Blog

Update on the Preferential Tariff Rate Quota Utilisation under the EU-SADC EPA

EU-SADC EPA a boost from the TDCA for South Africa

The Economic Partnership Agreement (EPA) between the European Union (EU) and the Southern African Development Community (SADC) EPA countries entered into force on 10 October 2016. South Africa is part of the SADC EPA group of countries along with Botswana, Eswatini, Lesotho, Namibia, and Mozambique. All SADC EPA countries excluding South Africa receive Duty Free Quota Free (DFQF) access for their exports to the EU. For South Africa, the EU has fully or partially removed custom duties for South African exports (except aluminium and some agricultural products) under EPA.

In comparison with the Trade, Development and Cooperation Agreement (TDCA) which previously governed the trading relationship between South Africa and the EU, the EPA brings significant changes to the provisions on trade and trade-related matters, new areas of cooperation, including sustainable development and tax governance, and dispute settlement provisions. EPA specifies rules of origin (RoO) to be met for the products to obtain preferential access. EPA provides for trade remedies to deal with unfair trade and allows for safeguards to increase import duties after following due process when import surges cause disturbances or injury in the domestic market[i].

The EU an important market for SADC EPA States

The significance of the EU as an export destination for SADC EPA countries cannot be over emphasised. As noted, five of the SADC EPA countries with exception of South Africa have duty free quota free access (DFQF) to the EU. In 2020 the SADC EPA countries’ combined exports were over US$ 100 billion which on average is about 20% share of their total exports to the world. Mozambique, South Africa, and Botswana’s exports to the EU each account for more than 20% share of their total exports to the world, while Lesotho and Namibia’s EU exports each account for more than 15% of total world exports. Only Eswatini’s EU exports are less than 10% of its total world exports. The products exported are diverse, albeit mostly primary based agricultural and mineral products, with South Africa exporting some manufactured products to the EU.

Table 1: SADC EPA countries 2020 trade with World and the EU

|

Country |

2020 World Exports (USD billions) |

2020 EU Exports (USD billions) |

% share of World (2020) |

|

Botswana

|

4.30

|

0.90

|

22.00%

|

|

Eswatini

|

2.00

|

0.10

|

6.00%

|

|

Lesotho

|

0.60

|

0.10

|

18.00%

|

|

Mozambique

|

3.50

|

1.20

|

36.00%

|

|

Namibia

|

5.40

|

1.00

|

19.00%

|

|

South Africa

|

85.70

|

20.90

|

24.00%

|

Source: ITC TradeMap

Tariff Rate Quota preferences not fully utilised

Certain products originating from South Africa are eligible for a preferential tariff-rate quota (TRQ) under the SADC-EU EPA. A TRQ establishes a tariff preference for a specific volume of imports of a particular product that can enter a market duty-free; when this quota is fully allocated, a tariff will apply to further imports. South African products eligible for TRQ access into the EU include citrus jams and juices, sugar, wine, and canned fruits.

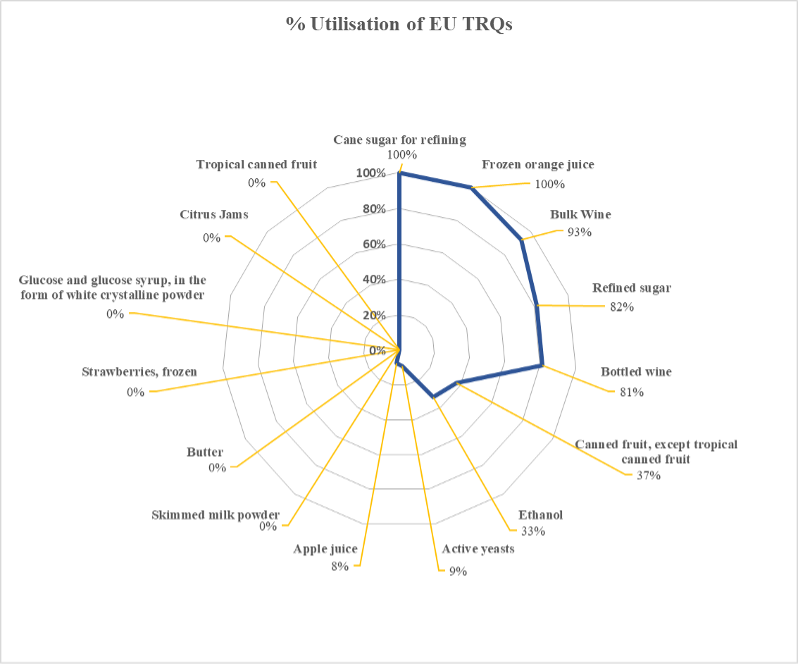

Figure 1: Illustration of TRQ utilisation (2020)

Source: EC Taric Database

Since the 2016, South Africa has not fully utilised the annual TRQ’s for most products, while exports of these albeit exporting to other countries. Sugar, Wine and Frozen Orange Juice have benefitted significantly since the EPA came into force. Prior to EPA, exports of refined sugar from South Africa were non-existent. Wine exports have benefited from increased quota volumes. Full utilisation of TRQ for wine was affected by the disruption of trade in alcoholic products due to the COVID-19 lockdown restrictions which saw the ban in trade and distribution of alcoholic product. Despite the disruptions in 2020, South Africa managed to export 31.8 million litres (93% TRQ allocation) of bulk wine and 64.8 million litres (81% of TRQ allocation) within a 6-month period. In previous years, South Africa has managed to fully utilise its wine TRQ allocations (see table 2).

Despite producing for export, South Africa has failed to export goods such as citrus jams, tropical canned fruit, and strawberries, among others, under the TRQs. This is attributed to, among other things, a failure to process relevant applications at the national level[ii]. See further discussion below.

Table 2: Summary of South Africa TRQ Utilisation by quantities (2020)

|

Product |

TRQ Allocated |

Unit |

TRQ Utilised |

Balance |

% Utilisation |

|

Cane sugar for refining

|

100,000,000

|

Kilograms

|

100,000,000

|

-

|

100%

|

|

Frozen orange juice

|

1,120,000

|

Kilograms

|

1,120,000

|

-

|

100%

|

|

Bulk wine

|

34,270,800

|

Litres

|

31,824,215

|

2,446,585

|

93%

|

|

Refined sugar

|

50,000,000

|

Kilograms

|

40,834,500

|

9,165,500

|

82%

|

|

Bottled wine

|

79,965,200

|

Litres

|

64,839,464

|

15,125,736

|

81%

|

|

Canned fruit, except tropical canned fruit

|

57,156,000

|

Kilograms

|

21,306,938

|

35,849,062

|

37%

|

|

Ethanol

|

80,000,000

|

Kilograms

|

26,244,402

|

53,755,598

|

33%

|

|

Active yeasts

|

350,000

|

Kilograms

|

31,500

|

318,500

|

9%

|

|

Apple juice

|

3,946,000

|

Kilograms

|

299,368

|

3,646,632

|

8%

|

|

Skimmed milk powder

|

500,000

|

Kilograms

|

-

|

500,000

|

0%

|

|

Butter

|

500,000

|

Kilograms

|

-

|

500,000

|

0%

|

|

Strawberries, frozen

|

407,500

|

Kilograms

|

-

|

407,500

|

0%

|

|

Glucose and glucose syrup, in the form of…

|

500,000

|

Kilograms

|

-

|

500,000

|

0%

|

|

Citrus jams

|

100,000

|

Kilograms

|

-

|

100,000

|

0%

|

|

Tropical canned fruit

|

3,200,000

|

Kilograms

|

-

|

3,200,000

|

0%

|

Source: EC Taric Database

What of reciprocity?

It is important to note that the EPAs are built upon the principle of reciprocal trade liberalisation in which not only the EU opens its markets, but African countries also open their domestic markets for imports originating in the EU. Under the EU-SADC EPA, the EU face TRQs for export to the Southern Africa Customs Union (SACU) on eight agricultural products and there is no preference on some products, while others were given a margin of preference.

EU products eligible for TRQ access into SACU include wheat, cheese, pork, and cereals. While the TRQs apply to all SACU countries, most imports are directed to South Africa, which accounts on average for about 70% of all imported goods under the SACU TRQ allocation.

|

Product |

Preferential tariff |

SACU Allocation |

South Africa Allocation |

RSA % share |

|

Cheese

|

0%

|

8,150

|

5,705

|

70%

|

|

Pig fat

|

0%

|

200

|

140

|

70%

|

|

Butter

|

< 75% MFN

|

500

|

350

|

70%

|

|

Wheat & Meslin

|

0%

|

300,000

|

251,495

|

84%

|

|

Barley

|

0%

|

10,000

|

8,970

|

90%

|

|

Cereal based food preparations

|

< 25% MFN

|

2,300

|

1,160

|

70%

|

|

Pork

|

< 75% MFN

|

1,500

|

1,250

|

83%

|

|

Ice cream

|

< 50% MFN

|

150

|

105

|

70%

|

|

Mortadella Bologna

|

0%

|

100

|

70

|

70%

|

Source: South Africa Department of Agriculture Fisheries and Forestry (DAFF)

A look at the EU’s market access into SACU and more specifically into South Africa, reveals that apart from South Africa’s imports of Cheese; Pig Fat; Wheat & Meslin and Pork, which for the past 5 years were near to, or full utilisation of the TRQ, the rest of the products on the list are not traded at all, or trade is limited (e.g., butter).

Capitalising on opportunities the EU-SADC EPA post COVID-19

Since the EU – SADC EPA came into force, uptake of TRQs for some of the products has been weak. Several reasons have been highlighted including that:

-

some smallholder producers lack the knowledge and technical capacity to access domestic markets, let alone exploit the trade opportunities offered under the EPA;

-

the South African Department of Agriculture, Forestry, and Fisheries (DAFF) is hampered by capacity constraints in promoting understanding of the EPA’s implications.

Trade promotion agencies have an important role in providing information and promoting uptake of trade opportunities offered by the EPAs. Business organisations scan also play a role to provide information and training to their constituencies on the benefits of the EPAs. COVID-19 has seriously disrupted business and trade, making support especially to small scale enterprises even more important. This should include support to develop digital capabilities to manage production and access to trade opportunities.

[i] Viljoen, W. 2017. From the TDCA to the SADC-EU EPA – the significant changes, Discussion Note, tralac, Stellenbosch. [online]: https://www.tralac.org/blog/article/12514-from-the-tdca-to-the-sadc-eu-epa-the-significant-changes.html

[ii] Tofa, M. Patterson, M. 2018. South Africa, the SADC, Economic Partnership Agreement, and Regional Integration in Southern Africa, Centre for Conflict Resolution, Cape Town. [online]: https://media.africaportal.org/documents/CCR_Policy_Brief_42_-_Final_Web_Version.pdf

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...