News

Global manufacturing growth expected to remain low in 2016 amid weakened financial support, says UNIDO report

World manufacturing growth is expected to remain low in 2016 due to weakened financial support for productive activities, according to a report released on 5 September 2016 by the United Nations Industrial Development Organization (UNIDO).

The report states that, with financial uncertainty still looming across Europe, foreign direct investment has not yet reached the 2007 pre-crisis level.

According to UNIDO, world manufacturing output is expected to increase by 2.8 per cent in 2016. The current trend indicates that, in contrast to recent years, there will be no breakout from the low-growth trap in 2016. Manufacturing production is likely to rise by 1.3 per cent in industrialized countries and by 4.7 per cent in developing economies.

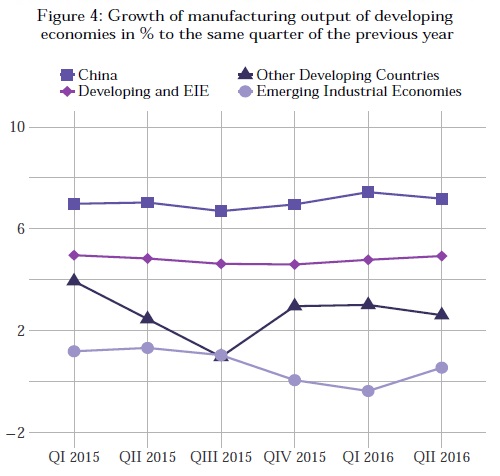

By the end of 2016, the growth rate performance of China, the world’s largest manufacturer, is likely to further decline from last year’s 7.1 per cent to to 6.5 per cent this year. Similarly, downward growth rate trends are expected in Japan, Europe, and the United States.

The report contains expected annual growth rate estimates for 2016, as well as observed growth rates for the second quarter of this year.

According to UNIDO, lower industrial growth rates pose a challenge for the implementation of Sustainable Development Goal 9, which aims to significantly raise the share of manufacturing in the economies of developing countries.

World manufacturing output rose by 2.2 per cent in the second quarter compared to the same period in the previous year. Most of the growth was contributed by developing and emerging industrial economies where manufacturing output rose by 4.9 per cent. In industrialized countries growth was marginal at 0.2 per cent.

In Europe, the uncertainty following the Brexit affected the growth rate performance in manufacturing in the second quarter of 2016, below 1.0 per cent for the first time since 2013. Lower growth was also observed in the Russian Federation and the United States, where manufacturing output rose at the marginal rate of 1.0 per cent and 0.3 per cent respectively. In Japan, manufacturing output fell by 1.8 per cent.

Among Latin American economies, manufacturing output fell by 3.2 per cent in the second quarter, amid a continuing production decline in the region. Manufacturing output plunged by 6.7 per cent in Brazil, and by 4.2 per cent in Argentina.

Asian countries largely maintained higher growth rates. Manufacturing output rose by 5.6 per cent in Indonesia, 3.9 per cent in Malaysia and 13.5 per cent in Viet Nam. However, the growth figures showed a sudden 0.7 per cent drop in production in India.

Estimates from the limited available data showed that manufacturing output rose by 2.5 per cent in Africa. South Africa, the continent’s largest manufacturer, significantly improved its growth performance to 3.3 per cent in the second quarter. Higher growth rates of 8.3 per cent and 7.6 per cent were achieved in Cameron and Senegal.

The UNIDO report also presents growth estimates by manufacturing sectors. The production of tobacco fell for the second consecutive quarter, declining by 2.6 per cent. Developing economies maintained higher growth in the production of textiles, chemical products and fabricated metal products, while the growth performance of industrialized economies was higher in the pharmaceutical industry and in production of motor vehicles.

Findings by country group

Developing and emerging industrial economies

A slowdown in China and a downturn in Latin America have impacted the overall growth of manufacturing in developing and emerging industrial economies. In the second quarter of 2016, manufacturing production in China rose by 7.2 per cent over the same period of the previous year, which marked a modest slowdown compared to the 7.4 per cent expansion recorded in the previous quarter and represented one of the slowest growth rates since 2005, but not when compared with other economies of the world. Due to strong domestic demand, China’s manufacturing has proven resilient to external shocks. Compared to other economies, China has maintained relatively high growth rates under conditions of declining capital inflow and exports.

Latin American economies, on the other hand, were not as resilient and were negatively affected by the subdued global demand for commodities and falling oil prices. The manufacturing production in Latin America dropped by 3.2 per cent, mostly driven by a protracted recession in Brazil, where manufacturing output plunged by 6.7 per cent on a year-to-year basis. Outspread declines were recorded across almost all other larger Latin American manufacturers, namely Mexico, Argentina, Chile and Peru, which reported a decrease by 0.2 per cent, 4.2 per cent, 1.0 per cent and 8.5 per cent, respectively. The only exception among the major economies of the continent was Columbia, which showed persistent positive growth despite the extended manufacturing depression evident across Latin America.

Growth performance was much higher in Asian economies, where manufacturing output rose by 6.5 per cent in the second quarter of 2016. Viet Nam defended its position of one of the fastest growing Asian economies and maintained a two-digit growth rate in quarterly manufacturing output for the seventh time in a row. At present, though Viet Nam is experiencing the worst drought in the last three decades, its economy is benefitting from the manufacturing industry, which is primarily driven by export-oriented industries such as computers, electronics and optical products that have grown in importance over the last years. Manufacturing output in Indonesia, which recently entered the top-10 largest manufacturers worldwide, grew by 5.6 per cent in the second quarter of 2016. India’s manufacturing output, which achieved impressive growth rates in the last quarters, experienced a second slight decline in a row, this time by 0.7 per cent, but the prospects for India’s manufacturing are conclusive, since India is on the path to becoming a pivot for high-tech world manufacturing.

Estimates based on the limited available data indicate that manufacturing output in Africa has increased by 2.5 per cent. This respectable increase in growth is attributable to the region’s most industrialized economy – South Africa, whose manufacturing production was mainly driven by increasing output in refined petroleum products and chemical products. According to our estimates on growth rates, all developing African economies managed to retain a non-negative growth rate compared to the previous year.