Blog

Women, trade and financial inclusion in SADC

Financial inclusion is linked to both economic growth and poverty alleviation. It enables people to participate in the economy, and therefore to trade. It is necessary for business growth and is an important mechanism for converting the informal to the formal.

Small businesses, which are more likely to have a lack of access to credit for example, will be the growth engines for intra-African trade – especially in a digital era. But this only works if they are financially included.

Similarly, financial inclusion is an import part of converting informal to formal. Formality is important to trade as businesses need access to trade finance and other financial products to support international trade. For informal cross-border traders, access to finance can support traders to improve and expand their businesses. Formality also assists in data collection, improving understanding of the effects of trade and possible interventions. It can also improve tax and other revenue collection.

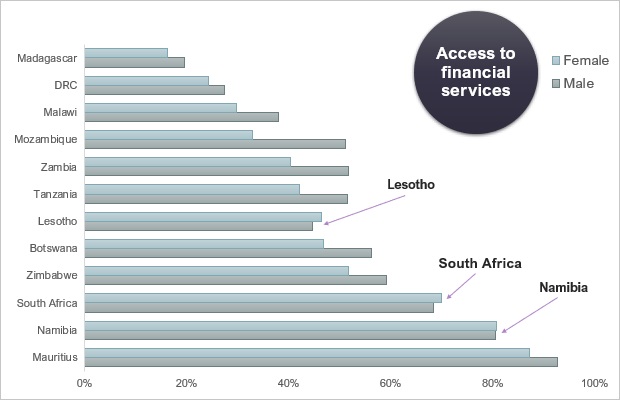

World Bank Global Findex data for 2017 shows a stubborn persistence in the gender financial inclusion gap globally. Given the role of financial inclusion in poverty alleviation and its importance to economic development and trade, it is concerning that gender gaps continue to exist. For women to take advantage of trade opportunities, and for trade to benefit women, we need to narrow the financial inclusion gaps.

What is financial inclusion?

Financing inclusion means having access to affordable financial services to meet one’s savings, credit and insurance needs. This includes managing money, making everyday transactions, sending and receiving payments, smoothing income over time, borrowing and investing in business or education, or protecting against unexpected expenses. Formal services give greater access to economic life more generally, is typically safer and often cheaper. Financial inclusion is not just about accounts – but this is the first point of access and an important indicator.

There are some bright spots in SADC. In Lesotho and South Africa, women are not lagging men in access to bank accounts, and in Namibia, financial inclusion is both high, and equal. These economies demonstrate what is possible; and may offer insights for others to learn from.

Source: World Bank Global Findex 2017

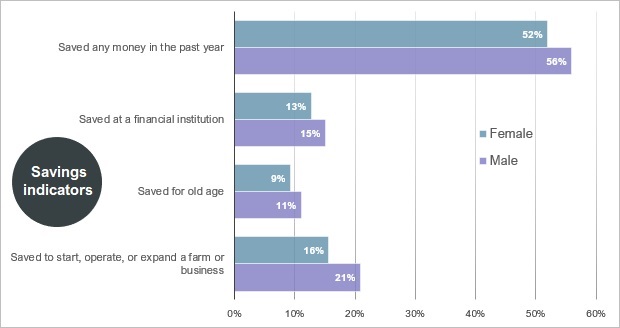

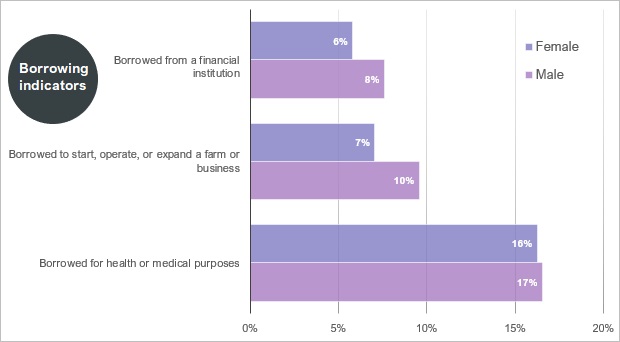

Women also lag men in a number of other important indicators of financial inclusion across the SADC region. This is most apparent in the differences in both saving and borrowing to start operate or expand a farm or business – critical to trade. It is important to also note that these numbers are low for both men and women. The indicators also show an important gap between saving and saving at a formal institution. This suggests that there is a clear opportunity for more saving at formal institutions within the region.

Source: World Bank Global Findex 2017

Source: World Bank Global Findex 2017

Borrowing for health or medical reasons may not seem immediately relevant to trade, however, it is important for smoothing income. In addition, poor health and caring responsibilities impact on women’s participation in the labour force. Without finance, the burden is higher.

The role of trade in financial inclusion

Increased trade in financial services can improve the efficiency, choice and affordability of these services. In particular, innovative new fintech services have the potential to dramatically increase financial inclusion. Africa is already leading the way on fintech solutions that are increasing inclusion and alleviating poverty. The sharing of these ideas and services across borders offers the possibility of leapfrogging to faster and deeper financial inclusion.

It’s not all upside. There is a risk that trade obligations could restrict how governments implement financial inclusion measures, so liberalisation needs to be coordinated with domestic policies to ensure it is supportive of financial inclusion.

Trade can also support financial inclusion in other ways – the movement of people under trade agreements can promote the use of remittances, and therefore increase financial inclusion. To the extent trade supports regulatory convergence and mutual recognition, financial services can become simpler to navigate. Coordination between countries can also open up cross border payment channels, as well as increase the speed and reduce the cost of these payments.

The promise of technology

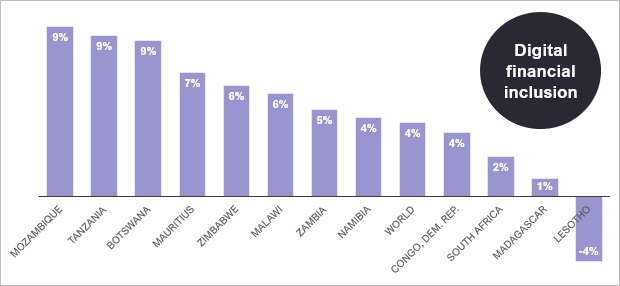

Innovative new fintech services have the potential to dramatically increase financial inclusion. Africa is already leading the way on fintech solutions that are increasing inclusion and alleviating poverty. The sharing of these ideas and services across borders offers the possibility of leapfrogging to faster and deeper financial inclusion. Here too, with the exception of Lesotho, the data shows a gender gap in an aggregation of indicators of digital inclusion:

-

Used a mobile phone to access an account

-

Made or received digital payments

-

Mobile money account

-

Used the internet to pay bills or buy something online

Source: World Bank Global Findex 2017

However, increased cross-border e-commerce can stimulate demand for formal financial services, thus increasing financial inclusion. As for women traders, being online helps level the playing field for women-owned firms: overall, only a quarter of firms doing offline trade identified themselves as women-owned, whereas for those trading exclusively through e-commerce, women-owned firms represent half of the total. Financial services and financial access are essential for transacting in the digital world.

Financial inclusion is all about having meaningful and affordable access to the kind of financial services one needs to fully participate in the economy. Trade is an important component of the economy, and without financial services, participating and benefiting from trade can be challenging. As such, narrowing the financial inclusion gap can contribute to narrowing the gap in women’s participation in trade, and can also help improve trade outcomes for our economies. More directly, the financially excluded can be viewed as a profitable opportunity for financial services businesses and therefore a potential source of financial services exports.

Trade can also be an important contributor to financial inclusion, in the broad sense of its contribution to growth, and in the direct sense that increased trade in financial services can mean more services available to the financially excluded. When it comes to both trade and financial inclusion there is a convergence of goals – increasing economic and social participation, particularly for the most vulnerable communities – including women – on the continent.

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...