Discussions

The competitiveness of African economies: innovation, infrastructure, goods trade and public institutions

On 26 September, the World Economic Forum (WEF) released the annual Global Competitiveness Report for 2017/2018. The report examines the Global Competitiveness Index (GCI) which measures the competitiveness of 137 countries in terms of their institutions, policies and other factors which determine the level of productivity of each economy. The GCI evaluates 114 indicators grouped into 12 pillars: institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labour market efficiency, financial market development, technological readiness, market size, business sophistication and innovation. The aim of the GCI is to identify challenges to be addressed and strengths economies can build on through economic growth strategies.

Four of the five most competitive countries are in Europe and North America (Switzerland ranked 1st, United States ranked 2nd, Netherlands ranked 4th and Germany ranked 5th). Singapore is ranked the third most competitive economy. The nine least competitive countries are all in sub-Saharan Africa and are Mauritania (133rd), Liberia (134th), Chad (135th), Mozambique (136th) and Yemen (137th). The best ranked African economies are Mauritius (45th), Rwanda (58th), South Africa (61st) and Botswana (63rd). Although most African economies have improved in the rankings, South Africa slipped 14 positions (previously ranked 47th) due to a weaker institutional environment, weaker financial markets and goods market efficiency.

On average, the competitiveness of sub-Saharan African countries has not changed significantly over the last decade. Only Ethiopia, Senegal, Tanzania and Uganda have been able to improve their performance for five consecutive years since 2010. Continued deterioration in the macroeconomic environment has been detrimental to the competitiveness of the African economies; average inflation is above 10%, public finances are still struggling due to slower global growth and commodity prices are well below previous levels. The performance in the institutions pillar has worsened and there has been increased volatility and uncertainty in the African business environment. However, African economies have shown some improvement in infrastructure, health, technological readiness and business sophistication.

a) Innovation

The innovation pillar is important for those economies that want to add value to their economies by going beyond just integrating and adapting existing technologies. Countries ranked high in terms of innovation mean that firms in these economies are staying ahead by developing cutting-edge products and processes to move towards higher value-added activities. In these economies, there is strong emphasis on investment in research and development (both public and private), high quality scientific research institutions and the protection of intellectual property rights. The countries ranked best in innovation are Switzerland, United States, Israel, Finland and Germany.

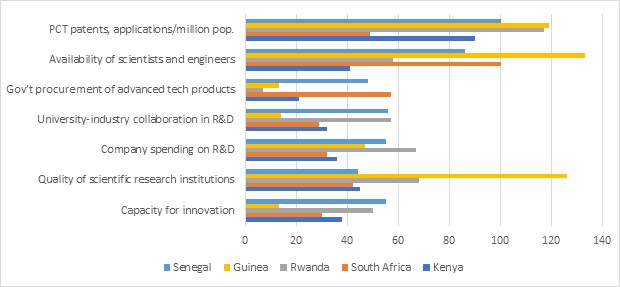

1(best)-137(worst)

Source: GCI (2017)

For African countries Kenya (ranked 37th) and South Africa (39th) outperformed the rest of Arica. Kenya shows the highest incidence of available scientists and engineers, while South Africa fares best in the areas of the application for patents, company spending on research and development and quality scientific research institutions. However, Rwanda and Guinea are ranked as some of the top countries for government procurement of advanced technological products, ranked 7th and 13th overall. Guinea also outperformed all other African countries in the areas of capacity for innovation (ranked 13th) and university-industry research and development collaboration (ranked 14th).

b) Goods market efficiency

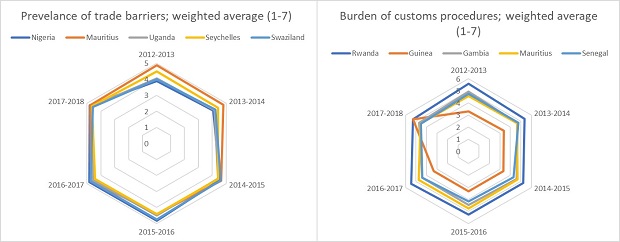

The goods market efficiency is a measure of business productivity; are firms producing the right mix of products and services given supply and demand conditions and are these products effectively traded. As a measure of healthy domestic competition, the GCI includes market dominance, the effectiveness of anti-monopoly policy and the cost of agricultural policies. Important indicators for determining the ability of foreign firms to compete in domestic markets include the prevalence of barriers to trade, applicable tariffs and the burden of customs procedures. Although numerous African economies are ranked in the bottom when it comes to goods market efficiency (including Mauritania, Zimbabwe, DRC and Ethiopia) the majority of African economies outperform Latin American countries, including Argentina and Brazil. Rwanda and Mauritius are the best performing countries in terms of domestic competition, faring well in the areas of the time to start a business (Rwanda) and the use of tax policy as incentive for investment (Mauritius). In terms of the ability of foreign firms to compete in domestic markets the GCI indicates that market entry into almost all African economies is plagued by non-tariff barriers and burdensome customs procedures. The exceptions are Rwanda and Guinea, which are rated under the top 20 countries where customs procedures are not problematic, and Nigeria and Mauritius where market access is not plagued by non-tariff barriers.

Source: GCI (2017)

c) Infrastructure

The infrastructure indicators include the quality of road, port and air infrastructure; the quality of electricity supply and the connectivity (both mobile and fixed line) of the population of the country. The infrastructure indicators are some of the only ones in which many African countries have improved their rankings over the years.

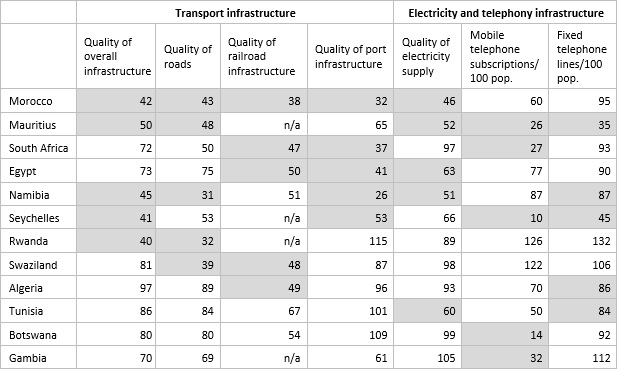

Table 1: African countries ranked best in infrastructure; ranking 1-137

Source: GCI (2017)

In terms of overall infrastructure performance Mauritius, Seychelles and Morocco are rated the top African countries. Countries which have shown a significant increase in access to overall infrastructure include Morocco and Kenya. The quality of transport infrastructure in South Africa, although still ranked the highest in Africa, has been on the decline over the last ten years. Morocco, Egypt, Kenya and Rwanda are some of the African countries which have significantly improved their rankings in the quality of transport infrastructure. Mauritius, Seychelles and Morocco are the African countries with the best total electricity and telephony infrastructure. Although most African countries have increased access to electricity and telephone infrastructure, countries including Madagascar, Malawi and Zambia have moved down in the rankings due to inadequate supply of electricity. There are several African countries ranked in the top 50 when it comes to mobile subscriptions, including Seychelles, Botswana, Mauritius and South Africa. Mobile connectivity has grown significantly in most African countries over the last years.

d) Institutions

The performance of institutions, especially public institutions has contributed to many African countries moving down the GCI rankings of overall institutional performance. Numerous African countries are performing poorly in terms of government bureaucracy, policy instability, corruption and the lack of transparency in policymaking.

-

Rwanda far outperforms all the other African countries in terms of the performance of public institutions. The other top ranked African economies are Mauritius, Namibia, Botswana and Gambia. The majority of African countries are in the bottom half of the public institutions indicator; Mozambique, Nigeria, Madagascar, Yemen and Chad are the worst performing countries.

-

Rwanda has shown significant improvement in the performance of public institutions in recent years, including efficient dispute settlement legal frameworks and transparency in government policymaking. However, Rwanda is performing quite poorly in efficient investor protection; with worsening performance since the 2010/2011 GCI when Rwanda was ranked 27th (now 87th).

-

The majority of African countries have performed worse over the last ten years in efficient investor protection. South Africa and Mauritius are the top African countries, but have respectively slipped 12 and 20 positions.

-

Numerous countries have improved performance in intellectual property rights protection (including Namibia, Botswana, Gambia and Lesotho), while countries like South Africa, Mali and Zimbabwe have been performing increasingly worse over the last decade.

-

All African countries, with few exceptions including Rwanda, Gambia and Uganda have seen an increase in wasteful government expenditure.

-

Gambia, Seychelles and Kenya do not have overly burdensome government regulations; Namibia, South Africa, Botswana and Mauritius have efficient legal frameworks to settle disputes and challenge regulations; and Namibia, Botswana and Mauritius have transparent policymaking processes. Transparency is becoming increasingly problematic in Zambia, South Africa, Malawi and Lesotho.

Source:

Global Competitiveness Report and the Global Competitiveness Index, available at http://reports.weforum.org/global-competitiveness-index-2017-2018/