan Africa’s exports in 1995, but 20 years later new partners, including Brazil, China, and India, account for more than 50 percent, with China accounting for about half of that. The story is similar on the import side. Total exports and imports have declined significantly in 2015, though the proportion of trade by destination and origin countries have remained fairly similar. By 2014, China was the single largest source of sub-Saharan Africa’s imports. Fuel and metal and mineral products account for 70 percent of sub-Saharan African exports to China whereas the majority of sub-Saharan Africa’s imports from China are manufactured goods, followed by machinery.

What has been the economic impact of sub-Saharan Africa’s growing engagement with China? Access to new markets for its raw materials has spurred Africa’s exports, which quintupled in real value over the past 20 years (1995-2015). But maybe even more important, by diversifying its trading partners, sub-Saharan Africa has reduced the volatility of its exports. This combination of trading partners helped cushion the impact of the global financial crisis in 2008-09, when advanced economies experienced a deep economic contraction that curbed their demand for imports. At the same time, China actually increased its contribution to the growth of sub-Saharan African exports, allowing most of sub-Saharan Africa to sustain robust economic growth during the Great Recession. Trade has also boosted living standards in Africa through access to cheap Chinese consumer goods, from clothing to mopeds, and has contributed to lower levels of inflation in many countries.

China Is a Growing Investor and Lender in Africa

Sub-Saharan Africa has also diversified its sources of capital. China’s outward foreign direct investment (FDI) to sub-Saharan Africa has increased significantly since 2006. Official statistics indicate that it remains small as measured by its share of total FDI to sub-Saharan Africa – less than 5 percent in 2012. But anecdotal evidence suggests that in reality the figure may be much higher, with a large number of small Chinese entrepreneurs establishing themselves in Africa. In addition, Chinese loans to sub-Saharan Africa – many of them financing public infrastructure projects – have risen rapidly, and China’s share of total external debt in sub-Saharan Africa has risen from less than 2 percent before 2005 to about 15 percent in 2012. These loans have provided many African countries with a welcome new source of project financing, particularly attractive for countries with low levels of external debt following comprehensive debt relief under the Heavily Indebted Poor Countries Initiative. And Africa is becoming increasingly important for China as well. By some accounts, by 2013 about a quarter of all Chinese engineering contracts worldwide were in sub-Saharan Africa. Most of these contracts were awarded in energy (hydropower) and transport (roads, autos, ports, aviation).

China and Africa – The New Balance

China’s investment-heavy, export-oriented growth model made it a growing importer of commodities. Between 2010 and 2014, China accounted for more than 40 percent of the world’s metal consumption, more than 10 percent of demand for crude oil, more than 20 percent of agricultural crops consumption, and more than 20 percent of primary energy demand. In the first decade of the century, base metal and energy prices rose by more than 160 percent, precious metals rose more than 300 percent, and agricultural commodities more than 100 percent. Sub-Saharan Africa’s many commodity exporters benefited enormously from this boom. But now, oil prices and many mineral prices have fallen by more than half from their peaks of the past few years, and many other commodities have suffered sharp declines Futures markets suggest little recovery in prices by 2020. Moreover, lower investment in China has curbed the country’s appetite for raw materials, resulting in a sharp swing in its trade balance with sub-Saharan Africa.

FDI is less cyclical and driven more by medium-term considerations. But a string of recent Chinese mining closures in sub-Saharan Africa (copper mines in Zambia, iron ore mines in South Africa, and the cancellation of an iron ore project in Cameroon) suggests that returns on investment in the traditional commodity sectors are falling. Data from China’s Ministry of Commerce corroborate this: the number of approved projects has been falling since 2014. In May 2015, the Ministry estimated a 45.9 percent drop in China’s FDI flows to Africa in the first quarter of 2015 compared with the same period in 2014. The impact extends beyond China, of course. Major planned investments in natural resources, such as the gas fields off Tanzania and Mozambique, may now need to be reevaluated.

Painful Adjustment Ahead

The immediate impact on commodity exporters has been severe. Oil-exporting countries, in particular, are experiencing sharp declines in exports, putting pressure on reserves and exchange rates. Many commodity exporters also rely on significant government revenue from natural resources and are now facing growing budget deficits and pressures to reduce spending. In Angola, for example, the fall in oil prices wiped out about half of the country’s revenue base, with a loss of more than 20 percent of GDP. Lower spending levels, in both the public and private sectors, have led to sharply lower growth rates for oil-exporting countries, now expected to average less than 1 percent in 2015-16, compared with an average of greater than 7 percent in the preceding decade.

Box 1. South Africa: Spillovers from China and Lower Commodity Prices

In South Africa, rising trade links and a reliance on commodities has increased spillovers from China. China absorbs 10 percent of South African exports, the most absorbed by any individual country. It also plays a key role in determining global demand for South Africa’s commodity exports. IMF staff analysis suggests China’s growth now matters more for South Africa than does growth in the United States and the European Union.

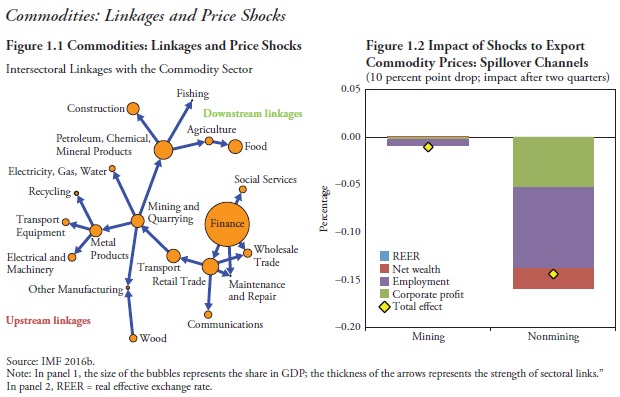

The impact of lower commodity prices is amplified by links between sectors (Figure 1.1). An analysis of input-output tables in South Africa suggests that links between the commodity sector and the rest of the economy are significant. A sectoral structural vector autoregression identified using multipliers from the input-output table suggests a 10 percent decline in export commodity prices would reduce real GDP growth by nearly 0.2 percentage points (quarter over quarter, seasonally adjusted, annualized) per year after two quarters, with most of the impact coming from downstream (for example, construction) and upstream (for example, transport) sectors, including manufactured commodities.

The African Departmental Paper Series presents research by IMF staff on issues of broad regional or cross-country interest. The views expressed in this paper are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.