News

Development of export industries in West Africa critical to reap maximum AGOA benefits

Since 2000, the United States’ African Growth and Opportunity Act (AGOA) has been a pillar of the U.S. trade policy towards Sub-Saharan Africa. It offers duty-free entry to over 6,400 products into the U.S. from eligible Sub-Saharan African countries, making African products more cost-effective and competitive. The recent extension of AGOA to 2025 gives new impetus to eligible countries to harness its advantages.

In West Africa, exports to the U.S. from seven countries (Benin, Burkina Faso, Cameroon, Côte d’Ivoire, Ghana, Nigeria and Senegal) totaled $5.3 billion in 2014, of which $1.3 billion was exported under AGOA (including GSP – Generalised System of Preferences), which represents about 24.52% of total exports to the U.S. The low percentage of AGOA exports can be attributed to the fact that most West African countries export primary products that attract no duty under the Normal Trade Regime (NTR).

For example, 63% of Côte d’Ivoire’s exports, and 48.52% of Ghana’s exports to the U.S. are cocoa beans (whole or broken, raw or roasted) that enter the U.S. duty-free under the NTR, so they are not counted under AGOA or GSP. Similarly, Benin and Burkina Faso mainly export cashew nuts to the U.S. (duty-free under the NTR), at 65.24% and 40.80%, respectively. Senegal registers low AGOA exports because 49.09% of its exports (wigs), and 11.98% (fish – frozen, except fillets, livers and roes) enter the U.S. duty-free under the NTR.

In addition to the low level of AGOA exports as a result of duty-free under the NTR, U.S. importers also paid duty on products that were supposed to enter the U.S. duty-free under the GSP and AGOA, hence a missed opportunity for the selected African countries to take advantage of AGOA.

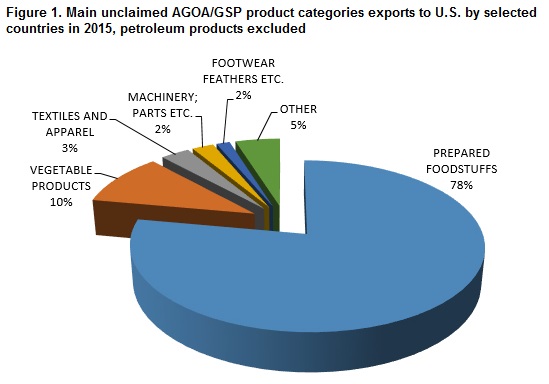

For the seven selected countries, the total value of unclaimed AGOA/GSP exports in 2014 was US $1.3 billion, or 24.77% of exports, while in 2015, the total value of unclaimed AGOA/GSP exports was US $520 million, or 17.85% of total exports. By value, top product categories – petroleum products excluded – that entered the U.S. from the seven countries with unclaimed AGOA benefits were: prepared foodstuffs, vegetable products, and textiles and apparel.

With petroleum products excluded, prepared foodstuffs are the main unclaimed AGOA/GSP exports. They comprised cocoa paste (not defatted) and cocoa powder (not containing added sugar). Over US $100 million in cocoa paste and cocoa powder were exported from Côte d’Ivoire and Ghana. Vegetable products were the second largest unclaimed AGOA/GSP exports amounting to US $12 million in exported vegetable products (including kola nuts from Côte d’Ivoire, ground ginger and spices from Nigeria, yams from Ghana, and dried mangoes from Burkina Faso).

Textile and apparel products, AGOA products par excellence, represented over US $950,000 in 2014 and US $1.4 million in 2015 in unclaimed AGOA benefits. This means some of the selected countries are not effectively using their textile visa arrangements in order to take advantage of AGOA.

The low performance of AGOA exports initially resides in the structure of most African economies that still focus on the export of primary products which do not attract duty in the U.S. under the NTR in the first place. Even when African countries export processed products to the U.S., a big percentage of these products enter the U.S. with duty paid, hence missing a tremendous opportunity to expand duty-free exports under AGOA and GSP as suggested above.

The low performance of AGOA exports, including the missed opportunities of claiming duties on AGOA-eligible products as highlighted above, also suggests that customs documentation still remains an issue. For example, a Commercial Invoice without proper description of the product and the correct nomenclature or Harmonized System (HS) code, or the textile visa stamp for apparel products, will likely attract duties in the U.S. This issue can be easily solved without much financial cost by simply training export promotion agencies and customs officials on the right export documentation procedures.

The lost opportunities highlighted above suggests the need to rethink a normative framework to boost exports, create jobs, and attain inclusive growth that is anchored around moving from a commodity-led to a value-addition led economy. Since most AGOA-eligible products fall in the realm of value-added products, Sub-Saharan African countries need to strategically implement an industrialization policy centered on competitive global value chains (GVCs) with anchor firms that have developed their capacity to comply with international standards and regulations.

Countries that are most successful in exporting to the U.S. under AGOA have defined a clear strategic framework that targets the most competitive GVCs, and have set up an effective institutional mechanism that seeks to improve the business environment, and attract investment. More importantly, SSA countries need to graduate from local and national interests to a more dynamic regionalism that will create economies of scale and enhance their export competitiveness.

The last iteration of AGOA provides a unique opportunity for SSA to improve its overall competitiveness and increase its share of global trade. This, however, will only make sense if SSA countries address their internal supply-side constraints. SSA needs to look beyond these trade arrangements, and be serious about structuring their economies to become global players. In that respect, there may be value in incorporating the African Development Bank’s High 5s that provide an all-encompassing approach to address some of those supply-side constraints, notably through the Bank’s “Industrialize Africa” and “Integrate Africa” agendas.

Abou Fall was the AGOA Coordinator for USAID West Africa Trade and Investment Hub, and is currently a Senior Trade and Investment Officer at the African Development Bank (AfDB).