Blog

Trade remedies and trade disputes: the case of the US-EU large aircraft dispute, and how these disputes can offer opportunities for South Africa’s wine exports to the United States

One of the primary intentions of WTO laws is to create a more even and fair playing field with respect to trade between WTO member states, and to ensure that trade takes place on a generally non-discriminatory basis. There are of course certain exceptions to this general principle, for example where countries maintain a special preferential trade arrangement amongst themselves that covers essentially all trade, or where trade is covered by a non-reciprocal arrangement such as the Generalised System of Preferences (GSP).

This article discusses some of the links between international trade disputes (the case between the United States and the EU involving large civil aircraft), and potential impacts and opportunities for businesses not only in the countries directly involved, but in third countries, such as South Africa. Specifically, wine trade from affected countries following the imposition of trade remedies is used as an illustrative example, along with potential opportunities for South Africa’s wine exports to the US.

While most countries broadly aspire to free trade, the potential benefits from trade sometimes induce situations where governments support specific domestic industries to encourage exports (or to better enable them to compete with imports), to help develop national industries of strategic importance, to encourage economies of scale, for purposes of national prestige, or a host of other reasons. This can put countries in conflict with WTO rules and trigger trade disputes, and potentially result in WTO-sanctioned outcomes that allow countries to invoke a range of trade remedies. Such trade remedies, usually in the form of special import duties, can be against the exports from one (or more) specific country, against the exports of identified exporters in another country, or more generally against imports of a certain product following a surge in imports.

It is important to distinguish that safeguards involve measures that are implemented against imports of a product from all countries (i.e. relate to a country’s global imports), anti-dumping duties against the country from which the affected goods came, while countervailing action – as is the case with the large civil aircraft dispute – involves ‘punitive’ measures that can be taken against unrelated industries (i.e. exports from another country), usually in the form of special additional tariffs or quotas, following prohibited or actionable subsidies provided by another country.

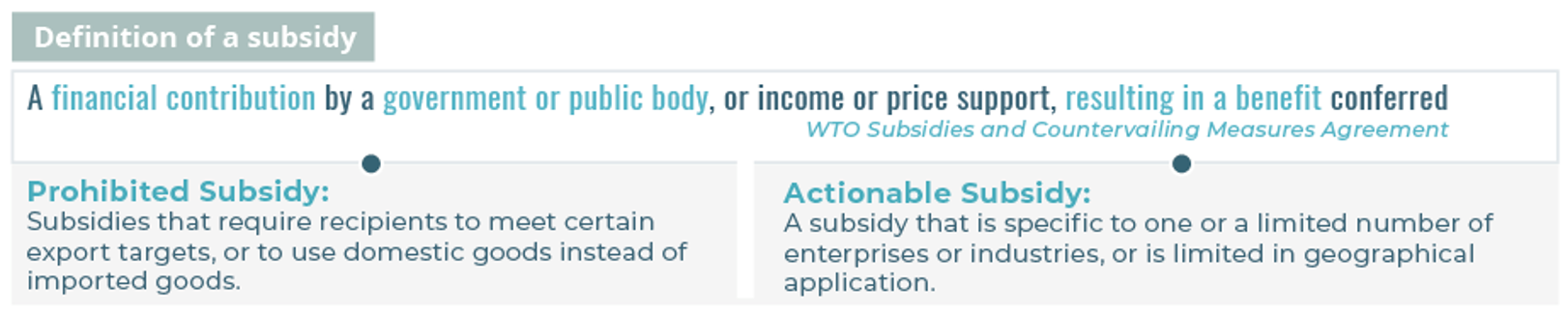

Countries can act on subsidies paid in another country that are ‘specific’. A specific subsidy is one that results in a distorted resource allocation and is specifically provided to an enterprise, or industry, or a group of enterprises or industries. However, subsidies that are commonly and widely available to a country’s economy are not ‘specific’ and do not distort normal resource allocation and are therefore not included in the WTO’s Subsidies and Countervailing Measures (SCM) Agreement principles.

A subsidy must meet three criteria:

-

there must be a financial contribution,

-

the contribution must be by a government or public body, and

-

involve income or price support that results in a benefit being conferred.

Prohibited subsidies are dependent on certain conditions such as export or local content targets, while actionable subsidies are specific to a firm or sector or otherwise limited in their geographic application, and can be challenged through the WTO and potentially result in penalties (additional tariffs etc.). Such countervailing action will often impact trade in unrelated sectors, not only between the countries concerned but potentially also with third countries who may not be a party to the dispute or target of any remedial action.

Broad timeline of the large civil aircraft dispute and link to countervailing measures

Competition between Boeing and Airbus has been intense for decades. Boeing, the older of the two companies was founded in the US State of Washington in 1916, while Airbus was formed out of a consortium of European aviation companies in 1970, based mainly in France and Germany, as well as Spain and the UK. At the heart of the dispute lies launch aid and special financing and infrastructure-related measures for Airbus[1] companies, and State-level and national government aid to Boeing[2] respectively. These measures formed the basis of the disputes raised formally through the WTO in 2004; the EU and US both notified their own disputes in that year. A discussion on the various aspects and milestone underlying the dispute is beyond the scope of this article, suffice to say that these related disputes underwent more than 15 years of processing, panel reports, interim outcomes and provisional remedial action, compliance panel reviews, mediation and appeals, culminating in separate findings that ruled favourably on significant aspects of the merits of the respective cases.

On the Airbus matter, arbitration proceedings concluded in October 2019 and validated the US claim for $7.5 billion in annual countermeasures against its imports from the EU. Later in 2020, on the Boeing subsidies matter, countermeasures covering trade worth just under $4 billion were given the green light. In both cases, as is custom, the ‘awards’ to the parties were in the form of a ‘suspension’ of certain of their GATT concessions – thus a permitted deviation from MFN principles – that would allow the parties to raise additional duties on each others’ trade in products and sectors of their choosing. Both parties began raising special duties against the other. On 18 October 2019, the US imposed special tariffs of 10% on imports from the EU of non-military aircraft (this was later increased) and 25% on a wide range of consumer goods. It must be noted that these duties are additional to any MFN duties already in place, and were allowed to go beyond their bound tariffs notified to the WTO. The EU followed suit in 2020 and on 10 November raised additional ad valorem tariffs of 10-25% on certain imports from the US.

Impact on third countries and link to possible opportunities for South African wine exports

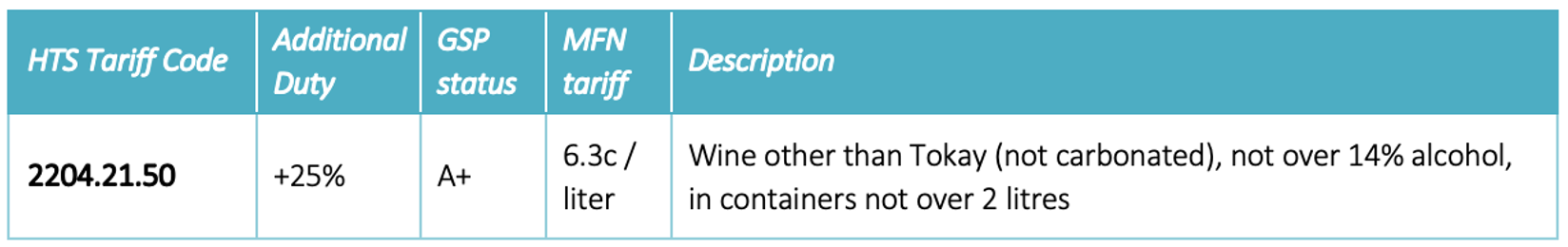

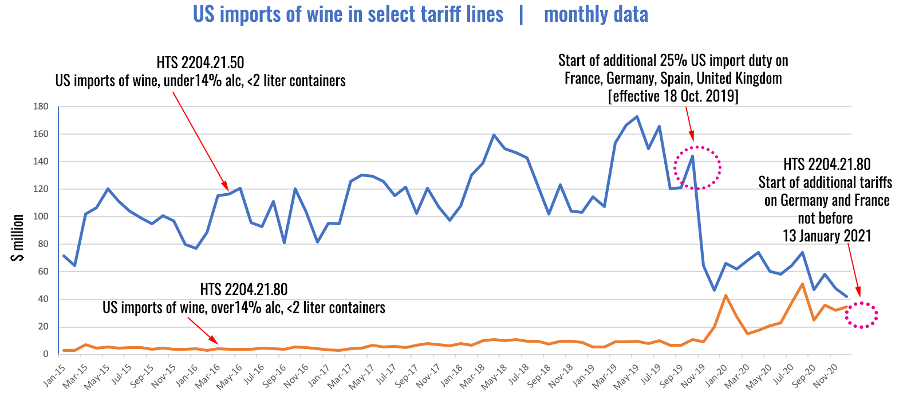

US countermeasures on EU-originating trade covered a somewhat eclectic mix of industrial and consumer goods, from kitchen implements (such as steel knives) to coffee, scotch whisky, seafood, pork cuts, cured hams, olives and oil, cheese and wine. Initially only one category of wine (HTS 2204.21.50) was ‘penalised’: European wine containing not over 14% by volume of alcohol and in containers of not over 2 liters became subject to additional 25% duties. Notably, this applied only to wine imports from France, Germany, Spain and the UK (given the countries’ links to the actionable subsidies); in January 2021 the same additional tariff was imposed on another dozen wine tariff lines, including wine containing over 14% alcohol, and wine in larger containers.

The major increase in the landed cost of wine predictably led to the major decline in US imports within this specific tariff line. Imports from the affected source countries (France -53%, Germany -33%, Spain -58% and the UK -98%) were substantially lower in 2020 than compared to the previous year, resulting in a cumulative decrease in US imports within this tariff line of 21% to $3.2 billion. Interestingly, after duties were imposed on European (<14% alcohol) wine, US imports in the >14% alcohol category increased substantially immediately after (orange line in chart above). This could suggest a rapid change in buyer or consumer preference to higher-alcohol wine from the affected supplier countries, or be the result of other factors, possibly even tariff (mis)classification issues, which remains a widespread international problem.

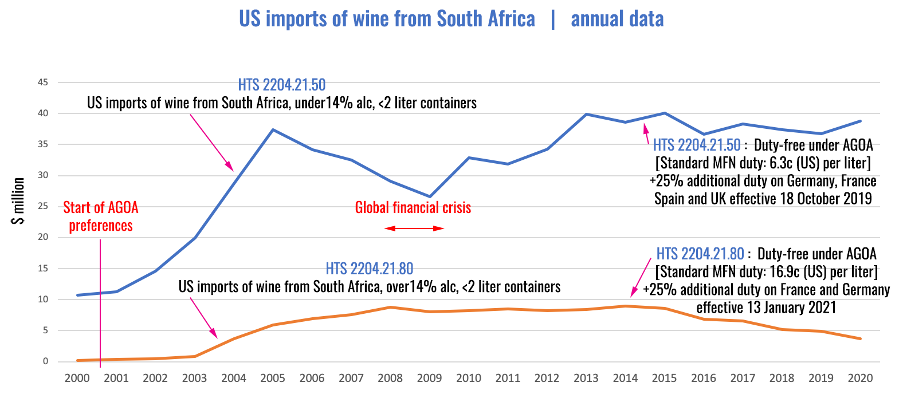

Overall global imports in this wine category, when excluding the four affected countries, remained virtually unchanged. Imports from South Africa show an increase of 5.5% by value, albeit off a much smaller base: in 2019, prior to the full impact of new tariffs on EU exports, US imports from South Africa in this wine tariff line were only 3% of those from France, the leading European supplier after Italy. South Africa is (only) ranked as the 10th largest supplier of wine to the US (within this tariff) line over the past few years, with US imports valued at $39m in 2020.

(Underutilised) opportunities for South Africa?

The relatively small increase by value in imports from South Africa in the wine category directly impacted by trade remedies is shaded when compared to, for example, the ‘performance’ from other smaller new world wine producing countries. New Zealand, which at 3hl produces only approximately one third of the volume of wine that South Africa does, increased its exports to the US in the tariff-impacted category by over 6% to $415m in 2020, albeit off a much higher base: US imports from New Zealand in this category exceed imports from South Africa by a factor of more than 10. Additionally, New Zealand trades with the US under MFN tariffs compared to South Africa which enjoys duty-free access to the US market under AGOA. South Africa still accounts for a relatively small share of the US import market, in both the =<14% and >14%, 2 litre containers or less tariff lines (HTS 2204.21.50 and HTS 2204.21.80 respectively), where South Africa’s share of the US import market was 1.2% and 0.5% respectively during 2020. This is notwithstanding the fact that South Africa is consistently one of the top 10 wine producers globally. South Africa has the added advantage of duty-free access to the US market under the African Growth and Opportunity Act (AGOA), the US’ non-reciprocal preferential market access laws for qualifying imports from Sub-Saharan African countries. The apparent nominal mismatch between South Africa’s national wine production, and exports to the US in spite of duty-free market access, suggests that South Africa continues to ‘box below its weight class’.

Reference to New Zealand was made, but the contrast with a country such as Italy is even more stark: Italy accounts for a wine production volume that is 5 to 6 times that of South Africa’s, but the US imports more than 30 times (by value) within the HTS2204.21.50 category from Italy under normal tariff relations, compared with its purchases of South African wine. The US remains the world’s largest consumer market, with wine consumption far exceeding national production (33hl in 2018 versus 23.9hl)[3] which represents an obvious ‘mismatch’ between the two variables, and excess demand (for imported wine). The US has furthermore increased its national wine consumption in recent years.

Concluding remarks

Trade and political tensions, and international disputes that lead to WTO-sanctioned (and often unsanctioned) remedies and actions, can have numerous intended and unintended consequences not only for the countries involved, but for businesses in uninvolved third countries. When countervailing duties are used to ‘penalise’ another country’s exports then this need not relate to the sector at the heart of a dispute; such remedies are often applied in a strategic manner and on unrelated products and sectors, clearly in order to use maximum economic (and political) leverage and extract maximum advantage. In other words, countries will apply pressure in areas where it hurts, for example to politically sensitive sectors in the target country, or sectors where local competing producers would benefit from a temporary “boost” in protection from imports. Invariably, these measures impact trade between the ‘disputing’ countries, but can also significantly impact third countries.

The dramatic drop in US imports of wine in the affected wine tariff lines from certain European countries suggests that this could be expected to pave the way for a potential increase in wine imports from other alternative supplier countries; this is supported by some of the data, notwithstanding difficult economic and trading conditions in 2020 as a result of Covid-19. While wine is not a straightforward generic product where wine produced in one country is simply substitutable by wine made locally in the US or sourced from other supplier countries, punitive tariffs against the leading foreign supplier countries of wine to the US will undoubtedly have a significant impact on demand. And herein lies opportunity for a wine-producing country such as South Africa that can compete in terms of price, quality, and the overall value proposition.

The trade data does not suggest that South Africa has fully embraced these new (and old) opportunities, despite the fact that – on the whole – the country appears to have had a nominally fairly successful year in terms of resilient export performance overall, even though the year-on-year growth has been in the bulk-wine category. South African wine exports to the US, in terms of landed US$ value, have remained fairly static in recent years notwithstanding the fact that South African producers enjoy duty-free access to the US market as a result of AGOA. This preference arrangement places South African exporters on a similar footing as those countries with which the US has a fully-fledged bilateral trade agreement, and waives the duties otherwise faced by (competing) European producers and many other WTO Member States. The reported overall doubling of wine exports (by volume) from South Africa to the US during the March 2020 - February 2021 period is due to a large increase in bulk wine exports, while packaged wine exports declined slightly.

International trade is complex, technical, time-consuming and highly competitive, and often involves significant planning and lead times, which means that many factors can impact on the decisions of consumers and importers to purchase or source certain wine from a specific country. This includes country and industry reputation as a whole, brand and individual producer recognition, logistical considerations, differentiated products that can outcompete others on the shelf, certification, packaging and labeling, trade show presence, getting onto buyer and agency lists, performance in reputable wine competitions and favourable ratings from international wine critics and many other factors all play some role. Nevertheless, there is little doubt that South African can hold its own amongst the best in the world, and that it is not the inherent quality of output that constrains South African wine exports.

Active monitoring of these international trade developments, whether they play out at the multilateral WTO level or bilaterally outside of WTO disciplines, should – if not already the case – form an important part of the strategic planning by wine producers, exporters and related industry bodies. The US-EU trade dispute and related action against wine is not the only current example: for example, trade tensions between China and Australia have been escalating recently, and China imposed special duties of 107% - 212% on Australian wine imports from 28 November 2020 following alleged subsidies paid to Australian producers, leading to an almost immediate stop in wine trade (despite the fact that the two countries have a trade agreement which removed tariffs on wine). This has impacts on bilateral trade but is also likely to offer opportunities to other exporters. Wine exports to China represented only 3% of South Africa’s global total in 2020.

The capacity and flexibility to respond rapidly to such developments, also as part of any sector development and export strategy, remains important. In March 2020, the EU[4] and US[5] jointly issued statements temporarily suspending – for a period of 4 months – their respective trade remedies against one another amid further attempts to resolve the matter and agree on permissible industry support measures for their aircraft sectors going forward. But, in a sign of how the possible settlement of one trade dispute has little to no bearing on the next one, proposed digital services taxes (DST) remain a contentious issue between the parties and the US on 31 March proposed[6] additional punitive duties on UK consumer goods as a result (this will however have less bearing on the South African wine).

While sustainable business development in one country cannot rely on the “pain” brought about by the consequences of international trade disputes faced by the sector elsewhere, these issues can often be important business opportunities especially for a sector facing as much competitive pressure as the wine sector. Even temporary “windfall” competitiveness can play a critical role in boosting exports and in creating new markets.

[1] WTO (date unknown). ‘EC and certain Member States – Large Civil Aircraft (DS316). Summary https://www.wto.org/english/tratop_e/dispu_e/cases_e/1pagesum_e/ds316sum_e.pdf

[2] WTO. DS317: United States — Measures Affecting Trade in Large Civil Aircraft https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds317_e.htm

[3] OIV (2019). International Organisation of Vine and Wine Intergovernmental Organisation. 2019 Statistical Report on World Viniviticulture [Internet:] https://www.oiv.int/public/medias/6782/oiv-2019-statistical-report-on-world-vitiviniculture.pdf

[4] European Commission (2021). EU and U.S. agree to suspend all tariffs linked to the Airbus and Boeing disputes [Internet:] https://ec.europa.eu/commission/presscorner/detail/en/IP_21_1047

[5] USTR (2021). Joint Statement of the European Union and the United States on the Large Civil Aircraft WTO Disputes [Internet:] https://ustr.gov/about-us/policy-offices/press-office/press-releases/2021/march/joint-statement-european-union-and-united-states-large-civil-aircraft-wto-disputes

[6] Federal Register (2021). Section 301 Investigation [Internet:] https://ustr.gov/sites/default/files/enforcement/301Investigations/Proposted_Action_UK_FRN_March.pdf

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...