News

Creating global mining winners in Africa

The African continent delivers some of the best value in the world for every dollar spent on exploration. Even so, African mining companies have yet to fully tap the continent’s reserve potential. Using big data analysis, we found opportunities in productivity, strategy and stakeholder engagement that mining companies can use to steer their way towards world-class performance.

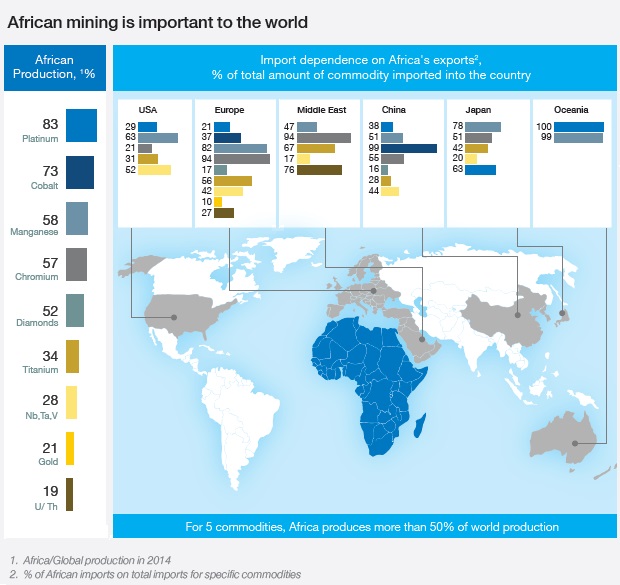

Africa has the luck of the geological draw. It supplies 83 per cent of the world’s platinum, 73 per cent of the world’s cobalt, and over half of the world’s manganese, chromium and diamonds. It is a principal commodity exporter to China, Japan, the United States and Western Europe. Given these endowments, African mining is critical to the region’s economies, and its mining companies have the potential to be worldclass performers. But when we assessed their performance against global peers, we found that they have underperformed in terms of value creation. If nothing changes, the odds are that African mining companies will fall further behind the world’s leading mining companies in the decade ahead.

The good news is that African mining companies have access to a range of levers to triple or quadruple their chances of becoming world-class performers.

Introducing the Power Curve

To gauge the performance of 65 publicly listed African mining companies, we compared their economic profit performance to the world’s top 3,999 companies, all of which compete for the same capital. By ranking companies this way, we produce what we term “the power curve” of economic profit. The power curve suggests that the world of corporate value creation is far from even: 20 per cent of companies at the top generate 90 per cent of the economic profit; 60 per cent in the middle meet their cost of capital; and 20 per cent at the bottom of the curve make large economic losses.

An industry view suggests that African miners do not perform well when compared to their global peers. In the first half of the 2000s, African companies were ahead of their global peers in terms of economic profit. In 2005, African companies started falling behind. The precise reasons for the change were not immediately obvious. Besides favourable geography, invested capital has actually grown over time. But ROIC has been below average and declining.

While it is good to know how the current performance of African mining companies compares to that of the world’s best corporations, a more interesting question is: How can African mining companies improve their odds of moving up the power curve of economic profit? Our analysis aims to deliver a fact-based answer to this question.

In examining the global data set, we found that, on average, only one in 10 companies move from the middle to the top of the curve over a decade.

We then used “big data” analytics to understand how companies can boost their odds of scaling the power curve, in other words, what they can do to beat the average. We found that ten attributes matter, and they can be grouped into three categories:

-

Endowment: A company’s profile today, measured as its size and headroom to fund growth

-

Trends: The industry and geographic tailwinds and headwinds that can propel a company up and down the power curve

-

Moves: The big strategic moves that companies can make to improve performance or shift their corporate portfolio towards tailwinds

Our analysis suggests that African mining companies can boost their odds of moving up the power curve by a multiple of three or four if they make bold moves.

The time for action is now, and by taking action now, we believe that the odds for the future of African mining companies will be on track as one of the most attractive regions for mining globally.