Blog

COVID-19 – implications for SEZ in Africa: lessons from Rwanda

COVID-19’s dire short-term economic consequences have the potential to act as a catalyst for much needed change for SEZs across Africa.

Many marginal Special Economic Zones (SEZ) programs, which were already underutilized prior to the pandemic, may fail. This will create room for new and better projects with a focus on knowledge transfer and long-term investment.

The World Trade Organisation (WTO) expects world trade to fall by 13-32% in 2020. Statistics from the International Monetary Fund’s (IMF) World Economic Outlook Database suggest that Africa’s exports represent an estimated 2.6% of total world exports in 2018.

According to this data, this would mean a 2020 loss of export earnings for the African continent of more than $500 billion.[1]

Additionally, logistics bottlenecks related to lockdowns and quarantines have significantly increased the costs of doing business in Africa.

Large economies such as South Africa and Nigeria will suffer the most from this chokepoint in trade competitiveness. Certain growing economies, such as Rwanda and others, may successfully use SEZs to benefit from COVID-19.

African economies dependent on international Foreign Direct Investment (FDI) flow will have to now rely on their local neighbours for trade.

A combination of factors will cause international FDI flows to continue slowing down. COVID-19, commodity and tariff trade wars, as well as US military withdrawal worldwide will decrease international trade.[2]

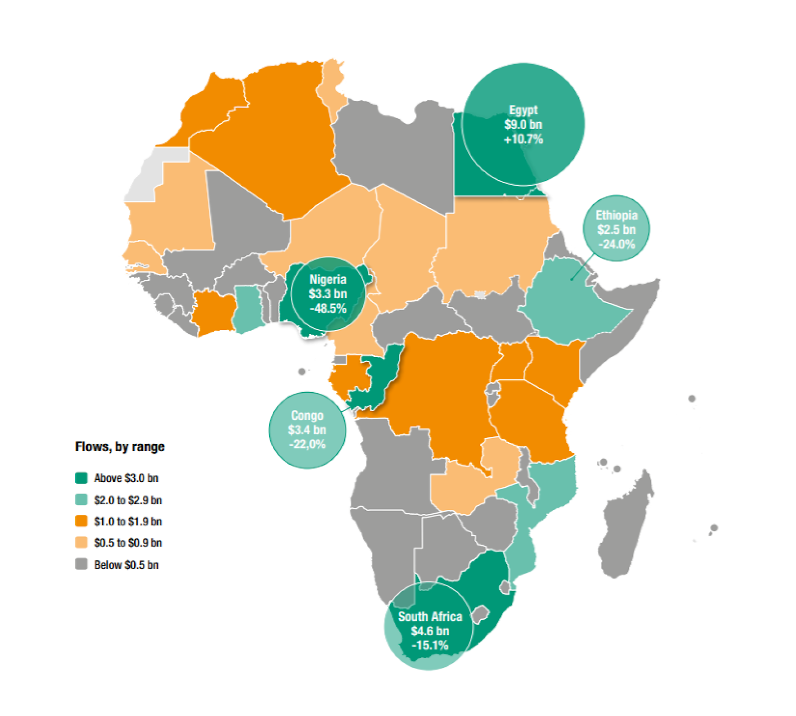

UNCTAD’s report outlines that 2019 was one of the worst years for African FDI in the past 15 years. View source.

This is problematic because intra-regional trade among African countries only accounts for 17% of total trade in the continent.[3]

The overall level of infrastructural connectivity among African countries is often inferior to their respective connectivity with cross-oceanic neighbours: sending a 20-foot shipping container from Shanghai to Mombasa by sea costs just over $500. Sending the same container from Mombasa to Kigali costs more than $3000.[4]

The African Continental Free Trade Agreement (AfCFTA)

Some see a silver lining in the African Continental Free Trade Area (AfCFTA), a continent-wide free-trade area which is the largest in the world in terms of the number of participating countries since the formation of the WTO.[5]

The AfCFTA does not provide for any restrictions on SEZ-style ‘state-aid programs’ by State Parties. This is very different from, for example, the situation in the European Union (EU). The establishment of SEZs in the EU has to be in line with the State aid rules outlined in EU Council Regulation 2015/1588, EU Council Regulation 2015/1589, and the General Block Exemption Regulations (GBER).[6]

The AfCFTA has no such restrictions written into its founding document.[7]

Furthermore, the AfCFTA advocates the creation and deepening of SEZ policy in all its State Parties to boost intra-African trade. A consensus model is expected to be agreed in AfCFTA discussions, where members pool resources and best practices to maximize the comparative advantage of each member country’s zone programs.

This leads to spirits being high as many of Africa’s up-and-coming countries are projecting bold development programs for the coming decade. Below is an examination of the example zone for Africa’s industrialization and move into the 21st century: Rwanda’s Kigali SEZ.[8]

Kigali SEZ: Follow the Leader

In April 2000, Paul Kagame became President of Rwanda. Formerly a military commander in the RFP during the civil war, Kagame’s administration began implementing several ambitious reforms including a new constitution, and a flagship Vision 2020 plan.

Kagame’s reforms laid the groundwork for the use of Special Economic Zones throughout the country, culminating in the SEZ Law of 2011. According to the World Bank’s Ease of Doing Business indicators, Rwanda has quickly jumped to 29th in the world, with Mauritius being the only African country with a higher ranking.

Pictured: Kigali SEZ hosts a campus for Carnegie Mellon University, among over 40 other firms.

As a comparison, Rwanda’s Ease of Doing Business score surpasses that of highly developed countries such as Japan and Switzerland. Kagame has gone on record to say that he wishes Rwanda to become the “Singapore of Africa”, a stable gateway for trade with the entire continent.[9]

On October 7th, 2019, the very first smartphone manufacturing plant on the African continent began operations. This new facility, operated by a subsidiary of Mara Group, sources all its materials from around Africa, and manufactures the phones from the motherboards all the way to the packaging.

Despite the gravity of this development and its pan-African significance, the factory is not set up in a large city such as Johannesburg, Lagos, or Nairobi. Instead, Africa’s first full smartphone plant was built in Rwanda, within the Kigali Special Economic Zone.[10]

The zone is operated as a public-private partnership in cooperation with Prime Economic Zones (PEZ) a Rwandan firm designated as the operator of KSEZ. After signing a contract with PEZ, zone tenants submit designs through templates provided by PEZ. After submission, the investor’s project has to be examined and approved by the Special Economic Zone Authority of Rwanda (SEZAR) before being granted a construction permit. SEZAR is housed within the overall authority of the Rwanda Development Board (RDB).

The core function of the RDB is to operate as a “one stop shop” for all of Rwanda’s business, regulatory and legal procedures, both inside and outside of the SEZs. Registering a company, obtaining a visa or work permit, or applying for land within an SEZ, are all done through the RDB.

The Rwandan Irembo system is a digital portal for all government services in Rwanda – it offers services ranging from paying taxes and registering companies, to driving tests and entry passes to national parks.

Since its inception, the Board appears to have focused heavily on streamlining these regulatory procedures for ease of use. Links to a more extensive account of RDB’s services can be found here and here.[11]

In addition to building up the country’s manufacturing base and growing its export potential, Rwanda’s SEZ strategy aims to support the long-term growth of a knowledge-based service sector.

Conclusion

The lessons from Kigali’s SEZ are simultaneously useful but difficult to replicate. Much of the infrastructural construction in Rwanda was performed by foreign investors, something that is growing more difficult to do during the age of COVID-19. Most of the zone’s tenants are internationally active companies that export to Asian and European markets.

However, the improvements in governance, state capacity, and legal procedure cannot be underestimated. The Kigali SEZ is an example for the continent to emulate.

[1] https://www.businessdailyafrica.com/analysis/ideas/Africa-exports-in-coronavirus-gloom/4259414-5557596-3j1quhz/index.html

pdf IMF World Economic Outlook Update: June 2020 (656 KB)

[2] https://warontherocks.com/2019/03/cost-plus-50-and-bringing-u-s-troops-home-a-look-at-the-numbers/

[3] https://blogs.worldbank.org/africacan/how-will-covid-19-impact-africas-trade-and-market-opportunities

[4] https://www.made-in-china.com/products-search/hot-china-products/Shipping_To_Mombasa%252Fkenya_Price.html

[5] https://www.businessdailyafrica.com/analysis/ideas/Africa-exports-in-coronavirus-gloom/4259414-5557596-3j1quhz/index.html

[6] https://www.europarl.europa.eu/thinktank/en/document.html?reference=EPRS_BRI(2020)646164

[7] https://www.ey.com/Publication/vwLUAssets/Raport_EY_Poland_-_a_true_special_economic_zone/$FILE/Raport-Poland-a-true-special-economic-zone.pdf

pdf Agreement establishing the AfCFTA: Consolidated text (21 March 2018) (973 KB)

[8] https://www.herald.co.zw/afcfta-considers-special-economic-zones/

[9] https://www.doingbusiness.org/content/dam/doingBusiness/country/r/rwanda/RWA.pdf

[10] https://maraphones.com/; https://www.fastcompany.com/90414915/rwandas-mara-x-z-are-1st-smartphones-made-fully-in-africa

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...