News

Investment flows through offshore financial hubs declined but remain high

Investment flows to offshore financial hubs, including offshore financial centers and special purpose entities (SPEs), were increasingly volatile in 2015, according to the latest UNCTAD Global Investment Trends Monitor.

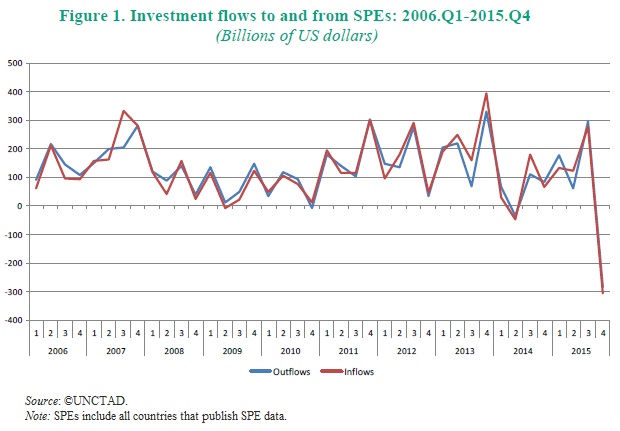

The research shows that these flows, which are excluded from UNCTAD’s foreign direct investment (FDI) statistics, declined but remain sizable. The magnitude of quarterly flows through SPEs, in terms of absolute value, rose sharply compared with 2014, reaching the levels last registered in 2012-2013.

Meanwhile, investment flows to offshore financial centers continued to retreat from their recent high of $132 billion in 2013, but remained roughly in line with the flows of previous years.

Offshore financial hubs offer low tax rates or beneficial fiscal treatment of cross-border financial transactions, extensive bilateral investment and double taxation treaty networks, and access to international financial markets, which make them attractive to companies large and small. Flows through these hubs are frequently associated with intra-firm financial operations − including the raising of capital in international markets − as well as holding activities, including of intangible assets such as brands and patents.

An in-depth analysis of FDI trends will feature in the forthcoming World Investment Report 2016, to be published in June 2016.

Highlights

-

In 2015, the volatility of investment flows to offshore financial hubs – including those to offshore financial centers and special purpose entities (SPEs) – rose significantly. These flows, which are excluded from UNCTAD’s FDI statistics, declined but remain sizable.

-

Financial flows through SPEs surged in volume during 2015. The magnitude of quarterly flows through SPEs, in terms of absolute value, rose sharply compared with 2014, reaching the levels registered in 2012-2013. Pronounced volatility, with flows swinging from large-scale net investment in the first three quarters to drastic net divestment in the last quarter, tempered the annual result, which dipped to US$221 billion.

-

Investment flows to offshore financial centres continued to retreat from its recent high of US$132 billion in 2013, but remained roughly in line with the flows of previous years. Investment to these jurisdictions, which hit an estimated US$72 billion in 2015, had risen in recent years by the growing flows from multinational enterprises (MNEs) located in developing and transition economies, sometimes in the form of investment round-tripping.

-

The proportion of investment income booked in low tax, often offshore, jurisdictions is high – and possibly growing. The disconnect between the locations of income generation and productive investment results in substantial fiscal losses, and is therefore a key concern for policy makers.

-

The persistence of financial flows routed through offshore financial mechanisms highlights the pressing need to create greater coherence among tax and investment policies at the global level. The international investment and tax policy regimes are both the object of separate reform process. Better managing their interaction would not only help to avoid conflict between the regimes but would also make them mutually supporting, with positive implications for productive cross-border investment.