Blog

The U.S. anti-dumping investigation against lemon juice exports from South Africa: background, recent updates and next steps

South African producers and exporters of lemon juice (and no doubt exporters of citrus fruit) received an unwelcome surprise early January 2022 that a California-based company producing various citrus juices – Ventura Coastal LLC[1] – had petitioned the United States International Trade Commission (USITC) and the Department of Commerce (DOC) to investigate shipments of lemon juice from South Africa and Brazil, claiming these were being sold on the U.S. market at less than fair value (LTFV), i.e. being dumped.

The petitioner submitted that the dumping margin – the difference between the export price in the U.S. and theoretical normal / fair price – was 128.61%, and proposed that as a trade remedy, the U.S. should impose equivalent anti-dumping duties on lemon juice imports from South Africa (the “subject imports”). A company in Paarl (Western Cape) and one in Addo (Eastern Cape) were listed in the petition, effectively as respondents in the matter.

The petitioner believes that as a result of the alleged sale of lemon juice at LTFV, the U.S. industry is being materially injured, or threatened with material injury.[3] Material injury in this context is defined by the U.S. legislation as “harm which is not inconsequential, immaterial, or unimportant”[4].

U.S. authorities accepted the petition as “legally sufficient”[5], and being representative of the industry in which the petitioner operates. U.S. tariff legislation – the U.S. Tariff Act of 1930, as amended – requires that petitions be filed on behalf of an industry; inter alia, the petition must be supported by producers or workers representing at least 25% of domestic production. Ventura Coastal, per the preliminary investigation by the Department of Commerce, is one of two operators in the U.S. market, and the larger of the two[6].

An anti-dumping investigation that meets the initial filing criteria and is accepted by the U.S. authorities then triggers a 45-day period in which initial investigations are undertaken by the USITC; this includes industry surveys, limited hearings and the accepting the filing of briefs. The role of the USITC is to make the initial determination on whether there is material injury to the local industry, or a threat thereof, and ultimately a positive determination by both the Trade Commission as well as the Department of Commerce (Enforcement and Compliance division) would lead to Customs and Border Protection (U.S. Customs) to assess additional duties against such imports.

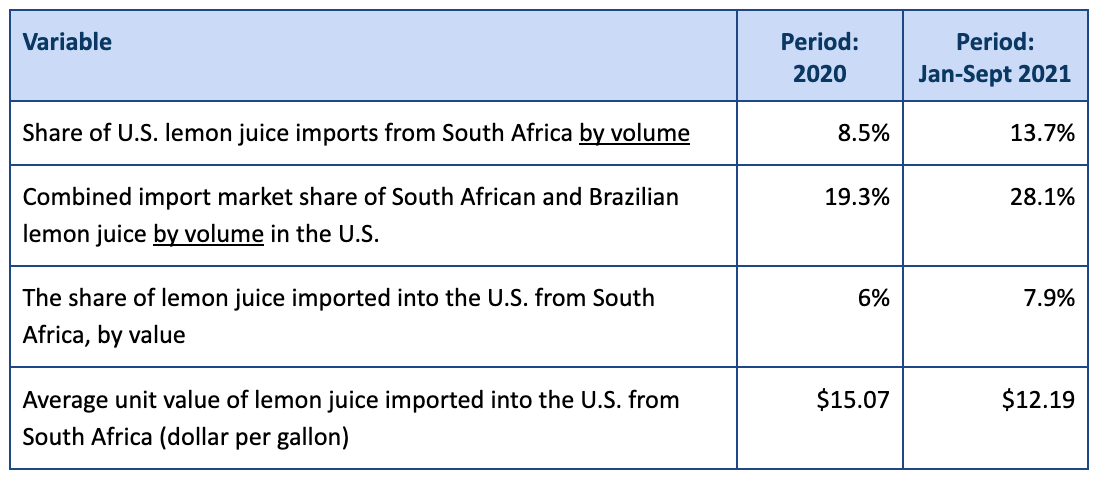

On 11 February 2022, the USITC voted to continue the investigation, finding in its preliminary investigation that there is a reasonable indication that there is material injury (or the threat thereof), or that the establishment of an industry is materially retarded by subject imports (South African and Brazilian lemon juice).[7] The preliminary investigation also established that subject imports had grown to 28.1% of the import market in the 9-month period to September 2021, thus exceeding any negligibility criteria set out in the legislation[8] which may otherwise have resulted in a possible early termination of the investigation. .

Which products have been identified as “subject imports”

This investigation covers lemon juice used for further manufacture, and generally used as an ingredient in other products; lemon juice typically sold in retail size containers for non-industrial use is excluded. Subject goods are described more narrowly as lemon juice with or without the addition of preservatives, sugar or other sweeteners, regardless of the citric acid concentration, brix level, brix/acid ratio, pulp content, clarity, grade, horticulture method (for example whether organic or not), its processed form (for example whether frozen or reconstituted from concentrate), packaging method, and so forth. Also included is lemon juice that is blended with lemon juice from sources that are not subject to the investigation; only the component of this blended merchandise that originates in South Africa and Brazil is covered by the investigation.

South Africa’s exports of ‘subject goods’ to the U.S.

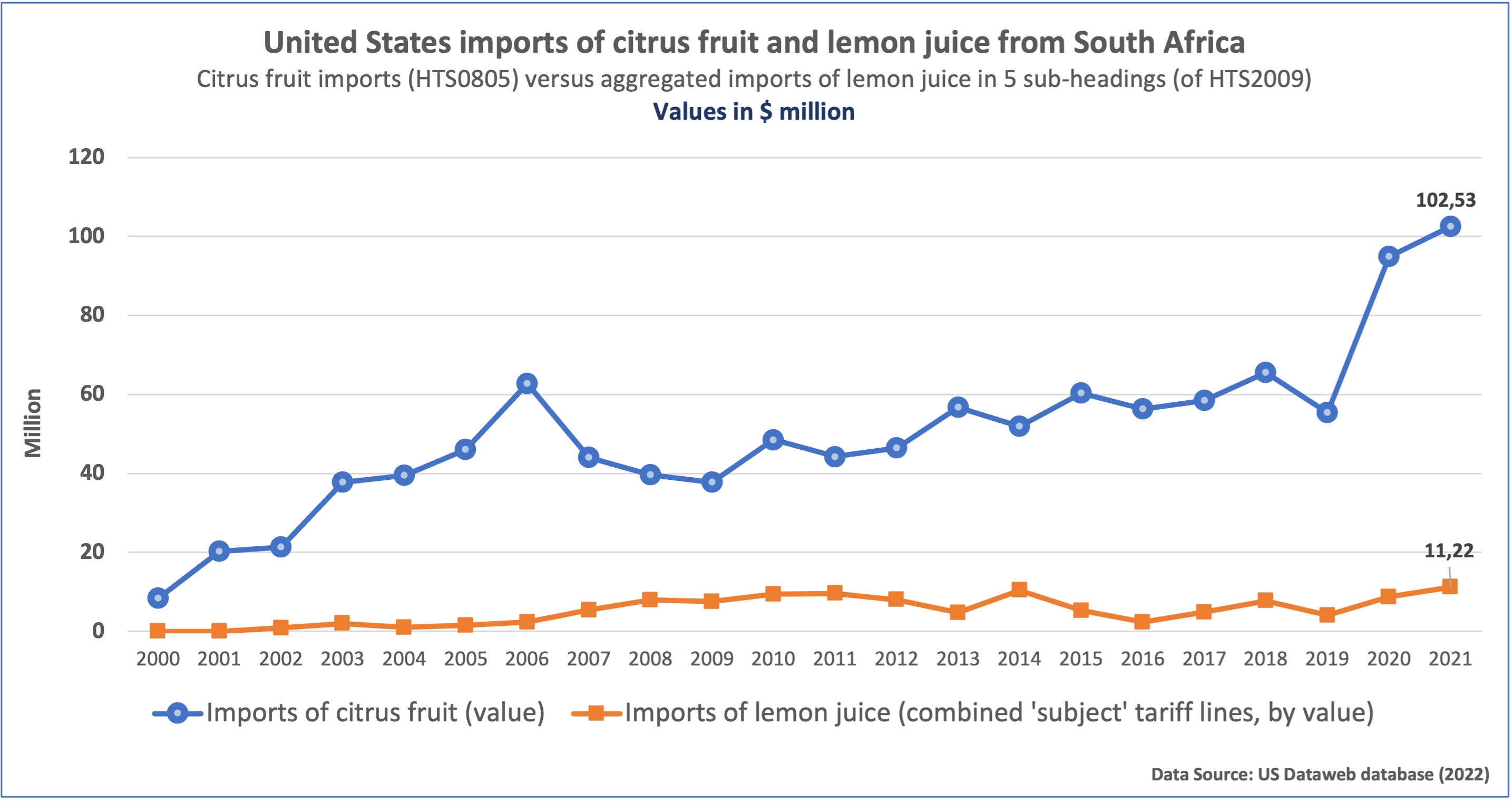

South Africa’s citrus exports to the U.S. achieved an all-time high in 2021; this applies to both the main category (citrus fruit classified under HTS 0805 – $103m) as well as to lemon juice ($11m). See the chart below. Despite the recent rise in lemon juice exports, this does however remain in the broad ballpark of exports over the past decade, notwithstanding a notable dip in the mid-2010s and again in 2019, just prior to the current period under investigation.

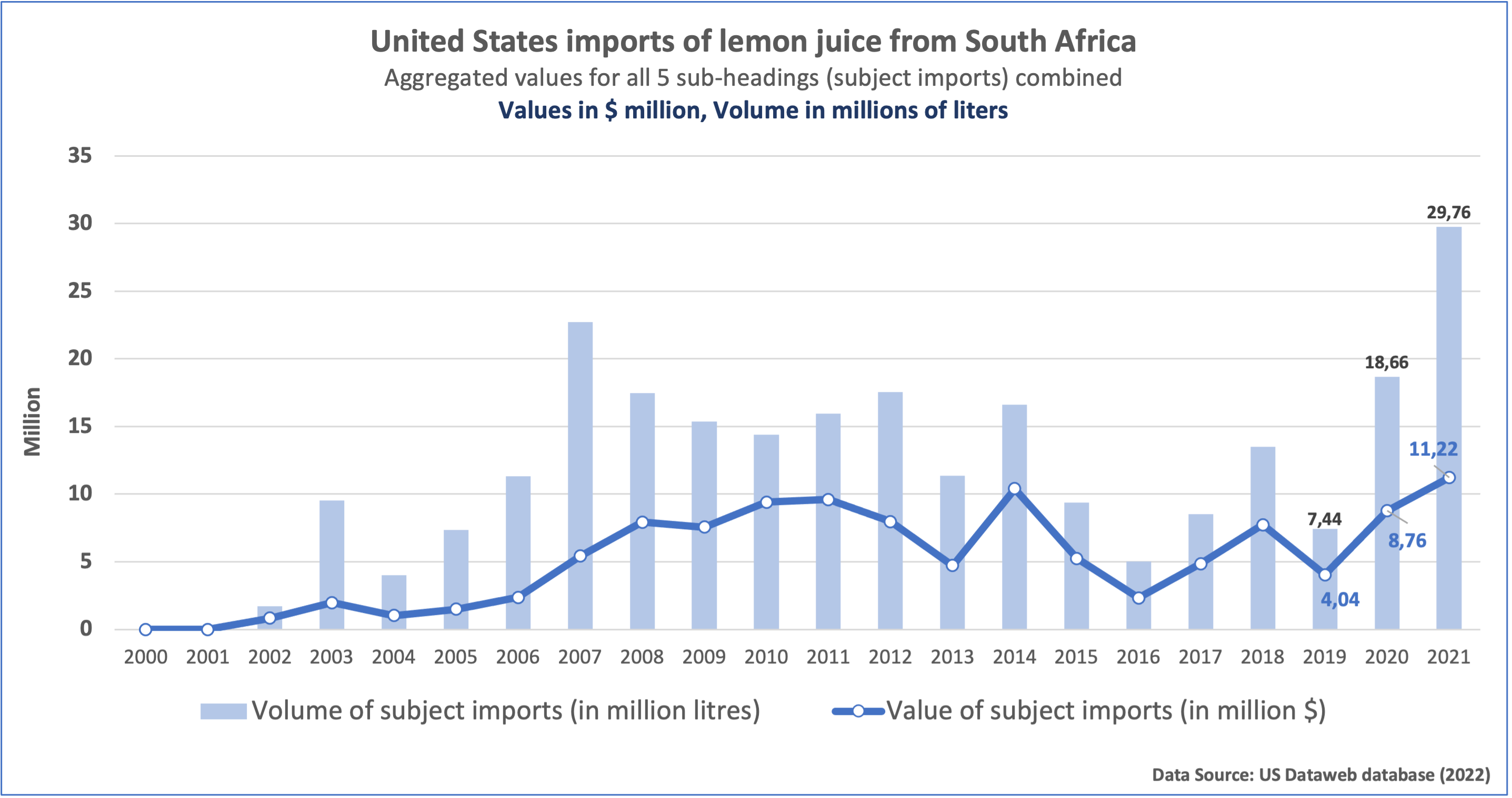

The U.S. investigation looks at the value and volume of lemon juice imported from South Africa, since both are elements in the assessment of average unit values and import market share. The following chart plots lemon juice imports in the subject tariff lines. Over the past two decades, the value and volume of U.S. imports from South Africa have broadly moved in a correlated way, albeit with exceptions. For example, in the 2011-2012 period, the volume increased while the overall value of shipments decreased. However, one should be cautious before drawing any firm conclusions, not least because other variables may be having a significant impact on these values, for example currency movements (a depreciation in the South African exchange rate versus the US $ would lower the nominal value of U.S. imports at each volume level) while input cost changes, harvest size and external (even global) competitive factors may also have an impact on selling prices.

During the most recent period, the trade data shows that U.S. imports of lemon juice rose rapidly in volume terms from 7.4m liters (2019) to 29.8m liters (2021) while the value of imports increased from $4m (2019) to $11.2m (2021). This roughly equals a fourfold increase in volume and a three-fold increase in value (U.S. $) and suggests a significant decline in unit values over this period.

In terms of U.S. import market share, the USITC’s preliminary investigation made certain findings with respect to subject imports:

AGOA status of ‘subject’ goods

U.S. importers sourcing South African-made lemon juice in the subject tariff lines are able to obtain these on a duty-free basis by virtue of South Africa’s AGOA eligibility status and each of these tariff lines qualifying for AGOA preferences[9]. This makes the product more competitive in the U.S. market relative to other countries’ goods, and avoids standard import tariffs of up to 7.9%. Products from Brazil would be subject to the standard U.S. import duties. U.S. importers of South African lemon juice actively utilize these preferences and have cleared 98% of South Africa-sourced lemon juice under AGOA since the preference program’s inception.

Outcome of the investigation so far

The U.S. anti-dumping investigation moved past the first substantial stage following the preliminary outcome announced by the USITC in February 2022, where the agency found there is a reasonable indication that the U.S. industry “is materially injured by reason of imports of lemon juice from Brazil and South Africa… that are alleged to be sold in the United States at less than fair value (“LTFV”)”[10]. The Commissioners were unanimous in this preliminary finding. The investigation reviewed the underlying legal standards, the competitive environment and business cycles of lemon juice production and trade, the volume and value of imports and price effects of subject imports, and other factors.

[1] Ventura Coastal LLC. Company website: https://www.venturacoastal.com

[2] United States Code. Selling at less than fair value is defined in the US legislation at 19 U.S.C. § 1677(34). https://www.law.cornell.edu/uscode/text/19/1677

[3] Federal Register (2022). Department of Commerce, International Trade Division. Lemon Juice from Brazil and South Africa: Initiation of Less-Than-Fair-Value Investigations. Vol. 87, No. 16.

[4] United States Code. 19 U.S.C. § 1677(7)(A). https://www.law.cornell.edu/uscode/text/19/1677

[5] United States Tariff Act (1930). 19 U.S. Code Chapter 4. https://www.law.cornell.edu/uscode/text/19/chapter-4

[6] See footnote 3 above.

[7] USITC (2022). Investigation Nos. 731-TA-1578-1579 (Preliminary). Federal Register Notice https://www.usitc.gov/secretary/fed_reg_notices/701_731/731_1578_notice_02152022sgl.pdf

[8] United States Code. 19 U.S.C. § 1677(24). https://www.law.cornell.edu/uscode/text/19/1677

[9] AGOA.info. AGOA product database tool. https://agoa.info/about-agoa/products.html

[10] See footnote 7 above.

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...