News

The changing global trade landscape: Implications for African Commonwealth countries

Although the global trade landscape is continuously changing, a connection between Commonwealth countries makes a difference from a trade perspective.

The global trade landscape is continuously changing. Deeply scarred by the financial crisis of 2008, the world has seen the anemic economic recovery marked by a weakened trade-growth nexus. Along with this, the phenomenal rise of developing countries, the intensification of global value chains, the proliferation and deepening of regional trading arrangements, including the rise of mega-regionals, and climate change concerns are all having profound implications for global trade.

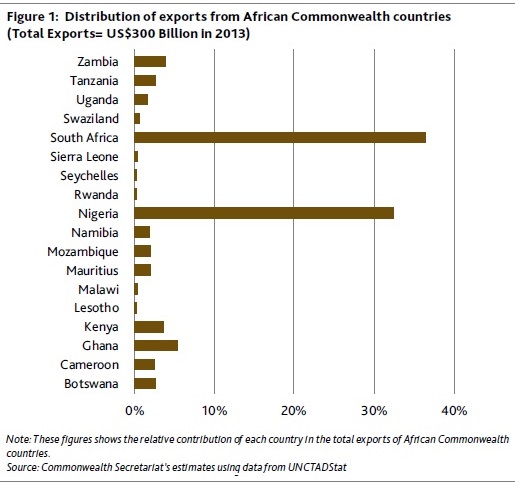

Although not a trading bloc, the Commonwealth’s favourable trading environment can be attributed to its unique nature, a diverse grouping of 53 countries of which 18 are located in Africa (Figure 1). These countries share historical ties, predominantly use English as one official language and have similar legal and administrative systems and large diaspora networks.

The continued effects of the global financial crisis

The global economic slowdown following the 2008 global financial crisis has had a significant impact on world trade. A simple trend projection suggests that had the post-crisis growth rate of trade flows matched the growth rate achieved between 2000 and 2008, the volume of global exports of goods and services in 2014 could have been as much as US$16 trillion higher than actually achieved. Commonwealth members have not been immune to this crisis. During the global financial crisis, their total exports fell by a massive US$600 billion: from US$2.9 trillion in 2008 to US$2.3 trillion in 2009. The exports of African Commonwealth countries dropped from US$246 billion in 2008 to US$190 billion in 2009 while their imports also dropped from $254 billion to $205 billion. The individual country experiences, however, differ widely.

One very encouraging development since the 1990s is Sub-Saharan Africa’s (SSA) impressive economic growth and trade performance, which, despite the global economic slowdown, remained steady. During the 2000s, SSA’s combined GDP grew at an annual average rate of more than five percent. Eight SSA Commonwealth countries (out of total of 18) registered an average GDP growth of more than five percent. Indeed, for the first time in many decades, SSA has outpaced overall global economic performance during a period when the world economy has experienced a downturn.

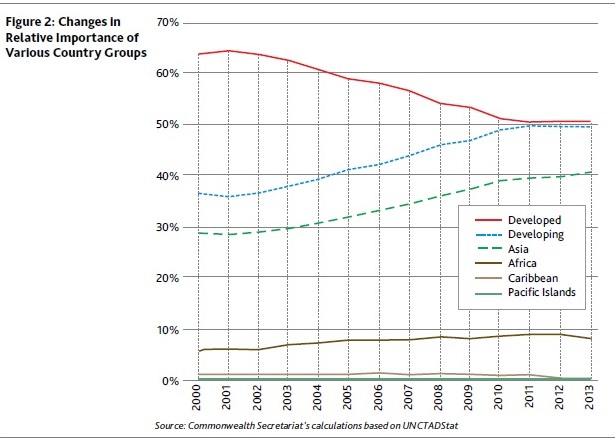

Increasing south-south trade

The growing prominence of developing countries is another salient feature of the shifting global trade landscape. Over the past two decades, the share of these countries in global merchandise exports has increased from around 30 percent to 50 percent. Although this shift is mainly driven by Asian economies, the contribution of African countries has increased from six percent in 2000 to nine percent in 2013 (Figure 2). This implies that, while traditional developed countries remain important markets, developing countries also provide enhanced trading opportunities.

However, one challenge of South-South trade lies in making it broad-based and more diversified, as primary commodities supplied by a handful of African countries currently dominate their exports to emerging economies. This has important implications for the economic and export diversification prospects of commodity-exporting African countries. For commodity-dependent exporters, one further concern relates to how the growth slowdown in China is going to unfold.

The unfolding global trade landscape

The proliferation of Regional Trade Agreements (RTAs) transcending regional boundaries with widening coverage of policy areas is another factor reshaping the global trade landscape. When the WTO was established in 1995, the number of active RTAs was 150, but by April 2015, 612 RTAs have been notified to the WTO, of which 406 are in force.

Trading through regional arrangements is shaping the global trade landscape in an unprecedented way. An overwhelming majority of African developing countries are members of several RTAs. However, for many of them, realising the benefits of increased trade is yet to happen. Additionally, laying aside participating countries’ limited capacity to negotiate and manage these overlapping arrangements, these RTAs can lead to adverse consequences for non-participating countries. This proliferation of RTAs, including those covering much broader ambits to generate trade rules and provisions in new areas, could weaken the multilateral trading system, especially in the absence of dynamism in WTO-led trade negotiations. A strong rules-based multilateral system is the best placed to protect small and poor countries, and promoting trade multilateralism while keeping up the momentum of RTAs constitutes a challenge.

Global value chains (GVCs) are fundamentally changing the traditional concept of an entire production process being undertaken by one firm located in one country. Because of the increasingly interconnected production processes, more trade is taking place in intermediate inputs. This geographic separation of production processes presents opportunities for African countries, since it requires specialisation in relatively limited number of tasks. It allows firms to enter into export markets without developing the full range of vertical capabilities along the value chain. Unfortunately, these GVCs currently bypass most African countries, and North America, Europe, and East Asia are recognised as the three major global GVC hubs. The experience of other Commonwealth countries’ participation in GVCs also varies enormously.

An analysis of 43 Commonwealth countries shows that between 2000 and 2012 the Commonwealth’s share of global trade in value added has remained steady around 16 percent, with the average share of domestic value added in Commonwealth members’ total exports estimated to be 68 percent in 2012, close to, yet below the global average of 70 percent. While GVCs present export opportunities through specialisation in only a relatively limited number of tasks, most Commonwealth African countries, being predominantly commodity exporters, are at a disadvantageous position in terms of linking into these chains. They lie at the bottom of the integration stage in GVCs, with limited capacity to upgrade. For small African states in particular, participation in GVCs is constrained by their inherent characteristics and associated trade challenges, for example their small market size, their lack of competitiveness, and so forth.

Climate change is one of the greatest challenges facing the international community with important implications for trade, growth and sustainable development. While climate change will impact all countries, the economic, social and environmental impacts of climate change will be most severe for the world’s poorest and most vulnerable economies, especially SSA, least developed countries (LDCs), and small island developing states (SIDS). These economies have high export concentrations in a range of climate-sensitive sectors, including agriculture, resource extraction, fisheries, and tourism. Over the medium to long term, climate change will significantly affect their trading capacity and competitiveness. Measures to deal with climate challenges will involve significant costs and pose a development challenge to weaker developing countries, especially LDCs. These countries have contributed the least to the causes of climate change and also have the least capacity to manage and adapt to it.

Ways forward

This shifting nature of the trade landscape implies a need to provide more intensive attention to broad priorities for improved trade performance of developing economies in general and African countries in particular. The achievement of a coherent, accountable, effective, and enabling global trading environment represents an overarching issue to many Commonwealth developing members. Central to this will be greater coherence and accountability among international support mechanisms and regimes.

The Commonwealth Trade Review – a report that was launched by the Commonwealth Heads of Government Meeting in Malta in November 2015 – highlights five of these priorities: building productive capacity; effectively managing trade policy and negotiations; addressing implementation gaps; promoting private sector development; and securing a trade-supporting global architecture. Since these determinants of trade success are interlinked, concerted efforts are required to generate the desired impact.

Aid for trade (AfT) remains important. However, there remains much scope to make this even more effective. Resource availability compared to actual needs is extremely limited. One particular objective of AfT – that is, helping countries with their trade-related adjustment needs – has hardly been utilised, even though it could be used to help develop productive capacity. Predictability of AfT has also been a major issue, with resources disbursements falling short of commitments on a regular basis. Therefore, more targeted and sustained AfT support is needed to promote export sector development.

For other emerging regions, trade preferences have played an important role in helping to develop trading capacity. Over time however, these mechanisms have largely been eroded. African countries should make the most of them before they disappear completely. This should be pursued together with trade promotion policies to attract investment and diversify exports. The first Commonwealth Trade Review also highlights important ways in which the “Commonwealth effect” could be more effectively harnessed.

Salamat Ali Phd. University of Nottingham, United Kingdom. He was also a member of the drafting team responsible for preparing the Commonwealth’s flagship publication on international trade.

This article is based on the Commonwealth Trade Review, November 2015. The Review provides a detailed assessment of the changing international trade landscape and offers new perspectives on Commonwealth trade in a global context. It demonstrates that a Commonwealth connection makes a difference from a trade perspective.

This article is published under Bridges Africa, Volume 5 - Number 2, by the ICTSD.

The Commonwealth is an association of 53 independent states, comprising large and small, developed and developing, landlocked and island economies. As the main intergovernmental body of the association, the Commonwealth Secretariat works with member governments to deliver on priorities agreed by Commonwealth Heads of Government. It provides technical assistance and advisory services to members, helping governments achieve sustainable, inclusive, and equitable development.